Gray Television, Inc. Reduces Outstanding Term Loan by $65 Million

June 27 2008 - 12:07PM

PR Newswire (US)

ATLANTA, June 27 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("we", "us" or "our") (NYSE:GTNNYSE:andNYSE:GTN.A) announced today

that on June 26, 2008 it made a voluntary permanent reduction of

$65 million to its outstanding term loan. After this payment the

current outstanding term loan balance now approximates $858 million

compared to approximately $923 million on March 31, 2008. We used a

portion of the net proceeds from our previously announced issuance

of $75 million liquidation value of Series D Perpetual Preferred

Stock (the "Series D Preferred Stock") to fund the voluntary

permanent reduction of the term loan. The $75 million, liquidation

value, of our Series D Preferred Stock represents an aggregate of

approximately 8% of our total outstanding debt plus the liquidation

value of the Series D Preferred Stock. Our total weighted average

cost of capital for our outstanding debt and Series D Preferred

Stock is estimated to approximate 6.3%. We believe this overall

cost of capital compares favorably to that of other leveraged

television broadcast companies. Gray Television, Inc. is a

television broadcast company headquartered in Atlanta, GA. Gray

currently operates 36 television stations serving 30 markets. Each

of the stations are affiliated with either CBS (17 stations), NBC

(10 stations), ABC (8 stations) or FOX (1 station). In addition,

Gray currently operates 40 digital second channels including 1 ABC,

5 Fox, 8 CW and 16 MyNetworkTV affiliates plus 8 local news/weather

channels and 2 "independent" channels in certain of its existing

markets. DATASOURCE: Gray Television, Inc. CONTACT: Bob Prather,

President, +1-404-266-8333, Jim Ryan, Chief Financial Officer,

+1-404-504-9828, both of Gray Television, Inc. Web site:

http://www.gray.tv/

Copyright

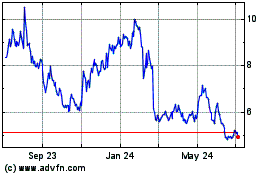

Gray Television (NYSE:GTN)

Historical Stock Chart

From Dec 2024 to Jan 2025

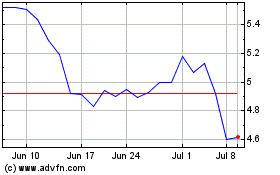

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jan 2024 to Jan 2025