Current Report Filing (8-k)

November 19 2019 - 4:17PM

Edgar (US Regulatory)

DOMINOS PIZZA INC false 0001286681 0001286681 2019-11-19 2019-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 19, 2019

Domino’s Pizza, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

001-32242

|

|

38-2511577

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

30 Frank Lloyd Wright Drive

Ann Arbor, Michigan

|

|

48105

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (734) 930-3030

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on Which Registered

|

|

Domino’s Pizza, Inc. Common Stock, $0.01 par value

|

|

DPZ

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities of Domino’s Pizza, Inc. (the “Company”) or any subsidiary of the Company.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

General

On November 19, 2019 (the “Closing Date”), Domino’s Pizza Master Issuer LLC, Domino’s SPV Canadian Holding Company Inc., Domino’s Pizza Distribution LLC and Domino’s IP Holder LLC, each of which is a limited-purpose, bankruptcy remote, wholly-owned indirect subsidiary of the Company (collectively, the “Co-Issuers”), completed a previously announced recapitalization transaction by issuing $675.0 million in aggregate principal amount of new Series 2019-1 3.668% Fixed Rate Senior Secured Notes, Class A-2 with an anticipated term of 10 years (the “2019-1 Class A-2 Notes”) in an offering exempt from registration under the Securities Act of 1933, as amended. The Co-Issuers also entered into a revolving financing facility on the Closing Date, which allows for the issuance of up to $200.0 million of Series 2019-1 Variable Funding Senior Secured Notes, Class A-1 (the “2019-1 Class A-1 Notes”) and certain other credit instruments, including letters of credit. The 2019-1 Class A-1 Notes and the 2019-1 Class A-2 Notes are referred to collectively as the “2019-1 Notes.”

The 2019-1 Notes were issued pursuant to (i) the Amended and Restated Base Indenture, dated March 15, 2012 (the “Amended and Restated Base Indenture”), as amended by the First Supplement thereto, dated September 16, 2013 (“the First Supplement”), the Second Supplement thereto, dated October 21, 2015 (the “Second Supplement”), the Third Supplement thereto, dated October 21, 2015 (the “Third Supplement”), the Fourth Supplement thereto, dated July 24, 2017 (the “Fourth Supplement”) and the Fifth Supplement thereto, dated November 21, 2018 (the “Fifth Supplement”) (the Amended and Restated Base Indenture as amended by the First Supplement, the Second Supplement, the Third Supplement, the Fourth Supplement and the Fifth Supplement being referred to herein collectively as the “Base Indenture”) and (ii) the Series 2019-1 Supplement thereto, dated November 19, 2019 (the “Series 2019-1 Supplement”), in each case entered into by and among the Co-Issuers and Citibank, N.A., as the trustee (the “Trustee”) and the securities intermediary thereunder. The Base Indenture allows the Co-Issuers to issue additional series of notes subject to certain conditions set forth therein, and the Base Indenture, together with the Series 2019-1 Supplement and any other supplemental indenture to the Base Indenture, is referred to herein as the “Indenture.”

The 2019-1 Notes are part of a securitization transaction initiated with the issuance and sale of certain senior secured notes by the Co-Issuers in 2012, pursuant to which substantially all of the Company’s revenue-generating assets, consisting principally of franchise-related agreements, product distribution agreements and related assets, its intellectual property and license agreements for the use of its intellectual property, were contributed to the Co-Issuers and certain other limited-purpose, bankruptcy remote, wholly-owned indirect subsidiaries of the Company that act as guarantors of the notes issued by the Co-Issuers. The Co-Issuers and the Guarantors referred to below under “Guarantees and Collateral” have pledged substantially all of their assets to secure the notes issued pursuant to the Indenture.

2019-1 Class A-2 Notes

While the 2019-1 Class A-2 Notes are outstanding, scheduled payments of principal and interest are required to be made on the 2019-1 Class A-2 Notes on a quarterly basis. The payment of principal of the 2019-1 Class A-2 Notes may be suspended if the leverage ratios for the Company and its subsidiaries and for the Securitization Entities (defined below) are less than or equal to 5.0x.

The legal final maturity date of the 2019-1 Class A-2 Notes is in October of 2049. If the Co-Issuers have not repaid or refinanced the 2019-1 Class A-2 Notes prior to October of 2029, additional interest will accrue thereon in an amount equal to the greater of (i) 5.00% per annum and (ii) a per annum interest rate equal to the amount, if any, by which (i) the sum of the yield to maturity (adjusted to a quarterly bond-equivalent basis) on the Series 2019-1 Class A-2 anticipated repayment date of the United States Treasury Security having a term closest to 10 years plus 6.95% exceeds (ii) the original interest rate.

The 2019-1 Class A-2 Notes are secured by the collateral described below under “Guarantees and Collateral.”

2019-1 Class A-1 Notes

The 2019-1 Class A-1 Notes were issued pursuant to the Base Indenture and the Series 2019-1 Supplement thereto referred to above and allow for drawings on a revolving basis. The 2019-1 Class A-1 Notes will be governed, in part, by the 2019-1 Class A-1 Note Purchase Agreement dated November 19, 2019 (the “2019-1 Class A-1 Note Purchase Agreement”), among the Co-Issuers, the Guarantors, Domino’s Pizza LLC, as manager, certain conduit investors, certain financial institutions and certain funding agents, and Coöperatieve Rabobank U.A., New York Branch, as provider of letters of credit, as swingline lender and as administrative agent, and by certain generally applicable terms contained in the Base Indenture and the Series 2019-1 Supplement thereto. Interest on the 2019-1 Class A-1 Notes will be payable at a per annum rate based on the cost of funds plus a margin of 150 basis points. The Co-Issuers have approximately $41.4 million in undrawn letters of credit issued under the 2019-1 Class A-1 Notes. There is a commitment fee on the unused portion of the 2019-1 Class A-1 Notes facility ranging from 50 to 100 basis points depending on utilization. It is anticipated that the principal and interest on the 2019-1 Class A-1 Notes will be repaid in full on or prior to October 2024, subject to two additional one-year extensions at the option of Domino’s Pizza LLC, a wholly-owned subsidiary of the Company, which acts as the manager (as described below). Following the anticipated repayment date (and any extensions thereof), additional interest will accrue on the 2019-1 Class A-1 Notes equal to 5.00% per annum. In connection with the issuance of the 2019-1 Class A-1 Notes and entry into the 2019-1 Class A-1 Note Purchase Agreement, the Co-Issuers permanently reduced to zero the commitment to fund the existing $175.0 million Series 2017-1 Class A-1 Notes and the Series 2017-1 Class A-1 Notes were cancelled and the 2017-1 Class A-1 Note Purchase Agreement, dated June 12, 2017, among the Co-Issuers, the Guarantors, Domino’s Pizza LLC, as manager, certain conduit investors, certain financial institutions and certain funding agents, and Coöperatieve Rabobank U.A., New York Branch, as provider of letters of credit, as swingline lender and as administrative agent (the “2017-1 Class A-1 Note Purchase Agreement”) terminated. The 2019-1 Class A-1 Notes and other credit instruments issued under the 2019-1 Class A-1 Note Purchase Agreement are secured by the collateral described below under “Guarantees and Collateral.”

Guarantees and Collateral

Pursuant to the Amended and Restated Guarantee and Collateral Agreement, dated March 15, 2012 (the “Guarantee and Collateral Agreement”), among Domino’s SPV Guarantor LLC, Domino’s Pizza Franchising LLC, Domino’s Pizza International Franchising Inc., Domino’s Pizza Canadian Distribution ULC, Domino’s RE LLC and Domino’s EQ LLC, each as a guarantor of the 2019-1 Notes (collectively, the “Guarantors”), in favor of the Trustee, the Guarantors guarantee the obligations of the Co-Issuers under the Indenture and related documents and secure the guarantee by granting a security interest in substantially all of their assets.

The 2019-1 Notes are secured by a security interest in substantially all of the assets of the Co-Issuers and the Guarantors (such assets, the “Securitized Assets” and the Co-Issuers and Guarantors collectively, the “Securitization Entities”). The 2019-1 Notes are obligations only of the Co-Issuers pursuant to the Indenture and are unconditionally and irrevocably guaranteed by the Guarantors pursuant to the Guarantee and Collateral Agreement. Except as described below, neither the Company nor any subsidiary of the Company, other than the Securitization Entities, will guarantee or in any way be liable for the obligations of the Co-Issuers under the Indenture or the 2019-1 Notes.

Management of the Securitized Assets

None of the Securitization Entities has employees. Each of the Securitization Entities entered into an amended and restated management agreement dated March 15, 2012 (the “Amended and Restated Management Agreement”), as amended by Amendment No. 1 dated as of October 21, 2015 to the Amended and Restated Management Agreement (“Amendment No. 1 to the Management Agreement”) and by Amendment No. 2 dated as of July 24, 2017 to the Amended and Restated Management Agreement (“Amendment No. 2 to the Management Agreement” and, together with the Amended and Restated Management Agreement and Amendment No. 1 to the Management Agreement, the “Management Agreement”), in each case entered into by and among the Securitization Entities, Domino’s Pizza NS Co., Domino’s Pizza LLC, as manager and in its individual capacity, and the Trustee. Domino’s Pizza LLC acts as the manager with respect to the Securitized Assets. The primary responsibilities of the manager are to perform certain franchising, distribution, intellectual property and operational functions on behalf of the Securitization Entities with respect to the Securitized Assets pursuant to the Management Agreement. Domino’s Pizza NS Co. performs all services for Domino’s Pizza Canadian Distribution ULC, which conducts the distribution business in Canada.

Covenants and Restrictions

The 2019-1 Notes are subject to a series of covenants and restrictions customary for transactions of this type, including as set forth in the Parent Company Support Agreement dated as of March 15, 2012 (the “Original Parent Company Support Agreement”), as amended by Amendment No. 1 dated as of October 21, 2015 to the Original Parent Company Support Agreement (“Amendment No. 1 to the Parent Company Support Agreement”), in each case entered into by and among the Company and the Trustee.

These covenants and restrictions include (i) that the Co-Issuers maintain specified reserve accounts to be used to make required payments in respect of the 2019-1 Notes, (ii) provisions relating to optional and mandatory prepayments, including mandatory prepayments in the event of a change of control (as defined in the Series 2019-1 Supplement) and the related payment of specified amounts, including specified make-whole payments in the case of the 2019-1 Notes under certain circumstances, (iii) certain indemnification payments in the event, among other things, the transfers of the assets pledged as collateral for the 2019-1 Notes are in stated ways defective or ineffective and (iv) covenants relating to recordkeeping, access to information and similar matters. The 2019-1 Notes are also subject to customary rapid amortization events provided for in the Indenture, including events tied to failure to maintain stated debt service coverage ratios, the sum of global retail sales for all stores being below certain levels on certain measurement dates, certain manager termination events, an event of default and the failure to repay or refinance the 2019-1 Notes on the scheduled maturity date. Rapid amortization events may be cured in certain circumstances, upon which cure, regular amortization will resume. The 2019-1 Notes are also subject to certain customary events of default, including events relating to non-payment of required interest, principal or other amounts due on or with respect to the 2019-1 Notes, failure to comply with covenants within certain time frames, certain bankruptcy events, breaches of specified representations and warranties, failure of security interests to be effective and certain judgments.

Following the recapitalization transaction, there will be approximately (i) $774.0 million in aggregate principal amount of Series 2015-1 4.474% Fixed Rate Senior Secured Notes, Class A-2-II outstanding under the Base Indenture, (ii) approximately $1,862.0 million in aggregate principal amount of (a) Series 2017-1 Floating Rate Senior Secured Notes, Class A-2-I(FL), (b) Series 2017-1 3.082% Fixed Rate Senior Secured Notes, Class A-2-II(FX) and (c) Series 2017-1 4.118% Fixed Rate Senior Secured Notes, Class A-2-III(FX) outstanding under the Base Indenture, (iii) approximately $814.7 million in aggregate principal amount of (a) Series 2018-1 4.116% Fixed Rate Senior Secured Notes, Class A-2-I and (b) Series 2018-1 4.328% Fixed Rate Senior Secured Notes, Class A-2-II outstanding under the Base Indenture, (iv) approximately $675.0 million in aggregate principal amount of 2019-1 Class A-2 Notes outstanding under the Base Indenture and (v) approximately $16.6 million in outstanding finance lease obligations of the Company. In addition, the Co-Issuers have access to $200.0 million under the 2019-1 Class A-1 Notes issued under the Base Indenture, under which approximately $41.4 million in undrawn letters of credit are currently outstanding.

The foregoing summaries do not purport to be complete and are subject to, and qualified in their entirety by reference to, the complete copies of the Amended and Restated Base Indenture, dated March 15, 2012, the form of which is attached as Exhibit 4.1 to the Current Report on Form 8-K filed by the Company on March 19, 2012, the First Supplement, the form of which is attached as Exhibit 4.1 to the Current Report on Form 8-K filed by the Company on October 22, 2015, the Second Supplement, the form of which is attached as Exhibit 4.2 to the Current Report on Form 8-K filed by the Company on October 22, 2015, the Third Supplement, the form of which is attached as Exhibit 4.3 to the Current Report on Form 8-K filed by the Company on October 22, 2015, the Fourth Supplement, the form of which is attached as Exhibit 4.1 to the Current Report on Form 8-K filed by the Company on July 25, 2017, the Guarantee and Collateral Agreement, the form of which is attached as Exhibit 10.2, to the Current Report on Form 8-K filed by the Company on March 19, 2012, the Amended and Restated Management Agreement, the form of which is attached as Exhibit 10.3 to the Current Report on Form 8-K filed by the Company on March 19, 2012, Amendment No. 1 to the Management Agreement, the form of which is attached as Exhibit 10.3 to the Current Report on Form 8-K filed by the Company on October 22, 2015, Amendment No. 2 to the Management Agreement, the form of which is attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Company on July 25, 2017, the Original Parent Company Support Agreement, the form of which is attached as Exhibit 10.4 to the Current Report on Form 8-K filed by the Company on October 22, 2015, Amendment No. 1 to the Parent Company Support Agreement, the form of which is attached as Exhibit 10.5 to the Current Report on

Form 8-K filed by the Company on October 22, 2015, the 2017-1 Class A-1 Note Purchase Agreement, the form of which is attached as Exhibit 10.2 to the Current Report on Form 8-K filed by the Company on June 14, 2017, the 2019-1 Class A-1 Note Purchase Agreement, the form of which is attached as Exhibit 10.1 hereto and the Series 2019-1 Supplement, the form of which is attached as Exhibit 4.1 hereto, and each of which are hereby incorporated herein by reference. Interested persons should read the documents in their entirety.

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

The descriptions in Item 1.01 are incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The descriptions in Item 1.01 are incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

Exhibit 99.1 hereto includes certain historical and pro forma financial information of the Company related to the securitization transaction.

As provided in General Instruction B.2 of Form 8-K, the information contained in this Item 7.01 of this Current Report on Form 8-K, including the information contained in Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

“Safe Harbor” Statement under Private Securities Litigation Reform Act of 1995

This Current Report on Form 8-K contains various forward-looking statements about the Company within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”) that are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. The following cautionary statements are being made pursuant to the provisions of the Act and with the intention of obtaining the benefits of the “safe harbor” provisions of the Act. You can identify forward-looking statements by the use of words such as “anticipates,” “believes,” “could,” “should,” “estimates,” “expects,” “intends,” “may,” “will,” “plans,” “predicts,” “projects,” “seeks,” “approximately,” “potential,” “outlook” and similar terms and phrases that concern our strategy, plans or intentions, including references to assumptions. These forward-looking statements address various matters including the terms of the Company’s recapitalization transactions. While we believe these statements are based on reasonable assumptions, such forward-looking statements are inherently subject to risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from our expectations are more fully described in our filings with the Securities and Exchange Commission, including under the section headed “Risk Factors” in our Annual Report on Form 10-K. Actual results may differ materially from those expressed or implied in the forward-looking statements as a result of various factors, including but not limited to our substantially increased indebtedness as a result of our recapitalization transactions and our ability to incur additional indebtedness or refinance or renegotiate key terms of that indebtedness in the future, our future financial performance and our ability to pay principal and interest on our indebtedness. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Current Report on Form 8-K might not occur. All forward-looking statements speak only as of the date of this Current Report on Form 8-K and should be evaluated with an understanding of their inherent uncertainty. Except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission, or other applicable law, we do not undertake, and specifically disclaim, any obligation to publicly update or revise any forward-looking statements to reflect events or circumstances arising after the date of this Current Report on Form 8-K, whether as a result of new information, future events or otherwise. You are cautioned not to place considerable reliance on the forward-looking statements included in this Current Report on Form 8-K or that may be made elsewhere from time to time by, or on behalf of, us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Description

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Supplemental Indenture, dated November 19, 2019, among Domino’s Pizza Master Issuer LLC, Domino’s SPV Canadian Holding Company Inc., Domino’s Pizza Distribution LLC and Domino’s IP Holder LLC, each as Co-Issuer of Series 2019-1 3.668% Fixed Rate Senior Secured Notes, Class A-2, and Citibank, N.A., as Trustee and Securities Intermediary.

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Class A-1 Note Purchase Agreement, dated November 19, 2019, among Domino’s Pizza Master Issuer LLC, Domino’s SPV Canadian Holding Company Inc., Domino’s Pizza Distribution LLC and Domino’s IP Holder LLC, each as Co-Issuer, Domino’s SPV Guarantor LLC, Domino’s Pizza Franchising LLC, Domino’s Pizza International Franchising Inc., Domino’s Pizza Canadian Distribution ULC, Domino’s RE LLC and Domino’s EQ LLC, each as Guarantor, Domino’s Pizza LLC, as manager, certain conduit investors, financial institutions and funding agents, and Coöperatieve Rabobank U.A., New York Branch, as provider of letters of credit, as swingline lender and as administrative agent.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Certain Historical and Pro Forma Financial Information of the Company.

|

|

|

|

|

|

|

|

|

104

|

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

DOMINO’S PIZZA, INC.

|

|

(Registrant)

|

|

|

|

/s/ Jeffrey D. Lawrence

|

|

Name:

|

|

Jeffrey D. Lawrence

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer

|

Date: November 19, 2019

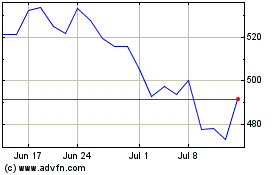

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

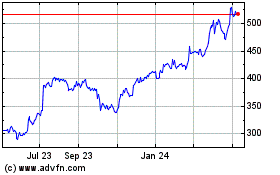

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024