Current Report Filing (8-k)

July 02 2020 - 5:55PM

Edgar (US Regulatory)

00010478620000023632false00010478622020-06-262020-06-260001047862ed:ConsolidatedEdisonCompanyofNewYorkInc.Member2020-06-262020-06-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 26, 2020

Consolidated Edison, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

|

1-14514

|

|

13-3965100

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Irving Place,

|

New York,

|

New York

|

|

10003

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 460-4600

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Consolidated Edison, Inc.,

|

|

ED

|

|

New York Stock Exchange

|

|

Common Shares ($.10 par value)

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

|

On June 26, 2020, Consolidated Edison, Inc. (“Con Edison”) entered into a Commitment Increase Supplement, dated as of June 26, 2020 (the “Commitment Increase Supplement”) between Con Edison and the additional lender party thereto (the “Additional Lender”) and accepted by Bank of America, N.A., as administrative agent (the “Agent”) for the lenders party to the Credit Agreement entered into on April 6, 2020 (the “Supplemental Credit Agreement”) among Con Edison, the lenders party thereto (collectively with the Additional Lender, the “Lenders”) and Bank of America, N.A., as Agent. The Commitment Increase Supplement increases the aggregate principal amount of loans available under the Supplemental Credit Agreement from $750 million to $820 million.

A copy of the Commitment Increase Supplement is included as an exhibit to this report, and this description is qualified in its entirety by reference to the Commitment Increase Supplement.

|

|

|

|

|

|

|

ITEM 2.03

|

CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

|

On July 1, 2020, Con Edison borrowed $820 million pursuant to the Supplemental Credit Agreement, as amended and supplemented by the Commitment Increase Supplement. Con Edison used the proceeds from the borrowing for general corporate purposes, including repayment of short-term debt bearing interest at variable rates.

Pursuant to the Supplemental Credit Agreement, the borrowing bears interest at a variable rate and converted to a term loan on July 2, 2020, which matures on March 29, 2021 (the “Term Loan”). Con Edison has the option to prepay the Term Loan. Subject to certain exceptions, the Term Loan under the Supplemental Credit Agreement is subject to mandatory prepayment with the net cash proceeds of debt or equity issuances by Con Edison or its non-regulated subsidiaries. Upon a change of control of, or upon an event of default by Con Edison under the Supplemental Credit Agreement (an “Event of Default”), the Lenders may declare the Term Loan due and payable. Events of Default include Con Edison exceeding at any time a ratio of consolidated debt to consolidated total capital of 0.65 to 1; having liens on its assets in an aggregate amount exceeding five percent of its consolidated total capital, subject to certain exceptions; Con Edison or any of its subsidiaries failing to make one or more payments in respect of other material financial obligations (in excess of an aggregate $150 million of debt or derivative obligations other than non-recourse debt) when due or within any applicable grace period; the occurrence of an event or condition which results in the acceleration of the maturity of any other material debt (in excess of an aggregate $150 million of debt other than non-recourse debt) or enables the holders of such debt to accelerate the maturity thereof; and other customary events of default.

|

|

|

|

|

|

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

Commitment Increase Supplement, dated as of June 26, 2020, between Con Edison, and the additional lender party thereto and accepted by Bank of America, N.A., as administrative agent.

|

|

Exhibit 104

|

Cover Page Interactive Data File - The cover page iXBRL tags are embedded within the inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED EDISON, INC.

|

|

|

|

|

|

|

|

|

|

|

|

By

|

|

/s/ Robert Muccilo

|

|

|

|

Robert Muccilo

|

|

|

|

Vice President and Controller

|

Date: July 2, 2020

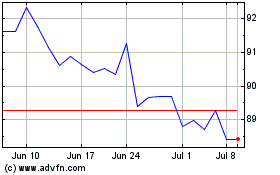

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Mar 2024 to Apr 2024

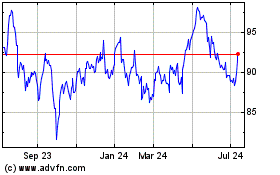

Consolidated Edison (NYSE:ED)

Historical Stock Chart

From Apr 2023 to Apr 2024