ServiceLink's Streamlined Approach Producing Faster Short Sale Turnaround

August 10 2010 - 12:02PM

Marketwired

ServiceLink, Fidelity National Financial's National Lender Platform

and a leading provider of origination, loss mitigation, and default

services, has reported the company's short sale business model is

resulting in dramatically reduced short sale approval and closing

timelines.

The Pittsburgh-based company is reporting completed package and

contract acceptance in less than 30 days from the moment it

receives the file assignment from the servicer. Just a year ago,

the industry was constrained by delays as long three months from

the time an agent submitted a package to contract approval.

ServiceLink is also reporting that the timeline from contract

approval to closing has been reduced to less than 45 days,

providing for a total short sale completion time of less than 75

days. Previously, the entire short sale process could take over

five months.

"The biggest difference we're making in the industry is our

streamlined asset management approach," said Jane Johnson, SVP of

Loss Mitigation at ServiceLink. "Our sites across the country are

staffed with experienced short sale specialists, and that's allowed

us to scale quickly and efficiently to offset our clients' capacity

struggles."

ServiceLink began expanding its loss mitigation operations early

this year in anticipation of an increased number of short sale

transactions. With a combination of tenured, client-dedicated teams

devoted solely to short sale transactions and a strong focus on

quality control, the company has emerged as one of the leading

outsource companies for loss mitigation services. ServiceLink

remains one of the few providers that can manage end-to-end and

component loss mitigation without the need for further

outsourcing.

Johnson attributes ServiceLink's success to the firm's unique

process. Unlike the traditional outsourcer model, ServiceLink

employs dedicated closing teams that support the servicer from

initiation through liquidation with an emphasis on the closing

process. "It's a process newer entrants to the marketplace will

struggle to develop," says Johnson.

ServiceLink's model also includes technology customized to a

lender's individual workflow. And, since all work is performed in

house, the firm can take a file at any stage.

Amid the growing number of short sale transactions, ServiceLink

Loss Mitigation Services, a division of Fidelity National Financial

Servicing Inc., has seen its short sale inventory increase over 35%

just in the last quarter and continues to win short sale

opportunities with large servicers and investors.

About ServiceLink ServiceLink, the

national lender platform for Fidelity National Financial (NYSE:

FNF), is a leading provider of origination and default related

products and services for the mortgage industry. The firm currently

serves 15 of the top 20 national lenders and servicers, helping

them drive maximum performance through the life of the loan.

ServiceLink combines its unrivaled Serve First culture and industry

experience with innovative products and technology to help its

client partners mitigate risk, reduce cycle times, and lower

operating costs. For more information about ServiceLink, visit

www.servicelinkfnf.com.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Dan Mahoney Marketing TBD, Inc. 970-405-8060 Email

Contact

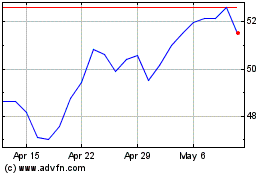

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Oct 2024 to Nov 2024

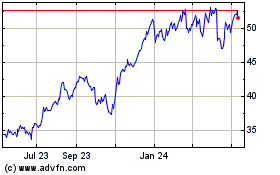

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Nov 2023 to Nov 2024