Cadbury Investors Seen Spurning Kraft's Early January Deadline

December 31 2009 - 11:19AM

Dow Jones News

Cadbury PLC (CBY, CBRY.LN) investors are doggedly holding out

for a sweeter takeover offer from Kraft Foods Inc. (KFT) or another

bidder, making it likely that Kraft will get few shareholder

acceptances of its hostile bid by next week's deadline.

Kraft has set a deadline of Jan. 5 for its current offer, now

valued at 741 pence a share, to be accepted by Cadbury

shareholders. Several of the U.K. confectioner's investors say

Kraft will likely have to go above 800 pence to attract

interest.

"I don't know why people would tender into the [current] offer

that is lower than the market price when they can just sell their

shares in the market," said Roy Behren, a portfolio manager for

Merger Fund, which focuses on merger arbitrage and holds Cadbury

shares. "People are speculating that either Kraft will raise their

bid or there will be a competing bid from either Hershey or Ferrero

or potentially Nestle."

Cadbury's shares have recently been trading around 790 pence,

well above Kraft's offer. Kraft can choose to extend the Jan. 5

deadline and is very likely to do so, a move that isn't unusual in

such deals. More closely watched will be Jan. 19, the deadline for

Kraft to raise its bid.

"I would speculate it will take in excess of 800 pence to obtain

[Cadbury] shareholder support," Behren said. Behren said his fund

started buying Cadbury shares after Kraft announced its bid and for

now he is waiting "to see how the situation plays out." His fund

wouldn't want to tender its shares at Kraft's current price.

Some 15% of Cadbury shares are held by hedge funds who bought

shares or boosted existing stakes after Kraft made its bid. One

hedge-fund manager who holds Cadbury shares, but asked not to be

named, said Kraft came in low deliberately and no one--not even

Kraft--expected Cadbury to accept that initial offer.

"Kraft has done a good job of managing expectations--the initial

derisory offer has everyone talking about an increased bid of

between GBP8 and GBP9 rather than upwards of GBP9," the hedge-fund

manager said, declining to specify at what price he would tender

shares. "Kraft can certainly afford to increase its offer without

losing its investment-grade rating," he added.

The emergence of another bidder could change the game. Hershey

Co. (HSY) and Italy's Ferrero SpA have said they are weighing their

options on Cadbury, although neither has bid so far. Nestle S.A.

(NSRGY, NESN.VX) has been silent so far.

Kevin Dreyer, an analyst at Gabelli & Co., said he isn't

discounting the possibility of a bid from Hershey, but he believes

the most likely end to the saga is Kraft increasing is offer and

taking over Cadbury. Gamco Investors Inc. (GBL), which is

affiliated with Gabelli & Co., holds shares of Cadbury, Hershey

and Kraft.

"Hershey probably wants to put a counter bid, but it would be a

stretch for them [financially] to put in something materially

higher than Kraft," Dreyer said. He said he feels Kraft probably

needs an offer of at least 800 pence to get Cadbury to come to the

table for discussions and a price in the range of 850 pence to get

a deal done.

Kraft didn't comment on the number of acceptances it has

received or on speculation about a higher bid.

Another long-term investor agreed that Kraft's existing bid

would be rejected but said he would sell for an increased bid of

anything "beginning with an 8." The manager said all his clients

had held Cadbury shares for well over a year and in some cases for

as many as 20 years. "We'd be upset to see it go but, having bought

in at just GBP5 in some cases, anything over GBP8 would do it," he

added.

-By Anjali Cordeiro, Dow Jones Newswires; 212-416-2200;

anjali.cordeiro@dowjones.com

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

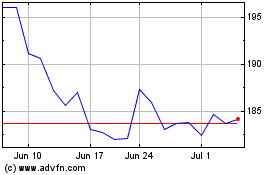

Hershey (NYSE:HSY)

Historical Stock Chart

From Jun 2024 to Jul 2024

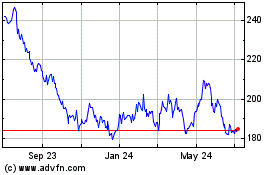

Hershey (NYSE:HSY)

Historical Stock Chart

From Jul 2023 to Jul 2024