Colgate-Palmolive Company (NYSE:CL) today announced strong

worldwide sales and unit volume growth for first quarter 2010, with

every operating division reporting sales increases. Worldwide sales

were $3,829 million, up 9.5% versus the year ago quarter and unit

volume increased 6.0%. Global pricing was even with the year ago

quarter while foreign exchange added 3.5%. Organic sales (excluding

foreign exchange, acquisitions and divestments) grew 6.0%.

Reported net income and diluted earnings per share for first

quarter 2010 were $357 million and $.69, respectively, as compared

with $508 million and $.97, respectively, in first quarter 2009. As

previously disclosed, first quarter 2010 results were reduced by a

one-time, non-cash aftertax charge of $271 million ($.52 per

diluted share) resulting from a required accounting change related

to the transition to hyperinflationary accounting in Venezuela as

of January 1, 2010. Excluding this charge, net income was $628

million and diluted earnings per share was $1.21, increases of 24%

and 25%, respectively, versus first quarter 2009.

Also as previously disclosed, included in net income for first

quarter 2010 was a one-time gain of $59 million ($.11 per diluted

share) related to the remeasurement of the Venezuelan balance sheet

and lower taxes on accrued but unpaid remittances as a result of

the currency devaluation on January 8, 2010. This gain was

partially offset by the impact of translating our Venezuelan

financial statements at a lower exchange rate as a result of the

devaluation, which reduced net income by approximately $30 million

($.06 per diluted share.) The Company continues to estimate that

the full year impact of the devaluation will be a net reduction in

2010 earnings of $.06 - $.10 per diluted share.

Gross profit margin increased 170 basis points to 59.2% in first

quarter 2010 from 57.5% in the year ago period, primarily

reflecting lower raw and packaging material costs and cost-savings

initiatives.

Selling, general and administrative expenses were 35.4% and

33.9% of net sales in first quarter 2010 and 2009, respectively.

Worldwide advertising costs increased 190 basis points as a

percentage to sales versus the year ago period, to 11.0% from

9.1%.

Operating profit as reported was $678 million in first quarter

2010 compared to $811 million in first quarter 2009. Excluding the

one-time charge resulting from the accounting change related to the

transition to hyperinflationary accounting in Venezuela noted

above, operating profit rose 17% to $949 million in first quarter

2010 from $811 million in first quarter 2009, increasing to 24.8%

from 23.2% as a percent to sales.

Net cash provided by operations year to date increased by 6% to

$733 million. Working capital as a percentage of sales improved by

220 basis points in first quarter 2010 versus the year ago period.

These results reflect the strength of the Company’s overall balance

sheet and key ratios as well as its tight focus on working

capital.

Ian Cook, Chairman, President and Chief Executive Officer,

commented on the results and outlook excluding the one-time charge

related to the transition to hyperinflationary accounting in

Venezuela:

“We are delighted to have started the year so strongly with

first quarter operating profit, net income and earnings per share

all increasing double-digit and global unit volume growing a

healthy 6.0%.

“Our focus on unit volume growth continues to pay off with

global unit volume increasing sequentially in each of the last

three quarters.

“The excellent 170 basis point improvement in gross profit

margin allowed for higher advertising spending behind Colgate’s

brands both in absolute dollars and as a percent to sales, which

helped to drive global market share gains.

“We are delighted that Colgate’s global market shares in

toothpaste and manual toothbrushes are both at record highs year to

date. Colgate’s share of the global toothpaste market strengthened

to 44.4% year to date, led by share gains in Mexico, Brazil, China,

India, Russia, Venezuela and Greece. Colgate also strengthened its

global leadership in manual toothbrushes, with its global market

share in that category reaching 31.5% year to date, up 1.3 share

points versus year ago.

“Overall, we are very pleased to have delivered another quarter

of strong results on both the top and bottom lines, despite

difficult economic conditions around the world.

“Our business fundamentals remain strong and we have a very full

pipeline of new products across categories. We expect the excellent

gross profit margin to continue which should allow for continued

strong advertising spending behind new and existing Colgate

products.

“All this adds to our confidence that this momentum will

continue, which bodes well for another year of double-digit

earnings per share growth in 2010.”

At 11:00 a.m. ET today, Colgate will host a conference call to

elaborate on first quarter results. To access this call as a

webcast, please go to Colgate’s web site at http://www.colgate.com.

The following are comments about divisional performance. See

attached Geographic Sales Analysis and Segment Information

schedules for additional information on divisional sales and

operating profit.

North America (20% of Company

Sales)

North America sales grew 3.0% in the first quarter. Unit volume

increased 5.0% with 3.5% lower pricing and 1.5% positive foreign

exchange. Organic sales grew 1.5% during the quarter. North America

operating profit increased 13% during the quarter due to higher

sales and higher gross profit margins driven by new products,

cost-savings initiatives and lower raw and packaging material

costs.

Colgate’s leadership of the U.S. toothpaste market continued

with its market share at 35.6% year to date, driven by strong sales

of Colgate Total Enamel Strength, Colgate Sensitive Enamel Protect

and Colgate Max White with Mini Bright Strips toothpastes.

Colgate’s share of the manual toothbrush market reached a record

33.6% year to date, up 5.6 share points versus year ago, including

Colgate Wisp mini-brush whose market share is at 4.9% year to date.

Colgate 360° ActiFlex, Colgate Max Fresh and Colgate Max White

manual toothbrushes also contributed to the share gains.

Successful new products contributing to growth in the U.S. in

other categories include Softsoap Nutri Serums and Softsoap Body

Butter Mega Moisture body washes, Softsoap Crisp Cucumber and Melon

and Softsoap Cherry Blossom liquid hand soaps and Ajax Lime with

Bleach Alternative dish liquid.

Recent introductions arriving on store shelves now include

Colgate ProClinical and Colgate Triple Action toothpastes, Colgate

Wisp Plus Whitening mini-brush, Colgate 360° ActiFlex Sonic Power

battery toothbrush, Speed Stick and Lady Speed Stick Stainguard

deodorants, and a relaunch of the entire line of Palmolive dish

liquids with more modernized packaging and an enhanced formula that

cleans more dishes with every drop.

Latin America (26% of Company

Sales)

Latin American sales grew 10.5% and unit volume increased 8.0%.

Volume gains were achieved in nearly every country, led by

significant increases in Brazil, Colombia and Mexico. Higher

pricing added 6.5% and foreign exchange was negative 4.0%. Organic

sales for Latin America grew 14.5% during the quarter. Latin

America operating profit increased 11% during the quarter. Higher

sales and cost-saving initiatives more than offset increased

advertising costs. As a result of the currency devaluation in

Venezuela noted above, operating profit for first quarter 2010

includes a pretax gain of $46 million related to the remeasurement

of the Venezuelan balance sheet, which was substantially offset by

the impact of translating our Venezuelan financial statements at a

lower exchange rate.

Colgate’s strong leadership in oral care throughout Latin

America continues with its regional toothpaste market share at

78.3% year to date, driven by market share gains in nearly every

country. In Brazil, for example, Colgate’s toothpaste market share

reached 70.4% year to date, up 50 basis points versus year ago.

Strong sales of Colgate Sensitive Pro-Alivio, Colgate Total

Professional Sensitive and Colgate Total Professional Whitening

toothpastes drove share gains throughout the region. Colgate’s

leading share of the manual toothbrush market for the region is

38.9% year to date. Strong sales of Colgate 360° ActiFlex, Colgate

Premier Clean and Colgate Classic manual toothbrushes throughout

the region contributed to this success.

In other product categories, Colgate Plax Complete Care and

Colgate Plax Sensitive mouthwashes, Palmolive Perfect Tone and

Protex Propolis bar soaps, Axion Professional dish liquid, Lady

Speed Stick Depil Control and Speed Stick Waterproof deodorants,

Fabuloso Continuous Effect liquid cleaner, and Suavitel GoodBye

Ironing and Suavitel Magic Moments fabric conditioners contributed

to market share gains in the region.

Europe/South Pacific (22% of

Company Sales)

Europe/South Pacific sales increased 14.5% and unit volume

increased 7.0% led by France, Italy, Spain, Denmark, the United

Kingdom, Poland and the GABA business. Pricing decreased 3.0% while

foreign exchange was positive 10.5%. Organic sales for Europe/South

Pacific grew 4.0%. Operating profit for the region increased 34%

during the quarter as higher sales, cost-savings initiatives and

lower raw and packaging material costs more than offset increased

advertising.

Colgate maintained its oral care leadership in the Europe/South

Pacific region with toothpaste share gains in France, Italy,

Portugal, Greece, Austria, Czech Republic, Norway, Poland and

Bulgaria. Successful premium products driving share gains include

Colgate Sensitive Pro-Relief, Colgate Total Advanced Clean, Colgate

Total Advanced Sensitive and Colgate Max Fresh with Mouthwash Beads

toothpastes. In the manual toothbrush category, Colgate 360°

ActiFlex and Colgate Max White toothbrushes contributed to share

gains in key countries throughout the region.

Recent premium innovations contributing to growth in other

product categories include Colgate Plax Alcohol Free and Colgate

Plax Ice mouth rinses, Palmolive Nutrafruit shower creme, Lady

Speed Stick Depil Protect deodorant and Soupline Magic Moments and

Soupline Aroma Tranquility fabric conditioners.

Greater Asia/Africa (19% of

Company Sales)

Greater Asia/Africa sales and unit volume increased 14.5% and

9.0%, respectively. Volume gains in India, the Greater China

region, Thailand, Philippines and Malaysia more than offset a

volume decline in South Africa. Pricing decreased 1.0% and foreign

exchange was positive 6.5%. Organic sales for Greater Asia/Africa

increased 8.0%. Operating profit for the region increased 24%

during the quarter as higher sales, cost-savings initiatives and

lower raw and packaging material costs more than offset increased

advertising.

Colgate maintained its toothpaste leadership in Greater Asia

with market share gains in key countries throughout the region

including India, China, Russia, Philippines, Singapore, Ukraine and

Vietnam. In India, for example, Colgate’s toothpaste market share

reached 51.3% year to date, up 180 basis points versus year ago.

Successful new products driving the share gains throughout the

region include Colgate Sensitive Pro-Relief, Colgate Total

Professional Clean and Colgate 360° Whole Mouth Clean

toothpastes.

Successful products contributing to growth in other categories

in the region include Colgate 360° ActiFlex, Colgate 360° Sensitive

ProRelief, Colgate Max White and Colgate Zig Zag manual

toothbrushes, Colgate Plax Ice mouthwash, Palmolive Spa Banya

shower liquid and Lady Speed Stick Depil Control deodorant.

Hill’s (13% of Company

Sales)

Hill’s sales grew 2.0% during the quarter. Unit volume decreased

2.0%, pricing decreased 0.5% and foreign exchange was positive

4.5%. Volume declined in the U.S., Japan, Italy, Germany and

Turkey, while volume gains were achieved in the United Kingdom,

Taiwan, Mexico and South Korea. Hill’s organic sales declined 2.5%

during the quarter. Operating profit increased 8% during the

quarter as benefits from cost-savings initiatives and lower raw and

packaging material costs more than offset increased

advertising.

Recent new product introductions succeeding in the U.S. include

Science Diet Small and Toy Breed Canine, a significantly expanded

line of Science Diet Simple Essentials Treats Canine launched late

last year, and Prescription Diet j/d Feline, the first therapeutic

food clinically proven to improve mobility in cats with arthritis,

a condition that affects over 90% of cats over the age of 12.

New pet food products contributing to international sales

include Science Plan Snacks Canine and Science Plan Healthy

Mobility Canine, a wellness food that promotes active mobility,

supports joint flexibility and enhances ease of movement.

Innovative new products planned for launch in second quarter

2010 include the international expansion of Science Diet Small and

Toy Breed Canine and the introduction in Europe of Science Plan Vet

Essentials Canine and Feline, a range of veterinary exclusive

products addressing the top five essential health needs of

pets.

* * *

About Colgate-Palmolive: Colgate-Palmolive is a leading global

consumer products company, tightly focused on Oral Care, Personal

Care, Home Care and Pet Nutrition. Colgate sells its products in

over 200 countries and territories around the world under such

internationally recognized brand names as Colgate, Palmolive,

Mennen, Softsoap, Irish Spring, Protex, Sorriso, Kolynos, Elmex,

Tom’s of Maine, Ajax, Axion, Fabuloso, Soupline and Suavitel, as

well as Hill’s Science Diet and Hill’s Prescription Diet. For more

information about Colgate’s global business, visit the Company's

web site at http://www.colgate.com.

Substantially all market share data included in this press

release is compiled from data as measured by ACNielsen.

Cautionary Statement on

Forward-Looking Statements

This press release and the related webcast (other than

historical information) may contain forward-looking statements.

Such statements may relate, for example, to sales or volume growth,

organic sales growth, profit and profit margin growth, earnings

growth, financial goals, the impact of the currency devaluation in

Venezuela, cost-reduction plans, tax rates and new product

introductions. These statements are made on the basis of our views

and assumptions as of this time and we undertake no obligation to

update these statements. We caution investors that any such

forward-looking statements are not guarantees of future performance

and that actual events or results may differ materially from those

statements. Investors should consult the Company’s filings with the

Securities and Exchange Commission (including the information set

forth under the captions “Risk Factors” and “Cautionary Statement

on Forward-Looking Statements” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2009) for information

about certain factors that could cause such differences. Copies of

these filings may be obtained upon request from the Company’s

Investor Relations Department or the Company’s web site at

http://www.colgate.com.

Non-GAAP Financial

Measures

The following provides information regarding the non-GAAP

measures used in this earnings release:

To supplement Colgate's condensed consolidated income statements

presented in accordance with accounting principles generally

accepted in the United States of America (GAAP), the Company has

disclosed non-GAAP measures of operating results that exclude

certain items. Operating profit, operating profit margin, net

income and earnings per share are discussed in this release both as

reported (on a GAAP basis) and excluding the impact of the one-time

charge related to the transition to hyperinflationary accounting in

Venezuela as of January 1, 2010. Management believes these non-GAAP

financial measures provide useful supplemental information to

investors regarding the underlying business trends and performance

of the Company’s ongoing operations and are useful for

period-over-period comparisons of such operations. See “Table 2 –

Non-GAAP Reconciliation” for the three months ended March 31, 2010

and 2009 included with this release for a reconciliation of these

financial measures to the related GAAP measures.

This release discusses organic sales growth (excludes the impact

of foreign exchange, acquisitions and divestments). Management

believes this measure provides investors with useful supplemental

information regarding the Company’s underlying sales trends by

presenting sales growth excluding the external factor of foreign

exchange as well as the impact from acquisitions and divestments.

See “Geographic Sales Analysis, Percentage Changes – First Quarter

2010 vs. 2009” for a comparison of organic sales growth to sales

growth in accordance with GAAP.

The Company uses these financial measures internally in its

budgeting process and as factors in determining compensation. While

the Company believes that these financial measures are useful in

evaluating the Company’s business, this information should be

considered as supplemental in nature and is not meant to be

considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP. In

addition, these non-GAAP financial measures may not be the same as

similar measures presented by other companies.

The Company defines free cash flow before dividends as net cash

provided by operations less capital expenditures. As management

uses this measure to evaluate the Company’s ability to satisfy

current and future obligations, repurchase stock, pay dividends and

fund future business opportunities, the Company believes that it

provides useful information to investors. Free cash flow before

dividends is not a measure of cash available for discretionary

expenditures since the Company has certain non-discretionary

obligations such as debt service that are not deducted from the

measure. Free cash flow before dividends is not a GAAP measurement

and may not be comparable to similarly titled measures reported by

other companies. See “Condensed Consolidated Statements of Cash

Flows For the Three Months Ended March 31, 2010 and 2009” for a

comparison of free cash flow before dividends to net cash provided

by operations as reported in accordance with GAAP.

(See attached tables for first

quarter results.)

Table 1

Colgate-Palmolive Company

Consolidated Income

Statements

For the Three Months Ended March 31, 2010 and 2009

(in Millions Except Per Share Amounts) (Unaudited)

2010

2009

Net sales $ 3,829 $ 3,503 Cost of sales

1,561 1,490 Gross profit 2,268 2,013 Gross profit

margin 59.2 % 57.5 % Selling, general and administrative

expenses 1,355 1,186 Other (income) expense, net 235 16

Operating profit 678 811 Operating profit margin 17.7

% 23.2 % Interest expense, net 16 21 Income before

income taxes 662 790 Provision for income taxes 275 254

Effective tax rate 41.5 % 32.1 % Net income including

noncontrolling interests 387 536 Less: Net income

attributable to noncontrolling interests 30 28 Net income

attributable to Colgate-Palmolive Company $ 357 $ 508

Earnings per common share Basic $ 0.71 $ 1.00 Diluted $ 0.69 $ 0.97

Average common shares outstanding Basic 493.7 500.7 Diluted

519.0 526.2

Table 2 Colgate-Palmolive Company

Non-GAAP Reconciliation For the Three Months Ended

March 31, 2010 and 2009 (in Millions Except Per Share

Amounts) (Unaudited) 2010 2009 As Reported 1

Venezuela

Hyperinflationary 2

As Adjusted

Non-GAAP

As

Reported

Other (income) expense, net $ 235 $ 271 $ (36 ) $ 16

Operating profit 678 (271 ) 949 811 Operating profit margin

17.7 % 24.8 % 23.2 % Income before income taxes 662 (271 )

933 790 Effective tax rate 41.5 % 29.5 % 32.1 % Net

income including noncontrolling interests 387 (271 ) 658 536

Net income attributable to Colgate-Palmolive Company $ 357 $ (271 )

$ 628 $ 508 Earnings per common share 3 Basic $ 0.71 $ (0.55

) $ 1.26 $ 1.00 Diluted $ 0.69 $ (0.52 ) $ 1.21 $ 0.97 1

Includes a $46 pre-tax ($59

after-tax, $0.11 diluted earnings per share) gain related to the

remeasurement of the Venezuelan balance sheet and lower taxes on

accrued but unpaid remittances as a result of the currency

devaluation on January 8, 2010.

2

Represents the one-time charge

related to the transition to hyperinflationary accounting in

Venezuela as of January 1, 2010. This amount primarily represents

the premium paid to acquire U.S. dollar-denominated cash and bonds.

Prior to January 1, 2010, these assets had been remeasured at the

parallel market rate and then translated for financial reporting

purposes at the official rate of 2.15.

3

The impact of Non-GAAP adjustments

on the basic and diluted earnings per share may not necessarily

equal the earnings per share if calculated independently as a

result of rounding.

Table 3

Colgate-Palmolive Company Condensed

Consolidated Balance Sheets As of March 31, 2010,

December 31, 2009 and March 31, 2009 (Dollars in

Millions) (Unaudited) March 31, December 31,

March 31, 2010 2009 2009 Cash and cash equivalents $ 561 $

600 $ 702 Receivables, net 1,709 1,626 1,565 Inventories 1,259

1,209 1,200 Other current assets 402 375 350 Property, plant and

equipment, net 3,466 3,516 3,055 Other assets, including goodwill

and intangibles 3,426 3,808

3,061 Total assets $ 10,823 $ 11,134 $ 9,933

Total debt 3,117 3,182 3,657 Other current

liabilities 3,456 3,238 2,890 Other non-current liabilities

1,486 1,457 1,448 Total

liabilities 8,059 7,877 7,995 Total Colgate-Palmolive Company

shareholders' equity 2,595 3,116 1,793 Noncontrolling interests

169 141 145 Total

liabilities and shareholders’ equity $ 10,823 $ 11,134

$ 9,933

Supplemental Balance Sheet

Information Debt less cash, cash equivalents and marketable

securities* $ 2,508 $ 2,541 $ 2,930 Working capital % of sales (0.8

%) (0.4 %) 1.4 %

* Marketable securities of $48,

$41 and $25 as of March 31, 2010, December 31, 2009 and March 31,

2009,

respectively, are included in

Other current assets.

Table 4 Colgate-Palmolive Company

Condensed Consolidated Statements of Cash Flows

For the Three Months Ended March 31, 2010 and 2009

(Dollars in Millions) (Unaudited)

2010

2009

Operating Activities Net income including

noncontrolling interests $ 387 $ 536 Adjustments to

reconcile net income including noncontrolling interests to net cash

provided by operations: Venezuela hyerinflationary transition

charge 271 - Restructuring, net of cash - (7 ) Depreciation and

amortization 92 82 Stock-based compensation expense 41 39 Deferred

income taxes 34 54 Cash effects of changes in: Receivables (99 )

(15 ) Inventories (56 ) (34 ) Accounts payable and other accruals

27 3 Other non-current assets and liabilities 36

32 Net cash provided by operations 733

690

Investing Activities Capital expenditures (81 )

(73 ) Sales of property and non-core product lines 1 4 Sales

(purchases) of marketable securities and investments

(7 ) (13 ) Net cash used in investing activities (87

) (82 )

Financing Activities Principal payments on

debt (1,154 ) (771 ) Proceeds from issuance of debt 1,116 711

Dividends paid (222 ) (203 ) Purchases of treasury shares (505 )

(202 ) Proceeds from exercise of stock options and excess tax

benefits 88 10 Net cash

used in financing activities (677 ) (455 ) Effect of

exchange rate changes on Cash and cash equivalents (8

) (6 ) Net increase (decrease) in Cash and cash

equivalents (39 ) 147 Cash and cash equivalents at beginning of

period 600 555 Cash and

cash equivalents at end of period $ 561 $ 702

Supplemental Cash Flow Information Free cash

flow before dividends (Net cash provided by operations less capital

expenditures) Net cash provided by operations $ 733 $ 690 Less:

Capital expenditures (81 ) (73 ) Free

cash flow before dividends $ 652 $ 617

Income taxes paid $ 216 $ 102

Table 5 Colgate-Palmolive Company Segment

Information For the Three Months Ended March 31, 2010

and 2009 (Dollars in Millions) (Unaudited)

Three Months Ended

March 31,

2010

2009

Net sales Oral, Personal and Home Care North America

$ 753 $ 730 Latin America 1,006 911 Europe/South

Pacific 824 719 Greater Asia/Africa 730

636 Total Oral, Personal and Home Care $ 3,313

$ 2,996 Pet Nutrition 516

507

Total Net sales $ 3,829 $

3,503 Three Months Ended

March 31,

2010

2009

Operating profit Oral, Personal and Home Care North

America $ 217 $ 192 Latin America 2 340 306 Europe/South Pacific

191 143 Greater Asia/Africa 189

152 Total Oral, Personal and Home Care $ 937 $ 793

Pet Nutrition 141 131 Corporate 1 (400 )

(113 )

Total Operating profit $

678 $ 811 Note: The Company

evaluates segment performance based on several factors, including

Operating profit.

The Company uses Operating profit

as a measure of the operating segment performance because it

excludes the impact of corporate-driven decisions related to

interest expense and income taxes.

1

Corporate operations include

stock-based compensation related to stock options and restricted

stock awards, research and development costs, Corporate overhead

costs, restructuring and related implementation costs and gains and

losses on sales of non-core product lines and assets. In 2010,

Corporate Operating profit also includes a one-time $271 charge

related to the transition to hyperinflationary accounting in

Venezuela as of January 1, 2010.

2

Latin America Operating profit

includes a $46 pre-tax gain related to the remeasurement of the

Venezuelan balance sheet as a result of the currency devaluation on

January 8, 2010. This gain was substantially offset by the impact

of translating our Venezuelan financial statements at a lower

exchange rate as a result of the devaluation.

Table 6

Colgate-Palmolive Company Geographic Sales

Analysis Percentage Changes - First Quarter 2010 vs

2009 March 31, 2010 (Unaudited)

COMPONENTS OF SALES CHANGE FIRST QUARTER

Pricing 1st Qtr 1st Qtr Coupons

Sales Sales 1st Qtr Consumer &

Change Change Organic Ex-Divested

Trade

Region

As Reported

Ex-Divestment

Sales Change

Volume

Incentives

Exchange

Total Company 9.5 % 9.5 % 6.0 % 6.0 % 0.0 % 3.5 %

Europe/South Pacific 14.5 % 14.5 % 4.0 % 7.0 % (3.0

%) 10.5 %

Latin America 10.5 % 10.5 % 14.5 % 8.0 %

6.5 % (4.0 %)

Greater Asia/Africa 14.5 % 14.5 % 8.0 %

9.0 % (1.0 %) 6.5 %

Total International 13.0 % 13.0 %

9.5 % 8.0 % 1.5 % 3.5 %

North America 3.0 % 3.0 % 1.5

% 5.0 % (3.5 %) 1.5 %

Total CP Products 10.5 % 10.5 %

7.5 % 7.5 % 0.0 % 3.0 %

Hill's 2.0 % 2.0 % (2.5 %)

(2.0 %) (0.5 %) 4.5 %

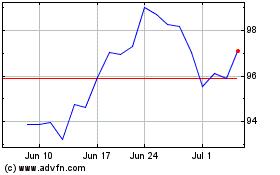

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Jul 2024 to Aug 2024

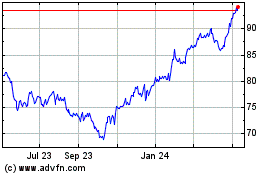

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Aug 2023 to Aug 2024