Gray Reports Operating Results for the Three Months and Year Ended

December 31, 2003 ATLANTA, March 8 /PRNewswire-FirstCall/ -- Gray

Television, Inc. (the "Company") today announced its results for

the three months ("fourth quarter") and year endedDecember 31,

2003. The Company's reported results for 2003 reflect the impact of

the acquisition of Stations Holding Company, Inc., on October 25,

2002, comprising 15 network affiliated television stations serving

13 television markets and the acquisition on December 18, 2002 of

KOLO-TV, the ABC affiliate serving Reno, Nevada. Both acquisitions

are collectively referred to as the "2002 Acquisitions". The

Company has also provided information on its operating results on a

"pro forma" basis which gives effect to the 2002 Acquisitions as if

they had occurred on January 1, 2002 (see Note 1). Fourth quarter

of 2003 Compared to the Fourth quarter of 2002 Revenues. Total

revenues for the three months ended December 31, 2003 increased 6%

to $80.4 million as compared to the corresponding period of the

prior year primarily reflecting the impact of the 2002

Acquisitions. Broadcasting revenues increased 7% to $66.5 million.

The stations acquired in 2002 had revenue of $35.1 million in the

fourth quarter of 2003 compared to $25.4 million from the

respective acquisition date in 2002 through December 31, 2002. For

the television stations that were owned continuously for the

quarters ended December 31, 2003 and 2002, total revenue for 2003

decreased $5.3 million, or 14%. This decrease primarily reflects

the net result of increases in local and national advertising

revenue of approximately 7% and 8%, respectively, offset by a

decrease in political advertising revenue of 88% or $6.9 million.

On a pro forma basis, total broadcasting revenues decreased 12%

from the pro forma results of the fourth quarter of 2002.

Broadcasting local and national revenues increased approximately 9%

and 6% respectively from the pro forma results of 2002 while

political advertising revenue decreased $12.8 million to $2.3

million from the pro forma results for the fourth quarter of 2002.

Operating expenses. Operating expenses before depreciation,

amortization and certain other non-cash charges increased 13% to

$51.5 million primarily reflecting the impact of the 2002

Acquisitions. Broadcasting expenses increased 18% to $39.4 million.

The stations acquired in 2002 had broadcast expense of $20.2

million in the fourth quarter of 2003 compared to $13.2 million

from the respective acquisition date in 2002 through December 31,

2002. For the television stations that were owned continuously for

the quarters ended December 31, 2003 and 2002, broadcast expenses

decreased 4% from the prior period. On a pro forma basis,

broadcasting operating expenses decreased 2% from the prior period.

Year ended December 31, 2003 Compared to the Year ended December

31, 2002 Revenues. Total revenues for the year ended December 31,

2003 increased 49% to $295.4 million as compared to the same period

of the prior year primarily reflecting the impact of the 2002

Acquisitions. Broadcasting revenues increased 66% to $243.1

million. The stations acquired in 2002 had revenue of $127.9

million for 2003 compared to $25.4 million from the respective

acquisition date in 2002 through December 31, 2002. For the

television stations that were owned continuously for the years

ended December 31, 2003 and 2002, total revenue for 2003 decreased

$6.2 million, or 5%. This decrease primarily reflectsthe net result

of increases in local and national advertising revenue of 5% and

4%, respectively, offset by a decrease in political advertising

revenue of 82% or $10.8 million. On a pro forma basis total

broadcasting revenues decreased 4% from the proforma results for

the full year of 2002. Broadcasting local and national revenue

increased approximately 5% and 4%, respectively from the pro forma

results of 2002 while political advertising revenue decreased $19.7

million to $5.7 million from the pro forma results for the full

year of 2002. Operating expenses. Operating expenses before

depreciation, amortization and certain other non-cash charges

increased 53% to $191.7 million primarily reflecting the impact of

the 2002 Acquisitions. Broadcasting expenses increased 78% to

$145.7 million. The stations acquired in 2002 had broadcast expense

of $76.4 million for 2003 compared to $13.2 million from the

respective acquisition date in 2002 through December 31, 2002. For

the television stations that were owned continuously for the years

ended December 31, 2003 and 2002, broadcast expenses increased 1%.

On a pro forma basis broadcasting operating expenses decreased 1%

from the prior year. Balance Sheet Total debt outstanding at

December 31, 2003 was $655.9 million compared to $658.2 million at

December 31, 2002. The Company's cash balance was $11.9 million at

December 31, 2003 compared to $12.9 million at December 31, 2002.

Settlement of IRS Litigation In January 2004, the Company settled

its litigation with the IRS relating to the acquisition of certain

television assets in 1996. The settlement requires no cash payments

from the Company. The Company agreed in the settlement to forego

certain claimed depreciation and amortization deductions relating

to the 1996 through 1999 tax years, which in turn resulted in a

reduction of the Company's current federal income tax net operating

loss carryforwards by approximately $16.3 million. After giving

effect to the settlement, the Company'sfederal net operating loss

carryforwards approximate $190 million. During the three months

ended December 31, 2003, the Company recorded a non-cash charge to

decrease its deferred tax assets by approximately $5.8 million to

reflect this settlement. Asa result of the settlement, the Company

is also entitled to collect a previously claimed federal tax cash

refund from 1996 of approximately $1.2 million, plus statutory

interest. Restatement of 2002 Transitional Impairment Charge The

Company has restated its 2002 and 2001 consolidated financial

statements for the items discussed below. These restatements had no

impact on cash or on income (loss) before cumulative effect of

accounting change. Reclassification Between Broadcast Licenses and

Goodwill for Acquisitions Prior to 2002 Broadcast licenses of

television stations acquired by the Company prior to January 1,

2002 were valued using a residual value methodology where the

excess of the purchase price over the fair value of all identified

tangible and intangible assets was attributed to the broadcast

license. In applying this methodology, the Company previously

reported deferred tax liabilities for the excess of book over tax

basis of assets acquired with a corresponding increase in goodwill.

The Company has determined that, instead of recognizing that amount

as additional goodwill, the amount should have been included with

the residual amount attributed to the broadcast license.

Accordingly, the Company has restated its December 31, 2002 balance

sheet to reflect the reclassification of approximately $36.4

million of amounts previously reported as "goodwill" to "broadcast

licenses". This reclassification, in turn, created additional book

over tax basis of the broadcast licenses, requiring recognition of

additional deferred tax liabilities and recognition of a

corresponding increase in the amount of broadcast licenses. This

grossing up effect resulted in an additional increase to broadcast

licenses and an increase to deferred tax liabilities of

approximately $29.0 million at December 31, 2002. Revision of the

Initial Transition Impairment Charge Calculation Upon Adoption of

SFAS 142 The adjustment mentioned above and the correction of

certain other computational errors in the initial transition

impairment calculation caused the pre-tax impairment charge as of

January 1, 2002 to increase from $39.5 million to $39.9 million and

caused the related tax benefit to increase from $8.9 million to

$13.2 million. Therefore, the cumulative effect of accounting

change of $30.6 million previously reported in the statement of

operations for the year ended December 31, 2002 has been restated

and is now reduced to $26.6 million. This net adjustment was

recorded as an increase in broadcast licenses of $6.4 million, an

increase in deferred taxes of $2.4 million and a decrease in the

cumulative effect of accounting change of $4.0 million. The

following table summarizes the effects of the restatements

discussed above. These restatements had no impact on cash or on

income (loss) before cumulative effect of accounting change.

(Dollars in thousands except per share data): Balance Sheet As of

December 31, 2002 As Previously Reported As Restated Assets:

Broadcast licenses $878,631 $950,321 Goodwill $173,341 $136,969

Other intangible assets, net $8,900 $8,905 Total assets $1,296,724

$1,332,048 Liabilities: Deferred income taxes $174,765 $206,143

Total liabilities $888,114 $919,492 Stockholders' equity: Retained

deficit $28,176 $24,230 Total stockholders' equity $369,420

$373,366 Statement of Operations For the Year Ended December 31,

2002 As Previously Reported As Restated Cumulative effect of

accounting change, net $(30,592) $(26,646) Net loss $(27,887)

$(23,941) Net loss available to common stockholders $(34,317)

$(30,371) Net loss per share available to common stockholders Basic

$ (1.55) $ (1.37) Diluted $ (1.53) $ (1.37) For the year ended

December 31, 2001 the Company has restated its intangible asset

amortization expense and its income tax benefit increasing each by

$958,000 to reflect, in that period, the impact of the

reclassification between broadcast licenses and goodwill plus the

related "tax-on-tax" gross-up mentioned above. Reclassifications

Certain prior year amounts have been reclassified to conform with

the 2003 presentation. Specifically, the Company has reclassified

amounts relating to the loss on disposal of assets from

miscellaneous income (expense) to a separate line item entitled

"Loss on disposal of assets, net" included in operating expenses.

Guidance for the First Quarter of 2004 The Company currently

anticipates that its results of operations for the three months

ended March 31, 2004 will approximate the ranges presented in the

table below. Three Months Ended Dollars in Thousands March 31, 2004

Estimated Range Low High OPERATING REVENUES Broadcasting (less

agency commissions) $59,000 $60,000 Publishing 10,500 10,700 Paging

1,700 1,800 TOTAL OPERATING REVENUES 71,200 72,500 OPERATING

EXPENSES Operating expenses before depreciation and amortization

Broadcasting 37,000 37,250 Publishing 8,000 8,100 Paging 1,425

1,450 Corporate 2,000 2,500 Depreciation and amortization 6,000

6,100 Amortization of restricted stock award 75 100 Loss on

disposal of assets 50 100 TOTAL OPERATING EXPENSES 54,550 55,600

OPERATING INCOME $16,650 $16,900 The Company currently estimates

that net politicalrevenue for the three months ended March 31, 2004

will range between $2.3 million and $2.5 million compared to

$741,000 earned in the three months ending March 31, 2003. Such

estimate for 2004 is included in the broadcast operating revenue

estimates presented above. In addition the Company currently

estimates that non-cash 401(k) plan expense will range between

$475,000 and $550,000 for the three months March 31, 2004 and such

estimate is included in the operating expense estimates presented

above. For the full year of 2004, the Company currently anticipates

that total operating expenses before depreciation, amortization and

certain other non- cash charges will increase approximately 3% over

the results for 2003. The Company currently anticipates that

broadcast operating expenses for the full year of 2004 will

increase approximately 3.5% over the results for 2003. These

increased operating costs primarily reflect general increases in

payroll and related employee benefit costs as well as

salescommissions on political revenue sold by national sales

representatives. Conference Call Information Gray Television, Inc.

will host a conference call to discuss its fourth quarter operating

results on March 8, 2004. The call will begin at 11:00 AM Eastern

Time. The live dial-in number is (877) 888-3855 and the reservation

number is T485854G. The call will be webcast live and available for

replay at http://www.graytvinc.com/ . The taped replay of the

conference call will be available at (888) 509-0081 until March 22,

2004. The Company Gray Television, Inc. is a communications company

headquartered in Atlanta, Georgia, and currently owns 29 television

stations serving 25 television markets. The stations include 15 CBS

affiliates, seven NBC affiliates and seven ABC affiliates. Gray

Television, Inc. has 22 stations ranked #1 in local news audience

and 22 stations ranked #1 in overall audience within their

respective markets based on the results of the Nielsen November

2003 ratings reports.The TV station group reaches approximately

5.3% of total U.S. TV households. The Company also owns four daily

newspapers, three in Georgia and one in Indiana. Gray Television,

Inc. (in thousands, except per share data and percentages) As

Reported(1) Pro Forma(1) Three Months Three Months Ended Ended

Selected operating data: December 31, December 31, % % 2003 2002

Change 2002 Change OPERATING REVENUES Broadcasting (less agency

commissions) $66,537 $62,173 7 % $75,404 (12)% Publishing 11,831

11,583 2 % 11,583 2 % Paging 2,029 2,070 (2)% 2,070 (2)% TOTAL

OPERATING REVENUES 80,397 75,826 6 % 89,057 (10)% OPERATING

EXPENSES Operating expenses before depreciation and amortization

Broadcasting 39,422 33,374 18 % 40,167 (2)% Publishing 8,176 8,373

(2)% 8,373 (2)% Paging 1,551 1,684 (8)% 1,684 (8)% Corporate and

administrative 2,301 2,322 (1)% 2,706 (15)% Depreciation and

amortization 6,178 6,663 (7)% 5,503 12 % Amortization of restricted

stock award 454 - 0 - NA - 0 - NA Loss on disposal of assets 1,075

592 82 % 592 82 % TOTAL OPERATING EXPENSES 59,157 53,008 12 %

59,025 0 % Operating income 21,240 22,818 (7)% 30,032 (29)%

Miscellaneous income (expense), net (192) 141 (236)% 141 (236)%

Interest expense (10,637) (10,759) (1)% (11,654) (9)% Loss on early

extinguishments of debt - 0 - (5,563) (100)% (5,563) (100)% INCOME

BEFORE INCOME TAXES 10,411 6,637 57 % 12,956 (20)% Income tax

expense 9,146 2,682 241 % 5,084 80 % NET INCOME 1,265 3,955 (68)%

7,872 (84)% Preferred dividends 822 858 (4)% 858 (4)% NET INCOME

AVAILABLE TO COMMON STOCKHOLDERS $443 $3,097 (86)% $7,014 (94)%

Diluted per share information: Net income per share available to

common stockholders $0.01 $0.08 (88)% $0.14 (94)% Weighted average

shares outstanding 50,21041,232 22 % 50,281 (0)% Other Selected

Data Political revenue $2,251 $11,213 (80)% $15,062 (85)% Selected

balance sheet data: December 31, 2003 2002 Cash and cash

equivalents $11,947 $12,915 Total Debt (2) 655,902 658,220 Total

debt net of cash 643,955 645,305 Gray Television, Inc. (in

thousands, except per share data and percentages) As Reported(1)

Pro Forma(1) Twelve Months Twelve Months Ended Ended Selected

operating data: December 31, December 31, Restated % % 2003 2002

Change 2002 Change OPERATING REVENUES Broadcasting (less agency

commissions) $243,061 $146,714 66 % $253,824 (4)% Publishing 44,366

43,657 2 % 43,657 2 % Paging 7,944 8,269 (4)% 8,269 (4)% TOTAL

OPERATING REVENUES 295,371 198,640 49 % 305,750 (3)% OPERATING

EXPENSES Operating expenses before depreciation and amortization

Broadcasting 145,721 81,996 78 % 146,648 (1)% Publishing 31,781

31,5831 % 31,583 1 % Paging 5,785 5,798 (0)% 5,798 (0)% Corporate

and administrative 8,460 5,607 51 % 9,010 (6)% Depreciation and

amortization 27,337 17,728 54 % 22,152 23 % Amortization of

restricted stock award 454 - 0 - NA - 0 - NA Loss on disposal of

assets 1,155 699 65 % 699 65 % TOTAL OPERATING EXPENSES 220,693

143,411 54 % 215,890 2 % Operating income 74,678 55,229 35 % 89,860

(17)% Miscellaneous income, net 20 303 (93)% 303 (93)% Appreciation

in value of derivatives, net - 0 - 1,581 (100)% 1,581 (100)%

Interest expense (43,337) (35,674) 21 % (49,731) (13)% Loss on

early extinguishment of debt - 0 - (16,838) (100)% (16,838) (100)%

INCOME BEFORE INCOME TAXES AND CUMULATIVE EFFECT OF ACCOUNTING

CHANGE 31,361 4,601 582 % 25,175 25 % Income tax expense 17,337

1,896 814 % 9,715 78 % NET INCOME BEFORE CUMULATIVE EFFECT OF

ACCOUNTING CHANGE 14,024 2,705 418 % 15,460 (9)% Cumulative effect

of accounting change, net of $13,215 income tax benefit - 0 -

(26,646) (100)% (26,646) (100)% NET INCOME (LOSS) 14,024 (23,941)

(159)% (11,186) (225)% Preferred dividends 3,287 2,461 34 % 2,461

34 % Preferred dividends associated with the redemption of

preferred stock - 0 - 3,969 (100)% 3,969 (100)% NET INCOME (LOSS)

AVAILABLE TO COMMON STOCKHOLDERS $10,737 $(30,371) (135)% $(17,616)

(161)% Diluted per share information: Net income (loss) before

cumulative effect of accounting change available to common

stockholders $0.21 $(0.17) (226)% $0.18 19 % Cumulative effect of

accounting change, net of income taxes - 0 - (1.20) (100)% (0.53)

(100)% Net income (loss) per share available to common stockholders

$0.21 $(1.37) (115)% $(0.35) (161)% Weighted average shares

outstanding 50,535 22,127 128 % 50,462 0 % Other Selected Data

Political revenue $5,668 $16,612 (66)% $25,349 (78)% Notes: Note 1.

"As Reported" and "Pro forma" Information in this earnings release

has been presented under two different methods: as reported and pro

forma. The as reported basis of presentation gives effect to the

acquisitions as of their respective acquisition dates. The pro

forma presentation gives effect to the acquisitions of Stations

Holding Company, Inc. which occurred on October 25, 2002 and

KOLO-TV which occurred on December 18, 2002 as if each had occurred

on January 1, 2002. Accordingly, the pro forma presentation

combines the Company's historical results of operations with the

respective acquired operation's historical pre-acquisition

operating results. Certain amounts of corporate overhead were

eliminated in the pro forma presentation. Depreciation and

amortization expense in the pro forma presentation give effect to

accounting for the respective acquisitions. Pro forma income tax

expense or benefit assumes an effective tax rate of 38% on the pro

forma incremental net pre-tax income or loss. Pro forma interest

expense and shares outstanding give effect to the Company's

issuance of additional debt and common equity to finance, in part,

the acquisitions. An unaudited reconciliation between the as

reported and the pro forma condensed consolidated statements of

operations for the three months and year ended December 31, 2002

follows: Data in Thousands Three Months Ended December 31, 2002 As

Effectof Reported Acquisitions Pro forma Operating revenues

Broadcasting (less agency commissions) $62,173 $13,231 $75,404

Publishing 11,583 - 0 - 11,583 Paging 2,070 - 0 - 2,070 Total

operating revenues 75,826 13,231 89,057 Operating expenses before

depreciation and amortization Broadcasting 33,374 6,793 40,167

Publishing 8,373 - 0 - 8,373 Paging 1,684 - 0 - 1,684 Corporate and

administrative 2,322 384 2,706 Depreciation and amortization 6,663

(1,160) 5,503 Loss on disposal of assets 592 - 0 - 592 Total

operating expenses 53,008 6,017 59,025 Operating income 22,818

7,214 30,032 Miscellaneous income, net 141 - 0 - 141 Interest

expense (10,759) (895) (11,654) Loss on early extinguishment of

debt (5,563) - 0 - (5,563) Income before income tax 6,637 6,319

12,956 Income tax expense 2,682 2,402 5,084 Net income 3,955 3,917

7,872 Preferred dividends 858 - 0 - 858 Net income available to

common stockholders $3,097 $3,917 $7,014 Diluted weighted average

shares outstanding 41,232 9,049 50,281 Other Selected Data:

Broadcast Revenue Local $31,760 $6,351 $38,111 National 15,193

2,427 17,620 Network compensation 2,441 251 2,692 Political 11,213

3,849 15,062 Other 1,566 353 1,919 Total Broadcast Revenue $62,173

$13,231 $75,404 Data in Thousands Year ended December 31, 2002 As

Effect of Restated Acquisitions Pro forma Operating revenues

Broadcasting (less agency commissions) $146,714 $107,110 $253,824

Publishing 43,657 - 0 - 43,657 Paging 8,269 - 0 - 8,269 Total

operating revenues 198,640 107,110 305,750 Operating expenses

before depreciation and amortization Broadcasting 81,996 64,652

146,648 Publishing 31,583 - 0 - 31,583 Paging 5,798 - 0 - 5,798

Corporate and administrative 5,607 3,403 9,010 Depreciation and

amortization 17,728 4,424 22,152 Loss on disposal of assets 699 - 0

- 699 Total operating expenses 143,411 72,479 215,890 Operating

income 55,229 34,631 89,860 Miscellaneous income, net 303 - 0 - 303

Appreciation in value of derivatives, net 1,581 - 0 - 1,581

Interest expense (35,674) (14,057) (49,731) Loss on early

extinguishment of debt (16,838) - 0 - (16,838) Income (loss) before

income tax and cumulative effect of accounting change 4,601 20,574

25,175 Income tax expense (benefit) 1,896 7,819 9,715 Net income

(loss) before cumulative effect of accounting change 2,705 12,755

15,460 Cumulative effect of accounting change, net of $13,215

income tax benefit (26,646) - 0 - (26,646) Net income (loss)

(23,941) 12,755 (11,186) Preferreddividends 6,430 - 0 - 6,430 Net

income (loss) available to common stockholders $(30,371) $12,755

$(17,616) Diluted weighted average shares outstanding 22,127 28,085

50,462 Other Selected Data: Broadcast Revenue Local $79,631 62,663

142,294 National 39,288 28,528 67,816 Network compensation 6,422

2,917 9,339 Political 16,612 8,737 25,349 Other 4,761 4,265 9,026

Total Broadcast Revenue $146,714 $107,110 $253,824 Note 2. Debt

Total debt as of December 31, 2003 and December 31, 2002 does not

include $1.2 million and $1.3 million, respectively, of unamortized

debt discount on the Company's 9-1/4% Senior Subordinated Notes due

March 2011. Cautionary Statements for Purposes of the "Safe Harbor"

Provisions of the Private Securities Litigation Reform Act The

preceding comments on Gray's current expectations of operating

results for the first quarter of 2004 are "forwardlooking" for

purposes of the Private Securities Litigation Reform Act of 1995.

Actual results of operations are subject to a number of risks and

may differ materially from the current expectations discussed in

this press release. See the Company's annual report on Form 10K for

a discussion of risk factors that may affect the Company.

DATASOURCE: Gray Television, Inc. CONTACT: Bob Prather, President

and Chief Operating Officer, +1-404-266- 8333, or Jim Ryan, Senior

V. P. and Chief Financial Officer, +1-404-504-9828, both of Gray

Television, Inc. Web site: http://www.graytvinc.com/

Copyright

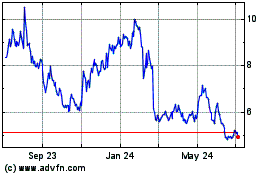

Gray Television (NYSE:GTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

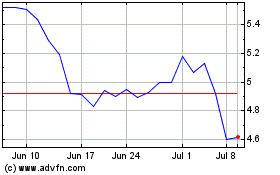

Gray Television (NYSE:GTN)

Historical Stock Chart

From Nov 2023 to Nov 2024