For Immediate Release

Chicago, IL – March 13, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Wal-Mart Stores,

Inc. (WMT), Target Corp. (TGT),

Ecolab Inc (ECL), Clorox (CLX)

and Church & Dwight (CHD).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Monday’s Analyst

Blog:

Walmart Finally Gets Massmart

Wal-Mart Stores, Inc. (WMT) has finally won the

approval from a South African court for its proposed acquisition of

Massmart Holdings Ltd., the third largest retailer of South

Africa.

The deal was first announced in September 2010, when Wal-Mart

had offered to acquire a 51% stake of the South Africa based

consumer goods distributor, Massmart. Wal-Mart offered to pay 16.5

billion rand or 148 rand per Massmart share as it aimed to capture

the high growth developing markets of South Africa.

After much consideration by the Competition Commission and over

some issues of job losses and local procurement raised by the South

African labor unions, Wal-Mart finalized the deal in June 2011 and

agreed to proceed with the deal on the conditions that there would

be no job cuts for a period of at least two years and the company

will create a 100 million-rand fund to assist local suppliers and

manufacturers.

Further, Wal-Mart also announced the creation of 15,000 jobs in

South Africa within the next five years. Walmart also stated that

it would open new stores over that period and expand its

procurement of food and consumer goods from local suppliers by an

additional 60 billion rand after its tie-up with Massmart.

However, the South African government later decided to review

its decision to allow Wal-Mart to purchase a controlling stake in

Massmart, as it failed to gather sufficient information from the

retailers related to product sourcing and other public interest

issues. Additionally, the government objected that Wal-Mart will

not be able to protect the economy and prevent a surge in imports

from undermining manufacturing output.

The Competition Appeal Court has now finally green signaled

Wal-Mart to go ahead with its 16.5 billion rand purchase of a

controlling share of a South African chain. In addition, the court

turned down the government's request to have the deal re-examined,

but stipulated that Wal-Mart must reinstate 503 South African

workers, which Massmart laid off as it tried to get Wal-Mart to

agree to a deal.

The court's decision was long-awaited and it will now allow

Wal-Mart and Massmart to move ahead with plans and work together to

offer a wide range of goods at affordable prices that will benefit

South African consumers. Besides, they plan to double food sales in

Africa in the next five years, thereby challenge South Africa's

dominant grocers such as Shoprite, Pick n Pay and Spar.

Wal-Mart, which competes with Target Corp.

(TGT), holds a Zacks #3 Rank implying a short-term Hold rating.

Ecolab Boosts Brazil Bid

In a bid to expand its rapidly growing Brazilian institutional

business, U.S. cleaning and sanitation products major

Ecolab Inc (ECL) has scooped up Sao Paulo-based

Econ Industria e Comercio de Produtos de Higiene e Limpeza Ltda,

which provides cleaning and sanitizing products and services to the

foodservice industry in Brazil.

Ecolab, in its press release, stated that the newly acquired

entity has sales of roughly $9 million. The Minnesota-based company

noted that it will integrate the acquired business with its

existing Brazilian institutional business. However, it has not

divulged the financial terms of the deal. The acquisition is

expected to boost Ecolab’s service capacity and scale while

improving customer coverage and relationships.

Ecolab is on an acquisition spree, which is evident from its

back-to-back buyouts to expand its global healthcare business. The

company, in late 2011, bought the InsetCenter pest elimination

business in Brazil for an undisclosed price. Earlier, Ecolab closed

its $8.3 billion acquisition of Illinois-based water treatment

services major Nalco Holding. The company also bought Italian

health care products maker Esoform.

Ecolab caters products and services to the hospitality,

foodservice, institutional and industrial markets across more than

160 countries. To spur growth, the company continues to invest in

strategic areas such as product innovation, healthcare, water and

energy and global pest elimination.

Moreover, Ecolab remains focused on bringing new technologies

aimed at reducing food safety risks. Moreover, the company is

aggressively pursuing acquisition to expand into emerging markets

for growth. Latin America remains a key growth engine for the

company’s overseas operation.

Although we are impressed by Ecolab’s strong international

exposure, we remain cautious about aggressive competition from the

likes of Clorox (CLX) and Church &

Dwight (CHD). Raw material price inflation also remains a

headwind. We currently have a Neutral recommendation on Ecolab,

which is supported by a Zacks #3 Rank (Hold).

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

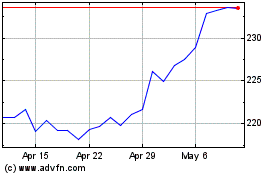

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2024 to Nov 2024

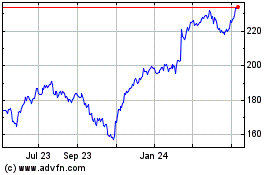

Ecolab (NYSE:ECL)

Historical Stock Chart

From Nov 2023 to Nov 2024