Ecolab's $8 Billion Acquisition - Analyst Blog

July 21 2011 - 2:30PM

Zacks

In a major move, leading cleaning

and sanitation products company Ecolab Inc (ECL)

has agreed to acquire Illinois-based water treatment company

Nalco Holding Company (NLC) in a cash and

stock deal worth roughly $8 billion. The deal, which is expected to

close in the fourth quarter, has been approved by the Boards of

both companies.

Shares of Nalco rocketed $7 (or

24.3%) to close at $35.87 on July 20 while the Minnesota-based

Ecolab’s shares

slid $4.08 (7.4%) to $51.31 as investors appear to perceive it to

be an expensive buy.

The Deal

Under the deal terms, shareholders

of Nalco may opt to receive either 0.7005 share of Ecolab common

stock or $38.80 in cash for each Nalco share,

representing a

34% premium over Nalco’s closing price of $28.87 on July 19.

The mix of overall consideration is 70% stock and 30%

cash.

Ecolab will issue roughly 68.9

million shares and will make a cash payment of roughly $1.6 billion

to Nalco stockholders, representing an offer value of $5.4 billion.

Moreover, Ecolab will assume $2.7 billion in Nalco debt, taking the

total deal value to about $8.1 billion.

The completion of the transaction

is contingent upon regulatory clearance, approval of shareholders of

both the companies and customary closing conditions.

Following the deal closure, Nalco will merge with a subsidiary of

Ecolab. Bank of America (BAC) and Goldman

Sachs (GS) acted as the financial advisors to Ecolab and

Nalco, respectively, on the deal.

A Clear Leader

Headquartered in Naperville, Nalco,

with annual sales of $4 billion, is the global leader in water

treatment services with operations stretching across more than 150

nations. It offers water management sustainability services and

focuses on industrial water, energy and air applications.

The company’s value-added

services enable

its customers to minimize energy, water and other natural

resource consumption, reduce environmental releases while improving

productivity. Nalco’s oil dispersants (the Corexit 9500) were used

to clean up the Deepwater Horizon oil spill (also known as “BP oil

spill”) in the Gulf of Mexico in 2010.

The deal is a strategic fit and

highly complementary for Ecolab as it will enable it to

bolster its water management business. It marks the union of

Nalco's market leadership in water and energy services with

Ecolab's competency in food safety and cleaning.

The merger will enable the combined

entity to address major trends such as growing food demand and food

safety, water scarcity, rising energy demand and aging population’s

need for healthcare. The integrated company will have roughly $1.5

billion in sales from fast growing emerging markets and will have

global leadership positions in key end-markets.

Financial

Impact

The deal is expected to be

accretive to the merged entity’s earnings in 2012 and beyond. There

is also an

opportunity for attractive synergies with Ecolab expecting combined

annual cost synergies of $150 million. Moreover, the

combined entity will have a strong

balance sheet and cash flows which will allow it to invest in key

growth areas and pare debt.

Separately, Ecolab has lifted its

adjusted earnings target for fiscal 2011 to $2.52-$2.56 per

share (excluding the Nalco deal impact) from its earlier projection

of $2.49-$2.53. Moreover, the company expects adjusted earnings of

64 cents a share for the second quarter, which is at the top end of

its projected range of 62-64 cents. The company is expected to

unveil its second quarter results on July 27.

Neutral on

Ecolab

Ecolab provides

products and services for the hospitality, foodservice,

institutional and industrial markets. It leads in cleaning,

sanitizing, pest elimination and food safety solutions with

revenues of $6 billion.

Ecolab believes in growth through

acquisition. The company made back-to-back acquisitions in

2010. Ecolab, in September 2010, acquired the commercial laundry

business of Illinois-based privately-held Dober Chemical, which has

boosted its North American commercial laundry operation. Moreover,

Ecolab closed its acquisition of Australian cleaning and hygiene

products maker Cleantec in December 2010, which expanded its

Asia-Pacific reach.

More recently, in March 2011,

Ecolab wrapped

up the purchase of Virginia-based privately-held O.R. Solutions for

roughly $260 million. The acquisition enables the company to

broaden its U.S. health care business and strengthens its infection

prevention solutions.

We are encouraged by Ecolab’s

strong international exposure and recovery across its end-markets.

However, the company faces stiff competition from

Clorox (CLX) and Church &

Dwight (CHD). Moreover, raw material price fluctuations

represent a headwind for Ecolab. While multiple acquisitions have

expanded Ecolab’s product range, such a strategy has

inherent integration risks.

Currently, we have a long-term

Neutral recommendation on Ecolab. The stock currently retains a

Zacks #2 Rank, which translates into a short-term Buy

recommendation.

BANK OF AMER CP (BAC): Free Stock Analysis Report

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

NALCO HLDG CO (NLC): Free Stock Analysis Report

Zacks Investment Research

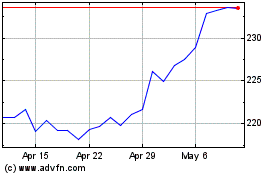

Ecolab (NYSE:ECL)

Historical Stock Chart

From May 2024 to Jun 2024

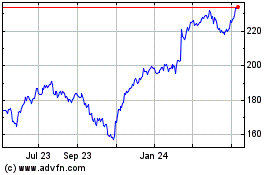

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jun 2023 to Jun 2024