Texas Capital Tops Estimate - Analyst Blog

January 27 2012 - 7:34AM

Zacks

Texas Capital Bancshares Inc. (TCBI) reported

fourth-quarter 2011 operating earnings of 67 cents per share,

surpassing the Zacks Consensus Estimate of 61 cents. The results

were also above the prior-year quarter’s earnings of 32 cents per

share.

Quarterly results of Texas Capital benefited from an increase in

net interest income. However, lower non-interest income and higher

expenses were the dampeners.

Quarter in Detail

Texas Capital’s net interest income was $88.1 million, up 33.6%

from the year-ago quarter. Total loans increased 30% while deposits

were 2% more than the prior-year period. Net interest margin

increased 48 bps basis points (bps) year over year to 4.60%.

Texas Capital’s non-interest income was $9.0 million, down 2.0%

year over year. The decline stemmed from a fall in service charges

on deposit accounts, brokered loan fees and equipment rental

income. The decline was partly offset by an increase in trust fee

income, bank owned life insurance (BOLI) income and other

income.

Additionally, Texas Capital’s non-interest expense grew 12.9%

year over year to $50.4 million. The growth reflects higher

salaries and employee benefit expenses primarily related to

business expansion.

Moreover, the company reported an increase in expenses for

marketing activities and legal and professional activities from the

prior-year quarter. However, lower allowance and other carrying

costs pertaining to real estate owned assets and FDIC insurance

expenses partly offset the increase.

Credit Quality

Credit metrics improved during the quarter at Texas Capital. Net

charge-offs decreased to $3.4 million from $6.3 million in the

prior quarter and $17.0 million in the year-ago quarter.

Net charge-offs as a percentage of average loans on a trailing

12-month basis were 0.58%, falling 32 bps sequentially and 56 bps

year over year. Provisions for credit losses were $6.0 million,

down from $7.0 million in the prior quarter and $12.0 million in

the year-ago quarter.

Moreover, non-accrual loans at Texas Capital were $54.6 million,

or 0.98% of loans held for investment at the end of the reported

quarter, going down from $66.7 million, or 1.26% at the end of the

prior quarter and $112.1 million, or 2.38%, at the end of the

year-ago quarter.

Non-performing assets reported both sequential and

year-over-year decline and equaled 1.58% of the loan portfolio plus

other real estate owned assets, reflecting a sequential drop of 34

bps and a year-over-year decline of 167 bps.

Capital Ratios

Capital ratios were mixed in the quarter. Though Texas Capital’s

Tier 1 capital ratio was 9.6%, down 10 bps sequentially, leverage

ratio was 8.8%, down 100 bps sequentially.

Our Take

For Texas Capital, which has peers such as First

Financial Bankshares Inc. (FFIN) and Cullen/Frost

Bankers Inc. (CFR), the business model remains a chief

growth driver. Additionally, the gain in market share from its

competitors and organic growth augur well. The improvements in the

credit quality metrics were also quite impressive.

However, Texas Capital continues to experience an increase in

expenses. Though the company’s efforts to hire experienced bankers

and expand its presence are encouraging, the resultant expenses

that continues to grow nearly as fast as revenues, negate the

incremental effects of business expansion. Moreover, we believe

that a significant turnaround will remain elusive in the near term,

based on the sluggish economic growth.

Texas Capital retains a Zacks #1 Rank, which translates into a

short-term ‘Strong Buy’ recommendation.

CULLEN FROST BK (CFR): Free Stock Analysis Report

FIRST FIN BK-TX (FFIN): Free Stock Analysis Report

TEXAS CAP BCSHS (TCBI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

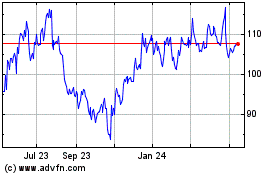

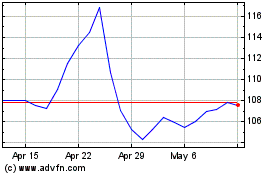

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cullen Frost Bankers (NYSE:CFR)

Historical Stock Chart

From Jul 2023 to Jul 2024