Report of Foreign Issuer (6-k)

March 18 2016 - 4:41PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2016

FOMENTO ECONÓMICO MEXICANO, S.A.B.

DE C.V.

(Exact name of Registrant as specified in

its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name

into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _______

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _______

Indicate by check mark whether by furnishing

the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-_____________

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned, there unto duly

authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V. |

| |

|

| |

By: /s/ Miguel Eduardo Padilla Silva |

| |

Miguel Eduardo Padilla Silva |

| |

Chief Financial and Corporate Officer

|

Date: March 18, 2016

Exhibit 99.1

FEMSA Announces

Successful Issuance

in Euro

Bond Market

Monterrey, Mexico, March 18,

2016 — Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”) (NYSE: FMX; BMV: FEMSAUBD) announced the

placement of Euro-denominated notes in the international capital markets.

FEMSA successfully issued €$1,000

million in 7-year senior unsecured notes at a spread of 155 basis points over the relevant benchmark mid-swap, for a total yield

of 1.824%.

This issuance received credit

ratings of A- from Standard & Poor’s and A from Fitch Ratings.

The proceeds from this issuance

will be used for general corporate purposes, improving FEMSA’s cost of debt. FEMSA has again increased its financial flexibility

under extremely favorable conditions in order to continue to advance its long-term growth strategy.

This press release does not constitute

an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sales of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of

any jurisdiction.

####

FEMSA is a leading company that

participates in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world;

and in the beer industry, through its ownership of the second largest equity stake in Heineken, one of the world's leading brewers

with operations in over 70 countries. In the retail industry it participates through FEMSA Comercio, comprising a Retail Division

operating various small-format store chains including OXXO, and a Fuel Division operating the OXXO GAS chain of retail service

stations. Additionally, through its Strategic Businesses unit, it provides logistics, point-of-sale refrigeration solutions and

plastics solutions to FEMSA's business units and third-party clients.

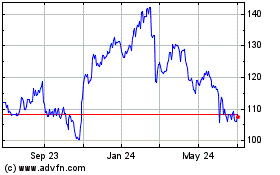

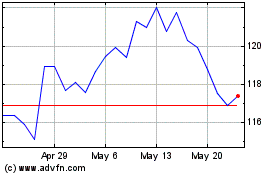

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From May 2024 to Jun 2024

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Jun 2023 to Jun 2024