0001609550False00016095502024-02-062024-02-06

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 6, 2024

_________________________

INSPIRE MEDICAL SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

_________________________ | | | | | | | | | | | | | | |

| Delaware | | 001-38468 | | 26-1377674 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5500 Wayzata Blvd., Suite 1600

Golden Valley, Minnesota 55416

(Address of principal executive offices) (Zip Code)

(844) 672-4357

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | INSP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 6, 2024, Inspire Medical Systems, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and full year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

In February and March of 2024, the Company will be participating in various meetings with investors and analysts, and a copy of the Company’s presentation materials being used at these meetings is furnished as Exhibit 99.2 hereto and is incorporated herein by reference. These presentation materials are also available on the Investor Relations page of the Company’s website at https://investors.inspiresleep.com.

The information in each of Item 2.02 and Item 7.01 of this Current Report on Form 8-K and in the press release attached as Exhibit 99.1 and the presentation attached as Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | INSPIRE MEDICAL SYSTEMS, INC. |

| | |

| Date: | February 6, 2024 | By: | /s/ Richard J. Buchholz |

| | | Richard J. Buchholz |

| | | Chief Financial Officer |

Exhibit 99.1

Inspire Medical Systems, Inc. Announces Fourth Quarter and

Full Year 2023 Financial Results and Reaffirms 2024 Outlook

Inspire Reports First Quarter with Operating Income and Year-over-Year

Revenue Growth of 40% in the Fourth Quarter

MINNEAPOLIS, Minnesota - February 6, 2024 - Inspire Medical Systems, Inc. (NYSE: INSP) (Inspire), a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea, today reported financial results for the quarter and year ended December 31, 2023.

Recent Business Highlights and Full Year 2024 Guidance

•Generated revenue of $192.5 million in the fourth quarter of 2023, a 40% increase over the same quarter last year, and revenue of $624.8 million in full year 2023, a 53% increase over full year 2022

•Achieved gross margin of 85.4% in the fourth quarter of 2023

•Reported net income of $14.8 million and diluted net income per share of $0.49 in the fourth quarter of 2023

•Activated 78 new U.S. centers in the fourth quarter of 2023, bringing the total to 1,180 U.S. medical centers providing Inspire therapy

•Created 13 new U.S. sales territories in the fourth quarter of 2023, bringing the total to 287 U.S. sales territories

•Reaffirms full year 2024 revenue to be in the range of $775 million to $785 million, which would represent year-over-year growth of approximately 24% to 26%

"We are thrilled with our strong performance in the fourth quarter, growing revenue 40% year-over-year and delivering over $14 million in net income. Our growth continues to be driven primarily by higher utilization at existing sites and was complemented by the addition of 78 new U.S. implanting centers and 13 new sales territories," said Tim Herbert, President, and Chief Executive Officer of Inspire Medical Systems. "During the quarter, we worked diligently with commercial payers to update coverage policies for our expanded indications, and we achieved several important milestones, including surpassing 60,000 patients treated with Inspire therapy and reporting our first quarter of operating income. We expect this strong operating leverage to continue and to reach profitability for the second half of 2024.”

Fourth Quarter 2023 Financial Results

Revenue was $192.5 million for the three months ended December 31, 2023, a 40% increase from $137.9 million in the corresponding period in the prior year. U.S. revenue for the quarter was $189.4 million, an increase of 41% as compared to the prior year quarter. Fourth quarter revenue outside the U.S. was $3.1 million, a decrease of 16% as compared to the fourth quarter of 2022.

Gross margin was 85.4% for the three months ended December 31, 2023, compared to 83.9% for the corresponding prior year period. This increase was driven by increased volume and higher manufacturing yields.

Operating expenses increased to $155.2 million for the fourth quarter of 2023, as compared to $116.1 million in the corresponding prior year period, an increase of 34%. This increase primarily reflected ongoing investments in the expansion of the U.S. sales organization, direct-to-patient marketing programs, continued product development efforts, as well as increased general corporate costs.

Net income was $14.8 million for the fourth quarter of 2023, as compared to $3.2 million in the corresponding prior year period. The diluted net income per share for the fourth quarter of 2023 was $0.49 per share, as compared to $0.10 in the prior year period.

Full Year 2023 Financial Results

Revenue was $624.8 million for full year 2023, a 53% increase from $407.9 million in the prior year. U.S. revenue for the full year was $606.2 million, an increase of 54% as compared to the prior year. Full year 2023 revenue outside the U.S. was $18.6 million, an increase of 43% as over full year 2022.

Gross margin was 84.5% for full year 2023, compared to 83.8% for full year 2022.

Operating expenses were $568.5 million compared to $389.3 million for full year 2022, an increase of 46%.

Net loss was $21.2 million compared to $44.9 million for full year 2022, a 53% improvement.

As of December 31, 2023, cash, cash equivalents, and investments increased to $469.5 million from $451.4 million on December 31, 2022.

Full Year 2024 Guidance

Inspire is maintaining its full year 2024 revenue guidance of between $775 million to $785 million, which represents growth of 24% to 26% over full year 2023 revenue of $624.8 million.

Gross margin for the full year is anticipated to be in the range of 83% to 85%.

In addition, during each quarter of 2024, the Company expects to activate 52 to 56 new U.S. medical centers implanting Inspire therapy and add 12 to 14 new U.S. sales territories.

Webcast and Conference Call

Inspire’s management will host a conference call after market close today, Tuesday, February 6, 2024, at 5:00 p.m. Eastern Time to discuss these results and answer questions.

To access the conference call, please preregister on

https://register.vevent.com/register/BI4da0fb8e7625480f8890c3e09699bec4. Registrants will receive confirmation with dial-in details.

A live webcast of the event can be accessed on https://edge.media-server.com/mmc/p/9hhddszn/. A replay of the webcast will be available on https://investors.inspiresleep.com starting approximately two hours after the event and archived on the site for two weeks.

About Inspire Medical Systems

Inspire is a medical technology company focused on the development and commercialization of innovative, minimally invasive solutions for patients with obstructive sleep apnea. Inspire’s proprietary Inspire therapy is the first and only FDA-approved neurostimulation technology that provides a safe and effective treatment for moderate to severe obstructive sleep apnea.

For additional information about Inspire, please visit www.inspiresleep.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements, including, without limitation, statements regarding full year 2024 financial outlook, our expectations to activate new U.S. medical centers and add new territories per quarter in 2024 and the impact of such additions, our expectations regarding operating leverage and profitability during 2024, and our strategy and investments to grow and scale our

business. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” “guidance,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words.

These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, estimates regarding the annual total addressable market for our Inspire therapy in the U.S. and our market opportunity outside the U.S.; future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; commercial success and market acceptance of our Inspire therapy; the impact of macroeconomic trends; general and international economic, political, and other risks, including currency, inflation, stock market fluctuations and the uncertain economic environment; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies and technologies in our industry; our ability to enhance our Inspire system, expand our indications and develop and commercialize additional products; our business model and strategic plans for our products, technologies and business, including our implementation thereof; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to increase the number of active medical centers implanting Inspire therapy; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to commercialize or obtain regulatory approvals for our Inspire therapy and system, or the effect of delays in commercializing or obtaining regulatory approvals; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; and the timing or likelihood of regulatory filings and approvals. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this press release can be found under the captions “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations“ in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 to be filed with the SEC, and as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this press release.

Investor & Media Contact

Ezgi Yagci

Vice President, Investor Relations

ezgiyagci@inspiresleep.com

617-549-2443

Inspire Medical Systems, Inc.

Consolidated Statements of Operations and Comprehensive Income (Loss) (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 192,508 | | | $ | 137,900 | | | $ | 624,799 | | | $ | 407,856 | |

| Cost of goods sold | | 28,054 | | | 22,152 | | | 96,576 | | | 66,115 | |

| Gross profit | | 164,454 | | | 115,748 | | | 528,223 | | | 341,741 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 31,052 | | | 21,248 | | | 116,536 | | | 68,645 | |

| Selling, general and administrative | | 124,105 | | | 94,835 | | | 451,958 | | | 320,688 | |

| Total operating expenses | | 155,157 | | | 116,083 | | | 568,494 | | | 389,333 | |

| Operating loss | | 9,297 | | | (335) | | | (40,271) | | | (47,592) | |

| Other (income) expense: | | | | | | | | |

| Interest and dividend income | | (5,870) | | | (3,369) | | | (20,560) | | | (5,050) | |

| Interest expense | | — | | | — | | | — | | | 1,677 | |

| Other (income) expense, net | | (73) | | | (241) | | | 195 | | | 49 | |

| Total other income | | (5,943) | | | (3,610) | | | (20,365) | | | (3,324) | |

| Income (loss) before income taxes | | 15,240 | | | 3,275 | | | (19,906) | | | (44,268) | |

| Income taxes | | 477 | | | 125 | | | 1,247 | | | 613 | |

| Net income (loss) | | 14,763 | | | 3,150 | | | (21,153) | | | (44,881) | |

| Other comprehensive income (loss): | | | | | | | | |

| Foreign currency translation gain | | 144 | | | 195 | | | 140 | | | 89 | |

| Unrealized gain (loss) on investments | | 612 | | | 82 | | | 746 | | | (120) | |

| Total comprehensive income (loss) | | $ | 15,519 | | | $ | 3,427 | | | $ | (20,267) | | | $ | (44,912) | |

| Basic income (loss) per share | | $ | 0.50 | | | $ | 0.11 | | | $ | (0.72) | | | $ | (1.60) | |

| Diluted income (loss) per share | | $ | 0.49 | | | $ | 0.10 | | | $ | (0.72) | | | $ | (1.60) | |

| Basic weighted average shares outstanding | | 29,517,375 | | | 28,931,271 | | | 29,302,154 | | | 28,071,748 | |

| Diluted weighted average shares outstanding | | 30,236,821 | | | 30,209,503 | | | 29,302,154 | | | 28,071,748 | |

Inspire Medical Systems, Inc.

Consolidated Balance Sheets (unaudited)

(in thousands, except share and per share amounts) | | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 185,537 | | | $ | 441,592 | |

| Investments, short-term | 274,838 | | | 9,821 | |

Accounts receivable, net of allowance for credit losses of

$1,648 and $36, respectively | 89,884 | | | 61,228 | |

| Inventories, net | 33,885 | | | 11,886 | |

| Prepaid expenses and other current assets | 9,595 | | | 5,505 | |

| Total current assets | 593,739 | | | 530,032 | |

| Investments, long-term | 9,143 | | | — | |

| Property and equipment, net | 39,984 | | | 17,249 | |

| Operating lease right-of-use assets | 22,667 | | | 6,880 | |

| Other non-current assets | 11,278 | | | 10,715 | |

| Total assets | $ | 676,811 | | | $ | 564,876 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 38,839 | | | $ | 26,847 | |

| Accrued expenses | 39,266 | | | 34,339 | |

| | | |

| Total current liabilities | 78,105 | | | 61,186 | |

| | | |

| Operating lease liabilities, non-current portion | 24,846 | | | 7,536 | |

| Other non-current liabilities | 1,346 | | | 146 | |

| | | |

| Total liabilities | 104,297 | | | 68,868 | |

| Stockholders' equity | | | |

| Preferred Stock, $0.001 par value, 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

| Common Stock, $0.001 par value, 200,000,000 shares authorized; 29,560,464 and 29,008,368 shares issued and outstanding at December 31, 2023 and 2022, respectively | 30 | | | 29 | |

| Additional paid-in capital | 917,107 | | | 820,335 | |

| Accumulated other comprehensive income (loss) | 800 | | | (86) | |

| Accumulated deficit | (345,423) | | | (324,270) | |

| Total stockholders' equity | 572,514 | | | 496,008 | |

| Total liabilities and stockholders' equity | $ | 676,811 | | | $ | 564,876 | |

1 Inspire Medical Systems, Inc. February 2024 NYSE: INSP

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. The forward- looking statements in this presentation relate to, among other things, statements regarding the planned investments in our business, our growth strategies, the expected timing of regulatory approval and market introduction for new products, including the Inspire V neurostimulator, the potential impact that our growth strategies and initiatives may have on our business, full year 2024 financial and operational outlook, the ability of our SleepSync digital health platform to drive growth, and positive insurance coverage of Inspire therapy and improvements in market access, clinical data growth, product development, indication expansion, market development, and prior authorization approvals. These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, estimates regarding the annual total addressable market for our Inspire therapy in the U.S. and our market opportunity outside the U.S.; future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; commercial success and market acceptance of our Inspire therapy; the impact of the ongoing and global COVID-19 pandemic; general and international economic, political, and other risks, including currency and stock market fluctuations and the uncertain economic environment; challenges experienced by patients in obtaining prior authorization; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies and technologies in our industry; our ability to enhance our Inspire system, expand our indications and develop and commercialize additional products; our business model and strategic plans for our products, technologies and business, including our implementation thereof; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to increase the number of active medical centers implanting Inspire therapy; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to obtain regulatory approvals for, and commercialize, our Inspire therapy and system, or the effect of delays in obtaining regulatory approvals or commercializing; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; the timing or likelihood of regulatory filings and approvals; risks related to our debt and capital structure; our ability to establish and maintain intellectual property protection for our Inspire therapy and system or avoid claims of infringement; tax risks; risks that we may be deemed an investment company under the Investment Company Act of 1940; regulatory risks; the volatility of the trading price of our common stock; and our expectations about market trends. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this presentation can be found under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any such forward-looking statements represent management’s estimates as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. 2

Company Overview • Inspire is the first and only FDA-approved neurostimulation technology for Obstructive Sleep Apnea (OSA) with significant first-mover advantage • Innovative, closed-loop, primary cell solution with ~11-year battery life • ~90-minute, safe, convenient, minimally invasive outpatient procedure • Full-body MRI compatibility • Over 60,000 patients treated with Inspire therapy • ~$10 billion annual U.S. market opportunity • Significant body of clinical evidence involving thousands of patients across more than 100 studies • Established reimbursement with 260 million U.S. covered lives including commercial payers, Medicare coverage in all 50 states, and Veterans Affairs • Proven management team leading 1,000+ employees • Strong financial profile with 83-85% gross margin • Well-capitalized balance sheet with $470 million in net cash (as of December 31, 2023) Our History & Key Milestones 1990s: Medtronic (MDT) begins early work on the development of Inspire 2001: Initial clinical results published by MDT 2007: Inspire is founded after being spun-out of MDT 2011: Initiated Phase III pivotal STAR trial; CE mark received in Europe 2014: STAR results published in the New England Journal of Medicine; received PMA approval from the FDA 2015: 18-month STAR data published; revenues of $8.0M 2016: 1,000th implant milestone; revenues of $16.4M 2017: Launched Inspire IV neurostimulator in U.S.; announced 5-year STAR results; 2,000th implant; revenues of $28.6M 2018: Inspire IV CE mark; 5-year STAR results publication; IPO on NYSE; Aetna begins covering the Inspire therapy; revenues of $50.6M 2019: 7,500th patient receives Inspire therapy; many BCBS plans and other large insurers write positive coverage; revenues of $82.1M 2020: Medicare coverage in all 50 states; FDA approved age range expansion of 18 to 21; Inspire Sleep app released; 10,000th implant; revenues of $115.4M 2021: Anthem policy issued; FDA approved 2-incision approach and Bluetooth® remote; 20,000th implant; revenues of $230.4M 2022: First implants in Japan, Singapore, and the U.K.; strategic investments in digital health platform capabilities; FDA approved full-body MRI compatibility; 36,000th implant; revenues of $407.9M 2023: Expanded AHI, BMI and pediatric Down syndrome indications; first implants in Hong Kong; reimbursement in Belgium; 60,000th implant; revenues of $624.8M 2024E: SleepSync physician programmer expected to launch in the U.S.; expected FDA approval of Inspire V; expected reimbursement in France 3

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Obstructive Sleep Apnea is a Serious and Chronic Disease OSA is Caused by a Blocked or Partially Blocked Airway • Blockage prevents airflow to the lungs • Results in repeated arousals and oxygen de-saturations • Severity of sleep apnea is measured by frequency of apnea or hypopnea events per hour, which is referred to as the Apnea-Hypopnea Index (AHI) Airway obstruction during breathing Normal range: AHI < 5 events per hour Mild sleep apnea: 5 ≤ AHI < 15 events per hour Moderate sleep apnea: 15 ≤ AHI < 30 events per hour Severe sleep apnea: AHI ≥ 30 events per hour Most Patients Are Unaware of Their Condition… …and Untreated OSA Multiplies Serious Health Risks • High risk patients: obese, male or of advanced age • Common first indicator: heavy snoring • Other indicators: • Lack of energy • Headaches • Depression • Nighttime gasping • Dry mouth • Memory or concentration problems • Excessive daytime sleepiness Source: Company Website 1. Redline et al, The Sleep Heart Health Study. Am J Res and Crit Care Med 2010. 2. Gami et al, J Am Coll Cardiol 2013. 3. Young et al, J Sleep 2008. 2x The risk for stroke1 2x The risk for sudden cardiac death2 57% Increased risk for recurrence of Atrial Fibrillation after ablation4 Years of Follow-up % S ur vi vi ng Increased Risk of Mortality 5 4. Li et al, Europace 2014. 5. Prospective Study of Obstructive Sleep Apnea and Incident Coronary Heart Disease and Heart Failure from SHHS and Wisconsin Sleep Cohort Study. 5x The risk for cardiovascular mortality3 4

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Current Treatment Options, Such as CPAP and Invasive Surgery, Have Significant Limitations Ina Uvulopalatopharyngoplasty (UPPP) Maxillomandibular Advancement (MMA) • Several variations of sleep surgery • Success rates vary widely (30% - 60%)1 • Irreversible anatomy alteration • Inpatient surgery with extended recovery Surgical Alternatives for OSA Ina Continuous Positive Airway Pressure (CPAP) is the Leading Therapy for OSA 1. Shah, Janki, et al; American Journal of Otolaryngology (2018). Uvulopalatopharyngoplasty vs. CN XII stimulation for treatment of obstructive sleep apnea: A single institution experience. Drivers of Non-Compliance Mask Discomfort Mask Leakage Pressure Intolerance Skin Irritation Nasal Congestion Nasal Drying Nosebleeds Claustrophobia Lack of Intimacy • Demonstrated improvements in disease severity and long-term gold standard therapy • Major limitation as a therapeutic option is primarily due to low patient compliance (approximately 35% – 65%) 5

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL A Strong Market Opportunity Exists for an Alternative to CPAP that is Effective and Minimally Invasive Sleep apnea affects +100 million people worldwide1 Approximately 17 million individuals in the U.S. with moderate to severe OSA • Annually, ~2 million adult patients are prescribed a CPAP device 2 Annual U.S. economic costs of untreated moderate to severe OSA are between $65 - $165 billion3 OSA economic costs are potentially greater than asthma, heart failure, stroke, and hypertensive disease OSA is associated with an increase in: • Rate & severity of vehicle accidents • Increased healthcare utilization • Reduction of work performance • Occupational injuries Prevalence & Economic Costs 1. Source: World Health Organization. 2. Company estimates. 3. Represents moderate to severe OSA. Source: McKinsey & Company, 2010. Adults with Moderate to Severe OSA Prescribed CPAP2 = ~2 million •Less: 65% CPAP Compliant 35% of CPAP Non- Compliant Adults = ~700,000 •Less: 30% Anatomy Challenges 70% Inspire Anatomy Eligible = ~500,000 •Multiplied by our average selling price Inspire U.S. Market = ~$10 billion Published literature estimates CPAP non-compliance rates of 35% - 65% 6

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Inspire Has Similar Outcomes as CPAP, and Lower Symptoms & Disease Burden Population: New UAS (n=117) and CPAP (n=110) pts Follow-up: 12 months Inclusion of both arms • Sleepiness Symptoms • AHI between 15-65 • Predominant OSA Statistically Matched: 63 PAP vs 63 UAS • Baseline AHI: ~35 events/hour • Baseline ESS: ~15 Results – UAS better at improving symptoms, and possibly higher usageHow does UAS compare vs CPAP? 4.0 3.9 5 8 Usage/Night (hours) ESS reduction (points) UAS CPAP p = 0.0421 p = 0.087 1. Heiser, Sleep & Breathing 2022 7

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Inspire Therapy is a Proven Solution for Patients with OSA Inspire System 1 2 3 Three implanted devices and patient remote: Pressure sensing lead: detects when the patient is attempting to breathe Neurostimulator: houses the electronics and battery power for the device Stimulation lead: delivers electrical stimulation to the hypoglossal nerve Inspire Procedure Typically, a 60-90 min outpatient procedure Requires two small incisions Patients typically recover quickly and resume normal activities in just a few days Patient turns on the device each night with the remote control before going to sleep 2 1 Hypoglossal Nerve Neurostimulator Stimulation Lead Pressure Sensing Lead 3 Inspire Algorithm Active while patients sleep Closed-loop system which senses breathing patterns Inspire system turned on Airflow Breathing Oxygen Saturation No OSA eventsOSA events Provides stimulation during inspiratory phase of respiration maintaining open airway Over 60,000 Inspire procedures completed to date 8 Inspire V Neurostimulator in final qual and follow-up response to FDA early in 2024 • Incorporates sensing function • Provides software-based platform for future feature additions

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Continuous Data Collection and Outcomes Monitoring • Collect real-world, international outcomes data • Eligibility – ALL patients receiving Inspire therapy • ADHERE Registry - 5,000 enrollments at 62 medical centers (enrollment complete) • Transition to ADHERE 2.0 as part of Inspire SleepSync in the U.S. AHI = Apnea Hypopnea Index ESS = Epworth Sleepiness Scale Post Market Surveillance Data Real World Data Proactive Data Reactive Data Data Analysis for Signals 9

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Inspire Patient Experience Report - Safety Inspire System Survivability to Revision by Implant Year Inspire System Survivability to Explant by Implant Year 10 90% 91% 92% 93% 94% 95% 96% 97% 98% 99% 100% 0 6 12 18 24 30 36 42 48 54 60 Su rv iv al P ro ba bi lit y Pe rc en ta ge Months After Implant Freedom from Inspire Revision by Implant Year 2018 2020 2019 2021 2022 95.5% 96.0% 96.5% 97.0% 97.5% 98.0% 98.5% 99.0% 99.5% 100.0% 0 4 8 12 16 20 24 28 32 36 40 44 48 52 56 60 Su rv iv al P ro ba bi lit y Pe rc en ta ge Months After Implant Freedom from Explant by Implant Year 2018 2020 2019 2021 2022

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Inspire focus is to maintain strong Patient Outcomes 33.0 7.8 10.2 0 5 10 15 20 25 30 35 Baseline (n=1,963) 6-mo Titration Study (n=1,852) 12-mo All Night Study (n=890)M ed ia n A HI (e ve nt s/ ho ur ) Apnea Hypopnea Index (AHI1) AHI response at 12 Month AHI </= 20 and 50% reduction: 67% AHI </= 20: 76% 50% reduction in AHI: 69% 1. Bosschieter et al. Similar effect of hypoglossal nerve stimulation for OSA in five disease categories. J Clin Sleep Med. 2022 Jun 1;18(6):1657-166. 1 Bosschieter et al. Similar effect of hypoglossal nerve stimulation for OSA in five disease categories. J Clin Sleep Med. 2022 Jun 1;18(6):1657-166. 11

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL • Electronic medical records (Future) • Sleep coaching, telemedicine, and efficient home sleep apnea testing SleepSync Digital Health Platform Accelerates Growth Enhanced by Strategic Integrations Growing Inspire Value • Expanding sleep clinician confidence & capacity enables more patients to benefit from Inspire • Automated real-world clinical studies • SaaS revenue possibilities (Future) Patient Inspire App Clinician SleepSync Web Portal Remote patient management Dynamic patient engagement Efficient care coordination • Find a doctor • Customized education • Track therapy & sleep quality • Virtual check-ins • Access therapy quality measures • Manage patients by exception • Grow confidence & productivity • Support sleep practice economics • Symptom Relief • Adherence • Disease Burden (Future) • Remote Adjustments (Future) 12

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Three Key Areas Will Drive Our Success In 2024 & Beyond 13 Patient Flow Capacity Outcomes • New Website (www.inspiresleep.com) launched in Dec 2023 will significantly improve Patient Education & Lead Capture • Refined Direct-to-Consumer outreach • Accelerate Patient Nurturing Capabilities • Drive knowledge and engagement with high potential PCPs • Reduce time for a patient to navigate the steps required to the Inspire care pathway • Continue to expand individual ENT cases, train new ENTs and steady activation of new centers • Activate early career MDs to join/start Inspire programs The number ONE accelerator of physician belief and patient testimonials • Maximize adoption of SleepSync • Continue to monitor Inspire outcomes

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL $16.3 $18.0 $20.9 $26.9 $21.3 $12.2 $35.8 $46.0 $40.4 $53.0 $61.7 $78.4 $69.4 $91.4 $109.2 $127.9 $151.1 $153.3 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Quarterly Revenue ($ in Millions) %YoY Revenue Growth 31% -32% 72% 71% 89% 335% 72% 70% 72% 73% 77% 76% 84% 65% 40% 40% $137.9 14 $192.4E$192.5

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL $28.6 $50.6 $82.1 $115.4 $233.4 $624.7 2017 2018 2019 2020 2021 2022 2023 2017 – 2023 CAGR: 67% Annual Revenue and Gross Margin ($ in millions) Annual Gross Margin 78.9% 80.1% 83.4% 84.7% 85.7% 83.8% 84.5% 2024 Guidance: • FY2024 revenue range of $775M - $785M, representing 24% - 26% growth over FY2023 • FY2024 gross margin guidance between 83% - 85% $407.9 15 $$ .8

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL 7 10 12 18 15 15 15 22 20 19 21 33 28 15 42 55 47 63 68 81 73 51 58 61 68 72 62 78 Q 1 17 Q 2 17 Q 3 17 Q 4 17 Q 1 18 Q 2 18 Q 3 18 Q 4 18 Q 1 19 Q 2 19 Q 3 19 Q 4 19 Q 1 20 Q 2 20 Q 3 20 Q 4 20 Q 1 21 Q 2 21 Q 3 21 Q 4 21 Q 1 22 Q 2 22 Q 3 22 Q 4 22 Q 1 23 Q 2 23 Q 3 23 Q 4 23 1,180 Steady Cadence of New Center Adds 2017 2018 2019 2020 12 per quarter 17 per quarter 23 per quarter 35 per quarter 2021 65 per quarter 2022 287 Territory Managers* managing 4-6 centers per rep *as of Q4 2023 62 per quarter 2023 70 per quarter 16

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL KEEPING CONTROL WHILE GROWING FAST Focus on the rapid scaling of commercialization (implanting centers and sales reps) while ensuring proper training to maintain control of high-quality therapy outcomes The Great Balancing Act Patient Outcomes Revenue Growth 17

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Q4 Business Highlights (As of December 31, 2023) • Generated $192.5 million of revenue in the fourth quarter • 40% increase over the same quarter last year • Achieved gross margin of 85.4% in the fourth quarter • Reported first quarter with operating income in the fourth quarter • Improved diluted earnings per share to $0.49 compared to $0.10 in the prior year period • Activated 78 new centers in the U.S. bringing the total to 1,180 U.S. centers providing Inspire therapy • Created 13 new sales territories in the U.S. bringing the total to 287 U.S. sales territories • Surpassed 60,000 patients treated with Inspire therapy • Cash and investments of $470 million as of December 31, 2023 18

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Our Growth Strategy Through planned and controlled market expansion and robust physician training Ensure Strong Clinical Outcomes 1 By enhancing interconnectivity, simplifying the care pathway, and closely tracking outcomes Improve the Customer Experience 2 Amongst patients, ENT/Sleep physicians, and general practitioners Promote Widespread Consumer Awareness 3 Commensurate with new center additions and leveraging consumer outreach programs Drive Continued Commercial Scale 4 Driving breakthrough technology innovation and expanded indications Invest in Research & Development 5 Further penetrating existing markets and entering into new geographical locations Facilitate International Market Expansion 6 19

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Appendix 21

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Consolidated Statements of Operations & Comprehensive Income (Loss) (Unaudited)(In thousands, except share and per share amounts) 22

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Condensed Consolidated Balance Sheets (Unaudited)(In thousands) 23

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Randy Ban Chief Commercial Officer Bryan Phillips SVP, General Counsel & Chief Compliance Officer Tim Herbert President, CEO & Founder Strong Management Team Ezgi Yagci Vice President, Investor Relations Rick Buchholz Chief Financial Officer John Rondoni Chief Technology Officer Kathy Sherwood Sr. Vice President, Market Access Phil Ebeling Chief Operating Officer Steve Jandrich Vice President, Human Resources Carlton Weatherby Chief Strategy Officer Dr. Charisse Sparks Chief Medical Officer 24

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Product Development and Digital Health 25

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Supporting Patients on their Path to Inspire Implant Fine- tune ActivationInspire Advisor Care Program (ACP) DISE/ Prior Authorization Patient education using the InspireSleep.com website Community health talks Physician Consultations Awareness with direct-to- consumer outreach programs Life with Inspire – Patient management with SleepSync Time from ACP contact to implant can be as much as six months 26

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Inspire Patient THE PATIENT JOURNEY Awareness Education Consultation Implant Life w/ Inspire Confirm Sleep Study Fine- tuneActivationImplantPrior AuthDISE Conduct Online Search Attend Appt. Schedule an Appt. with IS Dr. Obtain Updated Sleep Study Request an Appt. Do I Qualify Lead Register for CHT Visit IS.com Ask their Dr. about Inspire See an Inspire Ad C h a l l e n g e s What is the biggest pain point for patients? S U P P O R T What key investments and programs is Inspire investing in to support patients? • Patients need sufficient information to feel prepared to take the next step with Inspire • There are limited ways to engage with Inspire for support and education • It is difficult to schedule an appointment • Sleep Studies can take months for patients to get • Time for scheduling DISE • Time for scheduling implant • Patients need support through the therapy optimization process • Lead capture + scoring • Lead nurturing via email, text, phone • Request a call for nights/weekends • Updated website content for patients • Chatbot improvements with two-way text messaging • Digital scheduling through ACP • Ognomy + EnsoData • Increase ENT capacity to grow number of Inspire procedures • Inspire V to reduce OR time • PREDICTOR to replace DISE for many patients • SleepSync cloud-based patient management system to support patient from contact to post-implant sleep management 27

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Patient Engagement Conversion Initiatives Improving Patient Engagement Conversion Initiatives Increasing ENT Capacity to Further Grow Utilization SleepSync Patient Management System increase Utility • Digital scheduling has shown significant improvements with initial sites • Patient education using chat guide bot • Patient nurturing with auto-email system • Improved patient tracking with SleepSync • Work with ENTs to optimize time by ensuring support team (sleep physicians) engages and conducts longitudinal patient management • Train additional ENTs in the practice • Continue to add new centers with ability to quickly grow utilization (complete teams) • Longitudinal Patient Engagement from first contact to long after Inspire implant • Fully incorporate both Objective data (utilization, sleep performance) and Subjective data (e-visit, questionnaires) to support strong patient outcomes • Future enhancements including Remote Patient Programming and Physician notifications Improving Patient Experience and Reducing Time-to-Implant • Inspire V neurostimulator with internal sensor expected to reduce OR time and improve patient experience • PREDICTOR study intended to replace DISE with office airway measurement for vast majority of patients • Continued development of Inspire VI and VII for auto- activation and future auto-titration 28

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Market Development 29

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Chief Commercial Officer Commercial Organization U.S. Sales Team Patient Outcomes Team Territory Managers Field Clinical Reps Area Business Managers Sleep Support Specialists Surgical Trainers Care Pathway Specialists 30

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL 9 Area Vice Presidents Sales Area Structure Area Business Managers (ABM) Regional Managers (RM) Territory Managers (TM) Field Clinical Reps (FCR) • One per area • Open new accounts • 3-5 per area • Coaching • C-Suite Engagement • 5-8 per region • Productive programs • Ecosystem development • 2-4 per region • Clinical Outcomes • Implant & Programming Support 31

Health Economics: Untreated OSA Cost Burden • Untreated OSA patients had ~$20,000 higher total annual Medicare costs • CPAP intolerant patients had higher Medicare utilization than PAP tolerant ALASKA-Study – non-adherent patients have greater chance of mortality (n>176,000)2 PAP non- adherent PAP adherent96% 98% 100% Su rv iv al Pr ob ab ili ty Conclusions: • Prioritize PAP intolerant to therapy, especially those with CV disease • Addressing PAP intolerance improves mortality1. Wickwire JCSM 2021; Wickwire Sleep Breathing 2021 2. Pepin, ERS 2021 Conference Growing evidence that CPAP intolerance is linked to higher healthcare costs1 94% 32

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Environmental, Social and Governance (ESG) ENVIRONMENTAL Committed to operating our business responsibly and minimizing our impact on the environment wherever possible. • By 2025, we aim to implement a formal environmental quality management system in line with International Organization for Standardization (ISO) 14001 standards to mitigate climate- related risks. • We are also working toward establishing a sustainability policy that will be approved by the Board of Directors and will serve as the vision and mission for all climate-related commitments company wide. Committed to improving the economic, social, and environmental impacts that our business has on the communities in which we operate, as well as our customers, business partners, suppliers, employees, and stockholders. SOCIAL Our corporate culture defines who we are and how we act, and our diverse employee base, who embody our culture, is the driving force behind our success. • Our company’s success is built on our enduring commitment to quality and patient outcomes. • Women comprise 48% of global workforce. We actively seek candidates from all backgrounds. • Foster a culture of continuous learning with significant investments in our people through programs focused on leadership and professional development. GOVERNANCE Strong governance practices and high standards of ethics, compliance, and accountability designed to provide long-term value creation opportunities. • Strong and diverse Board collectively possessing a range of qualifications, skills, and experiences that align with our long- term strategy and business needs. • Robust information security and data privacy governance and risk management. • ESG matters overseen by Board, executive leadership, and cross-functional team. 33

© Inspire Medical Systems, Inc. All Rights Reserved INSPIRE CONFIDENTIAL Our Intellectual Property Portfolio (as of December 31, 2023) Covers aspects of our current Inspire system and future product concepts 80 issued U.S. patents (expiring between 2029 and 2041) and 81 pending U.S. patent applications 55 issued foreign patents and 71 pending foreign patent applications 175 pending and registered trademark filings worldwide Competitive position enhanced by trade secrets, proprietary know-how and continuing technological innovation Entered into an agreement with Medtronic in 2007 to make, use, import, and sell products and practice methods in the field of electrical stimulation of the upper airway for the treatment of OSA Royalty-free license agreement Perpetual license (no right of termination) 34

v3.24.0.1

Document and Entity Information

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

INSPIRE MEDICAL SYSTEMS, INC.

|

| Entity Central Index Key |

0001609550

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38468

|

| Entity Tax Identification Number |

26-1377674

|

| Entity Address, Address Line One |

5500 Wayzata Blvd.

|

| Entity Address, Address Line Two |

Suite 1600

|

| Entity Address, City or Town |

Golden Valley

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55416

|

| City Area Code |

844

|

| Local Phone Number |

672-4357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

INSP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

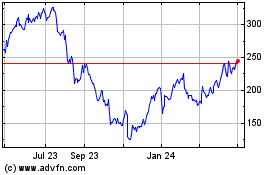

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Apr 2024 to May 2024

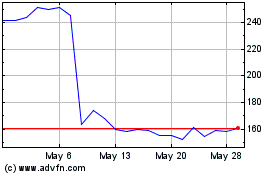

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From May 2023 to May 2024