Hexion Specialty Chemicals, Inc. Announces Termination of Merger Agreement With Huntsman Corporation and Settlement

December 14 2008 - 9:56PM

Business Wire

Hexion Specialty Chemicals, Inc. (�Hexion�), today announced that

on December 13, 2008, Huntsman Corporation (NYSE: HUN) (�Huntsman�)

terminated the proposed merger between Huntsman and Hexion. On

December 14, 2008, Hexion entered into a settlement agreement with

Huntsman and other parties to end all litigation among Hexion,

Apollo Management, L.P. (�Apollo�) and its affiliates, the

controlling shareholder of Hexion, Apollo�s principals and

Huntsman. Hexion will pay Huntsman the $325 million merger

agreement termination fee. Hexion has financial commitments from

affiliates of Credit Suisse and Deutsche Bank (the �Banks�) to fund

the $325 million termination fee, which Hexion expects to promptly

draw to fund the payment. Hexion intends for the termination fee to

be borrowed by Hexion LLC, the parent company of Hexion, which will

not impact Hexion�s operating performance or its compliance with

its debt covenants. Hexion fully expects the Banks to honor their

commitments associated with the funding of the termination fee.

Separately, an affiliate of Apollo has agreed to make a $200

million investment in Hexion�s parent company, the proceeds of

which will be used by Hexion for general business purposes. In

summary, under the terms of the agreement with Huntsman, an

affiliate of Apollo and certain funds managed by Apollo, have

agreed to pay Huntsman $425 million to settle all claims. In

addition, certain funds managed by Apollo have agreed to purchase

$250 million principal amount of Huntsman senior convertible notes.

�We are pleased that this matter has been resolved,� said Craig O.

Morrison, Chairman and CEO of Hexion. �We appreciate Apollo�s

ongoing support of Hexion. Their incremental investment in Hexion

will help to solidify our leadership position in the marketplace.

Moreover, it will help us remain a strong competitor in a difficult

economic environment. We are well-positioned to compete globally as

a stand-alone company, and we look forward to focusing fully on

serving our customers and growing our business.� About Hexion

Specialty Chemicals, Inc. Based in Columbus, Ohio, Hexion Specialty

Chemicals is the global leader in thermoset resins. Hexion serves

the global wood and industrial markets through a broad range of

thermoset technologies, specialty products and technical support

for customers in a diverse range of applications and industries.

Hexion has more than 7,000 associates and over 100 manufacturing

sites around the world. The company had 2007 revenues of $5.8

billion. Additional information is available at www.hexion.com.

Forward Looking Statements Certain statements in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. In addition, the

management of Hexion Specialty Chemicals, Inc. (which may be

referred to as �Hexion,� �we,� �us,� �our� or the �Company�) may

from time to time make oral forward-looking statements. Forward

looking statements may be identified by the words �believe,�

�expect,� �anticipate,� �project,� �plan,� �estimate,� �will� or

�intend� or similar expressions. Forward-looking statements reflect

our current views about future events and are based on currently

available financial, economic and competitive data and on our

current business plans. Actual results could vary materially

depending on risks and uncertainties that may affect our markets,

services, prices and other factors as discussed in our 2007 Annual

Report on Form 10-K, and our other filings, with the Securities and

Exchange Commission (SEC). Important factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to:

economic factors such as the current credit crisis and economic

downturn and an interruption in the supply of or increased pricing

of raw materials due to natural disasters; competitive factors such

as pricing actions by our competitors that could affect our

operating margins; and regulatory factors such as changes in

governmental regulations involving our products that lead to

environmental and legal matters as described in our 2007 Annual

Report on Form 10-K, and our other filings, with the SEC.

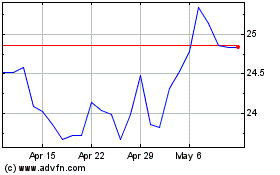

Huntsman (NYSE:HUN)

Historical Stock Chart

From Sep 2024 to Oct 2024

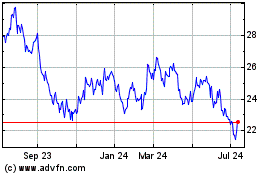

Huntsman (NYSE:HUN)

Historical Stock Chart

From Oct 2023 to Oct 2024