Fresenius Misses, Ups Guidance - Analyst Blog

May 05 2011 - 2:03PM

Zacks

Fresenius Medical Care (FMS), the largest

provider of dialysis products and services on the planet, reported

first-quarter 2011 earnings per ADS of 73 cents, missing the Zacks

Consensus Estimate of 75 cents while exceeding the year-ago

earnings of 70 cents.

However, on a positive note, net income (attributable to the

company) climbed 4.5% year over year to $220.7 million owing to

higher revenues.

Revenues

Net revenues rose 5.4% (up 5% at constant currency) year over

year to $3,036 million, yet missed the Zacks Consensus Estimate of

$3,057 million. Organic revenue growth was 3% on a global basis.

Geographically, revenues from the North American markets edged up

1% to $1,977 million while overseas revenues surged 14% to $1,055

million.

International sales were boosted by higher dialysis services

revenues while domestic revenues were impinged by the negative

impact of the implementation of the new Medicare end-stage renal

disease prospective payment system (the “bundled rate” system),

which resulted in a reduction in reimbursement.

Segment Results

Dialysis services revenues leapt 5.3% year over year to $2,285

million with domestic and international sales rising 1.2% and

22.6%, respectively, to $1,782 million and $503 million. Average

revenue per treatment for domestic clinics declined to $348 from

$355 a year-ago, impacted by lower Medicare reimbursement.

Consolidated dialysis product revenues lifted 5.6% to $751

million. Dialysis product sales in domestic markets fell 2% year

over year to $195 million as higher sales of dialysis products were

more than offset by pricing cuts on renal drugs.

International dialysis product sales jumped 8% to $552 million,

boosted by higher sales of peritoneal dialysis products, dialyzers,

bloodlines and products for acute care treatments.

Operating Statistics

Fresenius operated a network of 2,769 dialysis clinics (up 8%

year over year) across North America and overseas markets at the

end of the first quarter. It has provided dialysis treatment to

216,942 patients (up 9%) worldwide as of March 31, 2011. During the

quarter the company provided roughly 8.17 million dialysis

treatments globally, up 9% year over year.

Margins

Operating margin fell modestly to 14.7% from 14.8% a year-ago.

In North America, operating margin edged up to 15.8% from 15.7%.

Margin reflects favorable pharma costs as well as the

implementation of the new Medicare payment system. Operating margin

for overseas markets declined to 16.2% from 16.4%.

Cash Flows

Fresenius generated operating cash flows of $175 million

(roughly 6% of revenues) in the quarter, down 50% year over year.

The company spent $113 million on capital expenditure in the

quarter. Free cash flows (prior to acquisitions) decreased 75% year

over year to $62 million.

Acquisition of Euromedic's Unit

Fresenius, in January 2011, signed an agreement to acquire

Euromedic International’s (“Euromedic”) dialysis service segment

International Dialysis Centers (“IDC”) for €485 million ($648

million).

IDC provides treatment to over 8,200 hemodialysis patients,

mainly in Central and Eastern Europe, and runs 70 clinics in nine

nations. The deal is subject to regulatory approvals by anti-trust

authorities and is expected to close in second-quarter 2011.

Upon fruition, the newly purchased business will contribute

about $180 million in annual revenues for Fresenius. Moreover, this

deal is expected to be accretive to earnings in the very first year

following the transaction closure.

Outlook

Encouraged by its reasonably healthy first quarter results and

factoring in the favorable impact of Medicare’s elimination of fees

related to the new bundled system, Fresenius has raised its

revenues and earnings forecasts for fiscal 2011. The company now

expects revenues to grow to more than $13 billion in 2011 versus

its prior forecast of between $12.8 billion and $13 billion.

Moreover, the company has raised its net income forecast for

2011 to between $1.070 billion and $1.090 billion from the earlier

guidance of $1.035 billion and $1.055 billion. However, Fresenius

still expects capital expenditure of roughly 5% of its sales in

2011 and expects to spend around $1.2 billion on acquisitions.

Fresenius Medical is the world’s largest provider of products

and services for patients undergoing dialysis treatment. The

company’s principal competitor in the U.S. is DaVita

Inc. (DVA), which provides dialysis services for patients

suffering from chronic kidney failure or end stage renal

disease.

DAVITA INC (DVA): Free Stock Analysis Report

FRESENIUS MED (FMS): Free Stock Analysis Report

Zacks Investment Research

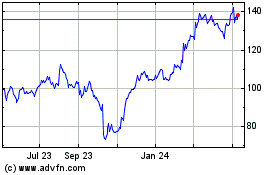

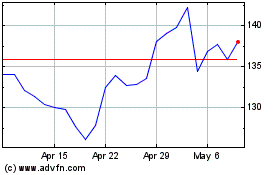

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024