DaVita Raises Optimism for 2H11 - Analyst Blog

October 19 2011 - 1:36PM

Zacks

Yesterday, DaVita Inc. (DVA) announced the

estimates for its third-quarter earnings and raised the operating

income guidance for 2011.

The company expects its third-quarter operating income to be in

the range of $314–322 million and earnings per share from

continuing operations to be between $1.43 and $1.48, based on

substantial volume growth and reduced operating costs. The

estimates exclude special

items.

Improved

clinical practices and physicians’ reaction to the new FDA label

for Epogen, a drug for increasing red blood cells in kidney

patients, led to reduced utilization of physician-prescribed

pharmaceuticals, thereby bringing down DaVita’s operating

costs.

Additionally, management

expects a 4.6% growth in normalized non-acquired treatment.

However, the mix of treatments reimbursed by non-government payors,

as a percentage of total treatments is expected to deteriorate

again in the third quarter, after showing a slight improvement in

the second quarter of 2011.

DaVita also

revealed that the operating results of DSI Renal Inc. will be

consolidated with the company’s earnings from September 1, 2011

onwards. The merger deal of approximately $690 million was

announced on February 4, 2011and was completed on September 6,

2011.

The third

quarter earnings estimates coupled with increased general and

administrative expense forecast for the fourth quarter and an

expected decline in rates from Veterans Administration, prompted

DaVita to raise its full year earnings guidance.

For 2011,

management increased its operating income guidance range to

$1.125–1.155 billion from the previously announced estimate of

$1.08–1.12 billion. The guidance excludes an after-tax non-cash

goodwill impairment charge of $14.4 million or 14 cents per

share recorded in the second quarter of 2011.

Moreover, DaVita affirmed its 2012 operating income guidance of

$1.2–1.3 billion. The guidance is based on the expected changes in

commercial and government rates and commercial mix, as well as the

expected increase in investments, particularly for international

expansion, and the uncertainty about physician-prescribed

pharmaceutical expenses.

Further, the company announced the receipt of a subpoena for

documents related to an investigation being carried out regarding

inappropriate alliances with pharmaceutical companies and

physicians.

The company will report its third-quarter earnings after the

market closes on November 3, 2011.The Zacks Consensus Estimate for

DaVita’s third-quarter earnings is currently at $1.29 per share, up

about 12% year-over-year. Of the 14 firms covering the stock, 2

firms revised their estimates downward, while no upward revisions

were witnessed in the last 30 days.

For 2011, DaVita’s earnings are expected to be about $4.81 per

share, climbing about 10% year-over-year. The company’s rival

HealthSouth Corporation (HLS) is expected to

announce its third quarter earnings after the market closes on

October 27, 2011.

Currently, DaVita caries a Zacks #2 Rank, implying a short term

Buy rating.

DAVITA INC (DVA): Free Stock Analysis Report

HEALTHSOUTH CP (HLS): Free Stock Analysis Report

Zacks Investment Research

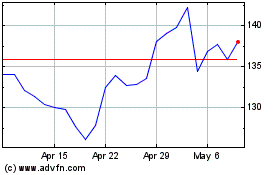

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

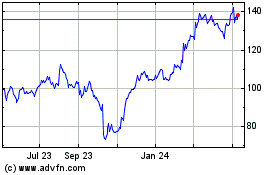

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024