Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 12 2022 - 2:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For May 12, 2022

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing

the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Incorporated in the Republic of South Africa

Registration number: 1950/038232/06

JSE share code: HAR

NYSE share code: HMY

ISIN: ZAE000015228

(“Harmony” or “the Company”)

| | |

OPERATIONAL UPDATE for the nine months ended 31 March 2022 (“Q3 FY22”) |

RETREATMENT OPERATIONS SHINE; LONG-TERM OBJECTIVES AND FULL YEAR GUIDANCE STILL ON TRACK DESPITE A TOUGH THIRD QUARTER

Johannesburg, South Africa. Thursday, 12 May 2022. Harmony Gold Mining Company Limited (“Harmony” or “the Company”) is pleased to report its operational performance for the nine months ended 31 March 2022.

Over the past few quarters, there has been a renewed wave of uncertainty, specifically for gold, as inflation seems to be returning after an almost 30-year hiatus. This uncertainty has been compounded by concerns of low economic growth, the increasing risk of conflict and further supply chain disruptions.

Despite our stringent controls and leaner operating model, we are not immune to the effects of rising costs. Cost increases are now a worldwide concern and it is imperative we continue to scrutinise our costs while adapting to what seems to be a period of higher inflation with protracted supply chain disruptions.

Encouragingly, Harmony has made significant progress in resolving and adapting to the various disruptions which impacted production across its operations in South Africa and Papua New Guinea during the course of this financial year.

Amidst the global uncertainty, we remain focused on our long term goals and objectives. Uncertainty creates both risks and opportunities but we continue investing in our people and in quality assets to improve our structural profitability. We remain committed to creating shared value through the effective and disciplined allocation of capital in order to take advantage of these opportunities. Our strategy is to produce safe, profitable ounces and improve margins through operational excellence and value-accretive acquisitions. By delivering on our four strategic pillars, the balance between meeting our short-term goals and achieving our longer-term objectives will be maintained as we continue “Mining with Purpose”.

Nine months of the financial year 2022 (“FY22”) – Key operational metrics*#

| | | | | | | | | | | | | | | | | |

| Unit | Y-on-Y

% | Nine

months

FY22 | Nine

months

FY21 | Comments |

| Gold revenue | Rm | 2 | % | 30 669 | 30 166 | Higher gold price received and higher production from South African operations |

| Gold price | R/kg | 1 | % | 877 249 | | 868 964 | | Higher US$ gold price amidst global geopolitical uncertainty and inflation concerns contributed to a higher Rand gold price received |

| Gold produced total | kg | -2% | 34 357 | 34 969 | Overall production was impacted in the third quarter as a result of the Hidden Valley overland conveyor belt failure, adverse ground conditions at Moab Khotsong, and safety-related stoppages at Mponeng and Bambanani as a result of seismicity. Continuous load-shedding and water outages in the Free State have negatively impacted the square meters mined |

| oz | -2% | 1 104 598 | 1 124 274 |

| Gold production – South Africa | kg | 2 | % | 32 051 | 31 470 | 9-months production from Mponeng and Mine Waste Solutions in this reporting period compared to 6-months in the comparable period |

| Gold production – Hidden Valley | kg | -34% | 2 306 | 3 499 | Lost production as a result of the failure of the overland conveyor belt |

| Underground total tonnes milled | t’000 | 3 | % | 4 762 | 4 618 | Improvement from Tshepong Operations, Moab Khotsong, Joel and Doornkop alongside a full 9-months production from Mponeng |

| Underground yield | g/t | -3% | 5.39 | 5.54 | Adverse ground conditions at Moab Khotsong alongside the seismicity at Mponeng and Bambanani. We are mining out Bambanani and this mine will be closed at the end of June 2022 |

| On-going development capital | Rm | 21 | % | 2 074 | 1 717 | Normalisation of capital expenditure post Covid-19. Tshepong Operations, Mponeng and Doornkop primary drivers of the increase |

| | | | | | | | | | | | | | | | | |

| Major capital | Rm | 67 | % | 787 | 470 | Planned capital expenditure at Tshepong sub-75 decline, the Zaaiplaats project and Great Noligwa pillar project at Moab Khotsong, Mponeng Carbon Leader project and West complex pump station project |

| All-in sustaining cost (“AISC”) | R/kg | 15 | % | 825 925 | 720 572 | Normalisation of capital expenditure post-Covid-19, lower Q3 FY22 production at Hidden Valley, Bambanani, Tshepong Operations, Target 1, Moab Khotsong and Mponeng |

| US$/oz | 20 | % | 1 703 | 1 416 |

| Average exchange rate | US$/Rand | -5% | 15.09 | 15.82 | Rand strengthened against the US$ year on year |

| Adjusted EBITDA** | Rm | -19% | 7 613 | | 9 439 | | Lower production and higher AISC |

* The financial information has not been reviewed by the Company’s external auditors

** The Company reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) and non-recurring events. For the reporting period, the non-recurring events include the gain on bargain purchase and acquisition-related costs. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS and should be considered in addition to and not as a substitute for other measures of financial performance and liquidity

# Quarter-on-quarter operational tables are available on our website: www.harmony.co.za

Health and safety

The Company continues to prioritise the safety of its employees. Through passionate leadership, resilient management systems, effective risk management and organisational learning, Harmony is developing an engaged and interdependent workforce who display a proactive relationship to safety.

January and February 2022 already served as testimony that we are on the correct trajectory, with zero loss of life incidents recorded during these two months. Several notable milestones and achievements were recorded during the third quarter of FY22. The lost-time injury rate was maintained below 6 for the second consecutive quarter at 5.99 per million shifts.

It is therefore with deep regret that Harmony reports that one employee, Mr. Makoae Cosmas Makhang, a tramming team leader at Doornkop, lost his life in a work-related incident on 11 March 2022. The Company sends its heartfelt condolences to the family and loved ones of our colleague who tragically passed away.

We are still in the process of investigating the multiple loss of life which occurred during routine engineering infrastructure-related work at our Kusasalethu mine, near Carletonville, which we announced on 9 May 2022. While the timing of the incident happened outside of this reporting period, we pay our respect to those who lost their lives. It is our priority to support the families of the deceased as well as everyone impacted by this tragedy and ensure it never happens again. The names of those who passed away will be released once all family members have been informed.

Harmony applies a holistic approach to the health of its employees. This approach includes initiatives aimed at preventing the spread of Covid-19, mitigating the impact thereof, curbing occupational diseases and improving the overall wellness of its employees. The Covid-19 response and vaccination teams have invested significant time in the management of Covid-19 at our operations. Currently, all employees are eligible to be vaccinated at the vaccination sites established at our operations with 85% of our employees having received a second vaccination.

Please see the Company’s website for more information on its safety and health initiatives and the incidents reported during the quarter, as well as the Harmony Risk Management guide.

Operational performance to date

The South African operations delivered a 2% increase in production to 32 051kg (1 030 459oz) for the nine months ended 31 March 2022 from 31 470kg (1 011 778oz) for the nine-month period ended

31 March 2021 (“the comparable period”). Much of this increase was attributable to the additional three months’ production from Mponeng and related assets in this nine-month period compared to only six months’ production in the comparable period.

Gold production during quarter three of financial year 2022 has been particularly challenging with electricity and water supply constraints persisting at our South African operations. With safety as our top priority, we delayed accessing certain higher-grade areas at Moab Khotsong to ensure that these areas were structurally well-supported before mining activities continued and stopped mining in areas impacted by seismicity at Mponeng and Bambanani. We are mining out Bambanani and this operation will be closed at the end of June 2022.

Overall production quarter on quarter was down 11% to 10 131kg (325 719oz) in Q3 FY22 from 11 358kg (365 165oz) in Q2 FY22. Group cash operating unit cost increased by 14% quarter-on-quarter to R767 292/kg from R672 745/kg (an increase of 16% to US$1 569/oz from US$1 356/oz) – primarily as a result of Hidden Valley. We expect Hidden Valley to return to normalised levels of production in the fourth quarter of FY22.

For the nine months to date, total cash operating costs for the group increased by 14% to R23 952 million from R20 978 million (an increase of 20% to US$1 588 million from US$1 326 million) against the comparable period. Most of the increase is attributable to the acquisition of Mponeng and related assets in financial year 2021 (“FY21”). Excluding Unisel (which was closed in FY21), and Mponeng and related assets, group cash operating costs increased by only 8% to R19 574 million from R18 092 million (an increase of 13% to US$1 297 million from US$1 143 million).

For the nine months to date, cash operating unit cost for the group increased by 16% to R697 146/kg from R599 910/kg (an increase of 22% to US$1 437/oz from US$1 179/oz) against the comparable period. The unit cost increase was higher than the total cash cost increase due to the abovementioned production challenges.

Annual production, cost and grade guidance

With one quarter’s production remaining for FY22, we are confident that we will achieve our previously revised annual guidance (announced in February 2022) of:

•1 480 000 to 1 560 000oz in total production

•overall AISC guidance of R805 000/kg to R835 000/kg and

•underground grade guidance at 5.40 to 5.57g/t

AISC

Harmony’s overall AISC for the reporting period increased by 15% to R825 925/kg from R720 572/kg (an increase of 20% to US$1 703/oz from US$1 416/oz). This remains within guidance. The primary reason for the increase was the reduced production as a result of the overland conveyor belt failure at Hidden Valley.

South African operations’ AISC increased by 10% to R797 014/kg from R726 100/kg (an increase of 15% to US$1 643/oz from US$1 427/oz).

At Hidden Valley, we anticipate a significant improvement in AISC as production returns to normalised levels.

Hedging

The Company’s hedging strategy is proving to be successful as its approach to hedge more selectively supports stronger margins and cash flows. The average forward Rand gold price on the hedge book is at R1 037 000/kg on a net position of 413 000oz at the end of the third quarter. Harmony will only hedge when it is certain that it can achieve a minimum margin of 25% above AISC and inflation.

Balance sheet and liquidity

Net debt has reduced substantially over the nine months, with a R350 million (US$24 million) decrease to R603 million (US$41 million) at 31 March 2022 from R953 million (US$65 million) at 31 March 2021. Quarter on quarter, net debt remained stable at R603 million (US$41 million) compared to R612 million (US$38 million) at 31 December 2021.

Adjusted EBITDA at 31 March 2022 decreased 19% to R7 613 million (US$521 million) compared to R9 439 million (US$639 million) at 31 March 2021.

The Company’s balance sheet remains strong with net debt to EBITDA stable at 0.1 times.

On 25 February 2022, an interim dividend of 40 SA cents (2.7 US cents) per share was declared and paid on 11 April 2022 in line with our policy of paying 20% of net free cash generated to shareholders.

Papua New Guinea

Discussions with the government of Papua New Guinea are ongoing as it relates to permitting and delivering the much-anticipated Wafi-Golpu project. At Hidden Valley, production has normalised and the Hidden Valley mine life extension project continues as planned.

ESG in action

Harmony remains an example of well-embedded Environment, Social and Governance (ESG) practices in action. This is encapsulated in the words “Mining with Purpose”. More information can be found in our Task Force on Climate-related Financial Disclosures and ESG reports at www.har.co.za

OPERATING RESULTS – NINE MONTHS ON NINE MONTHS (RAND/METRIC)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine

months

ended | SOUTH AFRICA |

| UNDERGROUND PRODUCTION |

| Tshepong operations | Moab

Khotsong | Mponeng | Bambanani | Joel | Doornkop | Target 1 | Kusasalethu | Masimong | Unisel | Total Underground |

| Ore milled | – t'000 | Mar-22 | 1 167 | 701 | 615 | 139 | 315 | 657 | 345 | 458 | 365 | — | 4 762 |

| Mar-21 | 1 123 | 656 | 442 | 167 | 257 | 624 | 371 | 538 | 383 | 57 | 4 618 |

| Yield | – g/tonne | Mar-22 | 4.48 | 6.94 | 7.32 | 8.03 | 3.36 | 4.06 | 4.13 | 7.46 | 3.85 | — | 5.39 |

| Mar-21 | 4.77 | 8.36 | 7.83 | 8.84 | 3.98 | 4.27 | 3.38 | 5.75 | 3.97 | 4.33 | 5.54 |

| Gold produced | – kg | Mar-22 | 5 226 | 4 868 | 4 502 | 1 116 | 1 057 | 2 668 | 1 424 | 3 415 | 1 407 | — | 25 683 |

| Mar-21 | 5 358 | 5 486 | 3 459 | 1 477 | 1 022 | 2 663 | 1 255 | 3 095 | 1 520 | 247 | 25 582 |

| Gold sold | – kg | Mar-22 | 5 263 | 4 866 | 4 515 | 1 125 | 1 064 | 2 730 | 1 421 | 3 476 | 1 416 | — | 25 876 |

| Mar-21 | 5 262 | 5 461 | 3 250 | 1 453 | 1 005 | 2 630 | 1 274 | 3 069 | 1 494 | 242 | 25 140 |

| Gold price received | – R/kg | Mar-22 | 885 165 | 885 941 | 917 957 | 877 664 | 884 992 | 879 473 | 890 521 | 885 622 | 889 311 | — | 890 681 |

| Mar-21 | 862 411 | 868 317 | 920 517 | 873 290 | 867 458 | 874 219 | 890 027 | 870 183 | 826 924 | 925 979 | 874 123 |

Gold revenue1 | (R'000) | Mar-22 | 4 658 626 | 4 310 989 | 4 144 574 | 987 372 | 941 631 | 2 400 962 | 1 265 431 | 3 078 421 | 1 259 265 | — | 23 047 271 |

| Mar-21 | 4 538 005 | 4 741 880 | 2 991 680 | 1 268 890 | 871 795 | 2 299 195 | 1 133 894 | 2 670 593 | 1 235 425 | 224 087 | 21 975 444 |

Cash operating cost

(net of by-product credits) | (R'000) | Mar-22 | 3 771 500 | 3 098 908 | 3 279 364 | 891 578 | 957 203 | 1 829 006 | 1 336 876 | 2 300 049 | 1 119 348 | — | 18 583 832 |

| Mar-21 | 3 646 124 | 2 864 447 | 1 891 369 | 866 356 | 838 601 | 1 601 328 | 1 234 973 | 2 232 842 | 1 074 876 | 178 154 | 16 429 070 |

| Inventory movement | (R'000) | Mar-22 | 22 581 | (68 962) | 37 140 | 9 918 | 3 221 | 29 239 | (5 821) | 14 389 | 715 | — | 42 420 |

| Mar-21 | (74 187) | 8 075 | 3 675 | (15 032) | (12 864) | (20 782) | 6 782 | (15 366) | (22 126) | 3 679 | (138 146) |

| Operating costs | (R'000) | Mar-22 | 3 794 081 | 3 029 946 | 3 316 504 | 901 496 | 960 424 | 1 858 245 | 1 331 055 | 2 314 438 | 1 120 063 | — | 18 626 252 |

| Mar-21 | 3 571 937 | 2 872 522 | 1 895 044 | 851 324 | 825 737 | 1 580 546 | 1 241 755 | 2 217 476 | 1 052 750 | 181 833 | 16 290 924 |

| Production profit | (R'000) | Mar-22 | 864 545 | 1 281 043 | 828 070 | 85 876 | (18 793) | 542 717 | (65 624) | 763 983 | 139 202 | — | 4 421 019 |

| Mar-21 | 966 068 | 1 869 358 | 1 096 636 | 417 566 | 46 058 | 718 649 | (107 861) | 453 117 | 182 675 | 42 254 | 5 684 520 |

| Capital expenditure | (R'000) | Mar-22 | 1 090 513 | 592 872 | 428 026 | 25 444 | 145 839 | 328 257 | 275 462 | 148 239 | 36 609 | — | 3 071 261 |

| Mar-21 | 769 822 | 457 707 | 343 844 | 48 812 | 128 354 | 316 598 | 274 479 | 147 212 | 17 005 | — | 2 503 833 |

| Cash operating costs | – R/kg | Mar-22 | 721 680 | 636 588 | 728 424 | 798 905 | 905 585 | 685 534 | 938 817 | 673 514 | 795 557 | — | 723 585 |

| Mar-21 | 680 501 | 522 138 | 546 796 | 586 565 | 820 549 | 601 325 | 984 042 | 721 435 | 707 155 | 721 271 | 642 212 |

| Cash operating costs | – R/tonne | Mar-22 | 3 232 | 4 421 | 5 332 | 6 414 | 3 039 | 2 784 | 3 875 | 5 022 | 3 067 | — | 3 903 |

| Mar-21 | 3 247 | 4 367 | 4 279 | 5 188 | 3 263 | 2 566 | 3 329 | 4 150 | 2 806 | 3 126 | 3 558 |

Cash operating cost

and capital | – R/kg | Mar-22 | 930 351 | 758 377 | 823 498 | 821 704 | 1 043 559 | 808 569 | 1 132 260 | 716 922 | 821 576 | — | 843 168 |

| Mar-21 | 824 178 | 605 569 | 646 202 | 619 613 | 946 140 | 720 213 | 1 202 751 | 769 000 | 718 343 | 721 271 | 740 087 |

| All-in sustaining cost | – R/kg | Mar-22 | 906 720 | 718 295 | 847 203 | 842 684 | 1 048 263 | 777 090 | 1 124 321 | 726 124 | 850 225 | — | 834 860 |

| Mar-21 | 828 079 | 604 840 | 701 250 | 638 621 | 966 315 | 682 872 | 1 164 805 | 788 756 | 745 626 | 782 126 | 749 497 |

Operating free cash flow margin2 | % | Mar-22 | (4) | % | 14 | % | 11 | % | 7 | % | (17) | % | 10 | % | (27) | % | 20 | % | 8 | % | — | % | 6 | % |

| Mar-21 | 3 | % | 30 | % | 25 | % | 28 | % | (11) | % | 17 | % | (33) | % | 11 | % | 12 | % | 20 | % | 14 | % |

| | |

¹ Includes a non-cash consideration to Franco-Nevada (Mar-22: R370.984m, Mar-21: R231.013m), excluded from the gold price calculation

² Excludes run-of-mine costs for Kalgold (Mar-22: R1.224m, Mar-21:- R2.703m) and Hidden Valley (Mar-22: R293.954m, Mar-21: -R16.974m) |

|

OPERATING RESULTS – NINE MONTHS ON NINE MONTHS (RAND/METRIC)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine

months

ended | SOUTH AFRICA | Hidden

Valley | TOTAL

HARMONY |

| SURFACE PRODUCTION | TOTAL

SOUTH

AFRICA |

| Mine Waste Solutions | Phoenix | Central plant reclamation | Dumps | Kalgold | Total Surface |

| Ore milled | – t'000 | Mar-22 | 17 924 | 4 662 | 3 020 | 6 776 | 1 084 | 33 466 | 38 228 | 2 285 | 40 513 |

| Mar-21 | 11 211 | 4 646 | 3 012 | 7 193 | 1 121 | 27 183 | 31 801 | 2 750 | 34 551 |

| Yield | – g/tonne | Mar-22 | 0.128 | 0.122 | 0.141 | 0.326 | 0.80 | 0.19 | 0.84 | 1.01 | 0.85 |

| Mar-21 | 0.122 | 0.126 | 0.141 | 0.373 | 0.74 | 0.22 | 0.99 | 1.27 | 1.01 |

| Gold produced | – kg | Mar-22 | 2 299 | 567 | 427 | 2 209 | 866 | 6 368 | 32 051 | 2 306 | 34 357 |

| Mar-21 | 1 372 | 587 | 424 | 2 681 | 824 | 5 888 | 31 470 | 3 499 | 34 969 |

| Gold sold | – kg | Mar-22 | 2 277 | 561 | 418 | 2 274 | 873 | 6 403 | 32 279 | 2 258 | 34 537 |

| Mar-21 | 1 340 | 580 | 426 | 2 623 | 827 | 5 796 | 30 936 | 3 513 | 34 449 |

| Gold price received | – R/kg | Mar-22 | 748 486 | 883 768 | 890 847 | 895 073 | 882 457 | 839 958 | 880 620 | 829 066 | 877 249 |

| Mar-21 | 747 663 | 806 409 | 869 277 | 887 894 | 878 695 | 844 639 | 868 599 | 872 186 | 868 964 |

Gold revenue1 | (R'000) | Mar-22 | 2 075 286 | 495 794 | 372 374 | 2 035 397 | 770 385 | 5 749 236 | 28 796 507 | 1 872 031 | 30 668 538 |

| Mar-21 | 1 232 882 | 467 717 | 370 312 | 2 328 947 | 726 681 | 5 126 539 | 27 101 983 | 3 063 988 | 30 165 971 |

Cash operating cost

(net of by-product credits) | (R'000) | Mar-22 | 1 193 631 | 328 102 | 215 004 | 1 452 705 | 659 550 | 3 848 992 | 22 432 824 | 1 519 021 | 23 951 845 |

| Mar-21 | 679 806 | 294 182 | 205 096 | 1 501 537 | 577 660 | 3 258 281 | 19 687 351 | 1 290 907 | 20 978 258 |

| Inventory movement | (R'000) | Mar-22 | (18 057) | (4 834) | (3 510) | 29 796 | 265 | 3 660 | 46 080 | (47 997) | (1 917) |

| Mar-21 | 90 468 | (5 413) | 415 | 15 342 | 865 | 101 677 | (36 469) | (10 398) | (46 867) |

| Operating costs | (R'000) | Mar-22 | 1 175 574 | 323 268 | 211 494 | 1 482 501 | 659 815 | 3 852 652 | 22 478 904 | 1 471 024 | 23 949 928 |

| Mar-21 | 770 274 | 288 769 | 205 511 | 1 516 879 | 578 525 | 3 359 958 | 19 650 882 | 1 280 509 | 20 931 391 |

| Production profit | (R'000) | Mar-22 | 899 712 | 172 526 | 160 880 | 552 896 | 110 570 | 1 896 584 | 6 317 603 | 401 007 | 6 718 610 |

| Mar-21 | 462 608 | 178 948 | 164 801 | 812 068 | 148 156 | 1 766 581 | 7 451 101 | 1 783 479 | 9 234 580 |

| Capital expenditure | (R'000) | Mar-22 | 124 165 | 13 140 | 12 519 | 22 872 | 118 960 | 291 656 | 3 362 917 | 1 103 885 | 4 466 802 |

| Mar-21 | 49 580 | 1 163 | 10 591 | 30 463 | 144 501 | 236 298 | 2 740 131 | 899 463 | 3 639 594 |

| Cash operating costs | – R/kg | Mar-22 | 519 196 | 578 663 | 503 522 | 657 630 | 761 605 | 604 427 | 699 910 | 658 725 | 697 146 |

| Mar-21 | 495 485 | 501 162 | 483 717 | 560 066 | 701 044 | 553 377 | 625 591 | 368 936 | 599 910 |

| Cash operating costs | – R/tonne | Mar-22 | 67 | 70 | 71 | 214 | 608 | 115 | 587 | 665 | 591 |

| Mar-21 | 61 | 63 | 68 | 209 | 515 | 120 | 619 | 469 | 607 |

Cash operating cost

and capital | – R/kg | Mar-22 | 573 204 | 601 838 | 532 841 | 667 984 | 898 972 | 650 227 | 804 834 | 1 137 427 | 827 157 |

| Mar-21 | 531 622 | 503 143 | 508 696 | 571 429 | 876 409 | 593 509 | 712 662 | 625 999 | 703 991 |

| All-in sustaining cost | – R/kg | Mar-22 | 557 865 | 600 758 | 540 332 | 661 570 | 910 825 | 645 432 | 797 014 | 1 239 065 | 825 925 |

| Mar-21 | 622 149 | 500 945 | 507 282 | 589 913 | 894 631 | 625 868 | 726 100 | 671 901 | 720 572 |

Operating free cash flow margin2 | % | Mar-22 | 19 | % | 31 | % | 39 | % | 28 | % | (1 | %) | 22 | % | 9 | % | (24 | %) | 7 | % |

| Mar-21 | 22 | % | 37 | % | 42 | % | 34 | % | 0 | % | 27 | % | 16 | % | 28 | % | 18 | % |

| | |

¹ Includes a non-cash consideration to Franco-Nevada (Mar-22: R370.984m, Mar-21: R231.013m), excluded from the gold price calculation

² Excludes run-of-mine costs for Kalgold (Mar-22: R1.224m, Mar-21:- R2.703m) and Hidden Valley (Mar-22: R293.954m, Mar-21: -R16.974m) |

|

OPERATING RESULTS – NINE MONTHS ON NINE MONTHS (US$/IMPERIAL)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine

months

ended | SOUTH AFRICA |

| UNDERGROUND PRODUCTION |

| Tshepong operations | Moab

Khotsong | Mponeng | Bambanani | Joel | Doornkop | Target 1 | Kusasalethu | Masimong | Unisel | Total Underground |

| Ore milled | - t'000 | Mar-22 | 1 287 | 774 | 678 | 153 | 347 | 724 | 380 | 505 | 403 | — | 5 251 |

| Mar-21 | 1 238 | 723 | 487 | 184 | 284 | 688 | 408 | 593 | 423 | 63 | 5 091 |

| Yield | - oz/ton | Mar-22 | 0.131 | 0.202 | 0.213 | 0.235 | 0.098 | 0.118 | 0.120 | 0.217 | 0.112 | — | 0.157 |

| Mar-21 | 0.139 | 0.244 | 0.228 | 0.258 | 0.116 | 0.124 | 0.099 | 0.168 | 0.116 | 0.126 | 0.162 |

| Gold produced | - oz | Mar-22 | 168 020 | 156 510 | 144 742 | 35 880 | 33 983 | 85 777 | 45 783 | 109 795 | 45 235 | — | 825 725 |

| Mar-21 | 172 263 | 176 378 | 111 209 | 47 486 | 32 858 | 85 617 | 40 348 | 99 506 | 48 869 | 7 941 | 822 475 |

| Gold sold | - oz | Mar-22 | 169 209 | 156 445 | 145 160 | 36 170 | 34 208 | 87 771 | 45 687 | 111 757 | 45 525 | — | 831 932 |

| Mar-21 | 169 177 | 175 575 | 104 490 | 46 715 | 32 311 | 84 556 | 40 960 | 98 670 | 48 033 | 7 780 | 808 267 |

| Gold price received | - $/oz | Mar-22 | 1 825 | 1 827 | 1 893 | 1 809 | 1 825 | 1 813 | 1 836 | 1 826 | 1 833 | — | 1 836 |

| Mar-21 | 1 695 | 1 707 | 1 809 | 1 717 | 1 705 | 1 718 | 1 749 | 1 710 | 1 625 | 1 820 | 1 718 |

Gold revenue1 | ($'000) | Mar-22 | 308 792 | 285 750 | 274 719 | 65 447 | 62 415 | 159 145 | 83 878 | 204 050 | 83 469 | — | 1 527 665 |

| Mar-21 | 286 784 | 299 668 | 189 062 | 80 189 | 55 094 | 145 300 | 71 658 | 168 771 | 78 074 | 14 161 | 1 388 761 |

Cash operating cost

(net of by-product credits) | ($'000) | Mar-22 | 249 990 | 205 408 | 217 369 | 59 097 | 63 447 | 121 234 | 88 613 | 152 456 | 74 195 | — | 1 231 809 |

| Mar-21 | 230 420 | 181 021 | 119 527 | 54 750 | 52 996 | 101 197 | 78 045 | 141 107 | 67 928 | 11 259 | 1 038 250 |

| Inventory movement | ($'000) | Mar-22 | 1 497 | (4 571) | 2 462 | 657 | 214 | 1 938 | (386) | 954 | 47 | — | 2 812 |

| Mar-21 | (4 688) | 510 | 232 | (950) | (813) | (1 313) | 429 | (971) | (1 398) | 232 | (8 730) |

| Operating costs | ($'000) | Mar-22 | 251 487 | 200 837 | 219 831 | 59 754 | 63 661 | 123 172 | 88 227 | 153 410 | 74 242 | — | 1 234 621 |

| Mar-21 | 225 732 | 181 531 | 119 759 | 53 800 | 52 183 | 99 884 | 78 474 | 140 136 | 66 530 | 11 491 | 1 029 520 |

| Production profit | ($'000) | Mar-22 | 57 305 | 84 913 | 54 888 | 5 693 | (1 246) | 35 973 | (4 349) | 50 640 | 9 227 | — | 293 044 |

| Mar-21 | 61 052 | 118 137 | 69 303 | 26 389 | 2 911 | 45 416 | (6 816) | 28 635 | 11 544 | 2 670 | 359 241 |

| Capital expenditure | ($'000) | Mar-22 | 72 284 | 39 298 | 28 371 | 1 687 | 9 667 | 21 758 | 18 259 | 9 826 | 2 427 | — | 203 577 |

| Mar-21 | 48 650 | 28 925 | 21 730 | 3 085 | 8 111 | 20 008 | 17 346 | 9 303 | 1 075 | — | 158 233 |

| Cash operating costs | - $/oz | Mar-22 | 1 488 | 1 312 | 1 502 | 1 647 | 1 867 | 1 413 | 1 936 | 1 389 | 1 640 | — | 1 492 |

| Mar-21 | 1 338 | 1 026 | 1 075 | 1 153 | 1 613 | 1 182 | 1 934 | 1 418 | 1 390 | 1 418 | 1 262 |

| Cash operating costs | - $/t | Mar-22 | 194 | 265 | 321 | 386 | 183 | 167 | 233 | 302 | 184 | — | 235 |

| Mar-21 | 186 | 250 | 245 | 298 | 187 | 147 | 191 | 238 | 161 | 179 | 204 |

Cash operating cost

and capital | - $/oz | Mar-22 | 1 918 | 1 564 | 1 698 | 1 694 | 2 151 | 1 667 | 2 334 | 1 478 | 1 694 | — | 1 738 |

| Mar-21 | 1 620 | 1 190 | 1 270 | 1 218 | 1 860 | 1 416 | 2 364 | 1 512 | 1 412 | 1 418 | 1 455 |

| All-in sustaining cost | - $/oz | Mar-22 | 1 869 | 1 481 | 1 747 | 1 737 | 2 161 | 1 602 | 2 318 | 1 497 | 1 753 | — | 1 721 |

| Mar-21 | 1 628 | 1 189 | 1 378 | 1 255 | 1 899 | 1 342 | 2 290 | 1 550 | 1 466 | 1 537 | 1 473 |

Operating free cash flow margin2 | % | Mar-22 | (4 | %) | 14 | % | 11 | % | 7 | % | (17 | %) | 10 | % | (27 | %) | 20 | % | 8 | % | 0 | % | 6 | % |

| Mar-21 | 3 | % | 30 | % | 25 | % | 28 | % | (11 | %) | 17 | % | (33 | %) | 11 | % | 12 | % | 20 | % | 14 | % |

| | |

¹ Includes a non-cash consideration to Franco-Nevada (Mar-22: US$24.590m, Mar-21: US$14.599m), excluded from the gold price calculation

² Excludes run-of-mine costs for Kalgold (Mar-22: US$0.081m, Mar-21:- US$0.168m) and Hidden Valley (Mar-22: US$19.484m, Mar-21: -US$0.574m) |

OPERATING RESULTS – NINE MONTHS ON NINE MONTHS (US$/IMPERIAL)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine

months

ended | SOUTH AFRICA | Hidden

Valley | TOTAL

HARMONY |

| SURFACE PRODUCTION | TOTAL

SOUTH

AFRICA |

| Mine Waste Solutions | Phoenix | Central plant reclamation | Dumps | Kalgold | Total Surface |

| Ore milled | - t'000 | Mar-22 | 19 765 | 5 140 | 3 330 | 7 472 | 1 195 | 36 902 | 42 153 | 2 520 | 44 673 |

| Mar-21 | 12 362 | 5 124 | 3 322 | 7 932 | 1 236 | 29 976 | 35 067 | 3 033 | 38 100 |

| Yield | - oz/ton | Mar-22 | 0.004 | 0.004 | 0.004 | 0.010 | 0.023 | 0.006 | 0.024 | 0.029 | 0.025 |

| Mar-21 | 0.004 | 0.004 | 0.004 | 0.011 | 0.021 | 0.006 | 0.029 | 0.037 | 0.030 |

| Gold produced | - oz | Mar-22 | 73 915 | 18 229 | 13 728 | 71 020 | 27 842 | 204 734 | 1 030 459 | 74 139 | 1 104 598 |

| Mar-21 | 44 110 | 18 873 | 13 632 | 86 196 | 26 492 | 189 303 | 1 011 778 | 112 496 | 1 124 274 |

| Gold sold | - oz | Mar-22 | 73 208 | 18 036 | 13 439 | 73 110 | 28 068 | 205 861 | 1 037 793 | 72 596 | 1 110 389 |

| Mar-21 | 43 082 | 18 648 | 13 696 | 84 331 | 26 589 | 186 346 | 994 613 | 112 945 | 1 107 558 |

| Gold price received | - $/oz | Mar-22 | 1 543 | 1 822 | 1 837 | 1 845 | 1 819 | 1 732 | 1 816 | 1 709 | 1 809 |

| Mar-21 | 1 470 | 1 585 | 1 709 | 1 745 | 1 727 | 1 660 | 1 707 | 1 714 | 1 708 |

Gold revenue1 | ($'000) | Mar-22 | 137 558 | 32 863 | 24 682 | 134 914 | 51 064 | 381 081 | 1 908 746 | 124 086 | 2 032 832 |

| Mar-21 | 77 913 | 29 558 | 23 402 | 147 180 | 45 923 | 323 976 | 1 712 737 | 193 632 | 1 906 369 |

Cash operating cost

(net of by-product credits) | ($'000) | Mar-22 | 79 119 | 21 748 | 14 251 | 96 291 | 43 718 | 255 127 | 1 486 936 | 100 687 | 1 587 623 |

| Mar-21 | 42 961 | 18 591 | 12 961 | 94 891 | 36 506 | 205 910 | 1 244 160 | 81 580 | 1 325 740 |

| Inventory movement | ($'000) | Mar-22 | (1 197) | (320) | (233) | 1 975 | 18 | 243 | 3 055 | (3 181) | (126) |

| Mar-21 | 5 717 | (342) | 26 | 970 | 55 | 6 426 | (2 304) | (657) | (2 961) |

| Operating costs | ($'000) | Mar-22 | 77 922 | 21 428 | 14 018 | 98 266 | 43 736 | 255 370 | 1 489 991 | 97 506 | 1 587 497 |

| Mar-21 | 48 678 | 18 249 | 12 987 | 95 861 | 36 561 | 212 336 | 1 241 856 | 80 923 | 1 322 779 |

| Production profit | ($'000) | Mar-22 | 59 636 | 11 435 | 10 664 | 36 648 | 7 328 | 125 711 | 418 755 | 26 580 | 445 335 |

| Mar-21 | 29 235 | 11 309 | 10 415 | 51 319 | 9 362 | 111 640 | 470 881 | 112 709 | 583 590 |

| Capital expenditure | ($'000) | Mar-22 | 8 230 | 871 | 830 | 1 516 | 7 885 | 19 332 | 222 909 | 73 170 | 296 079 |

| Mar-21 | 3 133 | 73 | 669 | 1 925 | 9 132 | 14 932 | 173 165 | 56 842 | 230 007 |

| Cash operating costs | - $/oz | Mar-22 | 1 070 | 1 193 | 1 038 | 1 356 | 1 570 | 1 246 | 1 443 | 1 358 | 1 437 |

| Mar-21 | 974 | 985 | 951 | 1 101 | 1 378 | 1 088 | 1 230 | 725 | 1 179 |

| Cash operating costs | - $/t | Mar-22 | 4 | 4 | 4 | 13 | 37 | 7 | 35 | 40 | 36 |

| Mar-21 | 3 | 4 | 4 | 12 | 30 | 7 | 35 | 27 | 35 |

Cash operating cost

and capital | - $/oz | Mar-22 | 1 182 | 1 241 | 1 099 | 1 377 | 1 853 | 1 341 | 1 659 | 2 345 | 1 705 |

| Mar-21 | 1 045 | 989 | 1 000 | 1 123 | 1 723 | 1 167 | 1 401 | 1 230 | 1 384 |

| All-in sustaining cost | - $/oz | Mar-22 | 1 150 | 1 239 | 1 114 | 1 364 | 1 878 | 1 331 | 1 643 | 2 555 | 1 703 |

| Mar-21 | 1 223 | 985 | 997 | 1 160 | 1 758 | 1 230 | 1 427 | 1 321 | 1 416 |

Operating free cash flow margin2 | % | Mar-22 | 19 | % | 31 | % | 39 | % | 28 | % | (1) | % | 22 | % | 9 | % | (24) | % | 7 | % |

| Mar-21 | 22 | % | 37 | % | 42 | % | 34 | % | — | % | 27 | % | 16 | % | 28 | % | 18 | % |

| | |

¹ Includes a non-cash consideration to Franco-Nevada (Mar-22: US$24.590m, Mar-21: US$14.599m), excluded from the gold price calculation

² Excludes run-of-mine costs for Kalgold (Mar-22: US$0.081m, Mar-21:- US$0.168m) and Hidden Valley (Mar-22: US$19.484m, Mar-21: -US$0.574m) |

DIRECTORATE AND ADMINISTRATION

| | |

HARMONY GOLD MINING COMPANY LIMITED |

Harmony Gold Mining Company Limited was incorporated and registered as a public company in South Africa on 25 August 1950

Registration number: 1950/038232/06 |

CORPORATE OFFICE |

Randfontein Office Park PO Box 2, Randfontein, 1760, South Africa Corner Main Reef Road and Ward Avenue Randfontein, 1759, South Africa Telephone: +27 11 411 2000 Website: www.harmony.co.za |

DIRECTORS |

Dr PT Motsepe* (chairman), JM Motloba* (deputy chairman), Dr M Msimang*^ (lead independent director), PW Steenkamp (chief executive officer), BP Lekubo (financial director), HE Mashego (executive director) JA Chissano*^#, KT Nondumo*^, VP Pillay*^, GR Sibiya*^, P Turner*^, JL Wetton*^, AJ Wilkens* * Non-executive ^ Independent # Mozambican |

INVESTOR RELATIONS |

E-mail: HarmonyIR@harmony.co.za

Telephone: +27 11 411 6073 or +27 82 746 4120 |

COMPANY SECRETARIAT |

E-mail: companysecretariat@harmony.co.za Telephone: +27 11 411 2359 |

| | |

TRANSFER SECRETARIES |

JSE Investor Services (Proprietary) Limited (Registration number 2000/007239/07) 19 Ameshoff Street, 13th Floor, Hollard House, Braamfontein PO Box 4844, Johannesburg, 2000, South Africa Telephone: +27 86 154 6572 E-mail: info@jseinvestorservices.co.za Fax: +27 86 674 4381 |

ADR* DEPOSITARY |

Deutsche Bank Trust Company Americas c/o American Stock Transfer and Trust Company Operations Centre, 6201 15th Avenue, Brooklyn, NY 11219, United States E-mail queries: db@astfinancial.com Toll free (within the US): +1 886 249 2593 Int: +1 718 921 8137 Fax: +1 718 921 8334 *ADR: American Depositary Receipts |

| SPONSOR |

JP Morgan Equities South Africa (Proprietary) Limited 1 Fricker Road, corner Hurlingham Road, Illovo, Johannesburg, 2196 Private Bag X9936, Sandton, 2146 Telephone: +27 11 507 0300 Fax: +27 11 507 0503 |

| TRADING SYMBOLS |

| ISIN: ZAE 000015228 |

HARMONY’S ANNUAL REPORTS

Harmony’s Integrated Annual Report, and its annual report filed on a Form 20F with the United States’ Securities and Exchange Commission for the financial year ended 30 June 2021, are available on our website (www.harmony.co.za/invest).

FORWARD-LOOKING STATEMENTS

This booklet contains forward-looking statements within the meaning of the safe harbour provided by Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters. These forward-looking statements, including, among others, those relating to our future business prospects, revenues, and the potential benefit of acquisitions (including statements regarding growth and cost savings) wherever they may occur in this booklet, are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in our integrated annual report. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation: overall economic and business conditions in South Africa, Papua New Guinea, Australia and elsewhere, impact of Covid-19 on our operational and financial estimates and results estimates of future earnings, and the sensitivity of earnings to the prices of gold and other metals prices estimates of future production and sales for gold and other metals, estimates of future cash costs, estimates of future cash flows, and the sensitivity of cash flows to the prices of gold and other metals, estimates of provision for silicosis settlement; estimates of future tax liabilities under the Carbon Tax Act, statements regarding future debt repayments, estimates of future capital expenditures, the success of our business strategy, exploration and development activities and other initiatives; future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; estimates of reserves statements regarding future exploration results and the replacement of reserves, the ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions, as well as at existing operation, fluctuations in the market price of gold, the occurrence of hazards associated with underground and surface gold mining, the occurrence of labour disruptions related to industrial action or health and safety incidents, power cost increases as well as power stoppages, fluctuations and usage constraints, supply chain shortages and increases in the prices of production imports and the availability, terms and deployment of capital; our ability to hire and retain senior management, sufficiently technically-skilled employees, as well as our ability to achieve sufficient representation of historically disadvantaged persons in management positions, our ability to comply with requirements that we operate in a sustainable manner and provide benefits to affected communities, potential liabilities related to occupational health diseases; changes in government regulation and the political environment, particularly tax and royalties, mining rights, health, safety, environmental regulation and business ownership including any interpretation thereof; court decisions affecting the mining industry, including, without limitation, regarding the interpretation of mining rights, our ability to protect our information technology and communication systems and the personal data we retain, risks related to the failure of internal controls, the outcome of pending or future litigation or regulatory proceedings; fluctuations in exchange rates and currency devaluations and other macroeconomic monetary policies; the adequacy of the Group’s insurance coverage; any further downgrade of South Africa’s credit rating and socio-economic or political instability in South Africa, Papua New Guinea and other countries in which we operate.

The foregoing factors and others described under “Risk Factors” in our Integrated Annual Report (www.har.co.za) and our Form 20F should not be construed as exhaustive. We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except as required by law. All subsequent written or oral forward-looking statements attributable to Harmony or any person acting on its behalf are qualified by the cautionary statements herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Harmony Gold Mining Company Limited |

| |

Date: May 12, 2022 | By: /s/ Boipelo Lekubo |

| Name: Boipelo Lekubo |

| Title: Financial Director |

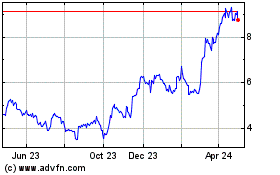

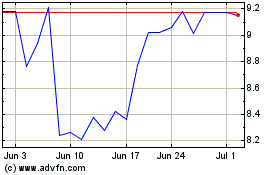

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Sep 2023 to Sep 2024