- Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (N-Q)

November 29 2012 - 11:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

_______________________________

Investment Company Act file number: 811-04632

The European Equity Fund, Inc.

(Exact name of registrant as specified in charter)

345 Park Avenue

New York, NY 10154

(Address of principal executive offices) (Zip code)

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and address of agent for service)

Registrant's telephone number, including area code:

(212) 250-3220

Date of fiscal year end:

12/31

Date of reporting period:

9/30/2012

|

ITEM 1.

|

SCHEDULE OF INVESTMENTS

|

THE EUROPEAN EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS — SEPTEMBER 30, 2012 (unaudited)

|

Shares

|

|

Description

|

|

Value

(a)

|

|

|

INVESTMENTS IN GERMANY – 38.2%

|

|

|

|

|

|

|

COMMON STOCKS – 34.0%

|

|

|

|

|

AIRLINES – 1.3%

|

|

|

|

70,000

|

|

|

Deutsche Lufthansa

|

|

$

|

949,933

|

|

|

|

|

|

AUTO COMPONENTS – 1.2%

|

|

|

|

9,000

|

|

|

Continental

|

|

|

882,145

|

|

|

|

|

|

CHEMICALS – 2.5%

|

|

|

|

11,000

|

|

|

Linde

|

|

|

1,896,006

|

|

|

|

|

|

DIVERSIFIED

TELECOMMUNICATION

SERVICES – 1.3%

|

|

|

|

80,000

|

|

|

Deutsche Telekom

|

|

|

985,306

|

|

|

|

|

|

ELECTRIC UTILITIES – 3.1%

|

|

|

|

100,000

|

|

|

E.ON

|

|

|

2,375,153

|

|

|

|

|

|

HEALTH CARE PROVIDERS &

SERVICES – 3.1%

|

|

|

|

20,000

|

|

|

Fresenius SE & Co.

|

|

|

2,324,087

|

|

|

|

|

|

INDUSTRIAL

CONGLOMERATES – 1.3%

|

|

|

|

10,000

|

|

|

Siemens

|

|

|

998,297

|

|

|

|

|

|

INSURANCE – 4.3%

|

|

|

|

19,000

|

|

|

Allianz

|

|

|

2,262,872

|

|

|

|

|

15,000

|

|

|

Hannover Rueckversicherung

|

|

|

959,419

|

|

|

|

|

|

|

3,222,291

|

|

|

|

|

|

MEDIA – 2.3%

|

|

|

|

40,000

|

|

|

Axel Springer

|

|

|

1,734,961

|

|

|

|

|

|

METALS & MINING – 2.2%

|

|

|

|

28,000

|

|

|

Aurubis

|

|

|

1,633,344

|

|

|

|

|

|

PERSONAL PRODUCTS – 2.7%

|

|

|

|

28,000

|

|

|

Beiersdorf

|

|

|

2,056,536

|

|

|

|

|

|

PHARMACEUTICALS – 2.8%

|

|

|

|

25,000

|

|

|

Bayer

|

|

|

2,149,086

|

|

|

|

|

|

SOFTWARE – 3.9%

|

|

|

|

45,000

|

|

|

PSI†

|

|

|

948,131

|

|

|

|

|

28,000

|

|

|

SAP

|

|

|

1,984,864

|

|

|

|

|

|

|

2,932,995

|

|

|

|

|

|

SPECIALTY RETAIL – 2.0%

|

|

|

|

16,000

|

|

|

Fielmann†

|

|

|

1,485,728

|

|

|

|

|

|

|

|

Total Common Stocks

(cost $23,033,346)

|

|

|

25,625,868

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

Description

|

|

Value

(a)

|

|

|

|

|

PREFERRED STOCKS – 4.2%

|

|

|

|

|

AUTOMOBILES – 2.4%

|

|

|

|

10,000

|

|

|

Volkswagen

(cost $951,062)

|

|

$

|

1,825,903

|

|

|

|

|

|

HOUSEHOLD PRODUCTS – 1.8%

|

|

|

|

17,000

|

|

|

Henkel & Co.

(cost $644,340)

|

|

|

1,353,355

|

|

|

|

|

|

|

|

Total Preferred Stocks

(cost $1,595,402)

|

|

|

3,179,258

|

|

|

|

|

|

|

|

Total Investments in Germany

(cost $24,628,748)

|

|

|

28,805,126

|

|

|

|

INVESTMENTS IN FRANCE – 19.3%

|

|

|

|

|

|

|

BUILDING PRODUCTS – 1.3%

|

|

|

|

28,000

|

|

|

Cie de St-Gobain

|

|

|

984,508

|

|

|

|

|

|

COMMERCIAL SERVICES &

SUPPLIES – 2.4%

|

|

|

|

15,000

|

|

|

Societe BIC

|

|

|

1,814,069

|

|

|

|

|

|

ELECTRICAL

EQUIPMENT – 2.8%

|

|

|

|

60,000

|

|

|

Alstom

|

|

|

2,105,802

|

|

|

|

|

|

HEALTH CARE EQUIPMENT &

SUPPLIES – 1.9%

|

|

|

|

15,000

|

|

|

Essilor International

|

|

|

1,405,990

|

|

|

|

|

|

INSURANCE – 2.4%

|

|

|

|

120,000

|

|

|

AXA

|

|

|

1,788,986

|

|

|

|

|

|

IT SERVICES – 1.9%

|

|

|

|

21,000

|

|

|

AtoS

|

|

|

1,465,147

|

|

|

|

|

|

OIL, GAS & CONSUMABLE

FUELS – 2.6%

|

|

|

|

40,000

|

|

|

Total

|

|

|

1,986,047

|

|

|

|

|

|

PHARMACEUTICALS – 2.6%

|

|

|

|

23,000

|

|

|

Sanofi

|

|

|

1,962,958

|

|

|

|

|

|

TEXTILES, APPAREL &

LUXURY GOODS – 1.4%

|

|

|

|

7,000

|

|

|

LVMH Moet Hennessy

Louis Vuitton

|

|

|

1,053,480

|

|

|

|

|

|

|

|

Total Investments in France

(cost $13,620,945)

|

|

|

14,566,987

|

|

|

6

THE EUROPEAN EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS — SEPTEMBER 30, 2012 (unaudited) (continued)

|

Shares

|

|

Description

|

|

Value

(a)

|

|

|

INVESTMENTS IN SPAIN – 9.1%

|

|

|

|

|

|

|

COMMERCIAL BANKS – 3.4%

|

|

|

|

342,000

|

|

|

Banco Santander*

|

|

$

|

2,549,305

|

|

|

|

|

|

DIVERSIFIED

TELECOMMUNICATION

SERVICES – 1.8%

|

|

|

|

100,000

|

|

|

Telefonica

|

|

|

1,334,536

|

|

|

|

|

|

INSURANCE – 2.0%

|

|

|

|

540,000

|

|

|

Mapfre†

|

|

|

1,480,892

|

|

|

|

|

|

OIL, GAS & CONSUMABLE

FUELS – 1.9%

|

|

|

|

76,000

|

|

|

Repsol YPF

|

|

|

1,475,180

|

|

|

|

|

|

|

|

Total Investments in Spain

(cost $6,754,203)

|

|

|

6,839,913

|

|

|

|

INVESTMENTS IN NETHERLANDS – 7.9%

|

|

|

|

|

|

|

CHEMICALS – 1.2%

|

|

|

|

18,000

|

|

|

Koninklijke DSM

|

|

|

898,352

|

|

|

|

|

|

COMPUTERS &

PERIPHERALS – 2.1%

|

|

|

|

18,000

|

|

|

Gemalto

|

|

|

1,584,850

|

|

|

|

|

|

DIVERSIFIED FINANCIAL

SERVICES – 1.2%

|

|

|

|

120,000

|

|

|

ING Groep*

|

|

|

949,135

|

|

|

|

|

|

FOOD PRODUCTS – 2.2%

|

|

|

|

22,000

|

|

|

Nutreco

|

|

|

1,631,131

|

|

|

|

|

|

SEMICONDUCTORS &

SEMICONDUCTOR

EQUIPMENT – 1.2%

|

|

|

|

17,000

|

|

|

AS

|

ML

|

Holding

|

|

|

909,453

|

|

|

|

|

|

|

|

Total Investments in Netherlands

(cost $6,009,496)

|

|

|

5,972,921

|

|

|

|

INVESTMENTS IN UNITED KINGDOM – 7.8%

|

|

|

|

|

|

|

COMMERCIAL SERVICES &

SUPPLIES – 2.3%

|

|

|

|

47,000

|

|

|

Aggreko

|

|

|

1,755,465

|

|

|

|

|

|

HEALTH CARE EQUIPMENT &

SUPPLIES – 2.3%

|

|

|

|

160,000

|

|

|

Smith & Nephew

|

|

|

1,765,945

|

|

|

|

|

|

MULTI-UTILITIES – 1.0%

|

|

|

|

140,000

|

|

|

Centrica

|

|

|

741,064

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

Description

|

|

Value

(a)

|

|

|

|

|

WIRELESS

TELECOMMUNICATION

SERVICES – 2.2%

|

|

|

|

580,000

|

|

|

Vodafone Group

|

|

$

|

1,646,047

|

|

|

|

|

|

|

|

Total Investments in

United Kingdom

(cost $5,052,230)

|

|

|

5,908,521

|

|

|

|

INVESTMENTS IN NORWAY – 4.7%

|

|

|

|

|

|

|

CHEMICALS – 1.5%

|

|

|

|

23,000

|

|

|

Yara International

|

|

|

1,152,812

|

|

|

|

|

|

ENERGY EQUIPMENT &

SERVICES – 3.2%

|

|

|

|

24,000

|

|

|

Fred Olsen Energy

|

|

|

1,073,000

|

|

|

|

|

40,000

|

|

|

TGS Nopec Geophysical

|

|

|

1,305,624

|

|

|

|

|

|

|

2,378,624

|

|

|

|

|

|

|

|

Total Investments in Norway

(cost $2,888,068)

|

|

|

3,531,436

|

|

|

|

INVESTMENTS IN ITALY – 3.5%

|

|

|

|

|

|

|

COMMERCIAL BANKS – 3.5%

|

|

|

|

1,000,000

|

|

|

Intesa Sanpaolo

|

|

|

1,521,693

|

|

|

|

|

260,000

|

|

|

UniCredit*

|

|

|

1,080,904

|

|

|

|

|

|

|

2,602,597

|

|

|

|

|

|

|

|

Total Investments in Italy

(cost $2,790,054)

|

|

|

2,602,597

|

|

|

|

INVESTMENTS IN LUXEMBOURG – 2.9%

|

|

|

|

|

|

|

MEDIA – 2.9%

|

|

|

|

80,000

|

|

|

SES

|

|

|

2,177,963

|

|

|

|

|

|

|

|

Total Investments in Luxembourg

(cost $2,097,894)

|

|

|

2,177,963

|

|

|

|

INVESTMENTS IN FINLAND – 2.3%

|

|

|

|

|

|

|

INSURANCE – 2.3%

|

|

|

|

56,000

|

|

|

Sampo

|

|

|

1,743,914

|

|

|

|

|

|

|

|

Total Investments in Finland

(cost $1,417,011)

|

|

|

1,743,914

|

|

|

7

THE EUROPEAN EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS — SEPTEMBER 30, 2012 (unaudited) (continued)

|

Shares

|

|

Description

|

|

Value

(a)

|

|

|

INVESTMENTS IN AUSTRIA – 1.4%

|

|

|

|

|

|

|

MACHINERY – 1.4%

|

|

|

|

18,000

|

|

|

Andritz

|

|

$

|

1,020,370

|

|

|

|

|

|

|

|

Total Investments in Austria

(cost $773,049)

|

|

|

1,020,370

|

|

|

|

INVESTMENTS IN SWITZERLAND – 1.2%

|

|

|

|

|

|

|

CHEMICALS – 1.2%

|

|

|

|

2,500

|

|

|

Syngenta

|

|

|

934,741

|

|

|

|

|

|

|

|

Total Investments in Switzerland

(cost $834,335)

|

|

|

934,741

|

|

|

|

INVESTMENTS IN DENMARK – 1.2%

|

|

|

|

|

|

|

CONSTRUCTION &

ENGINEERING – 1.2%

|

|

|

|

15,000

|

|

|

FLSmidth & Co.

|

|

|

870,859

|

|

|

|

|

|

|

|

Total Investments in Denmark

(cost $1,140,720)

|

|

|

870,859

|

|

|

|

|

|

|

|

Total Investments in

Common and Preferred

Stocks – 99.5%

(cost $68,006,753)

|

|

|

74,975,348

|

|

|

|

SECURITIES LENDING COLLATERAL – 1.8%

|

|

|

|

|

|

1,320,530

|

|

|

Daily Assets Fund

Institutional, 0.23%

(cost $1,320,530)(b)(c)

|

|

|

1,320,530

|

|

|

|

CASH EQUIVALENTS – 0.9%

|

|

|

|

|

|

705,980

|

|

|

Central Cash Management

Fund, 0.15%

(cost $705,980)(c)

|

|

|

705,980

|

|

|

|

Number of

contracts

|

|

Description

|

|

Value

(a)

|

|

|

PUT OPTIONS PURCHASED – 0.3%

|

|

|

|

500

|

|

|

DAX Index, Expiration:

12/21/2012 Exercise Price

EUR 5,900

(cost $117,648)

|

|

$

|

86,182

|

|

|

|

|

350

|

|

|

CAC 40 Index, Expiration:

12/21/2012 Exercise Price

EUR 2,900

(cost $129,976)

|

|

|

132,360

|

|

|

|

|

|

Total Investments in

Purchased Options – 0.3%

(cost $247,624)

|

|

|

218,542

|

|

|

|

|

|

Total Investments – 102.5%

(cost $70,280,887)**

|

|

|

77,220,400

|

|

|

|

|

|

Other Assets and Liabilities,

Net – (2.5%)

|

|

|

(1,892,796

|

)

|

|

|

|

|

NET ASSETS – 100.0%

|

|

$

|

75,327,604

|

|

|

For information on the Fund's policies regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent semi-annual or annual financial statements.

* Non-income producing security.

** The cost for federal income tax purposes was $70,402,036. At September 30, 2012, net unrealized appreciation for all securities based on tax cost was $6,818,364. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $10,649,672 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $3,831,308.

† All or a portion of these securities were on loan. The value of all securities loaned at September 30, 2012 amounted to $1,256,828, which is 1.7% of net assets.

(a) Value stated in U.S. dollars.

(b) Represents collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

Currency Abbreviations

EUR – Euro

For purposes of its industry concentration policy, the Fund classifies issuers of portfolio securities at the industry sub-group level. Certain of the categories in the above Schedule of Investments consist of multiple industry sub-groups or industries.

8

THE EUROPEAN EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS — SEPTEMBER 30, 2012 (unaudited) (continued)

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of September 30, 2012 in valuing the Fund's investments.

|

Category

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

Common Stocks and/or Other Equity Investments

(1)

|

|

|

Germany

|

|

$

|

28,805,126

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

28,805,126

|

|

|

|

France

|

|

|

14,566,987

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14,566,987

|

|

|

|

Spain

|

|

|

6,839,913

|

|

|

|

—

|

|

|

|

—

|

|

|

|

6,839,913

|

|

|

|

Netherlands

|

|

|

5,972,921

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,972,921

|

|

|

|

United Kingdom

|

|

|

5,908,521

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,908,521

|

|

|

|

Norway

|

|

|

3,531,436

|

|

|

|

—

|

|

|

|

—

|

|

|

|

3,531,436

|

|

|

|

Italy

|

|

|

2,602,597

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,602,597

|

|

|

|

Luxembourg

|

|

|

2,177,963

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,177,963

|

|

|

|

Finland

|

|

|

1,743,914

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,743,914

|

|

|

|

Austria

|

|

|

1,020,370

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,020,370

|

|

|

|

Switzerland

|

|

|

934,741

|

|

|

|

—

|

|

|

|

—

|

|

|

|

934,741

|

|

|

|

Denmark

|

|

|

870,859

|

|

|

|

—

|

|

|

|

—

|

|

|

|

870,859

|

|

|

|

Short-Term Instruments

(1)

|

|

|

2,026,510

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,026,510

|

|

|

|

Purchased Options

|

|

|

218,542

|

|

|

|

—

|

|

|

|

—

|

|

|

|

218,542

|

|

|

|

Total

|

|

$

|

77,220,400

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

77,220,400

|

|

|

There have been no transfers between fair value measurement levels during the period ended September 30, 2012.

(1) See Schedule of Investments for additional detailed categorizations.

9

|

ITEM 2.

|

CONTROLS AND PROCEDURES

|

|

|

|

|

|

(a)

The Chief Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on the evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report.

|

|

|

|

|

|

(b)

There have been no changes in the registrant’s internal control over financial reporting that occurred during the registrant’s last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting.

|

|

|

|

|

ITEM 3.

|

EXHIBITS

|

|

|

|

|

|

Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant:

|

The European Equity Fund, Inc.

|

|

|

|

|

By:

|

/s/W. Douglas Beck

W. Douglas Beck

President

|

|

|

|

|

Date:

|

November 20, 2012

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By:

|

/s/W. Douglas Beck

W. Douglas Beck

President

|

|

|

|

|

Date:

|

November 20, 2012

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/Paul Schubert

Paul Schubert

Chief Financial Officer and Treasurer

|

|

|

|

|

Date:

|

November 20, 2012

|

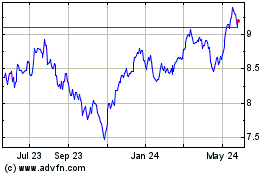

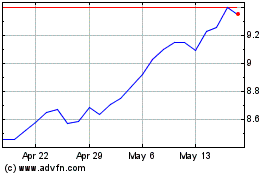

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2024 to Jul 2024

European Equity (NYSE:EEA)

Historical Stock Chart

From Jul 2023 to Jul 2024