South African High Court Rules Against Harmony Gold

May 20 2005 - 11:28AM

PR Newswire (US)

South African High Court Rules Against Harmony Gold JOHANNESBURG,

South Africa, May 20 /PRNewswire-FirstCall/ -- Harmony Gold Mining

(NYSE:HMY)(JSE:HAR) notes with surprise the judgment of the

Witwatersrand Local Division of the High Court of South Africa that

Harmony's further offer for Gold Fields (NYSE:GFI)(JSE:GFI) lapsed

at midnight on 18 December 2004. Accordingly, the further offer is

no longer in force and no further Gold Fields shares tendered into

the further offer will be settled. Acceptances in respect of 22,927

Gold Fields shares were settled by Harmony on Tuesday, 17 May 2005,

in accordance with the provisions of the offer and the Securities

Regulation Code. Harmony will investigate the need and mechanisms

for unwinding such settlements. Harmony will decide whether or not

to appeal the judgment after having had an opportunity to consider

the reasons given for the judgment. Given the situation, Harmony

does not see any merit in becoming embroiled in a costly legal

process unnecessarily. The ruling has no effect on the early

settlement offer. Accordingly, following its early settlement

offer, and including the acceptances referred to above, Harmony

owns a total of 56,629,409 Gold Fields shares representing

approximately 11.5% of the entire issued share capital of Gold

Fields. CE Bernard Swanepoel said: "Whilst I am surprised that the

High Court reached this decision, the impact on Harmony is minimal.

The judgment impacts only on those Gold Fields shareholders that

have accepted the further offer. Harmony had already chosen not to

pay the price indicated by the prevailing market ratio as this

would have resulted in too great a transfer of value to Gold Fields

shareholders and would have been contrary to Harmony's commitment

to always act in the best interests of its shareholders. Our bid

was neither value destroying nor anything other than a legitimate

offer from one set of shareholders to another designed to assist

the South African gold mining industry on its inevitable course to

consolidation. Following the offer, we now have a substantial asset

in our Gold Fields shares, currently worth about R3.6 billion, and

look forward to concrete evidence that the Gold Fields' board has a

coherent strategy in place to deliver on any of its promises in a

manner that is in the best interests of all of its shareholders,

now including Harmony." Unless the context otherwise requires, the

definitions contained in the offer document or the registration

statement sent to Gold Fields shareholders have the same meaning in

this announcement. The directors of Harmony accept responsibility

for the information contained in this announcement. To the best of

the knowledge and belief of the directors of Harmony (who have

taken all reasonable care to ensure that such is the case), the

information contained in this announcement is in accordance with

the facts and does not omit anything likely to affect the import of

such information. In connection with the proposed acquisition of

Gold Fields, Harmony has filed a registration statement (File no:

333-120975) on Form F-4 (which was declared effective by the

Securities and Exchange Commission ("SEC") on February 28, 2005)

and filed a final prospectus, dated February 25, 2005, with the SEC

pursuant to Rule 424(b)(3) of the Securities Act of 1933, to

register the Harmony ordinary shares (including Harmony ordinary

shares represented by Harmony American Depositary Shares ("ADSs"))

to be issued in exchange for Gold Fields ordinary shares held by

Gold Fields shareholders located in the United States and for Gold

Fields ADSs held by Gold Fields shareholders wherever located, as

well as a Statement on Schedule TO. Investors and holders of Gold

Fields securities are strongly advised to read the registration

statement, the related exchange offer materials and the final

prospectus, the Statement on Schedule TO and any other relevant

documents filed with the SEC, as well as any amendments and

supplements to those documents, because they contain important

information. Investors and holders of Gold Fields securities may

obtain free copies of the registration statement, related exchange

offer materials, the final prospectus and the Statement on Schedule

TO, as well as other relevant documents filed or to be filed with

the SEC, at the SEC's web site at http://www.sec.gov/. Investors

and holders of Gold Fields securities will receive information at

an appropriate time on how to obtain transaction- related documents

for free from Harmony or its duly designated agent. The final

prospectus and other transaction-related documents may be obtained

for free from MacKenzie Partners, Inc., the information agent for

the U.S. offer, at the following address: 105 Madison Avenue, New

York, New York 10016; telephone 1 (212) 929 5500 (call collect) or

1 (800) 322 2885 (toll-free call); e-mail . This communication is

for information purposes only. It shall not constitute an offer to

purchase or exchange or the solicitation of an offer to sell or

exchange any securities of Gold Fields or an offer to sell or

exchange or the solicitation of an offer to buy or exchange any

securities of Harmony, nor shall there be any sale or exchange of

securities in any jurisdiction in which such offer, solicitation or

sale or exchange would be unlawful prior to the registration or

qualification under the laws of such jurisdiction. The distribution

of this communication may, in some countries, be restricted by law

or regulation. Accordingly, persons who come into possession of

this communication should inform themselves of and observe these

restrictions. The solicitation of offers to buy Gold Fields

ordinary shares (including Gold Fields ordinary shares represented

by Gold Fields ADSs) in the United States will only be made

pursuant to a prospectus and related offer materials that Harmony

has sent to holders of Gold Fields securities. The Harmony ordinary

shares (including Harmony ordinary shares represented by Harmony

ADSs) may not be sold, nor may offers to buy be accepted, in the

United States prior to the time the registration statement becomes

effective. No offering of securities shall be made in the United

States except by means of a prospectus meeting the requirements of

Section 10 of the United States Securities Act of 1933, as amended.

DATASOURCE: Harmony Gold CONTACT: Harmony Gold: Ferdi Dippenaar,

+27-11-684-0140, mobile, +27-82-807-3684, Brenton Saunders,

+27-11-684-0140, or Vusi Magadana, +27-11-684-0140; United States -

Financial Dynamics Business Communications: Hollis Rafkin-Sax,

+1-212-850-5789, mobile, +1-917-509-0255, hrafkin-sax@fd- us.com,

or Torie Pennington, +1-212-850-5629, mobile, +1-917-838-1369, ;

South Africa - Beachhead Media & Investor Relations: Jennifer

Cohen, +27-11-214-2401, mobile, +27-82-468-6469, , or Patrick

Lawlor, +27-11-214-2410, mobile, +27-82-459-6709, ; United Kingdom

- Financial Dynamics Business Communications: Nic Bennett,

+44-207-269-7115, mobile, +44 7979 536 619, , or Charles Watenphul,

+44-207-269-7216, mobile, +44-7866-438-013, ; US Information Agent

- MacKenzie Partners, Inc., Daniel Burch, +1-212-929-5500, , or

Steve Balet, +1-800-322-2885

Copyright

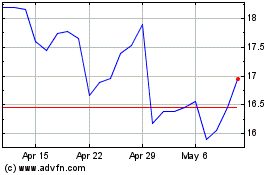

Gold Fields (NYSE:GFI)

Historical Stock Chart

From May 2024 to Jun 2024

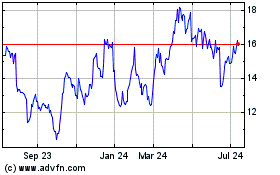

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jun 2023 to Jun 2024