Defiance ETFs introduces IONX, the Defiance Daily Target 2X Long

IONQ ETF, a 2X leveraged single-stock ETF designed to provide

amplified exposure to IonQ, Inc. (NYSE: IONQ). This ETF offers

traders a way to seek enhanced returns on IonQ without requiring a

margin account.

IONX seeks daily investment results that correspond to

twice (200%) the daily percentage change of IonQ,

a leader in quantum computing, advancing the

industry with cutting-edge innovations and strategic

partnerships.

“IONX offers a compelling opportunity for investors seeking

amplified exposure to IONQ, a leader in quantum computing,” said

Sylvia Jablonski, CEO of Defiance ETFs. “With ongoing technological

developments, strategic industry partnerships, and a growing

presence in the sector, IONQ continues to play a key role in the

evolution of quantum innovation.”

For more information, visit DefianceETFs.com.

The Fund is not intended to be used by, and is not appropriate

for, investors who do not intend to actively monitor and manage

their portfolios. The Fund pursues a daily leveraged investment

objective, which means that the Fund is riskier than alternatives

that do not use leverage because the Fund magnifies the performance

of the Underlying Security. The Fund is not suitable for

all investors. The Fund is designed to be utilized only by

knowledgeable investors who understand the potential consequences

of seeking daily leveraged (2X) investment results, understand the

risks associated with the use of leverage, and are willing to

monitor their portfolios frequently. For periods longer than a

single day, the Fund will lose money if the Underlying Security’s

performance is flat, and it is possible that the Fund will lose

money even if the Underlying Security’s performance increases over

a period longer than a single day. An investor could lose the full

principal value of his/her investment within a single

day.

An investment in IONX is not an investment in IonQ, Inc.

About Defiance ETFs

Founded in 2018, Defiance is at the forefront of ETF innovation.

Defiance is a leading ETF issuer specializing in thematic, income,

and leveraged ETFs.

Our first-mover leveraged single-stock ETFs empower investors to

take amplified positions in high-growth companies, providing

precise leverage exposure without the need to open a margin

account.

IMPORTANT DISCLOSURES

Defiance ETFs LLC is the ETF sponsor. The Fund’s investment

adviser is Tidal Investments, LLC (“Tidal” or the “Adviser”).

The Funds’ investment objectives, risks, charges, and expenses

must be considered carefully before investing. The prospectus and

summary prospectus contain this and other important information

about the investment company. Please read carefully before

investing. A hard copy of the prospectuses can be requested by

calling 833.333.9383.

Investing involves risk. Principal loss is possible. As

an ETF, the funds’ may trade at a premium or discount to NAV.

Shares of any ETF are bought and sold at market price (not NAV) and

are not individually redeemed from the Fund. A portfolio

concentrated in a single industry or country, may be subject to a

higher degree of risk.

IONQ Risks: The Fund invests in swap contracts

and options that are based on the share price of IONQ. This

subjects the Fund to certain of the same risks as if it owned

shares of IONQ even though it does not.

Indirect Investment Risk. IONQ is not

affiliated with the Trust, the Fund, or the Adviser, or their

respective affiliates and is not involved with this offering in any

way and has no obligation to consider your Shares in taking any

corporate actions that might affect the value of Shares.

Trading Risk. The trading price of the fund may be subject to

volatility and could experience wide fluctuations due to various

factors. Short sellers may also play a significant role in trading

IONQ potentially affecting the supply and demand dynamics and

contributing to market price volatility. Public perception and

external factors beyond the company’s control may influence IONQ’s

stock price disproportionately.

Performance Risk. IONQ may fail to meet publicly announced

guidelines or other expectations about its business, which could

cause the price of IONQ to decline.

IONQ Technology Hardware, Storage & Peripherals Risks.

Companies in the technology hardware, storage, and peripherals

industry may face intense competition, both domestically and

internationally, which can pressure profit margins and market

share. These companies often rely on complex supply chains and

third-party providers for components, manufacturing, and services.

Additionally, operations may be impacted by resource constraints,

including shortages of electricity, rare earth elements, or other

essential materials. Companies in this industry are also exposed to

cybersecurity threats, intellectual property risks, and evolving

technological standards, which may increase operational costs and

hinder competitiveness.

IONQ Business Risks: Dependence on proprietary ion trap

technology and specific isotopic materials introduces supply chain

risks, while compatibility with industry-standard software and

hardware remains a concern. IONQ is also exposed to risks related

to international expansion, government contracts, and regulatory

changes, including tariffs and trade restrictions.

IONX Fund Risks

Leverage Risk. The Fund obtains investment

exposure in excess of its net assets by utilizing leverage and may

lose more money in market conditions that are adverse to its

investment objective than a fund that does not utilize leverage. An

investment in the Fund is exposed to the risk that a decline in the

daily performance of the Underlying Security will be magnified.

High Portfolio Turnover Risk. Daily rebalancing

of the Fund’s holdings pursuant to its daily investment objective

causes a much greater number of portfolio transactions when

compared to most ETFs.

Liquidity Risk. Some securities held by the

Fund may be difficult to sell or be illiquid, particularly during

times of market turmoil. Markets for securities or financial

instruments could be disrupted by a number of events, including,

but not limited to, an economic crisis, natural disasters,

epidemics/pandemics, new legislation or regulatory changes inside

or outside the United States.

Derivatives Risk. The Fund’s investments in

derivatives may pose risks in addition to, and greater than, those

associated with directly investing in securities or other ordinary

investments, including risk related to the market, leverage,

imperfect daily correlations with underlying investments or the

Fund’s other portfolio holdings, higher price volatility, lack of

availability, counterparty risk, liquidity, valuation and legal

restrictions.

Compounding and Market Volatility Risk. The

Fund has a daily leveraged investment objective and the Fund’s

performance for periods greater than a trading day will be the

result of each day’s returns compounded over the period, which is

very likely to differ from two times (200%) the Underlying

Security’s performance, before the Fund’s management fee and other

expenses.

Fixed Income Securities Risk. When the Fund

invests in fixed income securities, the value of your investment in

the Fund will fluctuate with changes in interest rates. Typically,

a rise in interest rates causes a decline in the value of fixed

income securities owned by the Fund.

Single Issuer Risk. Issuer-specific attributes

may cause an investment in the Fund to be more volatile than a

traditional pooled investment which diversifies risk of the market

generally. The value of the Fund, which focuses on an individual

security, may be more volatile than a traditional pooled investment

or the market as a whole and may perform differently from the value

of a traditional pooled investment or the market as a whole.

New Fund Risk. The Fund is a recently organized

management investment company with no operating history. As a

result, prospective investors do not have a track record or history

on which to base their investment decisions.

Diversification does not ensure a profit nor protect against

loss in a declining market.

Brokerage Commissions may be charged on trades.

Distributed by Foreside Fund Services, LLC

Contact Information

David Hanono

info@defianceetfs.com

833.333.9383

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8979d6ab-1cf6-4d0b-9ce0-a14b0205d0b2

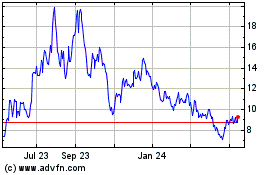

IonQ (NYSE:IONQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

IonQ (NYSE:IONQ)

Historical Stock Chart

From Mar 2024 to Mar 2025