0001501134FALSE00015011342023-10-132023-10-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 13, 2023

| | |

| Invitae Corporation |

| (Exact name of the registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-36847 | | 27-1701898 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. employer |

| incorporation or organization) | | File Number) | | identification number) |

1400 16th Street, San Francisco, California 94103

(Address of principal executive offices, including zip code)

(415) 374-7782

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, $0.0001 par value per share | | NVTA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Management Retention Arrangements

On October 18, 2023, upon the recommendation of the Compensation Committee of the Board of Directors (the “Board”) of Invitae Corporation (the “Company”), the Board (and all of the independent members of the Board) approved certain management retention arrangements for certain officers of the Company as follows:

•Kenneth D. Knight (Chief Executive Officer and President). Subject to a repayment obligation that will lapse over a two-year period, the Company agreed to pay Mr. Knight a one-time cash retention bonus of $3,500,000, subject to applicable withholding and deductions. This bonus will be earned and vest in eight equal quarterly installments over two years beginning with the first installment on the date three months after October 19, 2023, subject to Mr. Knight’s continued employment with the Company on the applicable quarterly vesting date. If Mr. Knight’s employment with the Company terminates for any reason other than as a result of an involuntary termination (e.g., a termination without cause or as a result of a material reduction in authority, a material reduction in base compensation or a relocation by more than 50 miles of principal place of employment) prior to October 19, 2025, Mr. Knight will be required to repay any portion of such bonus that is unearned and unvested on the termination date. The Board also unilaterally terminated Mr. Knight’s participation in a 2023 long-term cash retention program approved by the Board on April 3, 2023, pursuant to which Mr. Knight would otherwise have been eligible for up to $1,000,000 in total payments, paid in equal annual installments over a three-year period subject to continued service, with the first installment to have been paid on May 15, 2024. The foregoing description of the cash retention bonus for Mr. Knight is qualified in its entirety by reference to the Long-Term Retention Bonus Agreement between the Company and Mr. Knight, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

•Thomas R. Brida (General Counsel, Chief Compliance Officer and Secretary). If Mr. Brida (i) remains actively employed by the Company in his current position through December 15, 2023, unless Mr. Brida is offered and accepts a different role or position with the Company or is terminated not for “cause” (as defined in the Company’s form of Change of Control and Severance Agreement for certain officers of the Company, a copy of which is attached hereto as Exhibit 10.2 and incorporated herein by reference – the “COC Agreement”) prior to December 15, 2023, and (ii) performs his duties for the Company, including specific projects assigned to him, and otherwise complies with his continuing obligations to the Company, then Mr. Brida will receive a payment of $100,000, subject to applicable withholding and deductions. If Mr. Brida performs his duties, including specific projects assigned to him, and otherwise complies with his continuing obligations to the Company and remains actively employed by the Company in his current position through: (i) March 15, 2024, then Mr. Brida will receive a payment of $114,750, subject to applicable withholding and deductions; (ii) August 15, 2024, then Mr. Brida will receive a grant of restricted stock units (“RSUs”) under the Company’s 2015 Stock Incentive Plan (the “2015 Plan”) covering 229,500 shares of the Company’s common stock, with such grant fully vested when made and subject to the terms and conditions of the 2015 Plan and the applicable stock award agreement; and (iii) August 16, 2024, then Mr. Brida will receive a payment of $114,750, subject to applicable withholding and deductions. The foregoing description of retention cash payments and a retention RSU grant for Mr. Brida is qualified in its entirety by reference to the Retention & Bonus Agreement between the Company and Mr. Brida, a copy of which is attached hereto as Exhibit 10.3 and incorporated herein by reference. In addition to the foregoing, the term of Mr. Brida’s existing COC Agreement, which otherwise would have expired on April 23, 2024, is extended until October 18, 2026.

Appointment of David B. Sholehvar, MD as Chief Operating Officer

On October 18, 2023, the Board appointed David B. Sholehvar, MD as Chief Operating Officer of the Company, effective November 13, 2023.

David B. Sholehvar, MD, 56, served as President, Clinical Services Division, of NeoGenomics, Inc. (Nasdaq: NEO), an oncology diagnostics company, from March 2022 to November 2022. Prior to that, from April 2017 to October 2020, Dr. Sholehvar served as Chief Executive Officer for Dynex Technologies, Inc., a manufacturer of laboratory instruments and technology. Dr. Sholehvar served in various capacities at Quest Diagnostics, a provider of diagnostic information services, including as Vice President from 2014 to 2017 and General Manager from 2013 to 2014. Dr. Sholehvar also served in various capacities at Ortho Clinical Diagnostics, Inc., a former Johnson & Johnson company and provider of in vitro diagnostics, including as Vice President, Americas and EMEA from 2012 to 2013, Vice President, Clinical Innovations and Franchise Board Member from 2010 to 2011, and General Manager from 2007 to 2009. From 2011 to 2012, Dr. Sholehvar served as General Manager and Franchise Board Member of Cellular Technologies, Inc., a former Johnson & Johnson company and provider of medical devices and molecular diagnostics. Dr. Sholehvar holds a BS from the University of Pittsburgh, an MD from Thomas Jefferson University, and an MBA from the Joseph M. Katz Graduate School of Business at the University of Pittsburgh.

In connection with Dr. Sholehvar’s appointment as Chief Operating Officer, Dr. Sholehvar and the Company entered into an offer letter (the “Offer Letter”), pursuant to which Dr. Sholehvar will be entitled to receive an annual base salary of $460,000. Dr. Sholehvar will be granted 850,000 RSUs, which will vest over a three-year period, subject to Dr. Sholehvar’s continued service with the Company through the applicable vesting dates. Dr. Sholehvar’s RSU grants will be subject to the terms and conditions of the 2015 Plan and the applicable stock award agreements. Dr. Sholehvar will be paid $150,000 as a sign-on bonus, which is to be repaid if he resigns before the anniversary of his start date. In addition, Dr. Sholehvar will be eligible for a retention bonus of $150,000 that will become payable on May 13, 2024 (and thereafter be subject to a claw-back that lapses, based upon continuing service, in equal monthly amounts over a 12-month period). Dr. Sholehvar will also be eligible to participate in the Company’s management incentive compensation plan and the Company’s medical and other employee benefits programs. Dr. Sholehvar’s employment will be on an “at will” basis.

The foregoing summary is qualified in its entirety by reference to the Offer Letter and the Retention Bonus Agreement, copies of which are attached hereto as Exhibit 10.4 and Exhibit 10.5, respectively, and incorporated herein by reference.

In connection with his appointment as Chief Operating Officer, the Company expects to enter into its form of COC Agreement and form of indemnification agreement with Dr. Sholehvar. There is no arrangement or understanding between Dr. Sholehvar and any other person pursuant to which he was selected as an officer of the Company. Additionally, there are no family relationships between any director or executive officer of the Company and Dr. Sholehvar, and Dr. Sholehvar has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits | | | | | | | | |

| Exhibit No. | | Description |

| |

| 10.1# | | |

| 10.2# | | |

| 10.3#* | | |

| 10.4# | | |

| 10.5# | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| # Indicates management contract or compensatory plan or arrangement. |

| * Portions of this exhibit have been redacted in accordance with Item 601(b)(10)(iv) of Regulation S-K. An unredacted copy of this exhibit will be provided to the Securities and Exchange Commission upon request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 19, 2023

| | | | | | | | |

| | |

| INVITAE CORPORATION |

| |

| By: | | /s/ Ana J. Schrank |

| Name: | | Ana J. Schrank |

| Title: | | Chief Financial Officer |

INVITAE CORPORATION

LONG-TERM RETENTION BONUS AGREEMENT

This Long-Term Retention Bonus Agreement (this “Agreement”) is made and entered into effective as of October 19, 2023 (the “Effective Date”), by and between Kenneth D. Knight (“Executive”) and Invitae Corporation, a Delaware corporation (the “Company”). Certain capitalized terms used in this Agreement are defined in Section 1 below.

The Board of Directors of the Company (the “Board”) recognizes Executive’s contributions to the Company and, to encourage and incentivize Executive to remain employed by the Company, the Board believes that it is in the best interests of the Company and its stockholders to provide Executive with a long-term retention bonus pursuant to the terms set forth in this Agreement.

AGREEMENT

In consideration of the mutual covenants herein contained and the continued employment of Executive by the Company, the parties agree as follows:

1.Definition of Terms. The following terms referred to in this Agreement shall have the following meanings:

(a)Cause. “Cause” shall mean Executive’s (i) commission of a felony, an act involving moral turpitude, or an act constituting common law fraud, and which has an adverse effect on the business or affairs of the Company or its affiliates or stockholders; (ii) intentional or willful misconduct or refusal to follow the lawful instructions of the Board that is not cured within thirty (30) days following written notice from the Board; (iii) commission of any violation of a Company policy that has a material adverse effect on the business or reputation of the Company; or (iv) intentional breach of Company confidential information obligations which has an adverse effect on the Company or its affiliates or stockholders. For these purposes, no act or failure to act shall be considered “intentional or willful” unless it is done, or omitted to be done, in bad faith without a reasonable belief that the action or omission is in the best interests of the Company.

(b)Involuntary Termination. “Involuntary Termination” shall mean:

(i)a material reduction in Executive’s title, duties, authorities or responsibilities as the Chief Executive Officer of the Company without the Executive’s consent;

(ii)without Executive’s express written consent, a reduction by the Company of Executive’s base compensation of more than ten percent (10%), unless such reduction in base compensation is part of a general reduction in compensation applicable to senior executives of the Company;

(iii)without Executive’s express written consent, the relocation of Executive’s principal place of employment to a facility or a location more than fifty (50) miles from its location as of the Effective Date;

(iv)any termination of Executive’s employment by the Company which is not effected for Cause; or

(v)the failure of the Company to obtain the assumption of this Agreement or any other agreement between the Company and Executive by any successors contemplated in Section 8 below.

A termination shall not be considered an “Involuntary Termination” unless Executive provides notice to the Company of the existence of the condition described in subsections (i), (ii), (iii), (iv) or (v) above within ninety (90) days of the initial existence of such condition, the Company fails to remedy the condition within thirty (30) days following the receipt of such notice, and Executive terminates employment within one-hundred eighty (180) days following the initial existence of such condition. A termination due to death or disability shall not be considered an Involuntary Termination.

(c)Termination Date. “Termination Date” shall mean Executive’s “separation from service” within the meaning of that term under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”).

2.Long-Term Retention Bonus. Subject to the Repayment Obligation set forth in Section 3, the Company will pay Executive a one-time cash retention bonus of Three Million Five Hundred Thousand Dollars ($3,500,000) (the “Long-Term Retention Bonus”), subject all to applicable withholdings and deductions required by law or pursuant to Company policy. The Long-Term Retention Bonus will be paid to Executive not later than ten (10) business days following the Effective Date.

3.Vesting and Repayment. The Long-Term Retention Bonus will be earned and vest in eight (8) equal quarterly installments over two (2) years beginning on the three (3)-month anniversary of the Effective Date, subject to Executive’s continued employment with the Company on the applicable quarterly vesting date. In the event that Executive’s employment with the Company terminates for any reason other than as a result of an Involuntary Termination prior to the second anniversary of the Effective Date, Executive will be required to repay, and hereby agrees to repay, to the Company (or a designated affiliate) any portion of the Long-Term Retention Bonus that is unearned and unvested on the Termination Date (with such repayment amount determined based on the Long-Term Retention Bonus before reduction for applicable withholdings and deductions) (the “Repayment Obligation”). Subject to Executive’s continued employment with the Company, the Repayment Obligation shall terminate with respect to 12.5% of the Long-Term Retention Bonus on each three (3)-month anniversary of the Effective Date.

4.Discretion. The Board (or a designated committee thereof) is responsible for the general administration of the Long-Term Retention Bonus and shall have all powers and duties necessary to fulfill these responsibilities, including, but not limited to, the full discretionary authority to interpret, administer and apply the terms of this Agreement, including the Repayment Obligation. The validity of any such interpretation, construction, decision, or finding of fact shall not be given de novo review if challenged in court, by arbitration, or in any other forum, and shall be upheld unless clearly arbitrary or capricious.

5.At-Will Employment. The Company and Executive acknowledge that Executive’s employment is and shall continue to be at-will, as defined under applicable law. The Company reserves the right to terminate Employee’s employment at any time with or without cause or prior notice.

6.Limitation on Payments. In the event that the benefits provided for in this Agreement or otherwise payable to Executive (i) constitute “parachute payments” within the meaning of Section 280G of the Code and (ii) would be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then Executive’s benefits under this Agreement shall be either:

(a)delivered in full or

(b)delivered as to such lesser extent which would result in no portion of such benefits being subject to the Excise Tax,

whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the Excise Tax, results in the receipt by Executive on an after-tax basis, of the greatest amount of benefits, notwithstanding that all or some portion of such benefits may be taxable under Section 4999 of the Code.

Unless the Company and Executive otherwise agree in writing, any determination required under this Section 6 shall be made in writing by the Company’s independent public accountants (the “Accountants”), whose determination shall be conclusive and binding upon Executive and the Company for all purposes. For purposes of making the calculations required by this Section 6, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and Executive shall furnish to the Accountants such information and documents as the Accountants may reasonably request in order to make a determination under this Section 6. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section 6. In the event that a reduction is required, the reduction shall be applied first to any benefits that are not subject to Section 409A of the Code, and then shall be applied to benefits (if any) that are subject to Section 409A of the Code, with the benefits payable latest in time subject to reduction first.

7.Section 409A; Delayed Commencement of Benefits. The parties intend that any amounts payable hereunder comply with or are exempt from Section 409A of the Code (“Section 409A”), and this Agreement shall be administered accordingly. In the event that any changes to this Agreement or any additional terms are required to ensure that a payment is either exempt from or complies with Section 409A so that the penalty taxes under Section 409A(a)(1)(B) are not applied, Executive hereby agrees that the Company may make such change or incorporate such terms (by reference or otherwise) without Executive’s consent. Each payment contemplated by this Agreement will be treated as a separate payment for purposes of Section 409A. Notwithstanding anything herein to the contrary, the Company shall have no liability to the Executive or to any other person if the payments and benefits provided in this Agreement that are intended to be exempt from or compliant with Section 409A are not so exempt or compliant, as applicable.

8.Successors.

(a)Company’s Successors. Any successor to the Company (whether direct or indirect and whether by purchase, lease, merger, consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets shall assume the Company’s rights and obligations under this Agreement and agree expressly to perform the Company’s obligations under this Agreement in the same manner and to the same extent as the Company would be required to perform such obligations in the absence of a succession. For all purposes under this Agreement, the term “Company” shall include any successor to the Company’s business and/or assets which executes and delivers the assumption agreement described in this subsection (a) or which becomes bound by the terms of this Agreement by operation of law.

(b)Executive’s Successors. Without the written consent of the Company, Executive shall not assign or transfer this Agreement or any right or obligation under this Agreement to any other person or entity. Notwithstanding the foregoing, the terms of this Agreement and all rights of Executive hereunder shall inure to the benefit of, and be enforceable

by, Executive’s personal or legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees.

9.Notices.

(a)General. Notices and all other communications contemplated by this Agreement shall be in writing and shall be deemed to have been duly given when personally delivered or when mailed by U.S. registered or certified mail, return receipt requested and postage prepaid. In the case of Executive, mailed notices shall be addressed to Executive at the home address which he most recently communicated to the Company in writing. In the case of the Company, mailed notices shall be addressed to its corporate headquarters, and all notices shall be directed to the attention of its Secretary.

(b)Notice of Termination. Any termination by the Company for Cause or by Executive as a result of an Involuntary Termination shall be communicated by a notice of termination to the other party hereto given in accordance with this Section 9. Such notice shall indicate the specific termination provision in this Agreement relied upon, shall set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination under the provision so indicated, and shall specify the Termination Date (which shall be not more than thirty (30) days after the giving of such notice). The failure by Executive to include in the notice any fact or circumstance which contributes to a showing of Involuntary Termination shall not waive any right of Executive hereunder or preclude Executive from asserting such fact or circumstance in enforcing Executive’s rights hereunder, subject to the requirements of Section 1(b).

10.Arbitration. Any controversy involving the construction or application of any terms, covenants or conditions of this Agreement, or any claims arising out of any alleged breach of this Agreement, will be governed by the rules of the American Arbitration Association and submitted to and settled by final and binding arbitration in San Francisco, California, except that any alleged breach of Executive’s confidential information obligations shall not be submitted to arbitration and instead the Company may seek all legal and equitable remedies, including without limitation, injunctive relief.

11.Miscellaneous Provisions.

(a)Waiver. No provision of this Agreement may be modified, waived or discharged unless the modification, waiver or discharge is agreed to in writing and signed by Executive and by an authorized officer of the Company (other than Executive). No waiver by either party of any breach of, or of compliance with, any condition or provision of this Agreement by the other party shall be considered a waiver of any other condition or provision or of the same condition or provision at another time.

(b)Integration. The Board (or a designated committee thereof) has or is expected to unilaterally terminate Executive’s participation in the 2023 long-term cash retention program approved by the Board on April 3, 2023. This Agreement supersedes and replaces any prior agreements, representation or understandings, whether written, oral, express or implied, between Executive and the Company, including any unearned 2023 long-term cash retention program benefit(s), and constitutes the entire agreement and understanding between the parties with respect to the subject matter hereof.

(c)Unfunded Arrangement. No provision of this Agreement shall require the Company to segregate any assets for the purpose of satisfying any obligations under this Agreement, nor shall Executive or other person have any interest in any particular assets of the

Company by reason of the right to receive the Long-Term Retention Bonus under this Agreement.

(d)Choice of Law. The validity, interpretation, construction and performance of this Agreement shall be governed by the internal substantive laws, but not the conflicts of law rules, of the State of California.

(e)Severability. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision hereof, which shall remain in full force and effect.

(f)Employment Taxes. The Long-Term Retention Bonus shall be subject to withholding of applicable income and employment taxes when paid. In the event that Executive repays all or a portion of the Long-Term Retention Bonus to the Company (or its designated affiliate) pursuant to the Repayment Obligation, Executive acknowledges that Executive may not be able to recover taxes previously withheld or paid on Executive’s receipt of the Long-Term Retention Bonus. Executive hereby acknowledges and agrees that the Company shall have no liability to Executive or to any other person with respect to the recovery of any taxes previously paid or payable by or on behalf of Executive in respect of the payment of the Long-Term Retention Bonus in the event that any portion of the Long-Term Retention Bonus is repaid by Executive to the Company (or its designated affiliate) pursuant to the Repayment Obligation.

(g)Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together will constitute one and the same instrument.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, each of the parties has executed this Agreement, in the case of the Company by its duly authorized officer, as of the day and year first above written.

| | | | | |

| COMPANY: | INVITAE CORPORATION By: /s/ Thomas R. Brida Name: Thomas R. Brida Title: General Counsel |

| EXECUTIVE: | /s/ Kenneth D. Knight Signature Printed Name: Kenneth D. Knight Title: Chief Executive Officer |

Exhibit 10.3

[**] Indicates that certain information in this exhibit has been excluded because it is both (i) not material and (ii) the type that the registrant treats as private or confidential.

RETENTION & [**] BONUS AGREEMENT

This Retention & [**] Bonus Agreement (“Agreement”) is made and entered into as of the date of execution by all parties as indicated below, by and between Invitae Corporation (the “Company”) and Tom Brida (“Employee”) with respect to the following facts:

A. Employee is currently employed by the Company.

B. [**].

C. The Company recognizes and values Employee’s contributions to the Company [**]. Accordingly, the Company enters into this Agreement with Employee to provide an incentive to Employee [**] and remain employed by the Company through the dates noted in Sections 1 and 2, below. These dates will be known as the Retention Dates and [**] Bonus Earned Date, as applicable.

Now, therefore, Employee and the Company agree as follows:

1. [**] Bonus. Provided Employee satisfies all the Conditions to Earning a Bonus described in Paragraph 3, below (including its subparts), Employee is eligible to receive a [**] Bonus in the amount shown below, less all applicable state and federal taxes and withholdings:

●[**] Bonus Earned Date - December 15, 2023: $100,000.00

If Employee resigns Employee’s employment for any reason or is terminated for Cause prior to the [**] Bonus Earned Date, Employee becomes ineligible to earn the [**] Bonus set forth in this Agreement. For purposes of this Agreement, termination for “Cause” has the same meaning used in Employee’s Change of Control and Severance Agreement, dated April 23, 2021 (the “CCSA”).

2. Retention Bonus. Provided Employee satisfies all the Conditions to Earning a Bonus described in Paragraph 3, below (including its subparts), Employee is eligible to receive Retention Bonuses in the form of (a) two lump sum cash payments, and (b) a grant of restricted stock unit shares (RSUs), in the amounts shown below as of the applicable Retention Date, less all applicable state and federal taxes and withholdings:

●Retention Date 1 - March 15, 2024: $114,750.00

●Retention Date 2 - August 15, 2024: 229,500 Shares of RSUs, vesting as of August 15, 2024

●Retention Date 3 - August 16, 2024: $114,750.00

The grant of RSUs under this Agreement, if any, is subject to the terms and conditions of Invitae’s 2015 Stock Incentive Plan and the applicable Stock Award Agreement. Any shares granted to Employee in connection with this Agreement will be canceled if this Agreement is not fully executed by both Employee and the Company.

Employee must be employed at the Company on each Retention Date to qualify for the applicable Retention Bonus under this Agreement. If Employee is terminated (with or without Cause) or resigns their

employment prior to any Retention Date, Employee becomes ineligible to earn any future Retention Bonuses pursuant to this Agreement.

3. Conditions to Earning a Bonus. Employee will earn a Retention Bonus and/or a [**] Bonus if all of the following conditions are met as of each applicable Retention Date and/or [**] Bonus Earned Date, subject to all other terms of this Agreement:

3.1

(a) For purposes of earning the [**] Bonus: Employee remains actively employed by the Company through the [**] Bonus Earned Date in Employee’s current position, unless Employee is offered and accepts a different role/position with the Company, or is terminated by the Company not for Cause (as defined in the CCSA) prior to the [**] Bonus Earned Date; and

(b) For purposes of earning one or more Retention Bonuses: Employee remains actively employed by the Company through the applicable Retention Date in Employee’s current position, unless Employee is offered and accepts a different role/position with the Company; and

3.2 Employee faithfully and diligently performs the duties of Employee’s position, and such other duties as may be assigned from time to time; and

3.3 Employee faithfully and diligently assists the Company in all of its efforts to complete the [**] in a timely manner up to and through the [**] Bonus Earned Date, including maintaining total confidentiality regarding the [**] (except as the Company permits Employee to disclose); and

3.4 Employee complies with all continuing obligations to the Company, including without limitation, the applicable Employee Manual and Code of Business Conduct and Ethics, and any agreements regarding Company Confidential Information or Trade Secrets; and

3.5 Employee keeps confidential until the [**] Bonus Earned Date the existence and terms of this Agreement and does not discuss it with anyone other than Employee’s People & Culture Business Partner, and, in confidence, Employee’s spouse, tax and/or legal advisor (except to the extent the terms of this Agreement are publicly disclosed by the Company) or as required by applicable law.

4. Timing of Payments. If a cash Retention Bonus and/or a [**] Bonus is earned by the Employee in accordance with Paragraphs 1 through 3 above, the applicable amount will be paid in a lump sum, less applicable taxes and withholdings, within fifteen (15) days after the applicable Retention Date and/or [**] Bonus Earned Date. The vesting of any RSUs earned by the Employee in accordance with Paragraphs 2 and 3 above is subject to the terms and conditions of Invitae’s 2015 Stock Incentive Plan and the applicable Stock Award Agreement; the RSUs will be fully vested and will be released per standard timelines.

5. At-Will Employment. Employee understands and agrees that Employee is and will continue to be an at-will employee of the Company. The Company reserves the right to terminate Employee’s employment at any time with or without cause or prior notice, except as provided in the CCSA.

6. Applicable Law. The validity, interpretation and performance of this Agreement shall be construed and interpreted according to the laws of the United States of America and the State in which Employee performed work for the Company during the period in which this Agreement was in effect.

7. Entire Agreement. This Agreement represents the complete understanding of the Company and Employee with respect to the subject matter hereof and supersedes all prior and contemporaneous discussions and agreements, whether written or oral, between any parties with respect to such subject matter. This Agreement shall be the exclusive agreement for the determination of any payments due to the Employee as described herein.

8. Modification, Waiver, & Amendment. No modification of or amendment to this Agreement will be effective unless in a writing signed by both the Company and Employee. No oral waiver, amendment, or modification will be effective under any circumstances whatsoever.

* * *

The parties to this Agreement have read the foregoing Agreement and fully understand each and every provision contained therein. Wherefore, the parties have executed this Agreement on the dates shown below.

Date: October 19, 2023 By: /s/ Tom Brida

Name: Tom Brida

Date: October 19, 2023 By: /s/ Ken Knight

Ken Knight

Invitae Corporation

October 12, 2023

David Sholehvar

Re: Offer of Employment with Invitae Corporation

Dear David,

Congratulations! It is with great pleasure to invite you to join the Invitae team. We look forward to having you join us on November 13, 2023.

The terms of our offer are as follows:

1.Duties. As a(n) Regular, full-time employee, your role will be Chief Operating Officer. As Invitae’s business evolves, your job responsibilities are subject to change. During your employment, you will devote your best efforts and your full business time, skill and attention to your Invitae job duties.

2.Location. This will be a remote position.

3.Salary. Invitae will pay you a base salary of $460,000.00 per year, less all deductions and withholdings that apply. We will pay you according to Invitae’s standard payroll practices, as they may change from time to time. The company may modify your compensation during the course of your employment.

4.Sign-on Bonus. In addition, you will receive a one-time sign-on bonus in the gross amount of $150,000.00, less applicable employment taxes and withholdings. Your sign-on bonus will be payable with your initial paycheck following your commencement of employment at Invitae. If you resign your employment for any reason or are terminated for cause within twelve (12) months following your start date, you will be required to repay Invitae the entirety of your sign-on bonus. For purposes of this Paragraph 4, termination “for cause” shall have the same meaning as set forth in your Invitae Corporation Change of Control and Severance Agreement (the “CCSA”).

5.Retention Bonus. You will also be provided a separate Retention Bonus Agreement setting forth the terms and conditions under which you may be eligible to earn a Retention Bonus in connection with your employment with Invitae, provided you satisfy the conditions set forth therein.

6.Incentive Compensation. Upon commencement of employment, you will be eligible to participate in the Invitae 2023 Management Incentive Compensation Plan (the “Plan”), subject to the terms of the Plan. The target award for your role is equal to 100% of your annual base salary on a pro-rated based for 2023, or $76,700. Eligibility to participate in the Plan and actual award amounts are not guaranteed and are determined

at sole the discretion of the independent members of Invitae’s Board of Directors (the “Board”) or the Board’s Compensation Committee.

7.Equity. Invitae will grant you 850,000 shares of restricted stock units (RSUs). RSUs will vest over a 3-year period, both subject to the terms and conditions of Invitae’s 2015 Stock Incentive Plan and the applicable Stock Award Agreement.

8.Benefits. If you choose to enroll, health coverage will begin on the 1st of the following month (e.g., if you start April 22nd, your medical benefits go live May 1st.) You will be eligible to participate in Invitae-sponsored medical and other employee benefits programs. For additional information on Invitae’s benefits package, please refer to the Employee Benefits summary enclosed with this letter. We will provide further details at your New Hire Orientation, to be scheduled soon after your first day on the job. The company may, from time to time, change these benefits.

9.Background and Reference Check. This offer of employment is contingent upon satisfactory results of a background and reference check to be performed pursuant to your written authorization.

10.Confidentiality Agreement. As a condition of your employment, you will be expected to sign Invitae’s standard At-Will Employment, Confidential Information, Invention Assignment and Arbitration Agreement.

11.At-Will Employment. Your employment with Invitae will be “at will.” This means that either you or Invitae may terminate your employment at any time, with or without cause, subject to the terms and conditions set forth in your CCSA. Any contrary representations or agreements which may have been made to you are superseded by this offer letter. The “at will” term of your employment can only be changed in writing signed by you and Invitae.

12.Arbitration.

(a)Agreement to Arbitrate All Disputes. To ensure the timely and economical resolution of disputes that may arise between you and Invitae, both you and Invitae mutually agree that pursuant to the Federal Arbitration Act, 9 U.S.C. §1-16, and to the fullest extent permitted by applicable law, you will submit solely to final, binding and confidential arbitration any and all disputes, claims, or causes of action arising from or relating to: (i) the negotiation, execution, interpretation, performance, breach or enforcement of this Agreement; or (ii) your employment with Invitae (including but not limited to all statutory claims); or (iii) the termination of your employment with Invitae (including but not limited to all statutory claims). BY AGREEING TO THIS ARBITRATION PROCEDURE, BOTH YOU AND INVITAE WAIVE THE RIGHT TO RESOLVE ANY SUCH DISPUTES THROUGH A TRIAL BY JURY OR JUDGE OR THROUGH AN ADMINISTRATIVE PROCEEDING.

(b)Arbitrator Authority. The Arbitrator shall have the sole and exclusive authority to determine whether a dispute, claim or cause of action is subject to arbitration under this Arbitration section and to determine any procedural questions which grow out of such disputes, claims or causes of action and bear on their final disposition.

(c)Individual Capacity Only. All claims, disputes, or causes of action under this Arbitration section, whether by you or Invitae, must be brought solely in an individual capacity, and shall not be brought as a plaintiff (or claimant) or class member in any purported class or representative proceeding, nor joined or consolidated with the claims of any other person or entity. The Arbitrator may not consolidate the claims of more than one person or entity, and may not preside over any form of representative or class proceeding. To the extent that the preceding sentences in this paragraph are found to violate applicable law or are otherwise found unenforceable, any claim(s) alleged or brought on behalf of a class shall proceed in a court of law rather than by arbitration.

(d)Arbitration Process. Any arbitration proceeding under this Arbitration section shall be presided over by a single arbitrator and conducted by JAMS, Inc. (“JAMS”) in San Francisco under the then applicable JAMS rules for the resolution of employment disputes (available upon request and also currently available at http://www.jamsadr.com/rules-employment-arbitration/). You and Invitae both have the right to be represented by legal counsel at any arbitration proceeding, at each party’s own expense. The Arbitrator shall: (i) have the authority to compel adequate discovery for the resolution of the dispute; (ii) issue a written arbitration decision, to include the arbitrator’s essential findings and conclusions and a statement of the award; and (iii) be authorized to award any or all remedies that you or Invitae would be entitled to seek in a court of law. Invitae shall pay all JAMS arbitration fees in excess of the amount of court fees that would be required of you if the dispute were decided in a court of law.

(e)Excluded Claims. This Arbitration section shall not apply to any action or claim that cannot be subject to mandatory arbitration as a matter of law, including, without limitation, claims brought pursuant to the California Private Attorneys General Act of 2004, as amended, the California Fair Employment and Housing Act, as amended, and the California Labor Code, as amended, to the extent such claims are not permitted by applicable law to be submitted to mandatory arbitration and such applicable law is not preempted by the Federal Arbitration Act or otherwise invalid (collectively, the “Excluded Claims”). In the event you intend to bring multiple claims, including one of the Excluded Claims listed above, the Excluded Claims may be filed with a court, while any other claims will remain subject to mandatory arbitration.

(f)Injunctive Relief and Final Orders. Nothing in this Arbitration section is intended to prevent either you or Invitae from obtaining injunctive relief in court to prevent irreparable harm pending the conclusion of any such arbitration. Any final award in any arbitration proceeding hereunder may be entered as a judgment in the federal and state courts of any competent jurisdiction and enforced accordingly.

13.Miscellaneous. This letter along with the documents referenced herein and the CCSA and documents referenced therein states the complete and exclusive

terms and conditions of your offer and supersedes any other agreements, whether written or oral. By joining Invitae, you are agreeing to abide by all Invitae policies and procedures as they are established. The terms of this offer and your employment with Invitae will be governed in all aspects by the laws of the state(s) in which you perform work for Invitae. As required by law, this offer is subject to satisfactory proof of your right to work in the United States.

We look forward to having you join us on November 13, 2023. If you wish to accept this offer under the terms and conditions described above please sign and date this letter and return it to me by October 17, 2023 If you have any questions about the terms of this offer, please contact me.

Best Regards,

/s/ John Curran

John Curran

Head of Talent Acquisition

Invitae Corporation

I have read this offer letter. I understand and agree to its terms.

/s/ David Sholehvar

David Sholehvar

Signed Date: October 13, 2023

RETENTION BONUS AGREEMENT

This Retention Bonus Agreement (“Agreement”) is made and entered into as of the date of execution by all parties as indicated below, by and between Invitae Corporation (the “Company”) and David Sholehvar.

(“Employee”) with respect to the following facts:

A.Employee will be and/or is currently employed by the Company as Chief Operating Officer.

B.The Company recognizes and values Employee’s contributions to the Company and is interested in retaining Employee in its employ. Accordingly, the Company enters into this Agreement with Employee to provide an incentive to Employee to remain employed by the Company until the date noted in Section 1, below. This date will be known as the Retention Date.

Now, therefore, Employee and the Company agree as follows:

1.Retention Bonus. Provided Employee satisfies all the Conditions to Earning a Bonus described in Paragraph 2, below (including its subparts), as of the Retention Date, Employee will earn a Retention Bonus in the amount shown below, less all applicable state and federal taxes and withholdings:

●Retention Date – May 13, 2024: $150,000.00

2.Conditions to Earning a Bonus. Employee will earn a Retention Bonus if all of the following conditions are met as of the Retention Date, subject to all other terms of this Agreement:

2.1Employee remains employed by the Company through the Retention Date in Employee’s current position, unless Employee is offered and accepts a different role/position with the Company; and

2.2Employee faithfully and diligently performs the duties of Employee’s position, and such other duties as may be assigned from time to time; and

2.3Employee complies with all continuing obligations to the Company, including without limitation, the applicable Employee Manual and Code of Ethics, and any agreement regarding Company Confidential Information or Trade Secrets.

3.Timing of Payments. If a Retention Bonus is earned by the Employee in accordance with Paragraphs 1 and 2 above, the amount will be paid in a lump sum, less applicable taxes and withholdings, within 30 days after the Retention Date.

4.Repayment Obligation. If Employee resigns his employment for any reason or is terminated for cause within the twelve (12) months following the Retention Date, Employee will be required to repay Invitae the applicable Retention Bonus in accordance with the table set forth in Section 5, below. For purposes of the Repayment Obligation, termination “for cause” means misconduct with respect to Employee’s employment or otherwise relating to the business of Invitae; material neglect of duties; falsification of any employment or other records; improper use or disclosure of Invitae’s trade secrets or confidential information; violation of or failure to comply with Invitae’s Employee Manual and/or Code of Business Conduct and Ethics; or other conduct that is likely to have an adverse effect on the name or public image of Invitae.

5.Repayment Calculation.

| | | | | |

Resignation/Termination During Month No. | Repayment Percentage |

1 | 100% |

2 | 91.67% |

3 | 83.33% |

4 | 75% |

5 | 66.67% |

6 | 58.33% |

7 | 50% |

8 | 41.67% |

9 | 33.33% |

10 | 25% |

11 | 16.67% |

12 | 8.33% |

After 12 | 0% |

6.At-Will Employment. Employee understands and agrees that Employee is and will continue to be an at-will employee of the Company. The Company reserves the right to terminate Employee’s employment at any time with or without cause or prior notice.

7.Applicable Law. The validity, interpretation and performance of this Agreement shall be construed and interpreted according to the laws of the United States of America and the State in which Employee performed work for the Company during the period in which this Agreement was in effect.

8.Entire Agreement. This Agreement constitutes the entire agreement between Employee and the Company with regard to a Retention Bonus for the time period at issue herein, and supersedes any and all prior agreements, whether written or oral, between the parties regarding retention bonuses. This Agreement shall be the exclusive agreement for the determination of any retention payments due to the Employee. No modification of or amendment to this Agreement will be effective unless in a writing signed by both the Company and Employee. No oral waiver, amendment, or modification will be effective under any circumstances whatsoever.

* * *

The parties to this Agreement have read the foregoing Agreement and fully understand each and every provision contained therein. Wherefore, the parties have executed this Agreement on the dates shown below.

/s/ David Sholehvar

David Sholehvar

/s/ Desarie French

Desarie French

Invitae Corporation

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

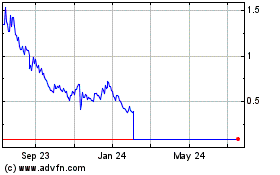

Invitae (NYSE:NVTA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Invitae (NYSE:NVTA)

Historical Stock Chart

From Jul 2023 to Jul 2024