Kraft Fails To Convince; Investors Pin Hopes On Hershey Bid

January 14 2010 - 8:42AM

Dow Jones News

Kraft Foods Inc. 's (KFT) latest attempt to win over investors

in Cadbury PLC (CBY) met with a lukewarm reception and shareholders

are instead pinning their hopes on a rival bid from Hershey Co.

(HSY), people familiar with the situation told Dow Jones Newswires

Thursday.

Kraft's chief executive Irene Rosenfeld has spent the last few

days meeting with key investors in London as time runs out for the

U.S. food giant to increase its GBP10 billion bid for the U.K.

confectioner.

"She said nothing particularly interesting or new," said an

investor who attended one of the meetings.

"What is clear is that shareholders want between 800 pence and

850 pence and as much cash as possible--no-one wants Kraft shares,"

the investor added.

Kraft's formal bid--the only one on the table--offers Cadbury

shareholders 300 pence in cash and 0.2589 new Kraft shares for each

Cadbury share. It is made up of 60% stock and 40% cash.

Following an agreement to sell its U.S. and Canadian frozen

pizza business to Nestle S.A. (NESN.VX), the Swiss consumer giant,

for $3.7 billion Jan.5, Kraft said it was going to give Cadbury

shareholders a "partial cash alternative" to its existing

offer.

The new proposal, which has yet to be formalized, offers 60

pence per Cadbury share, bringing the cash part of the deal to 360

a share. Kraft did not say how much the stock element of the

cash-and-shares bid would reduce by, but insisted that the

increased cash element did not represent a "raised offer." This

suggests the stock element of the deal will be cut.

Cadbury dismissed this altered offer which it said "remains

derisory" and investors are similarly unimpressed, hoping that

U.S.-based Hershey will come in with a higher offer including a

larger cash element.

"My gut feeling is that Kraft will raise its offer to between

835 pence and 850 pence a share. If Hershey then comes in higher,

as it must if it serious about a bid, then Kraft will have to think

hard," said another investor who was at the meeting.

Rosenfeld gave every indication that Kraft needs the scale and

scope that a takeover of Cadbury would bring, especially the U.K.

group's presence in emerging markets, the investor said. Kraft

could definitely pay 900 pence but won't unless forced to, he

added.

Kraft has until Jan. 19 to raise its bid while any rival bids

must be in by Jan. 23.

Hershey is continuing to work toward a bid for Cadbury,

according to media reports and despite other reports that Italian

chocolate maker Ferrero Spa has decided not to participate in a

joint offer. A spokesman for Hershey declined to comment.

"Shares have risen on the possibility of a Hershey bid and we

are hoping for more cash as well as a higher bid," said one

investor who had earlier suggested its fund would sell if any bid

reached 800 pence..

Shares in Cadbury at 1230 GMT Thursday were up 0.8% or 7 pence

and at 796 pence, having reversed a decline over the last week

which saw the E.U. clear Kraft's bid, Nestle pull out of the

auction and Warren Buffett, Kraft's biggest shareholder, say his

holding company Berkshire Hathaway Inc. (BRKA, BRKB) wouldn't

support the issuance of new Kraft stock to pay for a Cadbury

acquisition.

Kraft's stock closed down 1.6% at $29.23 Wednesday, making its

offer for Cadbury worth 764 pence a share and valuing the U.K.

company at GBP10.5 billion, or $17.1 billion.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

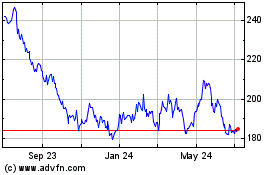

Hershey (NYSE:HSY)

Historical Stock Chart

From Jun 2024 to Jul 2024

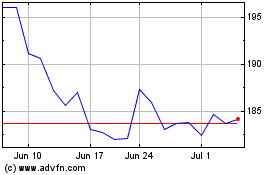

Hershey (NYSE:HSY)

Historical Stock Chart

From Jul 2023 to Jul 2024