Current Report Filing (8-k)

April 28 2020 - 6:20AM

Edgar (US Regulatory)

false 0000949039 0000949039 2020-04-26 2020-04-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: (Date of earliest event reported): April 26, 2020

Diamond Offshore Drilling, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13926

|

|

76-0321760

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification No.)

|

15415 Katy Freeway

Houston, Texas 77094

(Address of principal executive offices, including Zip Code)

(281) 492-5300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value per share

|

|

DO

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.03

|

Bankruptcy or Receivership.

|

As previously disclosed, on April 26, 2020, Diamond Offshore Drilling, Inc. (“Diamond”) and certain of its subsidiaries (the “Company”) commenced voluntary cases (the “Chapter 11 Cases”) under chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The Bankruptcy Court has granted a motion seeking joint administration of the Chapter 11 Cases under the caption In re Diamond Offshore Drilling, Inc., et al., Case No. 20-32307 (DRJ). Bankruptcy Court filings are, and other information related to the Chapter 11 Cases is, available at a website administered by the Company’s claims agent, Prime Clerk, at http://cases.primeclerk.com/diamond.

On April 26, 2020, the Bankruptcy Court entered orders granting the Company relief on several motions filed by the Company. Among others, the Bankruptcy Court entered an interim order (the “Interim Order”) designed to assist Diamond in preserving certain of its tax attributes by establishing, among other things, notification and hearing procedures relating to proposed transfers of its common stock and the taking of worthless stock deductions and setting a final hearing to consider the issues addressed in the Interim Order. The Interim Order requires, among other things, that (a) any person or “entity” (as defined in the applicable U.S. Treasury Regulations) owning or seeking to acquire ownership of 4.5% or more of Diamond’s common stock (the holders of at least 4.5% of Diamond’s common stock, the “Substantial Shareholders”) file with the Bankruptcy Court and serve on certain parties specified in the order (the “Notice Parties”) a Declaration of Status as a Substantial Shareholder and Declaration of Intent to Accumulate Common Stock and (b) any Substantial Shareholder seeking to acquire or dispose of Diamond’s common stock file with the Bankruptcy Court and serve on the Notice Parties a Declaration of Intent to Accumulate Common Stock (in the case of acquisitions) or Declaration of Proposed Transfer (in the case of dispositions), in each case subject to certain exceptions set forth in the Interim Order.

The foregoing description of the Interim Order does not purport to be complete and is qualified in its entirety by reference to the Interim Order filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On April 27, 2020, Diamond received notification from the staff of NYSE Regulation, Inc. (“NYSE Regulation”) that it has determined to commence proceedings to delist Diamond’s shares of common stock. NYSE Regulation determined that Diamond was no longer suitable for listing pursuant to Listed Company Manual Section 802.01D after Diamond’s April 27, 2020 disclosure that it and select subsidiaries have filed voluntary petitions for reorganization under chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court.

Diamond does not presently anticipate exercising its right to appeal NYSE Regulation’s delisting determination.

Diamond expects that its common stock will be quoted on the OTC Pink markets.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On April 27, 2020, Diamond issued a press release relating to the notice of delisting, a copy of which is attached hereto as Exhibit 99.2.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: April 27, 2020

|

|

|

|

DIAMOND OFFSHORE DRILLING, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ DAVID L. ROLAND

David L. Roland

Senior Vice President, General Counsel

and Secretary

|

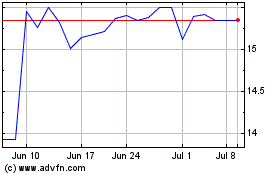

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Mar 2024 to Apr 2024

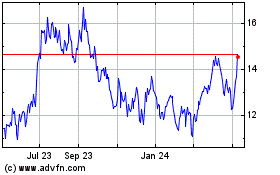

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Apr 2023 to Apr 2024