Danaos Corporation (“Danaos”) (NYSE: DAC), one of the world’s

largest independent owners of containerships, today reported

unaudited results for the first quarter ended March 31, 2023.

Highlights for the First Quarter Ended March 31,

2023:

- Adjusted net income1 of $145.3 million, or $7.14 per share,

for the three months ended March 31, 2023 compared to $235.3

million, or $11.36 per share, for the three months ended March 31,

2022, a decrease of 38.2%. Our adjusted net income for the three

months ended March 31, 2022 included a non-recurring $110.0 million

dividend from ZIM that accounted for $5.31 per share.

- Net income of $146.2 million, or $7.18 per share, for the

three months ended March 31, 2023 compared to $331.5 million, or

$16.00 per share, for the three months ended March 31, 2022. Our

net income for the three months ended March 31, 2022 included a

non-recurring $209.5 million total gain on ZIM investment that

accounted for $10.11 per share.

- Cash and cash equivalents were $359.6 million as of March

31, 2023.

- Total liquidity was $730.8 million as of March 31, 2023,

including undrawn available commitments under our Revolving Credit

Facility.

- As of the date of this release, Danaos has repurchased in

total 683,889 shares of its common stock in the open market for

$40.5 million, under its share repurchase program of up to $100

million announced in June 2022.

- During the three months ended March 31, 2023, we invested

$4.3 million for a 49% shareholding interest in a newly established

company, Carbon Termination Technologies Corporation (“CTTC”),

currently engaged in the research and development of

decarbonization technologies for the shipping industry.

- Operating revenues of $243.6 million for the three months

ended March 31, 2023 compared to $229.9 million for the three

months ended March 31, 2022, an increase of 6.0%.

- During the last three months, we concluded new charter

agreements for $380.7 million of contracted revenues that included

$262.0 million related to 3-year charters for six under

construction containerships expected to be delivered during the

second half of 2024.

- On May 12, 2023, we made an early prepayment of our

outstanding leaseback obligations related to two of our vessels,

which amounted to $66.3 million as of March 31, 2023. As a result

of this early prepayment, we currently have no lease obligations on

the balance sheet.

- Adjusted EBITDA1 of $179.0 million for the three months

ended March 31, 2023 compared to $269.5 million for the three

months ended March 31, 2022, a decrease of 33.6%. Our adjusted

EBITDA for the three months ended March 31, 2022 included a

non-recurring $110.0 million dividend from ZIM.

- Total contracted cash operating revenues, on the basis of

concluded charter contracts through the date of this release, were

$2.3 billion as of March 31, 2023. The remaining average contracted

charter duration was 3.2 years, weighted by aggregate contracted

charter hire.

- Contracted operating days charter coverage is currently

97.3% for 2023, and 73.2% for 2024.

- As of March 31, 2023, Net Debt2 was $137.9 million, and Net

Debt / LTM Adjusted EBITDA was 0.18x, while 44 of our vessels are

debt-free currently.

- Danaos has declared a dividend of $0.75 per share of common

stock for the first quarter of 2023, which is payable on June 7,

2023, to stockholders of record as of May 26, 2023.

Three Months Ended March 31, 2023

Financial Summary - Unaudited (Expressed in thousands of

United States dollars, except per share amounts)

Three months

ended

Three months

ended

March 31,

March 31,

2023

2022

Operating revenues

$

243,574

$

229,901

Net income

$

146,201

$

331,465

Adjusted net income1

$

145,255

$

235,297

Earnings per share, diluted

$

7.18

$

16.00

Adjusted earnings per share, diluted1

$

7.14

$

11.36

Diluted weighted average number of shares

(in thousands)

20,349

20,717

Adjusted EBITDA1

$

179,040

$

269,484

1

Adjusted net income, adjusted earnings per

share and adjusted EBITDA are non-GAAP measures. Refer to the

reconciliation of net income to adjusted net income and net income

to adjusted EBITDA provided below.

2

Net Debt is defined as total debt gross of

deferred finance costs less cash and cash equivalents.

Danaos’ CEO Dr. John Coustas

commented:

“Danaos reports yet another solid quarter, despite the

continuing geopolitical uncertainty and the turmoil in the

financial markets. Box rates strengthened after the Chinese New

Year due to the blank sailings and discipline on the part of liner

companies. In addition, the charter market improved due to the very

limited supply of charter-free vessels as well as the impact of

speed reduction as charterers seek to comply with CII

regulations.

Danaos has continued its successful chartering and asset

management strategy, driving steady and predictable performance and

laying the groundwork for continued growth while also pursuing

environmentally sound policies. Our chartering strategy delivered

another strong quarter, and we have operating days charter coverage

of 97% for 2023 and 73% for 2024. Our strong chartering

capabilities and our business strategy continue to drive solid

performance.

In the first quarter, we successfully secured more than $380

million of contracted revenue through multi-year charters,

including $262 million for all six new buildings that will be

delivered to us in 2024. In addition, we have placed an order for

two additional 6,000 TEU vessels of the latest eco design to be

delivered in the fourth quarter of 2024 and the second quarter of

2025. Our modernization efforts that are key to the future of the

Company, highlight our commitment to maintaining a high quality

fleet while supporting the ongoing decarbonization of the

industry.

We are very well positioned to navigate the operating

environment with the new regulatory requirements that are becoming

very demanding and complex. Our very strong operating platform

provides us significant competitive advantage in complying with

upcoming regulations, while strengthening our value proposition and

ties with our customers as the industry focuses on achieving

environmental goals and closer cooperation between owners and

charterers becomes increasingly important.

We appreciate the ongoing support of our customers and employees

and will continue to work diligently for the benefit of our

shareholders.”

Three months ended March 31, 2023

compared to the three months ended March 31, 2022

During the three months ended March 31, 2023, Danaos had an

average of 68.3 containerships compared to 71.0 containerships

during the three months ended March 31, 2022. Our fleet utilization

for the three months ended March 31, 2023 was 96.8% compared to

97.4% for the three months ended March 31, 2022.

Our adjusted net income amounted to $145.3 million, or $7.14 per

share, for the three months ended March 31, 2023 compared to $235.3

million, or $11.36 per share, for the three months ended March 31,

2022. We have adjusted our net income in the three months ended

March 31, 2023 for a $1.6 million gain on sale of vessel and a $0.7

million non-cash finance fees amortization. Please refer to the

Adjusted Net Income reconciliation table, which appears later in

this earnings release.

The $90.0 million decrease in adjusted net income for the three

months ended March 31, 2023 compared to the three months ended

March 31, 2022 is primarily attributable to a $110.0 million

dividend from ZIM (net of withholding taxes) recognized in the

three months ended March 31, 2022. We also incurred a $2.6 million

equity loss on investments in the three months ended March 31, 2023

and a $1.2 million increase in total operating expenses, which were

partially offset by a $13.7 million increase in operating revenues

and a $10.1 million decrease in net finance expenses.

On a non-adjusted basis, net income amounted to $146.2 million,

or $7.18 earnings per diluted share, for the three months ended

March 31, 2023 compared to net income of $331.5 million, or $16.00

earnings per diluted share, for the three months ended March 31,

2022. Our net income for the three months ended March 31, 2022

included a total gain on our investment in ZIM of $209.5 million,

net of withholding taxes on dividend.

Operating Revenues

Operating revenues increased by 6.0%, or $13.7 million, to

$243.6 million in the three months ended March 31, 2023 from $229.9

million in the three months ended March 31, 2022.

Operating revenues for the three months ended March 31, 2023

reflected:

- a $30.4 million increase in revenues in the three months ended

March 31, 2023 compared to the three months ended March 31, 2022

mainly as a result of higher charter rates;

- a $3.3 million decrease in revenues in the three months ended

March 31, 2023 compared to the three months ended March 31, 2022

due to vessel disposals;

- a $3.3 million decrease in revenues in the three months ended

March 31, 2023 compared to the three months ended March 31, 2022

due to lower non-cash revenue recognition in accordance with US

GAAP; and

- a $10.1 million decrease in revenues in the three months ended

March 31, 2023 compared to the three months ended March 31, 2022

due to decreased amortization of assumed time charters.

Vessel Operating Expenses

Vessel operating expenses increased by $1.4 million to $40.6

million in the three months ended March 31, 2023 from $39.2 million

in the three months ended March 31, 2022, primarily as a result of

an increase in the average daily operating cost for vessels on time

charter to $6,807 per vessel per day for the three months ended

March 31, 2023 compared to $6,307 per vessel per day for the three

months ended March 31, 2022, which was partially offset by a

decrease in the average number of vessels in our fleet. The average

daily operating cost increased mainly due to increased repair and

maintenance and crew expenses. Management believes that our daily

operating costs remain among the most competitive in the

industry.

Depreciation & Amortization

Depreciation & Amortization includes Depreciation and

Amortization of Deferred Dry-docking and Special Survey Costs.

Depreciation

Depreciation expense decreased by 5.4%, or $1.8 million, to

$31.5 million in the three months ended March 31, 2023 from $33.3

million in the three months ended March 31, 2022 due to our recent

sale of three vessels.

Amortization of Deferred Dry-docking and Special Survey

Costs

Amortization of deferred dry-docking and special survey costs

increased by $1.1 million to $3.8 million in the three months ended

March 31, 2023 from $2.7 million in the three months ended March

31, 2022.

General and Administrative Expenses

General and administrative expenses decreased by $0.6 million to

$6.8 million in the three months ended March 31, 2023, from $7.4

million in the three months ended March 31, 2022. The decrease was

primarily attributable to decreased management fees due to the

recent sale of three vessels and decreased stock-based compensation

expenses.

Other Operating Expenses

Other Operating Expenses include Voyage Expenses.

Voyage Expenses

Voyage expenses increased by $0.7 million to $7.9 million in the

three months ended March 31, 2023 from $7.2 million in the three

months ended March 31, 2022 primarily as a result of the increase

in commissions due to the increase in revenue per vessel, which was

partially offset by a decrease in the average number of vessels in

our fleet.

Gain on Sale of Vessels

In January 2023, we completed the sale of the Amalia C for net

proceeds of $4.9 million resulting in a gain of $1.6 million.

Interest Expense and Interest Income

Interest expense decreased by 60.8%, or $10.4 million, to $6.7

million in the three months ended March 31, 2023 from $17.1 million

in the three months ended March 31, 2022. The decrease in interest

expense is a result of:

- a $5.7 million decrease in interest expense due to a decrease

in our average indebtedness by $849.0 million between the two

periods. Average indebtedness was $507.7 million in the three

months ended March 31, 2023, compared to average indebtedness of

$1,356.7 million in the three months ended March 31, 2022. This

decrease was partially offset by an increase in our debt service

cost by approximately 3.0%;

- a $3.4 million decrease in interest expense due to capitalized

interest on our vessels under construction in the three months

ended March 31, 2023 compared to none in the three months ended

March 31, 2022;

- a $2.7 million decrease in the amortization of deferred finance

costs and debt discount related to our refinancing; and

- a $1.4 million reduction of accumulated accrued interest that

had been accrued in 2018 in relation to two of our credit

facilities that were fully repaid in May 2022.

As of March 31, 2023, outstanding debt, gross of deferred

finance costs, was $431.1 million, which included $262.8 million

aggregate principal amount of our Senior Notes, and our leaseback

obligations of $66.3 million. These balances compare to debt of

$1,118.6 million and a leaseback obligations of $210.2 million as

of March 31, 2022.

Interest income increased by $2.7 million to $2.7 million in the

three months ended March 31, 2023 compared to nil in the three

months ended March 31, 2022 mainly as a result of increased

interest income earned on time deposits in the three months ended

March 31, 2023.

Gain on investments

The gain on investments of $221.7 million in the three months

ended March 31, 2022 consisted of the change in fair value of our

shareholding interest in ZIM of $99.5 million and dividends

recognized on ZIM ordinary shares of $122.2 million. In April and

September 2022, we sold all of our remaining ordinary shares of ZIM

for net proceeds of $246.6 million.

Other finance expenses, net

Other finance expenses, net increased by $0.4 million to $1.0

million in the three months ended March 31, 2023 compared to $0.6

million in the three months ended March 31, 2022 mainly due to an

increase in commitment fees for our revolving credit facility.

Equity loss on investments

Equity loss on investments amounting to $2.6 million in the

three months ended March 31, 2023 relates to our share of initial

expenses of a newly established company, Carbon Termination

Technologies Corporation (“CTTC”), currently engaged in the

research and development of decarbonization technologies for the

shipping industry.

Loss on derivatives

Amortization of deferred realized losses on interest rate swaps

remained stable at $0.9 million in each of the three months ended

March 31, 2023 and March 31, 2022.

Other income/(expenses), net

Other income, net was $0.2 million in the three months ended

March 31, 2023 compared to other income, net of $0.5 million in the

three months ended March 31, 2022.

Income taxes

Income taxes of $12.2 million in the three months ended March

31, 2022, related to the taxes withheld on dividend income earned

on ZIM ordinary shares and compared to no income tax in the three

months ended March 31, 2023.

Adjusted EBITDA

Adjusted EBITDA decreased by 33.6%, or $90.5 million, to $179.0

million in the three months ended March 31, 2023 from $269.5

million in the three months ended March 31, 2022. As outlined

above, the decrease is primarily attributable to a recognition of a

$110.0 million dividend from ZIM in the three months ended March

31, 2022. We also incurred a $1.7 million increase in total

operating expenses and a $2.6 million equity loss on investments in

the three months ended March 31, 2023, which were partially offset

by a $23.8 million increase in operating revenues. Adjusted EBITDA

for the three months ended March 31, 2023 is adjusted for a $1.6

million gain on sale of vessel. Tables reconciling Net Income to

Adjusted EBITDA can be found at the end of this earnings

release.

Dividend Payment

Danaos has declared a dividend of $0.75 per share of common

stock for the first quarter of 2023, which is payable on June 7,

2023 to stockholders of record as of May 26, 2023.

Recent Developments

As of the date of this release, we have repurchased in total

683,889 shares of our common stock in the open market for $40.5

million, under our share repurchase program of up to $100 million

announced in June 2022.

On May 12, 2023, we made an early prepayment of our outstanding

leaseback obligations related to two of our vessels, which amounted

to $66.3 million as of March 31, 2023.

On April 28, 2023, we entered into contracts for the

construction of two 6,000 TEU container vessels with the latest eco

design characteristics. The vessels are expected to be delivered in

the fourth quarter of 2024 and second quarter of 2025,

respectively.

Conference Call and

Webcast

On Tuesday, May 16, 2023 at 9:00 A.M. ET, the Company's

management will host a conference call to discuss the results.

Participants should dial into the call 10 minutes before the

scheduled time using the following numbers: 1 844 802 2437 (US Toll

Free Dial In), 0800 279 9489 (UK Toll Free Dial In) or +44 (0) 2075

441 375 (Standard International Dial In). Please indicate to the

operator that you wish to join the Danaos Corporation earnings

call.

A telephonic replay of the conference call will be available

until May 23, 2023 by dialing 1 877 344 7529 (US Toll Free Dial In)

or 1-412-317-0088 (Standard International Dial In) and using

9465910# as the access code.

Audio Webcast

There will also be a live and then archived webcast of the

conference call on the Danaos website (www.danaos.com).

Participants of the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

Slide Presentation

A slide presentation regarding the Company and the containership

industry will also be available on the Danaos website

(www.danaos.com).

About Danaos Corporation

Danaos Corporation is one of the largest independent owners of

modern, large-size containerships. Our current fleet of 68

containerships aggregating 421,293 TEUs and 8 under construction

containerships aggregating 58,398 TEUs ranks Danaos among the

largest containership charter owners in the world based on total

TEU capacity. Our fleet is chartered to many of the world's largest

liner companies on fixed-rate charters. Our long track record of

success is predicated on our efficient and rigorous operational

standards and environmental controls. Danaos Corporation's shares

trade on the New York Stock Exchange under the symbol "DAC".

Forward-Looking

Statements

Matters discussed in this release may constitute forward-looking

statements within the meaning of the safe harbor provisions of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements reflect

our current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions. Although Danaos

Corporation believes that these assumptions were reasonable when

made, because these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control, Danaos

Corporation cannot assure you that it will achieve or accomplish

these expectations, beliefs or projections. Important factors that,

in our view, could cause actual results to differ materially from

those discussed in the forward-looking statements include the

impact of the COVID-19 pandemic and efforts throughout the world to

contain its spread, including effects on global economic activity,

demand for seaborne transportation of containerized cargo, the

ability and willingness of charterers to perform their obligations

to us, charter rates for containerships, shipyards constructing our

contracted newbuilding vessels, performing scrubber installations,

drydocking and repairs, changing vessel crews and availability of

financing, the strength of world economies and currencies, general

market conditions, including changes in charter hire rates and

vessel values, charter counterparty performance, changes in demand

that may affect attitudes of time charterers to scheduled and

unscheduled dry-docking, changes in Danaos Corporation's operating

expenses, including bunker prices, dry-docking and insurance costs,

ability to obtain financing and comply with covenants in our

financing arrangements, actions taken by regulatory authorities,

potential liability from pending or future litigation, domestic and

international political conditions, including the conflict in

Ukraine and related sanctions, potential disruption of shipping

routes due to accidents and political events or acts by

terrorists.

Risks and uncertainties are further described in reports filed

by Danaos Corporation with the U.S. Securities and Exchange

Commission.

Visit our website at www.danaos.com

Appendix

Fleet Utilization

Danaos had 44 unscheduled off-hire days in the three months

ended March 31, 2023. The following table summarizes vessel

utilization and the impact of the off-hire days on the Company’s

revenue.

Vessel Utilization (No. of

Days)

First

Quarter

First

Quarter

2023

2022

Ownership Days

6,150

6,390

Less Off-hire Days:

Scheduled Off-hire Days

(150

)

(148

)

Other Off-hire Days

(44

)

(16

)

Operating Days

5,956

6,226

Vessel Utilization

96.8

%

97.4

%

Operating Revenues (in '000s of US

Dollars)

$

243,574

$

229,901

Average Gross Daily Charter

Rate

$

40,896

$

36,926

Fleet List

The following table describes in detail our fleet deployment

profile as of May 12, 2023:

Vessel Name

Vessel Size

(TEU)

Year Built

Expiration of

Charter(1)

Hyundai Ambition

13,100

2012

June 2024

Hyundai Speed

13,100

2012

June 2024

Hyundai Smart

13,100

2012

May 2024

Hyundai Respect

13,100

2012

March 2024

Hyundai Honour

13,100

2012

February 2024

Express Rome

10,100

2011

May 2024

Express Berlin

10,100

2011

August 2026

Express Athens

10,100

2011

May 2024

Le Havre

9,580

2006

June 2028

Pusan C

9,580

2006

May 2028

Bremen

9,012

2009

January 2028

C Hamburg

9,012

2009

January 2028

Niledutch Lion

8,626

2008

May 2026

Kota Manzanillo

8,533

2005

February 2026

Belita

8,533

2006

July 2026

CMA CGM Melisande

8,530

2012

June 2024

CMA CGM Attila

8,530

2011

October 2023

CMA CGM Tancredi

8,530

2011

November 2023

CMA CGM Bianca

8,530

2011

January 2024

CMA CGM Samson

8,530

2011

March 2024

America

8,468

2004

April 2028

Europe

8,468

2004

May 2028

Kota Santos

8,463

2005

August 2026

CMA CGM Moliere

6,500

2009

March 2027

CMA CGM Musset

6,500

2010

September 2025

CMA CGM Nerval

6,500

2010

November 2025

CMA CGM Rabelais

6,500

2010

January 2026

Racine (ex CMA CGM Racine)

6,500

2010

February 2024

YM Mandate

6,500

2010

January 2028

YM Maturity

6,500

2010

April 2028

Zim Savannah

6,402

2002

May 2024

Dimitra C

6,402

2002

January 2024

Suez Canal

5,610

2002

February 2024

Kota Lima

5,544

2002

November 2024

Wide Alpha

5,466

2014

March 2024

Stephanie C

5,466

2014

June 2025

Maersk Euphrates

5,466

2014

April 2024

Wide Hotel

5,466

2015

May 2024

Wide India

5,466

2015

November 2025

Wide Juliet

5,466

2015

October 2025

Seattle C

4,253

2007

October 2024

Vancouver

4,253

2007

November 2024

Derby D

4,253

2004

January 2027

Tongala

4,253

2004

November 2024

Rio Grande

4,253

2008

November 2024

Paolo (ex ZIM Sao Paolo)

4,253

2008

July 2023

ZIM Kingston

4,253

2008

June 2025

ZIM Monaco

4,253

2009

October 2024

Dalian

4,253

2009

March 2026

ZIM Luanda

4,253

2009

August 2025

Dimitris C

3,430

2001

November 2025

Express Black Sea

3,400

2011

January 2025

Express Spain

3,400

2011

January 2025

Express Argentina

3,400

2010

May 2023

Express Brazil

3,400

2010

June 2025

Express France

3,400

2010

September 2025

Singapore

3,314

2004

May 2024

Colombo

3,314

2004

January 2025

Zebra

2,602

2001

November 2024

Artotina

2,524

2001

May 2025

Advance

2,200

1997

January 2025

Future

2,200

1997

December 2024

Sprinter

2,200

1997

December 2024

Stride

2,200

1997

January 2025

Progress C

2,200

1998

November 2024

Bridge

2,200

1998

December 2024

Highway

2,200

1998

July 2023

Phoenix D

2,200

1997

March 2025

Vessels under construction

Hull Number

Vessel Size

(TEU)

Expected Delivery Year

Minimum Charter

Duration

Hull No. C7100-7

7,165

2024

3 Years

Hull No. C7100-8

7,165

2024

3 Years

Hull No. HN4009

8,010

2024

3 Years

Hull No. HN4010

8,010

2024

3 Years

Hull No. HN4011

8,010

2024

3 Years

Hull No. HN4012

8,010

2024

3 Years

Hull No. CV5900-07

6,014

2024

-

Hull No. CV5900-08

6,014

2025

-

(1)

Earliest date charters could

expire. Some charters include options for the charterer to extend

their terms.

DANAOS CORPORATION Condensed

Consolidated Statements of Income - Unaudited (Expressed in

thousands of United States dollars, except per share

amounts)

Three months

ended

Three months

ended

March 31,

March 31,

2023

2022

OPERATING REVENUES

$

243,574

$

229,901

OPERATING EXPENSES

Vessel operating expenses

(40,639

)

(39,164

)

Depreciation & amortization

(35,364

)

(36,079

)

General & administrative

(6,845

)

(7,391

)

Other operating expenses

(7,883

)

(7,189

)

Gain on sale of vessels

1,639

-

Income From Operations

154,482

140,078

OTHER INCOME/(EXPENSES)

Interest income

2,723

1

Interest expense

(6,722

)

(17,114

)

Gain on investments

-

221,717

Other finance expenses

(976

)

(605

)

Equity loss on investments

(2,588

)

-

Other income/(expenses), net

175

499

Realized loss on derivatives

(893

)

(893

)

Total Other Income/(Expenses),

net

(8,281

)

203,605

Income Before Income Taxes

146,201

343,683

Income taxes

-

(12,218

)

Net Income

$

146,201

$

331,465

EARNINGS PER SHARE

Basic earnings per share

$

7.18

$

16.02

Diluted earnings per share

$

7.18

$

16.00

Basic weighted average number of common

shares (in thousands of shares)

20,349

20,697

Diluted weighted average number of common

shares (in thousands of shares)

20,349

20,717

Non-GAAP Measures1 Reconciliation of

Net Income to Adjusted Net Income – Unaudited

Three months

ended

Three months

ended

March 31,

March 31,

2023

2022

Net income

$

146,201

$

331,465

Change in fair value of investments

-

(99,539

)

Gain on sale of vessels

(1,639

)

-

Amortization of financing fees and debt

discount

693

3,371

Adjusted Net Income

$

145,255

$

235,297

Adjusted Earnings Per Share,

diluted

$

7.14

$

11.36

Diluted weighted average number of shares

(in thousands of shares)

20,349

20,717

1 The Company reports its financial results in accordance with

U.S. generally accepted accounting principles (GAAP). However,

management believes that certain non-GAAP financial measures used

in managing the business may provide users of this financial

information additional meaningful comparisons between current

results and results in prior operating periods. Management believes

that these non-GAAP financial measures can provide additional

meaningful reflection of underlying trends of the business because

they provide a comparison of historical information that excludes

certain items that impact the overall comparability. Management

also uses these non-GAAP financial measures in making financial,

operating and planning decisions and in evaluating the Company's

performance. See the Table above for supplemental financial data

and corresponding reconciliations to GAAP financial measures for

the three months ended March 31, 2023 and 2022. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative

for, the Company’s reported results prepared in accordance with

GAAP.

DANAOS CORPORATION Condensed

Consolidated Balance Sheets - Unaudited (Expressed in

thousands of United States dollars)

As of

As of

March 31,

December 31,

2023

2022

ASSETS

CURRENT ASSETS

Cash, cash equivalents and restricted

cash

$

359,580

$

267,668

Accounts receivable, net

7,574

5,635

Other current assets

102,631

99,218

469,785

372,521

NON-CURRENT ASSETS

Fixed assets, net

2,691,699

2,721,494

Advances for vessels under

construction

194,738

190,736

Deferred charges, net

31,461

25,554

Investments in affiliates

1,675

-

Other non-current assets

91,964

89,923

3,011,537

3,027,707

TOTAL ASSETS

$

3,481,322

$

3,400,228

LIABILITIES AND STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES

Long-term debt, current portion

$

27,500

$

27,500

Long-term leaseback obligations, current

portion

65,594

27,469

Accounts payable, accrued liabilities

& other current liabilities

159,786

173,438

252,880

228,407

LONG-TERM LIABILITIES

Long-term debt, net

396,003

402,440

Long-term leaseback obligations, net

-

44,542

Other long-term liabilities

142,202

164,425

538,205

611,407

STOCKHOLDERS’ EQUITY

Common stock

203

203

Additional paid-in capital

745,914

748,109

Accumulated other comprehensive loss

(73,130

)

(74,209

)

Retained earnings

2,017,250

1,886,311

2,690,237

2,560,414

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

3,481,322

$

3,400,228

DANAOS CORPORATION Condensed

Consolidated Statements of Cash Flows - Unaudited (Expressed

in thousands of United States dollars)

Three months

ended

Three months

ended

March 31,

March 31,

2023

2022

Operating Activities:

Net income

$

146,201

$

331,465

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of

right-of-use assets

31,529

33,359

Amortization of deferred drydocking &

special survey costs, finance cost and debt discount

4,528

6,091

Amortization of assumed time charters

(6,536

)

(16,651

)

Prior service cost and periodic cost

492

-

Gain on investments

-

(99,539

)

Gain on sale of vessels

(1,639

)

-

Payments for drydocking/special survey

(9,742

)

(9,255

)

Equity loss on investments

2,588

-

Amortization of deferred realized losses

on cash flow interest rate swaps

893

893

Stock based compensation

-

124

Accounts receivable

(1,939

)

(15

)

Other assets, current and non-current

(8,794

)

(133,417

)

Accounts payable and accrued

liabilities

(5,085

)

5,641

Other liabilities, current and

long-term

(24,902

)

768

Net Cash provided by Operating

Activities

127,594

119,464

Investing Activities:

Vessel additions and advances for vessels

under construction

(5,736

)

(2,043

)

Proceeds and advances received from sale

of vessels

3,914

13,000

Investments in affiliates

(4,263

)

-

Net Cash provided by/(used in)

Investing Activities

(6,085

)

10,957

Financing Activities:

Debt repayment

(6,875

)

(24,300

)

Payments of leaseback obligations

(6,629

)

(16,293

)

Dividends paid

(15,262

)

(15,535

)

Repurchase of common stock

(581

)

-

Payments of accumulated accrued

interest

-

(1,435

)

Finance costs

(250

)

(3,950

)

Net Cash used in Financing

Activities

(29,597

)

(61,513

)

Net increase in cash, cash equivalents and

restricted cash

91,912

68,908

Cash, cash equivalents and restricted

cash, beginning of period

267,668

129,756

Cash, cash equivalents and restricted

cash, end of period

$

359,580

$

198,664

DANAOS CORPORATION Reconciliation of

Net Income to Adjusted EBITDA - Unaudited (Expressed in

thousands of United States dollars)

Three months

ended

Three months

ended

March 31,

March 31,

2023

2022

Net income

$

146,201

$

331,465

Depreciation and amortization of

right-of-use assets

31,529

33,359

Amortization of deferred drydocking &

special survey costs

3,835

2,720

Amortization of assumed time charters

(6,536

)

(16,651

)

Amortization of deferred finance costs,

debt discount and commitment fees

1,451

3,371

Amortization of deferred realized losses

on interest rate swaps

893

893

Interest income

(2,723

)

(1

)

Interest expense

6,029

13,743

Income taxes

-

12,218

Gain on investments and dividend

withholding taxes

-

(111,757

)

Gain on sale of vessels

(1,639

)

-

Stock based compensation

-

124

Adjusted EBITDA(1)

$

179,040

$

269,484

(1)

Adjusted EBITDA represents net income before interest income and

expense, taxes other than withholding taxes on dividend,

depreciation, amortization of deferred drydocking & special

survey costs, amortization of assumed time charters, amortization

of deferred finance costs, debt discount and commitment fees,

amortization of deferred realized losses on interest rate swaps,

gain/loss on investments, gain on sale of vessels and stock based

compensation. However, Adjusted EBITDA is not a recognized

measurement under U.S. generally accepted accounting principles, or

“GAAP.” We believe that the presentation of Adjusted EBITDA is

useful to investors because it is frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in our industry. We also believe that Adjusted EBITDA

is useful in evaluating our operating performance compared to that

of other companies in our industry because the calculation of

Adjusted EBITDA generally eliminates the effects of financings,

income taxes and the accounting effects of capital expenditures and

acquisitions, items which may vary for different companies for

reasons unrelated to overall operating performance. In evaluating

Adjusted EBITDA, you should be aware that in the future we may

incur expenses that are the same as or similar to some of the

adjustments in this presentation. Our presentation of Adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or non-recurring items.

Note: Items to consider for comparability

include gains and charges. Gains positively impacting net income

are reflected as deductions to net income. Charges negatively

impacting net income are reflected as increases to net income.

The Company reports its financial results

in accordance with U.S. generally accepted accounting principles

(GAAP). However, management believes that certain non-GAAP

financial measures used in managing the business may provide users

of these financial information additional meaningful comparisons

between current results and results in prior operating periods.

Management believes that these non-GAAP financial measures can

provide additional meaningful reflection of underlying trends of

the business because they provide a comparison of historical

information that excludes certain items that impact the overall

comparability. Management also uses these non-GAAP financial

measures in making financial, operating and planning decisions and

in evaluating the Company's performance. See the Tables above for

supplemental financial data and corresponding reconciliations to

GAAP financial measures for the three months ended March 31, 2023

and 2022. Non-GAAP financial measures should be viewed in addition

to, and not as an alternative for, the Company’s reported results

prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230515005745/en/

For further information:

Company Contact: Evangelos Chatzis Chief Financial

Officer Danaos Corporation Athens, Greece Tel.: +30 210 419 6480

E-Mail: cfo@danaos.com

Iraklis Prokopakis Senior Vice President and Chief

Operating Officer Danaos Corporation Athens, Greece Tel.: +30 210

419 6400 E-Mail: coo@danaos.com

Investor Relations and Financial Media Rose & Company

New York Tel. 212-359-2228 E-Mail:

danaos@rosecoglobal.com

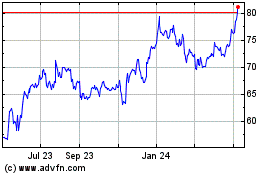

Danaos (NYSE:DAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

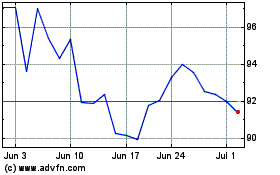

Danaos (NYSE:DAC)

Historical Stock Chart

From Jan 2024 to Jan 2025