Customers Bancorp, Inc. (NYSE:CUBI), the parent company of

Customers Bank (collectively “Customers”), reported net income to

common shareholders of $69.2 million for the full year of 2016

compared to net income to common shareholders of $56.1 million for

the full year of 2015, an increase of $13.1 million, or

23.3%. Fully diluted earnings per share for the full year of

2016 was $2.31 compared to $1.96 fully diluted earnings per share

for 2015, an increase of $0.35, or 17.9%. Average fully

diluted shares for 2016 were 30.0 million compared to average fully

diluted shares for 2015 of 28.7 million. During the fourth

quarter of 2016 ("Q4 2016"), Customers recognized an impairment

charge on equity securities for which Customers' intent to hold

until the market price recovered changed resulting in a charge of

$7.3 million, and adopted Accounting Standards Update 2016-9,

Improvements to Employee Share Based Accounting ("ASU 2016-9"),

resulting in a $4.1 million reduction in income tax expense, which

increased 2016 earnings. Net income to common shareholders

would have been $72.3 million, and fully diluted earnings per share

would have been $2.46 per share, for 2016 without the impact of the

impairment charge and adopting ASU 2016-9.

Customers also reported net income to common shareholders of

$16.2 million for Q4 2016 compared to net income to common

shareholders of $16.8 million for the fourth quarter of 2015 (“Q4

2015”), a decrease of $0.6 million, or 3.4%. Q4 2016 fully

diluted earnings per share was $0.51 compared to $0.58 for Q4 2015,

a decrease of $0.07 per share, or 12.1%. Average fully

diluted shares for Q4 2016 was 31.6 million shares compared to

average fully diluted shares for Q4 2015 of 28.9 million.

Customers changed its intent to hold certain equity securities

until the market price of the securities recovered, resulting in an

impairment charge of $7.3 million during Q4 2016. Customers’

adoption of ASU 2016-9 during Q4 2016 resulted in a $3.6 million

reduction in income tax expense, which increased earnings in Q4

2016 by $3.6 million. Excluding the impairment charge and the

impact of adopting ASU 2016-9, net income available to common

shareholders would have been $19.9 million, and fully diluted

earnings per share would have been $0.64 per share, in Q4 2016.

Net income to common shareholders from continuing operations

after preferred stock dividends was $78.2 million for 2016 and

$19.7 million for Q4 2016. Net income to common shareholders

from continuing operations after preferred stock dividends was

$60.6 million for 2015 and $17.9 million for Q4 2015. Fully

diluted earnings per common share from continuing operations after

preferred stock dividends was $2.61 for 2016 and $2.11 for 2015 and

$0.62 for Q4 2016 and $0.62 for Q4 2015. Fully diluted

earnings per common share from continuing operations after

preferred stock dividends would have been $2.76 for 2016 and $0.76

for Q4 2016 without the impact of the impairment charge and

adopting ASU 2016-9.

“In 2016 we slowed our growth rate in order to build a stronger

balance sheet, build a stronger capital base and risk management

infrastructure, and build BankMobile into a successful company that

could be divested so both Customers and BankMobile can grow and

thrive without Durbin Amendment restrictions. During the

year, we successfully built upon and strengthened our core business

franchise as we developed and successfully added to our commercial

loan and deposit generating teams in Pennsylvania, New York, and

New England, facilitating continued strong loan and deposit growth

in our target markets,” stated Jay Sidhu, Chairman and CEO of

Customers. “We strengthened our balance sheet by growing

deposits by nearly 21% while growing loans by nearly 14% and all

together producing net income to Customers' common shareholders of

$2.31 per share, or $2.46 per share excluding both the equity

securities impairment and benefit from adopting ASU 2016-9.

We strengthened our capital in 2016 and prepared for our future by

increasing our shareholders’ equity by $302 million as we issued

$161.9 million in preferred stock, and issued common shares and

retained all net income available to common shareholders totaling

$140.1 million. We further strengthened our risk management

infrastructure by investing more in risk management,

administrative, technical and compliance teams and initiating our

preparations for the increased regulatory attention and

requirements we will assume when we cross the $10 billion total

assets threshold. We also built BankMobile into a successful

business by acquiring the Disbursements business, combining the

acquired business with the internally developed BankMobile

business, and announcing our intention to sell the combined

business so that the business could continue to grow without Durbin

Amendment restrictions. In summary, we are very pleased with

all that was accomplished in 2016, and we are well positioned for a

successful 2017 and beyond,” continued Mr. Sidhu. "We regret

that our strategy to form a possible business alliance with

Religare Enterprises did not work out. Accordingly, we have decided

to exit that strategy and move forward," Mr. Sidhu concluded.

Other financial and business highlights for 2016 compared to

2015 include:

- Customers achieved a return on average assets of 0.86%, or

0.90% excluding the previously referenced impairment charge and ASU

2016-9 benefit, in 2016 compared to 0.81% in 2015, and achieved a

return on average common equity of 12.41%, or 12.97% excluding the

previously referenced impairment charge and ASU 2016-9 benefit, in

2016 compared to 11.82% in 2015.

- Total loans from continuing operations, including commercial

loans held for sale, increased $1.0 billion, or 13.9%, to $8.3

billion as of December 31, 2016 compared to total loans of $7.3

billion as of December 31, 2015. Commercial loans to mortgage

companies increased $374 million to $2.2 billion, multi-family

loans increased $266 million to $3.2 billion, commercial and

industrial loans increased $247 million to $1.3 billion, commercial

non-owner-occupied real estate loans increased $237 million to $1.2

billion, and consumer loans decreased $92 million to $0.3

billion.

- Total deposits from continuing operations increased by $1.2

billion, or 20.9%, to $6.9 billion as of December 31, 2016 compared

to total deposits of $5.7 billion as of December 31, 2015.

Non-interest demand deposit accounts increased $104 million to $513

million, interest bearing demand deposit accounts increased $212

million to $0.3 billion, money market demand accounts increased

$383 million to $3.1 billion, and certificates of deposit increased

$484 million to $2.8 billion from continuing operations.

BankMobile deposits held for sale increased $210 million to $457

million at December 31, 2016.

- 2016 net interest income from continuing operations of $249.5

million increased $53.2 million, or 27.1%, from comparable net

interest income for 2015 as average interest earning assets from

continuing operations increased $1.8 billion and the net interest

margin widened by 3 basis points. The higher rates earned on

the investment portfolio and commercial loans to mortgage companies

contributed significantly to the slightly wider net interest

margin.

- Customers’ 2016 provision for loan losses from continuing

operations totaled $2.3 million for 2016 compared to a provision

expense of $20.6 million in 2015. The 2015 provision expense

included a $9.0 million provision for a fraudulent loan that was

charged off and reflected greater growth in loans held for

investment and recoveries in 2016 totaled $2.7 million compared to

recoveries of $1.4 million in 2015. There were no significant

changes in Customers’ methodology for estimating its allowance for

loan losses and the provision for loan losses in 2016.

- Non-interest income from continuing operations, excluding the

previously described impairment charge, increased $2.9 million in

2016 to $30.4 million, a 10.4% increase. Increases in gains

on sale of Small Business Administration ("SBA") loans of $1.7

million and mortgage warehouse transactional fees of $1.2 million

were offset in part by a one-time benefit received on a bank-owned

life insurance policy in 2015.

- Non-interest expenses from continuing operations increased

$23.6 million from 2015, or 22.0%. Salaries and employee

benefits increased $11.5 million, technology and bank operations

increased $3.5 million, FDIC assessments and non-income taxes and

regulatory fees increased $2.5 million, and other expenses

generally increased. Much of the increased non-interest

expenses is attributable to the increased level of staff and other

operating expenses necessary to run a larger bank.

- BankMobile results for 2016, which include the results of the

acquired Disbursements business subsequent to its acquisition date

of June 15, 2016 and are presented on the income statement as

discontinued operations, included non-interest income of $33.2

million and operating expenses of $47.0 million. BankMobile

generated a net loss of approximately $9.0 million for the full

year of 2016. The financial statement presentation excludes

the internal allocation of interest income to BankMobile for

generating deposits of $4.3 million, net of taxes.

- The 2016 efficiency ratio from continuing operations was 46.9%,

compared to the 2015 efficiency ratio from continuing operations of

approximately 48.0%.

- Shareholders' equity increased $302 million in 2016 to $856

million as Customers increased its capital levels in preparation

for total assets increasing to over $10 billion in future

periods. The capital increase included issuance of preferred

stock totaling $162 million, and increasing common shareholder

interests by $140 million through the sale of additional common

shares and retaining all net income available to common

shareholders in 2016. Capital levels were strengthened

significantly in 2016 and continue to exceed the “well capitalized”

threshold established by regulation at the bank and exceed the

applicable Basel III regulatory thresholds for the holding company

and the bank.

- The book value per common share continued to increase, reaching

$21.08 per share at December 31, 2016 compared to $18.52 per share

at December 31, 2015, an increase of 13.8%.

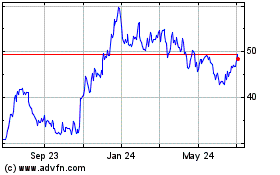

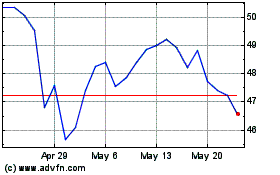

- Based on Customers Bancorp, Inc.'s December 31, 2016 stock

price of $35.82, Customers was trading at 1.7 times tangible book

value per common share.

Q4 2016 compared to Q4 2015:

- Q4 2016 net interest income from continuing operations of $64.1

million increased $10.7 million, or 19.9%, from net interest income

from continuing operations for Q4 2015 as average loan and security

balances increased $1.4 billion. Net interest margin expanded

by 1 basis point to 2.84% in Q4 2016 from 2.83% in Q4 2015.

- Commercial loan average balances increased $1.1 billion,

including commercial loans to mortgage companies, in Q4 2016

compared to Q4 2015.

- Multi-family average loan balances increased $485 million in Q4

2016 compared to Q4 2015.

- The net interest margin grew to 2.84% in Q4 2016 compared to Q4

2015 as the average yield on assets increased 11 basis points,

while the cost of funding the portfolio increased 13 basis

points.

- Customers reported a $(0.3) million provision for loan losses

from continuing operations in Q4 2016 compared to a $6.2 million

provision for loan losses in Q4 2015. Customers' provision for loan

losses for increased loan balances of $125.4 million of $0.6

million and provision for credit deterioration of $0.8 million were

offset by Q4 2016 recoveries totaling $1.8 million.

- Q4 2016 non-interest income from continuing operations of $8.2

million, excluding the impairment charge, decreased $1.1 million

from Q4 2015. The Q4 2016 increase in mortgage warehouse

transactional fees and gain on sale of loans were more than offset

by the $2.4 million decrease in bank-owned life insurance income

resulting from the Q4 2015 receipt of a one-time

benefit.

- Non-interest expenses from continuing operations in Q4 2016 of

$30.5 million increased $0.9 million, or 3.1%, from comparable

non-interest expenses in Q4 2015. Q4 2016 salaries and benefits

increased $2.8 million to $17.4 million due to increased headcount

and compensation increases, and occupancy expense increased

approximately $0.8 million to $2.9 million principally to

facilitate business expansion and relocation of teams in New York

City and other locations. These increases were partially

offset by FDIC assessments, non-income taxes and regulatory fees

decrease of $1.3 million as the deposit insurance fund reached a

targeted level and insurance premiums were reduced, and a decrease

in technology/communication and bank operations of $1.2 million

reflecting a reversal of approximately $1.0 million of previously

accrued technology-related expenses.

- Customers’ Q4 2016 income tax expense from continuing

operations of $11.5 million reflected an estimated effective tax

rate of 33.0% compared to Q4 2015 tax expense of $8.1 million, with

an effective tax rate of 30.0%. Customers' Q4 2016 tax

expense from continuing operations included a $3.6 million benefit

from the adoption of ASU 2016-9 in the fourth quarter of 2016.

- Customers achieved a return on average assets of 0.84%, or

1.00% excluding the impairment charge and ASU 2016-9 benefit, in Q4

2016 compared to 0.91% in Q4 2015, and achieved a return on average

common equity of 10.45%, or 12.83% excluding the impairment charge

and ASU 2016-9 benefit, in Q4 2016 compared to 13.46% in Q4 2015.

- BankMobile discontinued operating results for Q4 2016 included

non-interest income of $14.2 million and non-interest expenses of

$19.4 million. BankMobile generated a net loss of $3.5

million for Q4 2016. The financial statement presentation

excludes the internal allocation of interest income to BankMobile

for generating deposits of $1.5 million, net of taxes.

- BankMobile deposits held for sale totaled $456.8 million as of

December 31, 2016, and were predominately non-interest bearing.

- Customers' Q4 2016 efficiency ratio from continuing operations

was 42.2% compared to a 47.1% Q4 2015 efficiency ratio.

- Customers increased capital $66.1 million in Q4 2016 as a

result of the issuance of 2.4 million shares of common stock

generating net proceeds of $58.5 million and retention of net

income to common shareholders of $16.2 million offset in part by a

decrease in accumulated other comprehensive income of $5.7 million.

Customers' capital ratios increased as a result of the share

issuances and retaining net income to common shareholders combined

with limited growth in assets, and continue to exceed the "well

capitalized" thresholds established by regulation.

Q4 2016 compared to Q3 2016:Customers’ Q4 2016

net income to common shareholders decreased $2.4 million, or 13.1%,

to $16.2 million from net income to common shareholders of $18.7

million for the third quarter of 2016 ("Q3 2016"). The $2.4

million decrease in Q4 2016 net income compared to Q3 2016 net

income resulted primarily from a decrease in net interest income of

$0.5 million to $64.1 million, a decrease in non-interest income of

$10.2 million to $0.9 million, an increase in net loss from

BankMobile of $1.4 million, partially offset by a decrease in

operating expenses of $6.2 million to $30.5 million, a $4.4 million

decrease in income tax expense to $11.5 million, and a decrease in

provision expense of $0.1 million. Examining these

quarter-over-quarter changes further:

- The $0.5 million decrease in net interest income from

continuing operations in Q4 2016 was largely attributable to a

decrease in average loan balances of approximately $0.1 billion and

prepayment fees received in Q4 2016 compared to Q3 2016.

- The $0.1 million decrease in provision for loan losses from

continuing operations in Q4 2016 resulted primarily from recoveries

on previously charged-off loans and purchased credit-impaired loans

that exceeded the provisions required for growth in end of period

loan balances and credit deterioration during the

period.

- The $10.2 million decrease in non-interest income from

continuing operations in Q4 2016 compared to Q3 2016 resulted

primarily from the impairment charge of $7.3 million in Q4 2016 and

a Q3 2016 $2.2 million recovery of a previously reported

loss.

- The $6.2 million decrease in non-interest expenses from

continuing operations in Q4 2016 compared to Q3 2016 resulted

primarily from a $3.9 million Q3 2016 one-time accrual for

technology-related services and the Q4 2016 reversal of

approximately $1.0 of the accrual.

- BankMobile's net loss increased in Q4 2016 by $1.4 million as a

result of reduced fees billed on certain accounts previously held

at a second bank as the accounts were closed and balances returned

to the depositors during Q4 2016, and lower than prior quarter and

expected activity within the accounts generating less than expected

fee income.

The following table presents a summary of key earnings and

performance metrics for the years ended December 31, 2016 and 2015

and for the quarter ended December 31, 2016 and the preceding

four quarters, respectively:

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

|

|

|

|

|

EARNINGS SUMMARY - UNAUDITED |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands,

except per-share data) |

|

|

|

|

|

|

|

| |

|

|

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

| |

2016 |

2015 |

2016 |

2016 |

2016 |

2016 |

2015 |

| |

|

|

|

|

|

|

|

| Net income available to

common shareholders |

$ |

69,187 |

|

$ |

56,090 |

|

$ |

16,213 |

|

$ |

18,655 |

|

$ |

17,421 |

|

$ |

16,898 |

|

$ |

16,780 |

|

| Basic earnings per

common share ("EPS") |

$ |

2.51 |

|

$ |

2.09 |

|

$ |

0.56 |

|

$ |

0.68 |

|

$ |

0.64 |

|

$ |

0.63 |

|

$ |

0.62 |

|

| Diluted EPS |

$ |

2.31 |

|

$ |

1.96 |

|

$ |

0.51 |

|

$ |

0.63 |

|

$ |

0.59 |

|

$ |

0.58 |

|

$ |

0.58 |

|

| Average common shares

outstanding - basic |

27,596,020 |

|

26,844,545 |

|

28,978,115 |

|

27,367,551 |

|

27,080,676 |

|

26,945,062 |

|

26,886,694 |

|

| Average common shares

outstanding - diluted |

30,013,650 |

|

28,684,939 |

|

31,581,811 |

|

29,697,207 |

|

29,504,329 |

|

29,271,255 |

|

28,912,644 |

|

| Shares outstanding

period end |

30,289,917 |

|

26,901,801 |

|

30,289,917 |

|

27,544,217 |

|

27,286,833 |

|

27,037,005 |

|

26,901,801 |

|

| Return on average

assets |

0.86 |

% |

0.81 |

% |

0.84 |

% |

0.89 |

% |

0.85 |

% |

0.87 |

% |

0.91 |

% |

| Return on average

common equity |

12.41 |

% |

11.82 |

% |

10.45 |

% |

13.21 |

% |

13.07 |

% |

13.23 |

% |

13.46 |

% |

| Return on average

assets - pre-tax and pre-provision (1) |

1.40 |

% |

1.50 |

% |

1.25 |

% |

1.51 |

% |

1.44 |

% |

1.40 |

% |

1.60 |

% |

| Return on average

common equity - pre-tax and pre-provision (2) |

21.19 |

% |

22.46 |

% |

16.58 |

% |

23.59 |

% |

23.38 |

% |

21.87 |

% |

24.35 |

% |

| Net interest margin,

tax equivalent |

2.84 |

% |

2.81 |

% |

2.84 |

% |

2.83 |

% |

2.83 |

% |

2.88 |

% |

2.83 |

% |

| Efficiency ratio |

56.92 |

% |

51.29 |

% |

57.70 |

% |

61.06 |

% |

53.47 |

% |

53.74 |

% |

50.11 |

% |

| Non-performing loans

(NPLs) to total loans (including held-for-sale loans) |

0.22 |

% |

0.15 |

% |

0.22 |

% |

0.16 |

% |

0.17 |

% |

0.20 |

% |

0.15 |

% |

| Reserves to

non-performing loans |

215.31 |

% |

341.71 |

% |

215.31 |

% |

287.88 |

% |

268.98 |

% |

242.10 |

% |

341.71 |

% |

| Net charge-offs

(recoveries) |

$ |

1,662 |

|

$ |

11,978 |

|

$ |

770 |

|

$ |

288 |

|

$ |

1,060 |

|

$ |

(455 |

) |

$ |

4,322 |

|

| Tier 1 equity to

average tangible assets |

9.29 |

% |

7.66 |

% |

9.06 |

% |

8.19 |

% |

7.17 |

% |

7.15 |

% |

7.16 |

% |

| Tangible common equity

to average tangible assets (3) |

6.83 |

% |

6.81 |

% |

6.66 |

% |

5.89 |

% |

5.71 |

% |

6.17 |

% |

6.37 |

% |

| Book value per common

share |

$ |

21.08 |

|

$ |

18.52 |

|

$ |

21.08 |

|

$ |

20.78 |

|

$ |

19.98 |

|

$ |

19.22 |

|

$ |

18.52 |

|

| Tangible book value per

common share (period end) (4) |

$ |

20.49 |

|

$ |

18.39 |

|

$ |

20.49 |

|

$ |

20.16 |

|

$ |

19.35 |

|

$ |

19.08 |

|

$ |

18.39 |

|

| Period end stock

price |

$ |

35.82 |

|

$ |

27.22 |

|

$ |

35.82 |

|

$ |

25.16 |

|

$ |

25.13 |

|

$ |

23.63 |

|

$ |

27.22 |

|

| |

|

|

|

|

|

|

|

| (1)

Non-GAAP measure calculated as GAAP net income, plus provision for

loan losses and income tax expense divided by average total

assets. |

| (2)

Non-GAAP measure calculated as GAAP net income available to common

shareholders, plus provision for loan losses and income tax expense

divided by average common equity. |

| (3)

Non-GAAP measure calculated as GAAP total shareholders' equity less

preferred stock and goodwill and other intangibles divided by total

average assets less average goodwill and other intangibles. |

| (4)

Non-GAAP measure calculated as GAAP total shareholders' equity less

preferred stock and goodwill and other intangibles divided by

common shares outstanding at period end. |

|

|

Capital

Customers recognizes the importance of not only being well

capitalized in the current environment but to have adequate capital

buffers to absorb any unexpected shocks. "Our capital ratios

improved significantly during 2016 due to continued strong

earnings, planned slow down in loan growth, and successful

preferred and common stock offerings during the year," stated Mr.

Sidhu. "We are targeting a Tier I capital ratio of 9.0% or

higher and a total risk-based capital ratio of around 13.0% as we

get ready to cross the $10 billion mark," Mr. Sidhu

continued. At December 31, 2016, Customers is

preliminarily calculating its Tier 1 leverage ratio at 9.1% and its

total risk-based capital ratio at 12.9%. "By continuing to

control our growth over the next few quarters, demonstrating strong

earnings, and completing the sale of BankMobile at an anticipated

substantial gain, we hope to reach the targeted capital levels in

2017," concluded Mr. Sidhu.

BankMobile

The BankMobile division took a significant step during Q3 2016

with Customers Bank’s integration of the Disbursements business

acquired from Higher One late in Q2 2016. Together the new

BankMobile division serviced over 1.2 million active deposit

accounts as of December 31, 2016. The combined businesses

also have the potential to add in excess of 400,000 new student

accounts annually. Since the acquisition of the Disbursements

business, BankMobile has added over 222,000 new accounts and

converted over 374,000 accounts at the student account holder's

election from a prior business partner of Higher One.

Customers previously announced its intent to sell BankMobile with

the expectation that Customers would be able to sell BankMobile at

a substantial gain, further strengthening its capital and the

balance sheet. In the meantime, Customers continues its

efforts to develop the BankMobile business and enhance its value to

shareholders.

Managing Commercial Real Estate Concentration Risks and

Providing High Net Worth Families Loans for Their Multi-Family

Holdings

Customers' loans collateralized by multi-family properties were

approximately 38.9% of Customers' total loan portfolio and

approximately 380.7% of Tier 1 capital at December 31,

2016. Recognizing the risks that accompany certain elements

of commercial real estate ("CRE") lending, Customers has as part of

its core strategies studiously sought to limit its risks and has

concluded that it has appropriate risk management systems in place

to manage this portfolio. Customers' total real estate construction

and development exposure, arguably the riskiest area of CRE, was

under $100 million as of December 31, 2016.

Customers' CRE exposures are focused principally on loans to

high net worth families collateralized by multi-family properties

that are of modest size and subject to what Customers believes are

conservative underwriting standards. Customers believes it has a

strong risk management process to manage the portfolio risks

prospectively and that this portfolio will perform well even under

a stressed scenario. Following are some unique characteristics of

Customers' multi-family loan portfolio:

- Principally concentrated in New York City and principally to

high net worth families;

- Average loan size is between $5 million - $7 million;

- Annual debt service coverage ratio is 140%;

- Median loan-to-value is 70%;

- All loans are individually stressed with an increase of 1% and

2% to the cap rate and an increase of 1.5% and 3% in loan interest

rates;

- All properties are inspected prior to a loan being granted and

monitored thereafter on an annual basis by dedicated portfolio

managers; and

- Credit approval process is independent of customer sales and

portfolio management process.

Asset Quality and Interest Rate Risk

Risk management is a critical component of how Customers creates

long-term shareholder value. Two of the most important risks of

banking to be understood and managed in an uncertain economy are

asset quality and interest rate risk.

Customers believes that asset quality risks must be diligently

addressed during good economic times with prudent underwriting

standards so that when the economy deteriorates the bank's capital

is sufficient to absorb all losses without threatening its ability

to operate and serve its community and other constituents.

"Customers adopted prudent underwriting standards in 2010 when the

current management team assumed responsibility for building the

Bank and has not compromised those standards," stated Mr. Sidhu.

"Customers' non-performing loans at December 31, 2016 were

only 0.22% of total loans, compared to our peer group

non-performing loans of approximately 0.88% of total loans, and

industry average non-performing loans of 1.62% of total loans. Our

expectation is superior asset quality performance in good times and

in difficult years," said Mr. Sidhu.

Interest rate risk is another critical element for banks to

manage. A significant shift in interest rates can have a

devastating effect on a bank's profitability for multiple years.

Banks can position their assets and liabilities to speculate on

future interest rate changes with the hope of gaining earnings by

guessing the next movement in interest rates. "Customers' objective

is to manage the estimated effect of future interest rate changes,

up or down, to a neutral effect on net interest income, so not

speculating on whether interest rates go up or down. At

December 31, 2016, we were slightly asset sensitive, hoping to

benefit somewhat from the anticipated higher short term

rates," said Mr. Sidhu. "This allows our team members to

focus on generating earnings from the business of banking,

aggregating deposits and making loans to customers in the

communities we serve," concluded Mr. Sidhu.

Diversified Loan Portfolio

Customers is a Business Bank that principally focuses on four

lending activities; commercial and industrial loans to privately

held businesses, multi-family loans principally to high net worth

families, selected commercial real estate loans, and commercial

loans and banking services to privately held mortgage companies.

Commercial and industrial loans, including owner-occupied

commercial real estate loans, and commercial loans to mortgage

companies, were approximately $3.5 billion at December 31,

2016. Multi-family loans, or loans to high net worth families, were

approximately $3.2 billion at December 31, 2016. Non-owner

occupied commercial real estate loans were approximately $1.2

billion at December 31, 2016. Consumer and residential

mortgage loans make up only about 4% of the loan portfolio.

Investment in Religare Enterprises Limited

In 2013, Customers invested approximately $23.0 million to

acquire 4.1 million common shares of Religare Enterprises Limited

("Religare"), a company headquartered near New Delhi, India

pursuant to a strategy to develop strong U.S. and India

correspondent banking relationships subsequent to Religare applying

for a license to provide banking services in India. As

Religare has been unable to obtain a banking license after three

years, and current prospects for obtaining such a license are

uncertain at this point, Customers' Board of Directors has decided

to exit its investment in Religare common stock. As a result

of this decision, and in accordance with generally accepted

accounting principles, Customers has reduced its recorded

investment in Religare common stock to the current market value and

recognized a loss of $7.3 million. Customers continues to

study its alternatives on how to exit the investment. As the

decline in fair value of the Religare stock is considered a capital

loss for U.S. tax purposes, and as Customers does not have

offsetting capital gains or prospects for generating such

offsetting gains at this time, the deferred tax benefits related to

this impairment have been fully reserved.

The table below provides supporting calculations for certain

earnings and earnings per share amounts reported in this press

release.

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

|

|

|

|

|

EARNINGS SUMMARY - UNAUDITED |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing

Operations: |

|

|

|

|

|

|

|

| |

Twelve Months Ended December 31,

2016 |

|

Three Months Ended December 31,

2016 |

| (amounts in thousands

except per share amounts) |

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

| Net income from

continuing operations |

$ |

87,707 |

|

|

— |

|

|

$ |

23,337 |

|

|

— |

|

| Preferred stock

dividends |

(9,515 |

) |

|

— |

|

|

(3,615 |

) |

|

— |

|

| GAAP net income from

continuing operations available to common shareholders |

$ |

78,192 |

|

|

$ |

2.61 |

|

|

$ |

19,722 |

|

|

$ |

0.62 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Impairment charge |

7,262 |

|

|

0.24 |

|

|

7,262 |

|

|

0.23 |

|

| Adoption

of ASU 2016-9: Effect to tax expense |

(4,136 |

) |

|

(0.14 |

) |

|

(3,580 |

) |

|

(0.11 |

) |

| Adoption

of ASU 2016-9: Effect on diluted shares |

— |

|

|

0.05 |

|

|

— |

|

|

0.02 |

|

| Net

income from continuing operations available to common shareholders

excluding impairment charge and ASU 2016-09 |

$ |

81,318 |

|

|

$ |

2.76 |

|

|

$ |

23,404 |

|

|

$ |

0.76 |

|

| |

|

|

|

|

|

|

|

| Average common shares

outstanding - diluted |

|

|

30,014 |

|

|

|

|

31,582 |

|

| Less effect on diluted

shares per adoption of ASU 2016-9 |

|

|

(559 |

) |

|

|

|

(669 |

) |

| Average common shares

outstanding - diluted (before ASU 2016-9 adoption) |

|

|

29,455 |

|

|

|

|

30,913 |

|

| |

|

|

|

|

|

|

|

| Combined

Operations:Continuing and Discontinued

Operations |

|

|

|

|

|

|

|

| |

Twelve Months Ended December 31,

2016 |

|

Three Months Ended December 31,

2016 |

| (amounts in thousands

except per share amounts) |

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

| GAAP net income

available to common shareholders |

$ |

69,187 |

|

|

$ |

2.31 |

|

|

$ |

16,213 |

|

|

$ |

0.51 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Impairment charge |

7,262 |

|

|

0.24 |

|

|

7,262 |

|

|

0.23 |

|

| Adoption

of ASU 2016-9: Effect to tax expense |

(4,136 |

) |

|

(0.14 |

) |

|

(3,580 |

) |

|

(0.11 |

) |

| Adoption

of ASU 2016-9: Effect on diluted shares |

— |

|

|

0.05 |

|

|

— |

|

|

0.01 |

|

| Net

income available to common shareholders excluding impairment charge

and ASU 2016-09 |

$ |

72,313 |

|

|

$ |

2.46 |

|

|

$ |

19,895 |

|

|

$ |

0.64 |

|

| |

|

|

|

|

|

|

|

| Average common shares

outstanding - diluted |

|

|

30,014 |

|

|

|

|

31,582 |

|

| Less effect on diluted

shares per adoption of ASU 2016-9 |

|

|

(559 |

) |

|

|

|

(669 |

) |

| Average common shares

outstanding - diluted (before ASU 2016-9 adoption) |

|

|

29,455 |

|

|

|

|

30,913 |

|

Conference Call

| Date: |

Thursday, January 26,

2017 |

| Time: |

9:00 AM ET |

| US Dial-in: |

888-609-5668 |

| International

Dial-in: |

913-643-0955 |

| Participant

Code: |

919167 |

Please dial in at least 10 minutes before the start of the call

to ensure timely participation. A playback of the call will

be available beginning January 26, 2017 at 12:00 noon ET until

12:00 noon ET on February 25, 2017. To listen, call within the

United States (888) 203-1112. Please use the replay pin number

1287334.

Institutional Background

Customers Bancorp, Inc. is a bank holding company located in

Wyomissing, Pennsylvania engaged in banking and related business

through its bank subsidiary, Customers Bank. Customers Bank

is a community-based, full-service bank with assets of

approximately $9.4 billion that was named one of Forbes magazine's

2016 100 Best Banks in America (there are over 6,200 banks in the

United States). A member of the Federal Reserve System with

deposits insured by the Federal Deposit Insurance Corporation,

Customers Bank is an equal opportunity lender that provides a range

of banking services to small and medium-sized businesses,

professionals, individuals and families through offices in

Pennsylvania, New York, Rhode Island, New Hampshire, Massachusetts,

and New Jersey. Committed to fostering customer loyalty,

Customers Bank uses a High Tech/High Touch strategy that includes

use of industry-leading technology to provide customers better

access to their money, as well as Concierge Banking® by appointment

at customers’ homes or offices 12 hours a day, seven days a week.

Customers Bank offers a continually expanding portfolio of loans to

small businesses, multi-family projects, mortgage companies and

consumers. BankMobile is a division of Customers Bank,

offering state of the art high tech digital banking services with

high level of personal customer service.

Customers Bancorp, Inc. voting common shares are listed on the

New York Stock Exchange under the symbol CUBI. Additional

information about Customers Bancorp, Inc. can be found on the

Company’s website, www.customersbank.com.

“Safe Harbor” Statement

In addition to historical information, this press release may

contain "forward-looking statements" within the meaning of the

"safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include

statements with respect to Customers Bancorp, Inc.'s strategies,

goals, beliefs, expectations, estimates, intentions, capital

raising efforts, financial condition and results of operations,

future performance and business. Statements preceded by, followed

by, or that include the words "may," "could," "should," "pro

forma," "looking forward," "would," "believe," "expect,"

"anticipate," "estimate," "intend," "plan," or similar expressions

generally indicate a forward-looking statement. These

forward-looking statements involve risks and uncertainties that are

subject to change based on various important factors (some of

which, in whole or in part, are beyond Customers Bancorp, Inc.'s

control). Numerous competitive, economic, regulatory, legal and

technological factors, among others, could cause Customers Bancorp,

Inc.'s financial performance to differ materially from the goals,

plans, objectives, intentions and expectations expressed in such

forward-looking statements. In addition, important factors relating

to the acquisition of the Disbursements business, the combination

of Customers’ BankMobile business with the acquired Disbursements

business and the implementation of Customers Bancorp, Inc.'s

strategy regarding BankMobile, including with respect to the

expected disposition of the BankMobile business, depending upon

market conditions and opportunities, also could cause Customers

Bancorp's actual results to differ from those in the

forward-looking statements. Customers Bancorp, Inc. cautions

that the foregoing factors are not exclusive, and neither such

factors nor any such forward-looking statement takes into account

the impact of any future events. All forward-looking statements and

information set forth herein are based on management's current

beliefs and assumptions as of the date hereof and speak only as of

the date they are made. For a more complete discussion of the

assumptions, risks and uncertainties related to our business, you

are encouraged to review Customers Bancorp, Inc.'s filings with the

Securities and Exchange Commission, including its most recent

annual report on Form 10-K for the year ended December 31, 2015,

subsequently filed quarterly reports on Form 10-Q, and current

reports on Form 8-K that update or provide information in addition

to the information included in the Form 10-K and 10-Q

filings. Customers Bancorp, Inc. does not undertake to update

any forward-looking statement whether written or oral, that may be

made from time to time by Customers Bancorp, Inc. or by or on

behalf of Customers Bank.

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE MONTHS

ENDED - UNAUDITED |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

| |

Q4 |

|

Q3 |

|

Q4 |

| |

2016 |

|

2016 |

|

2015 |

| Interest income: |

|

|

|

|

|

| Loans

receivable, including fees |

$ |

59,502 |

|

|

$ |

60,362 |

|

|

$ |

50,095 |

|

| Loans

held for sale |

19,198 |

|

|

18,737 |

|

|

13,125 |

|

|

Investment securities |

3,418 |

|

|

3,528 |

|

|

3,506 |

|

|

Other |

1,491 |

|

|

1,585 |

|

|

987 |

|

| Total

interest income |

83,609 |

|

|

84,212 |

|

|

67,713 |

|

| |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

Deposits |

13,897 |

|

|

13,004 |

|

|

9,285 |

|

| Other

borrowings |

1,571 |

|

|

1,642 |

|

|

1,573 |

|

| FHLB

advances |

2,322 |

|

|

3,291 |

|

|

1,698 |

|

|

Subordinated debt |

1,685 |

|

|

1,685 |

|

|

1,685 |

|

| Total

interest expense |

19,475 |

|

|

19,622 |

|

|

14,241 |

|

| Net

interest income |

64,134 |

|

|

64,590 |

|

|

53,472 |

|

| Provision

for loan losses |

(261 |

) |

|

(161 |

) |

|

6,173 |

|

| Net

interest income after provision for loan losses |

64,395 |

|

|

64,751 |

|

|

47,299 |

|

| |

|

|

|

|

|

| Non-interest

income: |

|

|

|

|

|

| Mortgage

warehouse transactional fees |

2,845 |

|

|

3,080 |

|

|

2,530 |

|

| Gain on

sale of loans |

1,549 |

|

|

1,206 |

|

|

859 |

|

|

Bank-owned life insurance |

1,106 |

|

|

1,386 |

|

|

3,599 |

|

| Deposit

fees |

307 |

|

|

302 |

|

|

252 |

|

| Mortgage

loans and banking income |

232 |

|

|

287 |

|

|

135 |

|

|

Interchange and card revenue |

156 |

|

|

160 |

|

|

144 |

|

| (Loss) on

sale of investment securities |

— |

|

|

(1 |

) |

|

— |

|

|

Impairment loss on investment securities |

(7,262 |

) |

|

— |

|

|

— |

|

|

Other |

1,988 |

|

|

4,701 |

|

|

1,781 |

|

| Total

non-interest income |

921 |

|

|

11,121 |

|

|

9,300 |

|

| |

|

|

|

|

|

| Non-interest

expense: |

|

|

|

|

|

| Salaries

and employee benefits |

17,362 |

|

|

17,715 |

|

|

14,585 |

|

|

Professional services |

3,204 |

|

|

2,742 |

|

|

3,324 |

|

|

Occupancy |

2,942 |

|

|

2,303 |

|

|

2,116 |

|

| FDIC

assessments, taxes, and regulatory fees |

1,803 |

|

|

2,635 |

|

|

3,093 |

|

|

Technology, communication and bank operations |

1,300 |

|

|

6,755 |

|

|

2,509 |

|

| Loan

workout |

566 |

|

|

592 |

|

|

586 |

|

| Other

real estate owned |

290 |

|

|

1,192 |

|

|

491 |

|

|

Advertising and promotion |

94 |

|

|

146 |

|

|

202 |

|

|

Other |

2,948 |

|

|

2,670 |

|

|

2,681 |

|

| Total

non-interest expense |

30,509 |

|

|

36,750 |

|

|

29,587 |

|

| Income

from continuing operations before income tax expense |

34,807 |

|

|

39,122 |

|

|

27,012 |

|

| Income

tax expense |

11,470 |

|

|

15,834 |

|

|

8,103 |

|

|

Net income from continuing operations |

23,337 |

|

|

23,288 |

|

|

18,909 |

|

| |

|

|

|

|

|

| Loss from

discontinued operations |

(5,659 |

) |

|

(3,357 |

) |

|

(1,811 |

) |

| Income

tax benefit from discontinued operations |

(2,150 |

) |

|

(1,276 |

) |

|

(688 |

) |

| Net loss

from discontinued operations |

(3,509 |

) |

|

(2,081 |

) |

|

(1,123 |

) |

|

Net income |

19,828 |

|

|

21,207 |

|

|

17,786 |

|

|

Preferred stock dividends |

3,615 |

|

|

2,552 |

|

|

1,006 |

|

|

Net income available to common shareholders |

$ |

16,213 |

|

|

$ |

18,655 |

|

|

$ |

16,780 |

|

| |

|

|

|

|

|

| Basic

earnings per common share from continuing operations |

$ |

0.68 |

|

|

$ |

0.76 |

|

|

$ |

0.67 |

|

| Basic

earnings per common share |

$ |

0.56 |

|

|

$ |

0.68 |

|

|

$ |

0.62 |

|

| Diluted

earnings per common share from continuing operations |

$ |

0.62 |

|

|

$ |

0.70 |

|

|

$ |

0.62 |

|

| Diluted

earnings per common share |

$ |

0.51 |

|

|

$ |

0.63 |

|

|

$ |

0.58 |

|

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE TWELVE MONTHS

ENDED - UNAUDITED |

|

(Dollars in thousands, except per share data) |

|

|

|

| |

December 31, |

|

December 31, |

| |

2016 |

|

2015 |

| Interest income: |

|

|

|

| Loans

receivable, including fees |

$ |

233,349 |

|

|

$ |

182,280 |

|

| Loans

held for sale |

69,469 |

|

|

51,553 |

|

|

Investment securities |

14,293 |

|

|

10,405 |

|

|

Other |

5,428 |

|

|

5,612 |

|

| Total

interest income |

322,539 |

|

|

249,850 |

|

| |

|

|

|

| Interest expense: |

|

|

|

|

Deposits |

48,249 |

|

|

33,973 |

|

| Other

borrowings |

6,438 |

|

|

6,096 |

|

| FHLB

advances |

11,597 |

|

|

6,743 |

|

|

Subordinated debt |

6,739 |

|

|

6,739 |

|

| Total

interest expense |

73,023 |

|

|

53,551 |

|

| Net

interest income |

249,516 |

|

|

196,299 |

|

| Provision

for loan losses |

2,345 |

|

|

20,566 |

|

| Net

interest income after provision for loan losses |

247,171 |

|

|

175,733 |

|

| |

|

|

|

| Non-interest

income: |

|

|

|

| Mortgage

warehouse transactional fees |

11,547 |

|

|

10,394 |

|

|

Bank-owned life insurance |

4,736 |

|

|

7,006 |

|

| Gain on

sale of loans |

3,685 |

|

|

4,047 |

|

| Deposit

fees |

1,140 |

|

|

943 |

|

| Mortgage

loans and banking income |

969 |

|

|

741 |

|

|

Interchange and card revenue |

620 |

|

|

536 |

|

| Gain

(loss) on sale of investment securities |

25 |

|

|

(85 |

) |

|

Impairment loss on investment securities |

(7,262 |

) |

|

— |

|

|

Other |

7,705 |

|

|

3,990 |

|

| Total

non-interest income |

23,165 |

|

|

27,572 |

|

| |

|

|

|

| Non-interest

expense: |

|

|

|

| Salaries

and employee benefits |

67,877 |

|

|

56,341 |

|

|

Technology, communication and bank operations |

12,888 |

|

|

9,379 |

|

| FDIC

assessments, taxes, and regulatory fees |

12,568 |

|

|

10,110 |

|

|

Professional services |

11,017 |

|

|

9,386 |

|

|

Occupancy |

9,846 |

|

|

8,467 |

|

| Loan

workout |

2,063 |

|

|

1,127 |

|

| Other

real estate owned |

1,953 |

|

|

2,516 |

|

|

Advertising and promotion |

576 |

|

|

697 |

|

|

Other |

12,429 |

|

|

9,545 |

|

| Total

non-interest expense |

131,217 |

|

|

107,568 |

|

| Income

before income tax expense |

139,119 |

|

|

95,737 |

|

| Income

tax expense |

51,412 |

|

|

32,664 |

|

|

Net income from continuing operations |

87,707 |

|

|

63,073 |

|

| |

|

|

|

| Loss from

discontinued operations |

(14,524 |

) |

|

(7,242 |

) |

| Income

tax benefit from discontinued operations |

(5,519 |

) |

|

(2,752 |

) |

| Net loss

from discontinued operations |

(9,005 |

) |

|

(4,490 |

) |

|

Net income |

78,702 |

|

|

58,583 |

|

|

Preferred stock dividends |

9,515 |

|

|

2,493 |

|

|

Net income available to common shareholders |

$ |

69,187 |

|

|

$ |

56,090 |

|

| |

|

|

|

| Basic

earnings per common share from continuing operations |

$ |

2.83 |

|

|

$ |

2.26 |

|

| Basic

earnings per common share |

$ |

2.51 |

|

|

$ |

2.09 |

|

| Diluted

earnings per common share from continuing operations |

$ |

2.61 |

|

|

$ |

2.11 |

|

| Diluted

earnings per common share |

$ |

2.31 |

|

|

$ |

1.96 |

|

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEET -

UNAUDITED |

| (Dollars in

thousands) |

| |

December 31, |

|

December 31, |

| |

2016 |

|

2015 |

|

ASSETS |

|

|

|

| Cash and due from

banks |

$ |

17,485 |

|

|

$ |

53,550 |

|

| Interest-earning

deposits |

227,224 |

|

|

211,043 |

|

| Cash and

cash equivalents |

244,709 |

|

|

264,593 |

|

| Investment securities

available for sale, at fair value |

493,474 |

|

|

560,253 |

|

| Loans held for

sale |

2,117,510 |

|

|

1,797,064 |

|

| Loans receivable |

6,142,390 |

|

|

5,452,895 |

|

| Allowance for loan

losses |

(37,315 |

) |

|

(35,647 |

) |

| Total

loans receivable, net of allowance for loan losses |

6,105,075 |

|

|

5,417,248 |

|

| FHLB, Federal Reserve

Bank, and other restricted stock |

68,408 |

|

|

90,841 |

|

| Accrued interest

receivable |

23,690 |

|

|

19,939 |

|

| Bank premises and

equipment, net |

12,259 |

|

|

11,146 |

|

| Bank-owned life

insurance |

161,494 |

|

|

157,211 |

|

| Other real estate

owned |

3,108 |

|

|

5,057 |

|

| Goodwill and other

intangibles |

3,639 |

|

|

3,651 |

|

| Assets held for

sale |

79,271 |

|

|

2,680 |

|

| Other assets |

70,099 |

|

|

68,522 |

|

|

Total assets |

$ |

9,382,736 |

|

|

$ |

8,398,205 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

| Demand, non-interest

bearing deposits |

$ |

512,664 |

|

|

$ |

408,874 |

|

| Interest-bearing

deposits |

6,334,316 |

|

|

5,253,559 |

|

| Total

deposits |

6,846,980 |

|

|

5,662,433 |

|

| Federal funds

purchased |

83,000 |

|

|

70,000 |

|

| FHLB advances |

868,800 |

|

|

1,625,300 |

|

| Other borrowings |

87,123 |

|

|

86,457 |

|

| Subordinated debt |

108,783 |

|

|

108,685 |

|

| Liabilities held for

sale |

484,797 |

|

|

247,139 |

|

| Accrued interest

payable and other liabilities |

47,381 |

|

|

44,289 |

|

|

Total liabilities |

8,526,864 |

|

|

7,844,303 |

|

| |

|

|

|

| Preferred stock |

217,471 |

|

|

55,569 |

|

| Common stock |

30,820 |

|

|

27,432 |

|

| Additional paid in

capital |

427,008 |

|

|

362,607 |

|

| Retained earnings |

193,698 |

|

|

124,511 |

|

| Accumulated other

comprehensive income (loss) |

(4,892 |

) |

|

(7,984 |

) |

| Treasury stock, at

cost |

(8,233 |

) |

|

(8,233 |

) |

|

Total shareholders' equity |

855,872 |

|

|

553,902 |

|

|

Total liabilities & shareholders' equity |

$ |

9,382,736 |

|

|

$ |

8,398,205 |

|

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES |

|

|

AVERAGE BALANCE SHEET / NET INTEREST MARGIN

(UNAUDITED) |

|

| (Dollars in thousands) |

|

|

|

|

|

|

| |

Three months ended |

|

| |

December 31, |

|

September 30 |

|

December 31, |

|

| |

2016 |

|

2016 |

|

2015 |

|

| |

Average Balance |

Average yield or cost (%) |

|

Average Balance |

Average yield or cost (%) |

|

Average Balance |

Average yield or cost (%) |

|

|

Assets |

|

|

|

|

|

|

|

|

|

| Interest earning

deposits |

$ |

265,432 |

|

0.56 |

% |

|

$ |

237,753 |

|

0.55 |

% |

|

$ |

199,142 |

|

0.31 |

% |

|

| Investment

securities |

515,549 |

|

2.65 |

% |

|

534,333 |

|

2.64 |

% |

|

541,541 |

|

2.59 |

% |

|

| Loans held for

sale |

2,121,899 |

|

3.60 |

% |

|

2,124,097 |

|

3.51 |

% |

|

1,572,068 |

|

3.31 |

% |

|

| Loans receivable |

6,037,739 |

|

3.92 |

% |

|

6,116,864 |

|

3.93 |

% |

|

5,119,391 |

|

3.88 |

% |

|

| Other interest-earning

assets |

66,587 |

|

6.68 |

% |

|

90,010 |

|

5.56 |

% |

|

70,689 |

|

4.68 |

% |

|

| Total interest earning

assets |

9,007,206 |

|

3.69 |

% |

|

9,103,057 |

|

3.68 |

% |

|

7,502,831 |

|

3.58 |

% |

|

| Non-interest earning

assets |

256,620 |

|

|

|

268,768 |

|

|

|

266,050 |

|

|

|

| Assets held for

sale |

75,332 |

|

|

|

67,748 |

|

|

|

2,840 |

|

|

|

|

Total assets |

$ |

9,339,158 |

|

|

|

$ |

9,439,573 |

|

|

|

$ |

7,771,721 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

| Total interest bearing

deposits (1) |

$ |

6,382,010 |

|

0.87 |

% |

|

$ |

6,147,771 |

|

0.84 |

% |

|

$ |

5,168,402 |

|

0.71 |

% |

|

| Borrowings |

919,462 |

|

2.42 |

% |

|

1,586,262 |

|

1.66 |

% |

|

1,292,624 |

|

1.52 |

% |

|

| Total interest bearing

liabilities |

7,301,472 |

|

1.06 |

% |

|

7,734,033 |

|

1.01 |

% |

|

6,461,026 |

|

0.87 |

% |

|

| Non-interest bearing

deposits (1) |

546,827 |

|

|

|

533,601 |

|

|

|

418,640 |

|

|

|

| Non-interest bearing

deposits held for sale (1) |

544,900 |

|

|

|

329,834 |

|

|

|

296,348 |

|

|

|

| Total deposits &

borrowings |

8,393,199 |

|

0.92 |

% |

|

8,597,468 |

|

0.91 |

% |

|

7,176,014 |

|

0.79 |

% |

|

| Other non-interest

bearing liabilities |

81,136 |

|

|

|

100,687 |

|

|

|

43,287 |

|

|

|

| Liabilities held for

sale |

30,343 |

|

|

|

31,015 |

|

|

|

2,130 |

|

|

|

|

Total liabilities |

8,504,678 |

|

|

|

8,729,170 |

|

|

|

7,221,431 |

|

|

|

|

Shareholders' equity |

834,480 |

|

|

|

710,403 |

|

|

|

550,290 |

|

|

|

|

Total liabilities and shareholders' equity |

$ |

9,339,158 |

|

|

|

$ |

9,439,573 |

|

|

|

$ |

7,771,721 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net interest

margin |

|

2.83 |

% |

|

|

2.82 |

% |

|

|

2.83 |

% |

|

| Net interest

margin tax equivalent |

|

2.84 |

% |

|

|

2.83 |

% |

|

|

2.83 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| (1) Total costs of deposits (including interest bearing and

non-interest bearing) were 0.74%, 0.74% and 0.63% for the three

months ended December 31, 2016, September 30, 2016 and December 31,

2015, respectively. |

|

| |

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES |

|

|

AVERAGE BALANCE SHEET / NET INTEREST MARGIN

(UNAUDITED) |

|

| (Dollars in thousands) |

|

|

|

| |

Twelve months ended |

|

| |

December 31, |

|

December 31, |

|

| |

2016 |

|

2015 |

|

| |

Average Balance |

Average yield or cost (%) |

|

Average Balance |

Average yield or cost (%) |

|

|

Assets |

|

|

|

|

|

|

| Interest earning

deposits |

$ |

225,409 |

|

0.54 |

% |

|

$ |

271,201 |

|

0.26 |

% |

|

| Investment

securities |

540,532 |

|

2.64 |

% |

|

427,638 |

|

2.43 |

% |

|

| Loans held for

sale |

1,967,436 |

|

3.53 |

% |

|

1,589,176 |

|

3.24 |

% |

|

| Loans receivable |

5,971,530 |

|

3.91 |

% |

|

4,635,136 |

|

3.93 |

% |

|

| Other interest-earning

assets |

84,797 |

|

4.96 |

% |

|

72,693 |

|

6.73 |

% |

|

| Total interest earning

assets |

8,789,704 |

|

3.67 |

% |

|

6,995,844 |

|

3.57 |

% |

|

| Non-interest earning

assets |

272,253 |

|

|

|

263,997 |

|

|

|

| Assets held for

sale |

$ |

40,160 |

|

|

|

$ |

2,690 |

|

|

|

|

Total assets |

$ |

9,102,117 |

|

|

|

$ |

7,262,531 |

|

|

|

| |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

| Total interest bearing

deposits (1) |

$ |

5,945,392 |

|

0.81 |

% |

|

$ |

4,659,785 |

|

0.73 |

% |

|

| Borrowings |

1,498,899 |

|

1.65 |

% |

|

1,369,841 |

|

1.43 |

% |

|

| Total interest-bearing

liabilities |

7,444,291 |

|

0.98 |

% |

|

6,029,626 |

|

0.89 |

% |

|

| Non-interest-bearing

deposits (1) |

496,571 |

|

|

|

379,196 |

|

|

|

| Non-interest bearing

deposits held for sale (1) |

377,028 |

|

|

|

312,963 |

|

|

|

| Total deposits &

borrowings |

8,317,890 |

|

0.88 |

% |

|

6,721,785 |

|

0.80 |

% |

|

| Other non-interest

bearing liabilities |

69,442 |

|

|

|

30,348 |

|

|

|

| Liabilities held for

sale |

17,884 |

|

|

|

1,207 |

|

|

|

|

Total liabilities |

8,405,216 |

|

|

|

6,753,340 |

|

|

|

|

Shareholders' equity |

696,901 |

|

|

|

509,191 |

|

|

|

|

Total liabilities and shareholders' equity |

$ |

9,102,117 |

|

|

|

$ |

7,262,531 |

|

|

|

| |

|

|

|

|

|

|

| Net interest

margin |

|

2.84 |

% |

|

|

2.81 |

% |

|

| Net interest

margin tax equivalent |

|

2.84 |

% |

|

|

2.81 |

% |

|

| |

|

|

|

|

|

|

| (1) Total costs of deposits (including interest bearing and

non-interest bearing) were 0.71% and 0.63% for the twelve months

ended December 31, 2016 and 2015, respectively. |

|

| |

|

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES |

|

|

|

|

|

PERIOD END LOAN COMPOSITION (UNAUDITED) |

|

|

|

|

| |

|

|

|

|

| (Dollars in

thousands) |

December 31, |

|

December 31, |

|

| |

2016 |

|

2015 |

|

| |

|

|

|

|

| Commercial: |

|

|

|

|

|

Multi-Family |

$ |

3,214,999 |

|

|

$ |

2,948,696 |

|

|

| Mortgage

warehouse |

2,171,763 |

|

|

1,797,753 |

|

|

|

Commercial & Industrial (1) |

1,315,905 |

|

|

1,068,597 |

|

|

|

Commercial Real Estate- Non-Owner Occupied |

1,193,715 |

|

|

956,255 |

|

|

|

Construction |

64,789 |

|

|

87,240 |

|

|

| Total

commercial loans |

7,961,171 |

|

|

6,858,541 |

|

|

| |

|

|

|

|

| Consumer: |

|

|

|

|

|

Residential |

194,197 |

|

|

274,470 |

|

|

|

Manufactured housing |

101,730 |

|

|

113,490 |

|

|

| Other

consumer |

2,726 |

|

|

3,124 |

|

|

| Total

consumer loans |

298,653 |

|

|

391,084 |

|

|

| Deferred

costs and unamortized premiums, net |

76 |

|

|

334 |

|

|

| Total

loans |

$ |

8,259,900 |

|

|

$ |

7,249,959 |

|

|

| |

|

|

|

|

| (1)

Commercial & industrial loans, including owner occupied

commercial real estate. |

|

| |

|

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

|

|

PERIOD END DEPOSIT COMPOSITION (UNAUDITED) |

|

|

|

|

|

|

|

| (Dollars

in thousands) |

December 31, |

|

December 31, |

|

|

|

2016 |

|

2015 |

|

|

|

|

|

|

|

| Demand,

non-interest bearing |

$ |

512,664 |

|

|

$ |

408,874 |

|

|

| Demand,

interest bearing |

339,398 |

|

|

127,215 |

|

|

|

Savings |

40,814 |

|

|

39,337 |

|

|

| Money

market |

3,122,342 |

|

|

2,739,411 |

|

|

| Time

deposits |

2,831,762 |

|

|

2,347,596 |

|

|

| Total

deposits |

$ |

6,846,980 |

|

|

$ |

5,662,433 |

|

|

|

|

|

|

|

|

| BankMobile non-interest bearing deposits included in

liabilities held for sale were $453 million and $245 million

respectively as of December 31, 2016 and 2015. BankMobile

interest bearing deposits included in liabilities held for sale

were $3 million and $2 million respectively as of December 31, 2016

and 2015. |

|

| |

| CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES |

| ASSET QUALITY - UNAUDITED |

|

|

|

|

|

|

(Dollars in thousands) |

As of December 31, 2016 |

As of December 31, 2015 |

|

|

Total Loans |

Non Accrual /NPLs |

Total Credit Reserves |

NPLs / Total Loans |

Total Reserves to Total

NPLs |

Total Loans |

Non Accrual /NPLs |

Total Credit Reserves |

NPLs / Total Loans |

Total Reserves to Total

NPLs |

|

Loan Type |

|

Originated Loans |

|

|

|

|

|

|

|

|

|

|

|

Multi-Family |

$ |

3,211,516 |

|

$ |

— |

|

$ |

11,602 |

|

— |

% |

— |

% |

$ |

2,903,814 |

|

$ |

— |

|

$ |

12,016 |

|

— |

% |

— |

% |

|

Commercial & Industrial (1) |

1,271,237 |

|

10,185 |

|

12,560 |

|

0.80 |

% |

123.32 |

% |

990,621 |

|

2,760 |

|

8,864 |

|

0.28 |

% |

321.16 |

% |

|

Commercial Real Estate- Non-Owner Occupied |

1,158,531 |

|

— |

|

4,569 |

|

— |

% |

— |

% |

906,544 |

|

788 |

|

3,706 |

|

0.09 |

% |

470.30 |

% |

|

Residential |

114,510 |

|

341 |

|

2,270 |

|

0.30 |

% |

665.69 |

% |

113,858 |

|

32 |

|

1,992 |

|

0.03 |

% |

6,225.00 |

% |

|

Construction |

64,789 |

|

— |

|

772 |

|

— |

% |

— |

% |

87,006 |

|

— |

|

1,074 |

|

— |

% |

— |

% |

|

Other consumer |

190 |

|

— |

|

12 |

|

— |

% |

— |

% |

128 |

|

— |

|

9 |

|

— |

% |

— |

% |

|

Total Originated Loans |

5,820,773 |

|

10,526 |

|

31,785 |

|

0.18 |

% |

301.97 |

% |

5,001,971 |

|

3,580 |

|

27,661 |

|

0.07 |

% |

772.65 |

% |

|

Loans Acquired |

|

|

|

|

|

|

|

|

|

|

|

Bank Acquisitions |

167,946 |

|

5,030 |

|

5,244 |

|

3.00 |

% |

104.25 |

% |

206,971 |

|

4,743 |

|

7,492 |

|

2.29 |

% |

157.96 |

% |

|

Loan Purchases |

153,595 |

|

2,236 |

|

1,279 |

|

1.46 |

% |

57.20 |

% |

243,619 |

|

2,448 |

|

1,653 |

|

1.00 |

% |

67.52 |

% |

|

Total Acquired Loans |

321,541 |

|

7,266 |

|

6,523 |

|

2.26 |

% |

89.77 |

% |

450,590 |

|

7,191 |

|

9,145 |

|

1.60 |

% |

127.17 |

% |

|

Deferred costs and unamortized premiums, net |

76 |

|

— |

|