- Current report filing (8-K)

August 30 2011 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 29, 2011

ECOLAB INC.

(Exact name of registrant as specified in charter)

|

Delaware

|

|

1-9328

|

|

41-0231510

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

370 Wabasha Street North

Saint Paul, Minnesota

|

|

55102

|

|

(Address of principal executive offices

and Zip Code)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

1-800-232-6522

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.13e-4(c))

Item 8.01 Other Information

.

As previously disclosed, on July 19, 2011, Ecolab Inc., a Delaware corporation (“Ecolab”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) among Ecolab, Sustainability Partners Corporation, a Delaware corporation and a wholly-owned subsidiary of Ecolab (“Merger Sub”), and Nalco Holding Company, a Delaware corporation (“Nalco”). The Merger Agreement, which has been unanimously approved by the Boards of Directors of each of Ecolab and Nalco, provides for the merger of Nalco with and into Merger Sub (the “Merger”), with Merger Sub continuing as the surviving corporation in the Merger.

On August 29, 2011, Ecolab issued the press release attached to this Current Report as Exhibit 99.1 announcing that it had received notice from the United States Federal Trade Commission of early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in connection with the Merger.

Cautionary Statements Regarding Forward-Looking Information

This communication contains certain statements relating to future events and our intentions, beliefs, expectations and predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “we believe,” “we expect,” “estimate,” “project,” “may,” “will,” “intend,” “plan,” “believe,” “target,” “forecast” (including the negative or variations thereof) or similar terminology used in connection with any discussion of future plans, actions or events generally identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding benefits of the merger, integration plans and expected synergies, the expected timing of completion of the merger, and anticipated future financial and operating performance and results, including estimates for growth. These statements are based on the current expectations of management of Ecolab and Nalco, as applicable. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These risks and uncertainties include (i) the risk that the stockholders of Nalco may not adopt the merger agreement, (ii) the risk that the stockholders of Ecolab may not approve the issuance of Ecolab common stock to Nalco stockholders in the merger, (iii) the risk that the companies may be unable to obtain regulatory approvals required for the merger, or that required regulatory approvals may delay the merger or result in the imposition of conditions that could have a material adverse effect on the combined company or cause the companies to abandon the merger, (iv) the risk that the conditions to the closing of the merger may not be satisfied, (v) the risk that a material adverse change, event or occurrence may affect Ecolab or Nalco prior to the closing of the merger and may delay the merger or cause the companies to abandon the merger, (vi) the risk that an unsolicited offer by another company to acquire shares or assets of Ecolab or Nalco could interfere with or prevent the merger, (vii) problems that may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, (viii) the possibility that the merger may involve unexpected costs, unexpected liabilities or unexpected delays, (ix) the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies currently expect, (x) the risk that the businesses of the companies may suffer as a result of uncertainty surrounding the merger and (xi) the risk that disruptions from the transaction will harm relationships with customers, employees and suppliers.

Other unknown or unpredictable factors could also have material adverse effects on future results, performance or achievements of Ecolab, Nalco and the combined company. For a further discussion of these and other risks and uncertainties applicable to the respective businesses of Ecolab and Nalco, see the Annual Reports on Form 10-K of Ecolab and Nalco for the fiscal year ended December 31, 2010 and the companies’ other public filings with the Securities and Exchange Commission (the “SEC”). These risks, as well as other risks associated with the merger, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that Ecolab will file with the SEC in connection with the merger. In light of these risks, uncertainties, assumptions and factors,

2

the forward-looking events discussed in this communication may not occur. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication. Neither Ecolab nor Nalco undertakes, and each of them expressly disclaims, any duty to update any forward-looking statement whether as a result of new information, future events or changes in their respective expectations, except as required by law.

Additional Information and Where to Find it

Ecolab will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Ecolab and Nalco that will also constitute a prospectus of Ecolab relating to the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION about Ecolab, Nalco and the proposed merger. Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website,

www.sec.gov

. In addition, copies of the registration statement and joint proxy statement/prospectus (when they become available) may be obtained free of charge by accessing Ecolab’s website at www.ecolab.com by clicking on the “Investor” link and then clicking on the “SEC Filings” link or by writing Ecolab at 370 Wabasha Street North, Saint Paul, Minnesota, 55102, Attention: Corporate Secretary or by accessing Nalco’s website at www.nalco.com by clicking on the “Investors” link and then clicking on the “SEC Filings” link or by writing Nalco at 1601 West Diehl Road, Naperville, Illinois 60563, Attention: Corporate Secretary and security holders may also read and copy any reports, statements and other information filed by Ecolab or Nalco with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

Participants in the Merger Solicitation

Ecolab, Nalco and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Ecolab’s directors and executive officers is available in its proxy statement filed with the SEC by Ecolab on March 18, 2011 in connection with its 2011 annual meeting of stockholders, and information regarding Nalco’s directors and executive officers is available in its proxy statement filed with the SEC by Nalco on March 14, 2011 in connection with its 2011 annual meeting of stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Non-Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Item 9.01. Financial Statements and Exhibits

.

(d)

Exhibits

.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release dated August 29, 2011.

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 29, 2011

|

|

ECOLAB INC.

|

|

|

|

|

|

|

By:

|

/s/ MICHAEL C. MCCORMICK

|

|

|

|

Michael C. McCormick

|

|

|

|

Assistant Secretary

|

4

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release dated August 29, 2011.

|

5

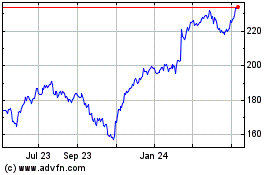

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2024 to Nov 2024

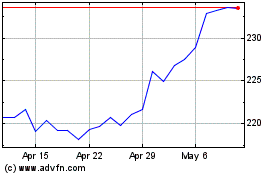

Ecolab (NYSE:ECL)

Historical Stock Chart

From Nov 2023 to Nov 2024