Current Report Filing (8-k)

March 03 2020 - 4:17PM

Edgar (US Regulatory)

0000033213

false

0000033213

2020-02-25

2020-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March 3, 2020 (February

26, 2020)

EQT CORPORATION

(Exact name of registrant as specified in

its charter)

|

Pennsylvania

|

|

001-3551

|

|

25-0464690

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

625 Liberty Avenue, Suite 1700,

Pittsburgh, Pennsylvania 15222

(Address of principal executive offices,

including zip code)

(412) 553-5700

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

EQT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive Agreement

On

February 26, 2020 (the Effective Date), EQT Corporation, a Pennsylvania Corporation (EQT), EQT Production Company, a Pennsylvania

corporation and wholly owned subsidiary of EQT (EQT Production), Rice Drilling B LLC, a Delaware limited liability company and

wholly owned subsidiary of EQT (Rice Drilling), and EQT Energy, LLC, a Delaware limited liability company and wholly owned subsidiary

of EQT (EQT Energy and, together with EQT, EQT Production and Rice Drilling, the Producer), entered into a Gas Gathering and Compression

Agreement (the Global GGA) with EQM Gathering Opco, LLC, a Delaware limited liability company (EQM Opco) and a wholly owned subsidiary

of EQM Midstream Partners, LP, a Delaware limited partnership (EQM), for the provision by EQM Opco of gas gathering services to

the Producer in the Marcellus and Utica Shales of Pennsylvania and West Virginia. Effective as of the Effective Date, the Producer

will be subject to an initial annual minimum volume commitment of 3.0 billion cubic feet of natural gas per day. The Global GGA

runs from the Effective Date through December 31, 2035, and will renew year-to-year thereafter unless terminated by the Producer

or EQM Opco. Pursuant to the Global GGA, EQM Opco will have certain obligations to build additional connections to connect additional

wells of the Producer within the dedicated area in Pennsylvania and West Virginia to the gathering system, subject to certain geographical

limitations in relation to the distance to the then-existing gathering system and other criteria relating to the Producer’s

interest in the wells.

In

addition to the fees related to gathering services, the Global GGA provides for potential cash bonus payments payable by EQT to

EQM during the period beginning on the first day of the quarter in which the in-service date of the Mountain Valley Pipeline (the

MVP) occurs until the earlier of (i) 36 months following the first day of the quarter in which in-service date of the MVP occurs

or (ii) December 31, 2024. The potential cash bonus payments are conditioned upon the quarterly average of the NYMEX Henry Hub

Natural Gas Spot Price exceeding certain price thresholds.

Following

the MVP in-service date, the gathering fees payable by EQT to EQM (or its affiliates) set forth in the Global GGA are subject to

potential reductions for certain contract years set forth in the Global GGA, conditioned upon the in-service date of the MVP, which

provide for estimated aggregate fee relief of $270 million in the first year after the in-service date of the MVP, $230 million

in the second year after the in-service date of the MVP, and $35 million in the third year after the in-service date of the MVP.

In addition, if the MVP in-service date has not occurred by January 1, 2022, EQT has an option, exercisable for a period of twelve

months, to forgo $145 million of the gathering fee relief in the first year after the MVP in-service date and $90 million of the

gathering fee relief in the second year after the MVP in-service date in exchange for a cash payment from EQM to EQT in the amount

of $196 million.

In

the ordinary course of business, EQT and its subsidiaries engage in transactions with EQM and its affiliates, including, but not

limited to, transportation service and precedent agreements, storage agreements and water services agreements. These agreements

have terms ranging from month-to-month up to 20 years.

The

foregoing description of the Global GGA is not complete and is qualified in its entirety by reference to the text of the Global

GGA, which will be filed as an exhibit to EQT’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. The foregoing

summary has been included to provide investors and security holders with information regarding the terms of the Global GGA and

is not intended to provide any other factual information about EQT or its subsidiaries.

Item 8.01. Other Events.

On March 3, 2020, EQT issued a press release

announcing the early results and upsizing of its previously announced tender offer (the Tender Offer) to purchase for cash up to

an amended Maximum Tender Amount (as defined herein) of its outstanding 4.875% Senior Notes due 2021 (the Notes). EQT has amended

the Tender Offer to increase the aggregate principal amount of Notes subject to the Tender Offer from $400 million to $500 million

(the Maximum Tender Amount). A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EQT CORPORATION

|

|

|

|

|

Date: March 3, 2020

|

By:

|

/s/ William E. Jordan

|

|

|

Name:

|

William E. Jordan

|

|

|

Title:

|

Executive Vice President and General Counsel

|

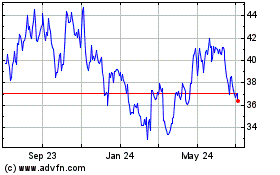

EQT (NYSE:EQT)

Historical Stock Chart

From Aug 2024 to Sep 2024

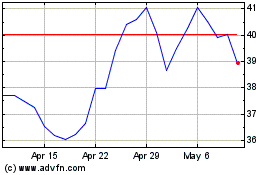

EQT (NYSE:EQT)

Historical Stock Chart

From Sep 2023 to Sep 2024