Amended Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k/a)

April 28 2023 - 6:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number: 001-34615

JinkoSolar Holding Co., Ltd.

(Translation of registrant’s name into English)

1 Yingbin Road

Shangrao Economic Development Zone

Jiangxi Province, 334100

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No x

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No x

This Amendment to Current Report on Form 6-K (the “Amended

Form 6-K”) is being filed to amend the information contained in the Current Report on Form 6-K filed on March 10, 2023 (the

“Original Form 6-K”) by JinkoSolar Holding Co., Ltd. (the “Company”) as a result of certain subsequent

adjustments and classification corrections to its unaudited financial results for the fourth quarter and full year 2022 contained in the

Original Form 6-K. Other than as set forth in this Amended Form 6-K and Exhibit 99.1 hereto, the information contained in the Original

Form 6-K remain unchanged.

Recognized Subsequent Events Occurred Subsequent to the Original

Form 6-K

On April 3, 2023, the Company terminated a solar module sales agreement

with one of its customers (the “Termination of Solar Module Sales Agreement”), which caused the shipment volume of

solar modules decreased from 16,020 MW to 15,833 MW for the fourth quarter of 2022 and from 44,520 MW to 44,333 MW for full year 2022.

The Company determined the Termination of Solar Module Sales Agreement to be a recognized subsequent event, and as a result, the Company

made certain adjustments to its unaudited condensed consolidated statements of operations for the quarter and the year ended December

31, 2022, and unaudited condensed consolidated balance sheet as of December 31, 2022 contained in the Original Form 6-K (the “Original

Financial Results”), including:

Unaudited Condensed Consolidated Statements

of Operations for Fourth Quarter 2022

| · | revenues from third parties of RMB29,917.9 million

(US$4,337.7 million), changed from RMB30,319.5 million (US$4,395.9 million); |

| · | cost of revenues of RMB25,793.8 million (US$3,739.7

million), changed from RMB26,127.1 million (US$3,788.1 million); and |

| · | selling and marketing expenses of RMB2,254.4 million

(US$326.9 million), changed from RMB2,290.9 million (US$332.2 million). |

Unaudited Condensed Consolidated Statements

of Operations for Full Year 2022

| · | revenues from third parties of RMB82,794.1 million

(US$12,004.0 million), changed from RMB83,195.7 million (US$12,062.2 million); |

| · | cost of revenues of RMB70,849.0 million (US$10,272.1

million), changed from RMB71,182.2 million (US$10,320.5 million); and |

| · | selling and marketing expenses of RMB7,241.9 million

(US$1,050.0 million), changed from RMB7,278.4 million (US$1,055.3 million). |

Unaudited Condensed Consolidated Balance

Sheet as of December 31, 2022

| · | accounts receivable, net of RMB16,674.9 million

(US$2,417.6 million), changed from RMB17,088.6 million (US$2,477.6 million); |

| · | inventories, net of RMB17,450.3 million (US$2,530.1

million), changed from RMB17,085.9 million (US$2,477.2 million); |

| · | prepayments and other current assets, net of RMB3,290.9

million (US$477.1 million), changed from RMB3,273.1 million (US$474.6 million); |

| · | other payables and accruals of RMB9,214.4 million

(US$1,336.0 million), changed from RMB9,216.4 million (US$1,336.2 million); and |

| · | accumulated other comprehensive income of RMB217.6

million (US$31.5 million), changed from RMB217.7 million (US$31.6 million). |

On April 28, 2023, the board of directors of Jinko Solar Co., Ltd.

(“Jiangxi Jinko”), a majority-owned principal operating subsidiary of the Company, approved its plan of distributing

earnings to its ordinary shareholders for the year ended December 31, 2022 (the “Earnings Distribution Plan”), which

the Company determined to be a recognized subsequent event. Under the Earnings Distribution Plan, 30% of the net income of Jiangxi Jinko

will be distributed to its ordinary shareholders, as compared to 20% which was initially determined by Jiangxi Jinko’s management

before the announcement of the Original Form 6-K. Based on the Earnings Distribution Plan, the Company made certain adjustments to the

Original Financial Results, including:

Unaudited Condensed Consolidated Statements

of Operations for Fourth Quarter 2022

| · | income tax of RMB265.4 million (US$38.5 million),

changed from RMB239.4 million (US$34.7 million). |

Unaudited Condensed Consolidated Statements

of Operations for Full Year 2022

| · | income tax of RMB605.3 million (US$87.8 million),

changed from RMB579.2 million (US$84.0 million). |

Unaudited Condensed Consolidated Balance

Sheet as of December 31, 2022

| · | deferred tax liability of RMB194.8 million (US$28.2

million), changed from RMB168.8 million (US$24.5 million). |

Classification Corrections

The Company made certain classification corrections to the Original

Financial Results, including:

| · | RMB2.5 million (US$0.4 million) from accounts receivable

due from related party to accounts receivable due from third party, net; |

| · | RMB112.0 million (US$16.2 million) from intangible

assets, net to land use rights, net; |

| · | RMB54.0 million (US$7.8 million) from notes payable

due to third party to notes payable due to related party, net; |

| · | RMB816.5 million (US$118.4 million) from long-term

borrowing to short-term borrowing, net; and |

| · | RMB79.2 million (US$11.5 million) and RMB50.0 million

(US$7.2 million) from cash and cash equivalents to restricted cash and restricted long-term investments, respectively. |

For the amended financial data, please also refer to the audited consolidated

financial statements contained in the Company’s annual report on Form 20-F for the year ended December 31, 2022, filed with the

SEC on April 28, 2023.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

JinkoSolar Holding Co., Ltd. |

| |

|

|

| |

By: |

/s/ Mengmeng (Pan) Li |

|

| |

Name: |

Mengmeng (Pan) Li |

| |

Title: |

Chief Financial Officer |

Date: April 28, 2023

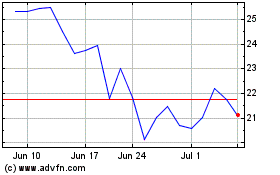

Jinkosolar (NYSE:JKS)

Historical Stock Chart

From Jun 2024 to Jul 2024

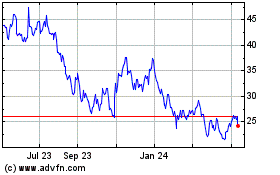

Jinkosolar (NYSE:JKS)

Historical Stock Chart

From Jul 2023 to Jul 2024