The European Equity Fund, Inc. and The New Germany Fund, Inc. Announce Upcoming Tender Offers

June 25 2012 - 4:10PM

Business Wire

The European Equity Fund, Inc. (NYSE: EEA) and The New

Germany Fund, Inc. (NYSE: GF) (each, a "Fund," and

collectively, the "Funds") announced that in accordance with each

Fund’s Discount Management Program (the “Program”), the Board of

Directors of each Fund approved a cash tender offer for up to 5% of

its issued and outstanding shares of common stock at a price equal

to 98% of its net asset value (“NAV”) per share as determined by

the Fund on the next business day after the date on which the offer

expires. Each Fund normally calculates its NAV per share at 11:30

a.m. New York Time on each day during which the New York Stock

Exchange is open for trading. If more than 5% of a Fund’s

outstanding shares are tendered in the offer and the Fund purchases

shares in accordance with the terms of the tender offer, the Fund

will purchase shares from tendering stockholders on a pro rata

basis. Subject to the Board’s exercise of its fiduciary duties, the

tender offer will commence on or about July 25, 2012 and will

remain open through August 22, 2012, unless extended. There can be

no assurance that a Fund’s tender offer will reduce the spread

between the market price of the Fund’s shares and its NAV per

share.

For more information on EEA or GF, including the most recent

month-end performance, visit www.dws-investments.com or call (800)

349-4281 or 00-800-2287-2750 from outside the US.

The European Equity Fund, Inc. is a diversified, closed-end

investment company seeking long-term capital appreciation through

investment primarily (normally at least 80% of its assets) in

equity or equity-linked securities of companies domiciled in

European countries utilizing the Euro currency. Investing in

foreign securities, particularly those of emerging markets,

presents certain risks, such as currency fluctuations, political

and economic changes, and market risks. Any fund that concentrates

in a particular segment of the market will generally be more

volatile than a fund that invests more broadly.

The New Germany Fund, Inc. is a diversified, closed-end

investment company seeking capital appreciation primarily through

investment in equity or equity-linked securities of small and

mid-cap German companies. The Fund may invest up to 35% of

its assets in large cap German companies and up to 20% in other

Western European companies. Investing in foreign securities

presents certain risks, such as currency fluctuations, political

and economic changes, and market risks. Any fund that concentrates

in a particular segment of the market will generally be more

volatile than a fund that invests more broadly.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and once issued,

shares of closed-end funds are bought and sold in the open market

through a stock exchange. Shares of closed-end funds frequently

trade at a discount to the net asset value. The price of a fund’s

shares is determined by a number of factors, several of which are

beyond the control of the fund. Therefore, a fund cannot predict

whether its shares will trade at, below or above net asset value.

There can be no assurance that the Program will be effective in

reducing the Funds’ market discounts.

Investments in funds involve risk. Additional risks are

associated with international investing, such as government

regulations and differences in liquidity, which may increase the

volatility of your investment. Foreign security markets generally

exhibit greater price volatility and are less liquid than the US

market. Additionally, these funds focus their investments in

certain geographical regions, thereby increasing their

vulnerability to developments in that region and potentially

subjecting the funds’ shares to greater price volatility. Some

funds have more risk than others. These include funds that allow

exposure to or otherwise concentrate investments in certain

sectors, geographic regions, security types, market capitalization

or foreign securities (e.g., political or economic instability,

which can be accentuated in emerging market countries).

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

This announcement is not a recommendation, an offer to

purchase or a solicitation of an offer to sell shares of either

Fund. Neither Fund has commenced its self-tender offer

described in this press release. Upon commencement of a

Fund’s tender offer, the Fund will file with the Securities and

Exchange Commission a tender offer statement on Schedule TO and

related exhibits, including an offer to purchase, a letter of

transmittal, and other related documents. Stockholders of

the applicable Fund should read the offer to purchase and the

tender offer statement on Schedule TO and related exhibits when

such documents are filed and become available, as they will contain

important information about the Fund’s tender offer.

Stockholders can obtain the offer to purchase and the tender

offer statement on Schedule TO and related exhibits when they are

filed and become available free of charge from the Securities and

Exchange Commission’s website at www.sec.gov.

Certain statements contained in this release may be

forward-looking in nature. These include all statements

relating to plans, expectations, and other statements that

are not historical facts and typically use words like “expect,”

“anticipate,” “believe,” “intend,” and similar expressions. Such

statements represent management’s current beliefs, based

upon information available at the time the statements are

made, with regard to the matters addressed. All

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such

statements. Management does not undertake any obligation to update

or revise any forward-looking statements, whether as a

result of new information, future events, or

otherwise.

NOT FDIC/ NCUA INSURED • MAY LOSE VALUE • NO

BANK GUARANTEE

NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY

DWS Investments is part of Deutsche Bank’s Asset Management

division and, within the US, represents the retail asset management

activities of Deutsche Bank AG, Deutsche Bank Trust Company

Americas, Deutsche Investment Management Americas Inc. and DWS

Trust Company. R-028259-1 (6/12)

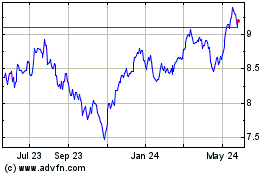

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2024 to Jul 2024

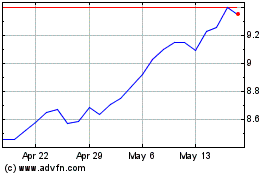

European Equity (NYSE:EEA)

Historical Stock Chart

From Jul 2023 to Jul 2024