ConAgra Foods Inc. (NYSE:CAG): -- Solid Operating Performance;

Three of Four Segments Post Operating Profit Growth -- Fiscal 2007

EPS Outlook Increased Based on 8.7 Million Shares Repurchased This

Quarter ConAgra Foods Inc. (NYSE:CAG), one of North America's

leading packaged food companies, today reported results for the

fiscal 2006 fourth quarter ended May 28, 2006. Fourth-quarter

fiscal 2006 diluted earnings per share were $0.21, including $0.11

per share of net expense from items that impact comparability.

Excluding the $0.11 per share of net expense from items that impact

comparability, fourth-quarter diluted EPS was $0.32. Diluted EPS in

the year-ago period was $0.20, which included $0.06 of net expense

from items that impact comparability. -- Current quarter diluted

EPS of $0.09 from continuing operations includes $0.18 per share of

net expense from items impacting comparability, primarily

restructuring and impairment charges; excluding those items, EPS

from continuing operations was $0.27. -- Current quarter diluted

EPS of $0.12 from discontinued operations includes $0.07 per share

of income from a gain on divestitures; excluding that item, EPS

from discontinued operations was $0.05. Gary Rodkin, ConAgra Foods'

chief executive officer, commented, "We had a solid finish to the

fiscal year, but more importantly, we finalized key aspects of our

organizational restructuring and plant rationalization initiatives

that will result in improved efficiencies." He continued, "As we

communicated when we outlined our three-year plans last March, we

expect fiscal 2007 to show a more efficient cost structure and

appropriately focused marketing investment. Our entire organization

is very focused on achieving our fiscal 2007 financial goals."

During the quarter, the company began reporting its operations in

four segments: Consumer Foods, Food and Ingredients, Trading and

Merchandising, and International Foods. Historical segment results

have been adjusted to reflect the segment changes. Consumer Foods

Segment (57% of annual sales) Branded consumer products sold in

retail and foodservice channels; excludes international consumer

operations. During the quarter, sales for the Consumer Foods

segment were $1.6 billion, roughly equal to the same period last

year, reflecting pricing gains that mostly offset a 2% volume

decline. -- Quarterly sales for the company's top 30 brands which,

as a group, represent over 80% of total segment sales, increased 1%

over year-ago amounts. Many of the company's priority brands posted

year-over-year sales growth. -- Major brands posting sales growth

include Chef Boyardee, Egg Beaters, Hebrew National, Hunt's, Marie

Callender's, Orville Redenbacher's, PAM, and Reddi-wip. -- Major

brands posting sales declines include ACT II, Banquet, Healthy

Choice, Slim Jim, and Snack Pack. -- A more complete list of brand

gains and declines is included in the question-and-answer

supplement to this release, which is posted on the company's Web

site. Segment operating profit was $188 million for the quarter, 2%

ahead of $184 million reported last year. Excluding restructuring

charges of $44 million in the current quarter and $28 million of

severance costs in the year-ago period, current quarter operating

profit grew 9% despite an increase in marketing investment; the

comparable profit growth reflects productivity gains and improved

product mix. Food and Ingredients Segment (28% of annual sales)

Specialty potato, dehydrated vegetable, seasonings, blends,

flavors, and milled products sold to foodservice and commercial

channels worldwide. During the quarter, sales for the Food and

Ingredients segment were $823 million, 6% ahead of last year,

reflecting strong volume growth from Lamb Weston specialty potato

operations, improved volume, pricing, and mix for dehydrated

garlic, onion, and vegetable products, and increased flour selling

prices driven by higher input costs. Segment operating profit was

$93 million for the quarter, 22% ahead of $77 million reported last

year, reflecting the strength of the potato and dehydrated products

operations. There were restructuring charges of $5 million in the

current quarter and $3 million of severance costs in the year-ago

period. Trading and Merchandising Segment (10% of annual sales)

Trading and merchandising agricultural commodities, fertilizer, and

energy worldwide. During the quarter, sales for the Trading and

Merchandising segment were $359 million, 16% below year-ago

amounts; the decrease was driven mostly by lower volumes and

selling prices for wholesale fertilizer operations as well as less

favorable trading conditions for energy-related products. Segment

operating profit was $36 million, 35% below year-ago amounts. The

operating profit decrease reflects substantially lower profits from

energy-related products and fertilizer, although profits from

agricultural commodities such as livestock, grains, and by-products

increased. International Foods Segment (5% of annual sales) Branded

consumer products sold internationally to retail channels. During

the quarter, sales for the International Foods segment were $156

million, roughly equal to the same period last year. Segment

operating profit was $23 million for the quarter, 14% ahead of $20

million reported last year, primarily reflecting a strong sales

performance from mix improvements driven by popcorn and canned

pasta. Results for Canada and Mexico, the largest of the company's

international markets, showed year-over-year profit declines;

however, the company made progress in Asian and Caribbean markets.

Other Items -- For the fourth quarter, corporate expense was $213

million. Current-quarter results include $30 million of expense

related to restructuring charges, $26 million of expense related to

early retirement of debt, and $41 million for a charge related to

an impairment of a note receivable. Prior-year corporate expense of

$124 million included $11 million of expense associated with

headcount reduction. -- Equity investments posted a loss of $18

million for the fourth quarter, reflecting an impairment charge of

$24 million, with no tax benefit, from a revision in the estimated

fair value for an equity method investment. For the same quarter

last year, equity investments posted earnings of $10 million and

included no impairment charges. -- Net interest expense for the

quarter was $54 million compared with $68 million last year. -- The

effective tax rate for continuing operations for the quarter was

11%, reflecting the benefit of changes in estimates related to

certain state and foreign tax matters, partially offset by the

impact of non-deductible impairment charges. The company considers

36% to be the effective tax rate on continuing operations going

forward. The EPS impact of the lower rate is cited as an item

impacting comparability detailed at the end of this release.

Capital Items -- During the quarter, the company completed the

divestiture of its ham and seafood businesses and received pretax

proceeds of approximately $440 million. The gain was approximately

$111 million pretax and approximately $35 million after tax. -- The

company repurchased approximately 8.7 million shares of common

stock during the fourth quarter at a total cost of approximately

$197 million. -- Dividends paid totaled $142 million versus $141

million last year; this reflects the payment on March 1, 2006. --

The dividend action communicated on March 16, 2006, which lowered

the dividend to $0.18 per share per quarter, was reflected in the

June 1, 2006 payment. -- At the end of the fourth quarter,

interest-bearing debt was approximately $3.6 billion, reflecting

the redemption of $250 million of the company's 7.875% senior debt

due September 2010; $500 million of that senior debt is still

outstanding. The current portion of long-term debt reflects $400

million of 7.125% senior debt due October 2026 that has been

reclassified because of a put option that is exercisable by the

holders of the debt from Aug. 1, 2006 to Sept. 1, 2006. Based on

current market conditions, the company does not anticipate the

holders to exercise the put option, and therefore expects to

reclassify the $400 million debt back into senior long-term debt

after Sept. 1, 2006 when the put option expires. -- For the

quarter, total capital expenditures for property, plant, and

equipment were $92 million compared with $102 million in the

year-ago period. Depreciation and amortization expense from

continuing operations was approximately $85 million for the

quarter; this compares with a total of $77 million in the year-ago

period. Discontinued Operations During the second half of fiscal

2006, ConAgra Foods announced the intended divestiture of its ham,

seafood, packaged meats, and cheese operations. Those businesses,

which represented aggregate annual revenue of approximately $2.8

billion, have been reclassified as discontinued operations. During

the fourth quarter, the company completed the sale of its ham and

seafood businesses. Diluted earnings per share from discontinued

operations were $0.12 for the quarter, which includes the gain on

divestitures of $0.07 per share. Excluding that item, EPS from

discontinued operations was $0.05 for the quarter. Impact of Recent

Share Repurchases on Outlook At its March 2006 Analyst and Investor

Event, the company estimated that fiscal 2007 EPS from continuing

operations would be in the range of $1.10 - $1.15. Those amounts

did not reflect any EPS benefit from allocating divestiture

proceeds towards share repurchases or debt reduction. Those amounts

also do not reflect items that could impact comparability,

including but not limited to restructuring and impairment charges

and gains and losses on sales of assets; the timing of such events

and therefore the impact on fiscal 2007 EPS cannot be estimated at

this time. During the fourth quarter of fiscal 2006, the company

repurchased approximately $197 million of its stock; this is

expected to add approximately $0.02 of annual benefit to the

previously cited EPS goals. Regarding divestitures yet to be

completed, the company notes that the plans are proceeding as

expected. To the extent that the company completes any significant

transactions in fiscal 2007, it is uncertain whether the company

would receive proceeds in time for any resulting share repurchases

or debt reduction to significantly impact the EPS outlook for

fiscal 2007. This reflects the customary delay between reaching an

agreement and receiving proceeds, and the fact that the company may

conduct its share repurchases at only certain times within the

fiscal year. Quarterly Earnings Patterns in Fiscal 2007 The company

expects to achieve its fiscal 2007 EPS target of $1.12 - $1.17 from

continuing operations, which includes the $0.02 benefit discussed

above and does not reflect items that could impact comparability.

The company is not offering guidance with regard to contribution

from discontinued operations, as those are expected to be sold

during the fiscal year. The company has the following quarterly

expectations for EPS from continuing operations, excluding items

that impact comparability, in fiscal 2007: -- First-quarter fiscal

2007 EPS from continuing operations is expected to be in the range

of $0.04 lower than comparable year-ago amounts. This primarily

reflects the fact that the commodity trading and merchandising

operations had an extremely strong performance in the first quarter

of fiscal 2006, and the company does not plan to repeat this

performance in the first quarter of fiscal 2007. -- The company

expects year-over-year improvement in EPS from continuing

operations in the second through fourth quarters, largely driven by

progress with the cost-savings initiatives under way in general and

administrative functions as well as the supply chain. Other

Reference At its Analyst and Investor Event last March, the company

announced plans to focus on increasing shareholder value by

delivering more consistent, sustainable profit growth over time.

These plans involve increasing investment behind the most promising

brands, achieving significant cost savings in manufacturing and

administrative functions, and divesting non-core operations. For

more details on the plans, please see

www.conagrafoods.com/investors, which references the Analyst and

Investor Event on March 16, 2006. In addition, the company has

posted a question-and-answer supplement relating to this release at

www.conagrafoods.com/investors. To view recent company news, please

visit www.conagrafoods.com/media. Major Items Affecting

Fourth-Quarter Fiscal 2006 EPS Comparability Included in the $0.21

diluted EPS for the fourth quarter of fiscal 2006 (EPS amounts

rounded and after tax): Classified within Continuing Operations: --

Expense of $0.09 per diluted share, or $79 million pretax, for

restructuring charges related to programs designed to reduce the

company's ongoing operating costs. These are classified as $44

million of expense within the Consumer Foods segment, $5 million of

expense within the Food and Ingredients segment, and $30 million of

corporate expense. -- Expense of $0.05 per diluted share, or $41

million pretax, for a charge related to a note receivable, which is

included in corporate expense. -- Expense of $0.05 per diluted

share, or $24 million, resulting from asset impairment charges

associated with an equity method investment, and classified within

the results of equity method investments. There is no tax benefit

related to these charges. -- Expense of $0.03 per diluted share, or

$26 million pretax, for a charge related to early retirement of

debt, which is included in corporate expense. -- Benefit of $0.04

per diluted share for a lower than normal tax rate. Classified

within Discontinued Operations: -- Gain of $0.07 per diluted share

on divestitures of businesses included in discontinued operations.

Included in the $0.20 diluted EPS for the fourth quarter of fiscal

2005 (EPS amounts after tax): -- Expense of $0.05 per diluted

share, or $43 million pretax, related to headcount reduction

program. -- Expense of $0.01 per diluted share, related to change

in estimated effective state income tax rates. Discussion of

Results ConAgra Foods will host a conference call at 9 a.m. EDT to

discuss fourth-quarter results. Following the company's remarks,

the call will include a question-and-answer session with the

investment community. Domestic and international participants may

access the conference call toll-free by dialing 1-877-447-8217 and

1-706-679-0415, respectively. No confirmation or pass code is

needed. This conference call also can be accessed live on the

Internet at www.conagrafoods.com/investors. A rebroadcast of the

conference call will be available after 1 p.m. EDT. To access the

digital replay, a conference ID number will be required. Domestic

participants should dial 1-800-642-1687, and international

participants should dial 1-706-645-9291 and enter conference ID

9609787. A rebroadcast also will be available on the company's Web

site. ConAgra Foods Inc. (NYSE:CAG) is one of North America's

largest packaged food companies, serving grocery retailers, as well

as restaurants and other foodservice establishments. Popular

ConAgra Foods consumer brands include: Banquet, Chef Boyardee, Egg

Beaters, Healthy Choice, Hebrew National, Hunt's, Marie

Callender's, Orville Redenbacher's, PAM, Reddi-wip, and many

others. Note on Forward-Looking Statements: This news release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are based on management's current views and assumptions of future

events and financial performance and are subject to uncertainty and

changes in circumstances. Readers of this release should understand

that these statements are not guarantees of performance or results.

Many factors could affect the company's actual financial results

and cause them to vary materially from the expectations contained

in the forward-looking statements. These factors include, among

other things, future economic circumstances, industry conditions,

company performance and financial results, availability and prices

of raw materials, product pricing, competitive environment and

related market conditions, operating efficiencies, access to

capital, actions of governments and regulatory factors affecting

the company's businesses and other risks described in the company's

reports filed with the Securities and Exchange Commission. The

company cautions readers not to place undue reliance on any

forward-looking statements included in this release, which speak

only as of the date made. -0- *T ConAgra Foods, Inc. Segment

Operating Results: CONTINUING OPERATIONS In millions FOURTH QUARTER

------------------------------------- 13 Weeks Ended 13 Weeks Ended

-------------- -------------- ------- Percent May 28, 2006 May 29,

2005 Change -------------- -------------- ------- SALES -----

Consumer Foods $1,637.2 $1,642.4 (0.3)% International Foods 155.5

155.1 0.3% Food and Ingredients 823.0 774.0 6.3% Trading and

Merchandising 358.9 427.1 (16.0)% -------------- --------------

Total 2,974.6 2,998.6 (0.8)% -------------- --------------

OPERATING PROFIT ---------------- Consumer Foods $187.9 $183.4 2.5%

International Foods 22.5 19.7 14.2% Food and Ingredients 93.4 76.6

21.9% Trading and Merchandising 36.0 55.0 (34.5)% --------------

-------------- Total operating profit for segments 339.8 334.7 1.5%

Reconciliation of total operating profit to income from continuing

operations before income taxes and equity method investment

earnings (loss) Items excluded from segment operating profit:

General corporate expense (213.3) (123.8) 72.3% Interest expense,

net (54.4) (67.7) (19.6)% -------------- -------------- Income from

continuing operations before income taxes and equity method

investment earnings (loss) 72.1 143.2 (49.7)% ==============

============== Segment operating profit excludes general corporate

expense, equity method investment earnings (loss) and net interest

expense. Management believes such amounts are not directly

associated with segment performance results for the period.

Management believes the presentation of total operating profit for

segments facilitates period-to-period comparison of results of

segment operations. ConAgra Foods, Inc. Segment Operating Results:

CONTINUING OPERATIONS In millions YEAR TO DATE

------------------------------------- 52 Weeks Ended 52 Weeks Ended

-------------- -------------- ------- Percent May 28, 2006 May 29,

2005 Change -------------- -------------- ------- SALES -----

Consumer Foods $6,600.6 $6,715.4 (1.7)% International Foods 604.4

578.2 4.5% Food and Ingredients 3,188.6 2,985.8 6.8% Trading and

Merchandising 1,185.8 1,224.3 (3.1)% -------------- --------------

Total 11,579.4 11,503.7 0.7% -------------- --------------

OPERATING PROFIT ---------------- Consumer Foods $838.5 $944.4

(11.2)% International Foods 62.3 62.7 (0.6)% Food and Ingredients

358.4 305.9 17.2% Trading and Merchandising 168.7 196.8 (14.3)%

-------------- -------------- Total operating profit for segments

1,427.9 1,509.8 (5.4)% Reconciliation of total operating profit to

income from continuing operations before income taxes and equity

method investment earnings (loss) Items excluded from segment

operating profit: General corporate expense (559.9) (402.2) 39.2%

Gain on sale of Pilgrim's Pride Corporation common stock 329.4

185.7 77.4% Interest expense, net (246.6) (295.0) (16.4)%

-------------- -------------- Income from continuing operations

before income taxes and equity method investment earnings (loss)

$950.8 $998.3 (4.8)% ============== ============== Segment

operating profit excludes general corporate expense, gain on sale

of Pilgrim's Pride Corporation common stock, equity method

investment earnings (loss) and net interest expense. Management

believes such amounts are not directly associated with segment

performance results for the period. Management believes the

presentation of total operating profit for segments facilitates

period-to-period comparison of results of segment operations.

ConAgra Foods, Inc. Consolidated Statements of Earnings In

millions, except per share amounts FOURTH QUARTER

------------------------------------- 13 Weeks Ended 13 Weeks Ended

-------------- -------------- ------- Percent May 28, 2006 May 29,

2005 Change -------------- -------------- ------- Net sales

$2,974.6 $2,998.6 (0.8)% Costs and expenses: Cost of goods sold

2,275.0 2,313.8 (1.7)% Selling, general and administrative expenses

573.1 473.9 20.9% Interest expense, net 54.4 67.7 (19.6)%

-------------- -------------- Income from continuing operations

before income taxes and equity method investment earnings (loss)

72.1 143.2 (49.7)% Income tax expense 5.9 66.2 (91.1)% Equity

method investment earnings (loss) (18.4) 10.0 NA --------------

-------------- Income from continuing operations 47.8 87.0 (45.1)%

Income from discontinued operations, net of tax 60.7 14.8 310.1%

-------------- -------------- Net income $108.5 $101.8 6.6%

============== ============== Earnings per share - basic Income

from continuing operations $0.09 $0.17 (47.1)% Income from

discontinued operations 0.12 0.03 300.0% --------------

-------------- Net income $0.21 $0.20 5.0% ==============

============== Weighted average shares outstanding 516.8 517.3

(0.1)% ============== ============== Earnings per share - diluted

Income from continuing operations $0.09 $0.17 (47.1)% Income from

discontinued operations 0.12 0.03 300.0% --------------

-------------- Net income $0.21 $0.20 5.0% ==============

============== Weighted average share and share equivalents

outstanding 518.8 521.0 (0.4)% ============== ==============

ConAgra Foods, Inc. Consolidated Statements of Earnings In

millions, except per share amounts YEAR TO DATE

-------------------------------------- 52 Weeks Ended 52 Weeks

Ended -------------- -------------- -------- Percent May 28, 2006

May 29, 2005 Change -------------- -------------- -------- Net

sales $11,579.4 $11,503.7 0.7% Costs and expenses: Cost of goods

sold 8,769.2 8,675.3 1.1% Selling, general and administrative

expenses 1,942.2 1,720.8 12.9% Interest expense, net 246.6 295.0

(16.4)% Gain on sale of Pilgrim's Pride Corporation common stock

329.4 185.7 77.4% -------------- -------------- Income from

continuing operations before income taxes and equity method

investment earnings (loss) 950.8 998.3 (4.8)% Income tax expense

308.0 408.0 (24.5)% Equity method investment earnings (loss) (49.6)

(24.8) (100.0)% -------------- -------------- Income from

continuing operations 593.2 565.5 4.9% Income (loss) from

discontinued operations, net of tax (1.2) 76.0 NA --------------

-------------- Net income $592.0 $641.5 (7.7)% ==============

============== Earnings per share - basic Income from continuing

operations $1.14 $1.09 4.5% Income (loss) from discontinued

operations - 0.15 (100.0)% -------------- -------------- Net income

$1.14 $1.24 (8.0)% ============== ============== Weighted average

shares outstanding 518.0 516.2 0.3% ============== ==============

Earnings per share - diluted Income from continuing operations

$1.14 $1.09 4.5% Income (loss) from discontinued operations - 0.14

(100.0)% -------------- -------------- Net income $1.14 $1.23

(7.3)% ============== ============== Weighted average share and

share equivalents outstanding 520.1 520.2 0.0% ==============

============== ConAgra Foods, Inc. Consolidated Balance Sheets In

millions May 28, 2006 May 29, 2005 ------------ ------------ ASSETS

Current assets Cash and cash equivalents $331.6 $207.6 Receivables,

less allowance for doubtful accounts of $27.8 and $30.1 1,180.9

1,260.8 Inventories 2,132.5 2,153.6 Prepaid expenses and other

current assets 741.3 631.3 Current assets held for sale 256.3 521.5

------------ ------------ Total current assets 4,642.6 4,774.8

Property, plant and equipment, net 2,280.7 2,365.0 Goodwill 3,446.1

3,451.5 Brands, trademarks and other intangibles, net 799.5 801.0

Other assets 346.3 798.4 Noncurrent assets held for sale 496.6

852.1 ------------ ------------ $12,011.8 $13,042.8 ============

============ LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Notes payable $10.0 $8.5 Current installments of

long-term debt 421.1 117.3 Accounts payable 868.9 781.6 Advances on

sales 103.2 149.6 Accrued payroll 310.9 269.7 Other accrued

liabilities 1,248.0 1,247.4 Current liabilities held for sale 2.7

65.6 ------------ ------------ Total current liabilities 2,964.8

2,639.7 Senior long-term debt, excluding current installments

2,754.8 3,949.2 Subordinated debt 400.0 400.0 Other noncurrent

liabilities 1,180.8 1,189.3 Noncurrent liabilities held for sale

3.2 5.4 Common stockholders' equity 4,708.2 4,859.2 ------------

------------ $12,011.8 $13,042.8 ============ ============ *T

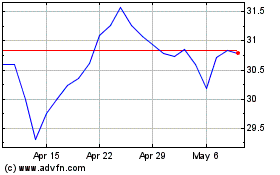

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jul 2023 to Jul 2024