Huntsman Corporation - Value

January 05 2012 - 7:00PM

Zacks

Huntsman Corporation (HUN) is trading at just 5.2x forward

estimates even though earnings are expected to grow in the triple

digits in 2011. Shares of this Zacks #2 Rank (buy) plunged over the

summer as investors abandoned the stock. Is it too late in the

cycle to buy the chemical companies?

Huntsman manufactures a variety of chemicals for

the global market, including the plastics, automotive, aviation,

textile, paint and coatings, technology, agriculture, furniture and

health care industries.

Strongest Third Quarter in History

On Nov 2, Huntsman reported its third quarter

results and surprised on the Zacks Consensus by 4.7%. Earnings were

45 cents compared to the consensus of 43 cents. The company made 34

cents in the third quarter of 2010.

Revenue jumped 24% to $3 billion from $2.4 billion

a year ago.

All divisions saw an increase in revenue except for

Textile Effects which saw a decrease due to lower sales volumes

which were only partially offset by higher average selling prices.

There was lower demand. The average selling prices increased due to

the strength of the Swiss Franc against the U.S. dollar.

The company also announced earlier in the third

quarter that it would record a cash restructuring charge of about

$135 million to deal with a restructuring plan to mitigate the

impact of the strong Swiss Franc and the challenging business

conditions of the global textile industry.

Record Year Expected in 2011

As of early November, Huntsman still expected to

post a record 2011 despite "sluggish" global business

conditions.

But, it also expected to see stronger earnings in

the coming year as many of its larger product lines are apparently

still far removed from peak earnings potential.

Double Digit Earnings Growth in 2012?

After triple digit earnings growth in 2010 and

another 104% expected in 2011, Huntsman is expected to slow in

2012.

The 2012 Zacks Consensus has actually fallen to

$1.91 from $1.96 over the last 90 days as 3 estimates moved lower

in the prior month. Still, this is earnings growth of 13% as the

Zacks Consensus is calling for $1.70 in 2011.

Super Cheap Stock

Investors have fled the stock since the summer

downturn.

Huntsman now has very attractive valuations. In

addition to a forward P/E of just 5.2, the company has a

price-to-book of 1.2. A P/B ratio under 3.0 usually indicates

value.

It also has a price-to-sales ratio of just 0.2. A

P/S ratio under 1.0 can mean a company is undervalued.

If an investor is also looking for income, in

addition to value, Huntsman rewards its shareholders with a

dividend currently yielding a juicy 4%.

In the third quarter earnings report Huntsman

sounded upbeat about 2012. It is scheduled to report fourth quarter

results on Feb 16. We'll soon find out whether or not chemical

companies have reached peak earnings in this cycle or if the global

economy is stronger than many realize.

This Week's Value Zacks Rank Buy Stocks

The steel companies are navigating a difficult

market as consumer demand appears to be solid but prices are

declining. Reliance Steel & Aluminum Company (RS) is

still expected to post double digit earnings growth in both 2011

and 2012. This Zacks #1 Rank (strong buy) is also a value stock

with a forward P/E of 10.9. Read the full article.

Not all banks are created equal. Oriental

Financial Group Inc. (OFG) recently raised its dividend by 20%

due to an improving outlook for its Puerto Rico-based business.

This Zacks #1 Rank (strong buy) also has attractive valuations with

a forward P/E of just 8.4. Read the full article.

The transports have momentum to start 2012.

Trinity Industries, Inc. (TRN) is expected to grow earnings

by the double digits as the backlog grew on its railcar and barge

businesses. This Zacks #1 Rank (strong buy) is a double threat in

both growth and value as it has a P/B ratio of just 1.3. Read the

full article.

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor of the Turnaround Trader and

Insider Trader services. You can follow her on twitter at

traceyryniec.

HUNTSMAN CORP (HUN): Free Stock Analysis Report

To read this article on Zacks.com click here.

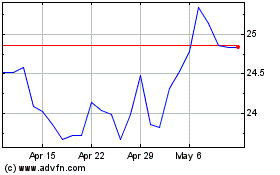

Huntsman (NYSE:HUN)

Historical Stock Chart

From May 2024 to Jun 2024

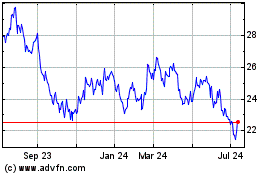

Huntsman (NYSE:HUN)

Historical Stock Chart

From Jun 2023 to Jun 2024