Cadbury Union Again Urges Shareholders To Reject Kraft Offer

December 11 2009 - 10:06AM

Dow Jones News

Cadbury PLC (CBY) shareholders were urged Friday by its workers'

trade union to reject Kraft Foods Inc.'s (KFT) GBP9.9 billion

hostile takeover offer, on grounds the debt the U.S. food giant

needed for the acquisition would destabilize the U.K. confectioner

and hit future returns.

"Cadbury has a great record of generating good returns for

shareholders and that success has also meant good, secure work for

thousands. We appeal to shareholders not to put this at risk by

entertaining this Kraft bid," Unite, the U.K.'s largest labor

union, said in a statement.

"This offer is not in the best interests of either shareholders

or the U.K., and certainly not the employees. It would saddle the

company with excessive debt, compromise investment and certainly

mean instability with attacks on jobs, wages and conditions," it

added.

Unite's appeal direct to shareholders comes ahead of a formal

defense document to be published Monday by Cadbury in which the

candy maker is expected to highlight its genuine value,

highlighting the group's ability to grow organic sales and the

success of its "Vision Into Action" efficiency drive.

The company will also publish its scheduled trading update which

analysts say will give further confirmation of the volume

improvements already seen in the first two quarters of the

year.

Unite, which will be attaching its own defense to that of

Cadbury's, is also approaching the U.K. government and E.U.

regulators as part of its campaign to ward off Kraft's bid which

has already fallen in value since it was made and was worth just

723 pence as of Dec. 11, compared with 745 pence a share when Kraft

made its offer Nov. 9.

The U.S. company is offering Cadbury shareholders 300 pence in

cash and 0.2589 new Kraft shares for each Cadbury share. The cash

and share offer originally valued Cadbury at GBP10.2 billion, but a

subsequent fall in Kraft's share price and the U.S. dollar has

since weakened the value of the bid.

Kraft, which is being advised by Lazard (LAZ), has rounded up a

raft of banks to finance its bid. It has secured a GBP5.5 billion

bridge loan from a group of nine banks led by Citigroup Inc. (C),

Deutsche Bank AG (DB) and HSBC Holdings PLC (HBC) and including BNP

Paribas SA (BNP.FR), Barclays Capital, Royal Bank of Scotland Group

PLC (RBS) as well as Credit Suisse (CS), Societe Generale SA

(SCGLY) and Banco Bilbao Vizcaya Argentaria SA (BBV).

Unite's strong and vocal oppostion to Kraft's bid comes on top

of recent comments by the U.K.'s top business minister, Peter

Mandelson, that any bidder for the British confectioner could face

government opposition if it is seen as trying to make a "quick

buck" on the company.

In the light of these warnings Cadbury, under its American chief

executive Todd Stitzer, won't need to play the nationalistic card

itself Monday and can instead use dry figures to support a robust

defense to the bid, which it has repeatedly called "derisory."

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

(Michael Carolan

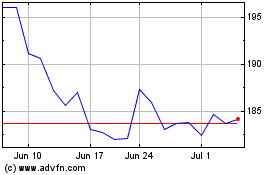

Hershey (NYSE:HSY)

Historical Stock Chart

From May 2024 to Jun 2024

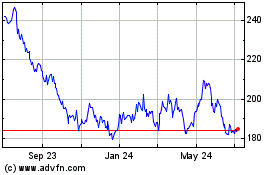

Hershey (NYSE:HSY)

Historical Stock Chart

From Jun 2023 to Jun 2024