Investor Presentation November 2023

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the “Company”) or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; and any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believe," "plan," "anticipate," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "will," "should," "estimate," "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons. Factors that could cause actual results to differ from those discussed in the forward-looking statements include but are not limited to: the effects of inflation and rising interest rates; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and ongoing pandemic variants) on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement and achieve the objectives of our BaaS initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic viruses and diseases) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd- Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); securities market and monetary fluctuations, including the replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index and uncertainties regarding potential alternative reference rates, including the Secured Overnight Financing Rate ("SOFR"); negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board ("PCAOB"), the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and in particular, the discussion of "Risk Factors" set forth therein and herein. We urge investors to consider all of these factors carefully in evaluating the forward- looking statements contained in this document. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CENTRAL PACIFIC BANK (CPB) TOTAL ASSETS $7.6 BILLION MARKET CAP $427 MILLION SHARE PRICE $15.78 DIVIDEND YIELD 6.6% Central Pacific Financial Corp. is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 27 branches across the State. CPB is a market leader in residential mortgage, small business banking and digital banking. Note: Total assets as of September 30, 2023. Other Market Information above as of October 31, 2023. Central Pacific Financial - Corporate Profile

4Central Pacific Financial Corp. Lahaina, Maui Loan Exposure Exposure is manageable and with mitigating factors, losses are not anticipated to be material • Loan Payment Deferral Programs being offered for all loan types for those impacted by the wildfire. • As of 9/30/23, 3- to 6-month loan payment deferrals processed on 142 loans with outstanding balances totaling $33 million on the island of Maui. • CRE, Residential, and HELOC loans require fire hazard insurance coverage. • C&I loans require business interruption insurance. FEMA/SBA disaster relief assistance is available. • Consumer loans may be supported by State/FEMA unemployment benefits. CRE 46% Residential 29% HELOC 7% C&I 14% Consumer 4% Lahaina, Maui Exposure Composition as of September 30, 2023 1 Includes 50% of consumer loans 2 Based on 2023 land tax assessed value Loans Not in Burn Zone $67MM, 62% No Damage/Loss in Burn Zone $16MM, 15% Damaged - Covered by Insurance and/or Land 2 $17MM, 16% Consumer Loans $2MM, 2% Remaining Balance to be Monitored 1 $5MM, 5%

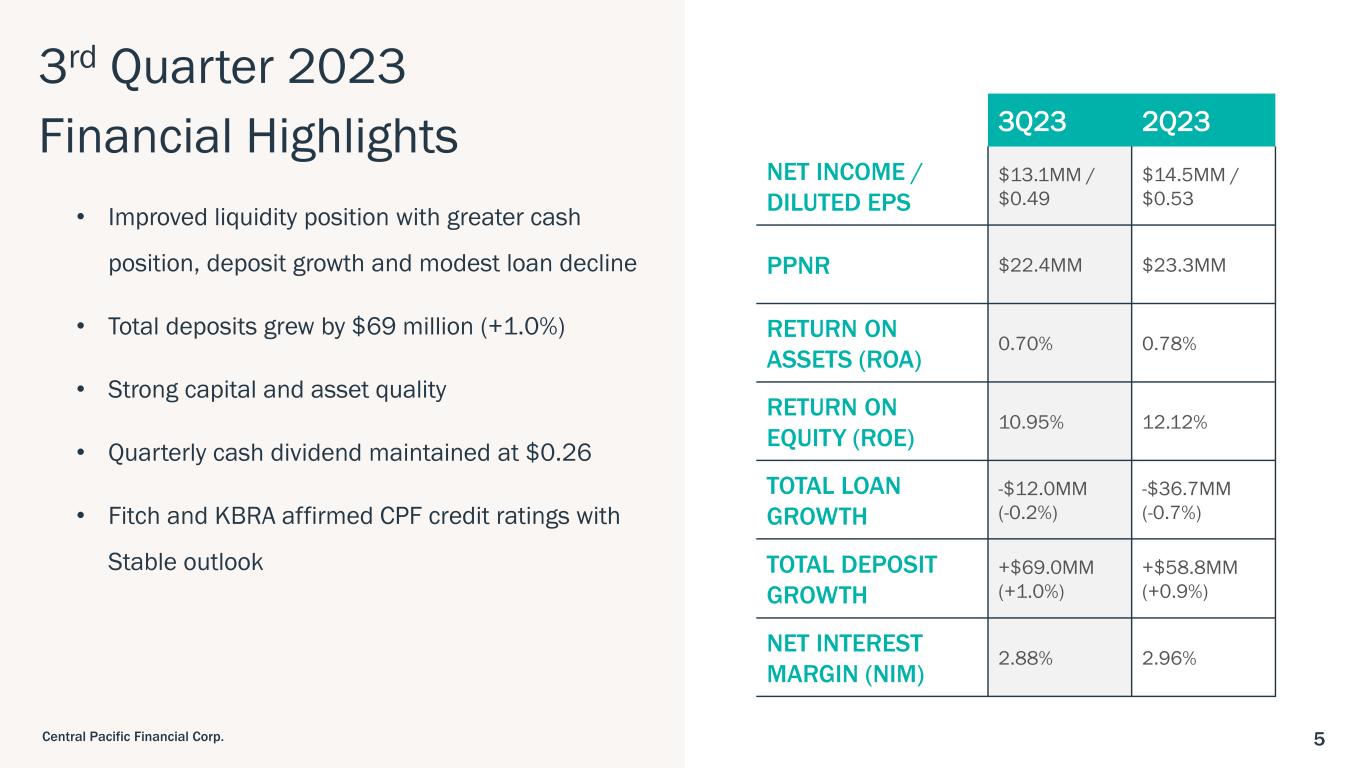

5Central Pacific Financial Corp. 3rd Quarter 2023 Financial Highlights • Improved liquidity position with greater cash position, deposit growth and modest loan decline • Total deposits grew by $69 million (+1.0%) • Strong capital and asset quality • Quarterly cash dividend maintained at $0.26 • Fitch and KBRA affirmed CPF credit ratings with Stable outlook 3Q23 2Q23 NET INCOME / DILUTED EPS $13.1MM / $0.49 $14.5MM / $0.53 PPNR $22.4MM $23.3MM RETURN ON ASSETS (ROA) 0.70% 0.78% RETURN ON EQUITY (ROE) 10.95% 12.12% TOTAL LOAN GROWTH -$12.0MM (-0.2%) -$36.7MM (-0.7%) TOTAL DEPOSIT GROWTH +$69.0MM (+1.0%) +$58.8MM (+0.9%) NET INTEREST MARGIN (NIM) 2.88% 2.96%

6Central Pacific Financial Corp. CPF Value Drivers Strong Hawaii Economic Position Diversified Loan Portfolio Valuable Deposit Franchise Focus on Driving Efficiency Solid Credit & Capital Profile Digital Initiatives to Expand Future Growth 1 2 3 4 5 6

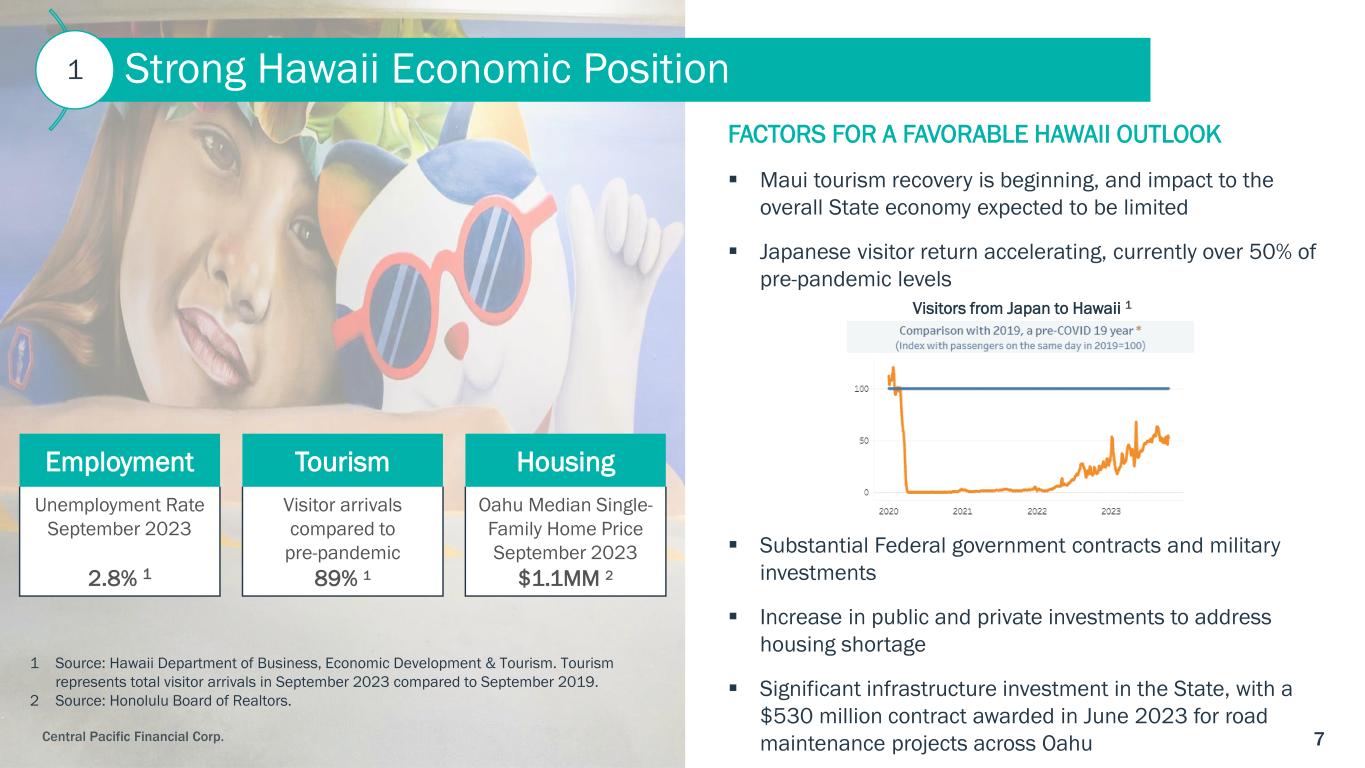

7Central Pacific Financial Corp. Tourism Visitor arrivals compared to pre-pandemic 89% 1 Employment Unemployment Rate September 2023 2.8% 1 FACTORS FOR A FAVORABLE HAWAII OUTLOOK ▪ Maui tourism recovery is beginning, and impact to the overall State economy expected to be limited ▪ Japanese visitor return accelerating, currently over 50% of pre-pandemic levels ▪ Substantial Federal government contracts and military investments ▪ Increase in public and private investments to address housing shortage ▪ Significant infrastructure investment in the State, with a $530 million contract awarded in June 2023 for road maintenance projects across Oahu 1 Source: Hawaii Department of Business, Economic Development & Tourism. Tourism represents total visitor arrivals in September 2023 compared to September 2019. 2 Source: Honolulu Board of Realtors. Strong Hawaii Economic Position Housing Oahu Median Single- Family Home Price September 2023 $1.1MM 2 1 Visitors from Japan to Hawaii 1

8Central Pacific Financial Corp. Continued focus on moderating near-term loan growth Strong and diverse loan portfolio, with over 75% secured by real estate Diversified Loan Portfolio2 3.53 3.77 4.08 4.45 4.55 5.01 5.55 5.56 5.52 5.51 3.00 3.50 4.00 4.50 5.00 5.50 6.00 2016 2017 2018 2019 2020 2021 2022 1Q23 2Q23 3Q23 $ B il li o n s Loan Balances Outstanding-Excluding PPP Commercial & Industrial 10% Construction 4% Residential Mortgage 35% Home Equity 14% Commercial Mortgage 25% Consumer 12% Loan Portfolio Composition as of September 30, 2023

9Central Pacific Financial Corp. Residential Mortgage Strength CPB RESIDENTIAL MORTGAGE LEADER • Instrumental in driving passage of Hawaii bill in 2023 that expands low-income housing tax credit investments • Market strength in purchased mortgages; less reliance on refinance market • Lead lender on many large residential development projects Market leader making a difference to support affordable housing in the State of Hawaii Introduced inaugural series “Hoʻolauleʻa” articles showcasing success stories of first-time homebuyers HAWAII RESIDENTIAL MARKET • Housing prices continue to be strong with median single-family home price of $1.1M • While demand is slowing, properties continue to move quickly with median days on market at 20 days $1.1M -5% YoY 0 200 400 600 800 1,000 1,200 $ M il s OAHU AND U.S. SINGLE FAMILY HOME MEDIAN SALES PRICE Oahu U.S.

101Central Pacific Financial Corp. Small Business Leader 2022 SBA HAWAII LENDER OF THE YEAR FOR THE 13TH CONSECUTIVE YEAR Originated more 7(a) SBA loans based on count and dollar amount than the 3 other large Hawaii banks combined1 Niche Markets • CPB has strong market share in the dental and physician niche as the primary bank to nearly half of the dentists and a quarter of the physicians in the State of Hawaii • Success is being replicated in other target niche markets Innovative Programs & Technology • Business Exceptional Campaign - provides a cash bonus for small businesses to open a checking account • On-Balance Sheet Sweep - product offers an automatic sweep to a higher-yielding money market account, while keeping a minimum balance in non-interest bearing checking • Women Entrepreneurs Conference – presented by CPB and provided over 220 women small business owners the opportunity to network and gain knowledge on managing and growing their business 1 As reported by the Small Business Administration (SBA) Hawaii District Office for Category 2, 7(a) SBA loans for the 2022 Fiscal Year.

11Central Pacific Financial Corp. • 57% of deposits FDIC insured; 65% including collateralized deposits • 56% Commercial / 44% Consumer • Long-tenured: 51% with CPB 10 years or longer • Average consumer account balance $19,000 • Average commercial account balance $114,000 • No brokered deposits Valuable Deposit Franchise Deposit balances increased by $69.0MM in 3Q23 3 4.61 4.96 4.95 5.12 5.80 6.64 6.74 6.75 6.81 6.87 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 2016 2017 2018 2019 2020 2021 2022 1Q23 2Q23 3Q23 $ B il li o n s Total Deposits Noninterest Bearing Demand 29% Interest Bearing Demand 19% Savings & Money Market 32% Time 20% Deposit Portfolio Composition All Other Sectors 23% Real Estate and Rental and Leasing 15% Other Services 14% Construction 11% Professional, Scientific, and Technical Services 9% Finance and Insurance 9% Health Care and Social Assistance 6% Accommodation and Food Services 6% Retail Trade 4% Wholesale Trade 3% Commercial Deposits by Industry Data as of September 30, 2023

12Central Pacific Financial Corp. 1.08% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 1Q23 2Q23 3Q23 Total Deposit Cost CPF Peer average* Fed Funds CPF Deposit Cost Advantage * Public banks $3-10 billion in total assets. Source: S&P Global. Data as of September 30, 2023. Cycle-to-date total deposit beta of 21% as of 3Q23 80 bps funding advantage High valued deposit franchise with proven history of funding cost advantage

13Central Pacific Financial Corp. Leadership Connections Strategic Alliances Best Service Level Captive Insurance Deposits CPF Chairman Emeritus, Paul Yonamine A distinguished leader in the Japanese business market. He serves on the Board of Directors of SMBC and Seven & i Holdings CPB and Tokyo Star Bank alliance announced in August 2023 for business and investment opportunities in Japan and Hawaii Favorable Hawaii State laws for Japanese captive insurance CPB is a member of the Hawaii Captive Insurance Council Japan Competitive Advantage Convenient, customized services and online banking experience tailored to Japanese customers

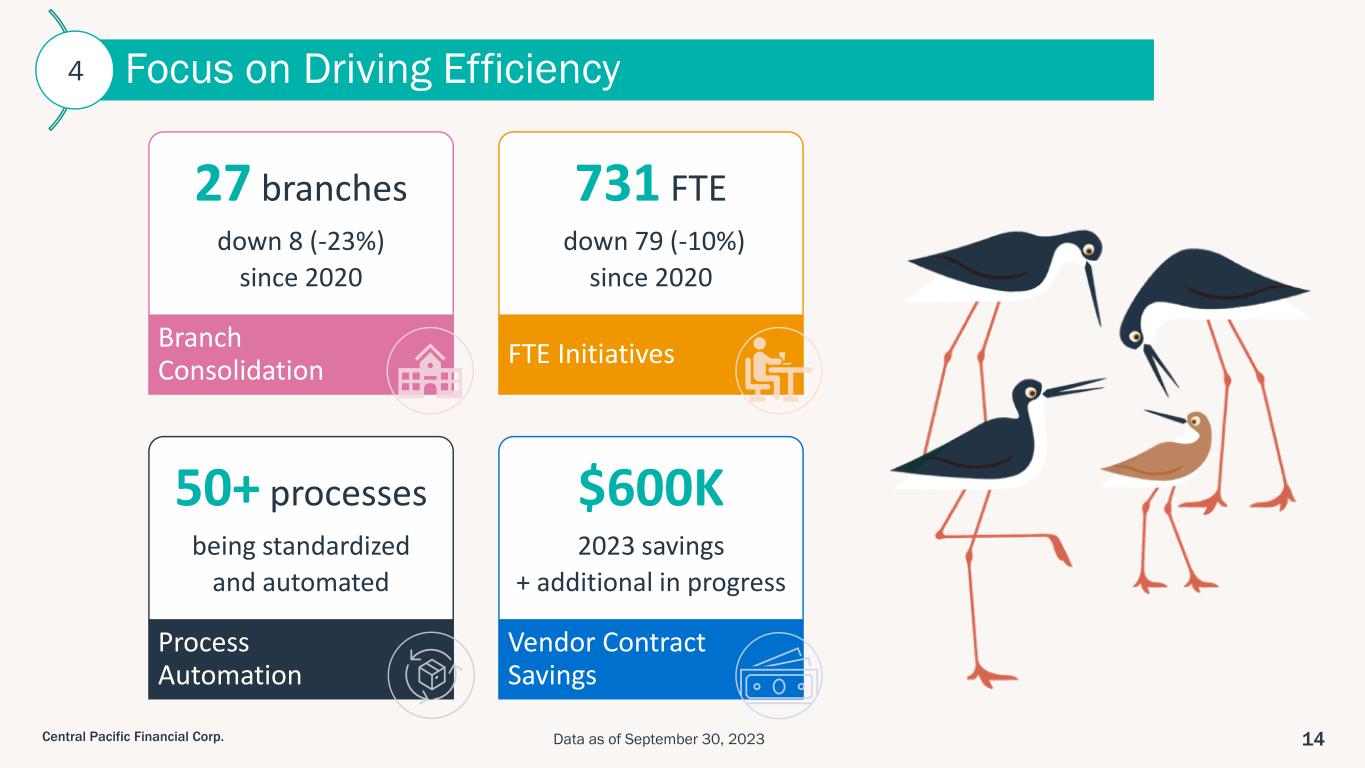

14Central Pacific Financial Corp. Focus on Driving Efficiency4 27 branches down 8 (-23%) since 2020 Branch Consolidation 731 FTE down 79 (-10%) since 2020 FTE Initiatives 50+ processes being standardized and automated Process Automation $600K 2023 savings + additional in progress Vendor Contract Savings Data as of September 30, 2023

15Central Pacific Financial Corp. • Positive trend with YTD expenses down 3% • Rightsizing salaries & benefits expense • Workflow and automation efficiencies • Vendor contract negotiations • Other efficiency initiatives in progress Expense Management 42.0 40.4 42.1 39.9 39.6 3Q22 4Q22 1Q23 2Q23 3Q23 Total Other Operating Expense ($ Millions)

16Central Pacific Financial Corp. 0.08% 0.09% 0.10% 0.20% 0.12% 3Q22 4Q22 1Q23 2Q23 3Q23 NPAs/Total Loans 0.12% 0.12% 0.16% 0.24% 0.28% 3Q22 4Q22 1Q23 2Q23 3Q23 Annualized NCO/Avg Loans Solid Credit & Capital Profile * NPA increase relates to 2 Hawaii construction loans to a single borrower that subsequently paid off in full in mid-July 2023. 2Q23 NPAs/Total Loans ratio is 0.11% excluding the 2 Hawaii construction loans mentioned above. * 5 Strong Credit Risk Management continues to drive low levels of problem assets 0.03% 0.03% 0.03% 0.06% 0.05% 3Q22 4Q22 1Q23 2Q23 3Q23 Delinquencies 90+Days/Total Loans 1.39% 1.39% 1.28% 1.34% 1.09% 3Q22 4Q22 1Q23 2Q23 3Q23 Criticized/Total Loans

171Central Pacific Financial Corp. 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As of September 30, 2023 Regulatory Minimum Well-Capitalized CPF Solid Capital Position 8.7% STRONG CAPITAL AND SHAREHOLDER RETURN • TCE ratio of 6.1% and CET1 ratio of 11.0% • Maintained quarterly cash dividend at $0.26 per share which will be payable on December 15, 2023 • Repurchased 4,500 shares in the 3Q23 at a total cost of $0.1 million, and 130,010 shares YTD at a total cost of $2.6 million • Assuming full realization of all unrealized AFS & HTM securities losses, CET1 ratio remains strong and well-capitalized at 7.4% $230 Mil capital cushion to well capitalized minimum $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2016 2017 2018 2019 2020 2021 2022 2023* Cash Dividends Declared per Common Share * Annualized 11.0% 14.1% Data as of September 30, 2023

181Central Pacific Financial Corp. Mobile App – Best in Market1 • CPB’s mobile app is rated 4.9 (out of 5) in the Apple store • Mobile app includes value added tools, including budgeting and cash flow to help manage money • CreditSense enables customers to monitor their credit scores and explore CPB loan product offers Consolidated loan and deposit online origination system • Initiative in progress • Will provide quick and seamless account opening • Full integration to core system creating efficiencies and streamlining processes Digital Initiatives to Expand Future Growth6 1 Among the 4 largest Hawaii banks (Bank of Hawaii, First Hawaiian Bank, American Savings Bank and Central Pacific Bank). 2 Excludes customers 75 years and older in addition to secondary users or joint owners. Approximately 40% of all consumer deposit transactions are done through digital channels Approximately 80% of all retail and business customers are enrolled in CPB digital banking2

19Central Pacific Financial Corp. Appendix

20Central Pacific Financial Corp. (*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our previously reported efficiency ratios. Note: Totals may not sum due to rounding. Historical Financial Highlights ($ in Millions) 3Q 2Q 1Q 2022 2021 2020 2019 2018 2017 2016 Balance Sheet (period end data) Loans and leases 5,508.7$ 5,520.7$ 5,557.4$ 5,555.5$ 5,101.6$ 4,964.1$ 4,449.5$ 4,078.4$ 3,770.6$ 3,524.9$ Total assets 7,637.9 7,567.6 7,521.2 7,432.8 7,419.1 6,594.6 6,012.7 5,807.0 5,623.7 5,384.2 Total deposits 6,874.7 6,805.7 6,747.0 6,736.2 6,639.2 5,796.1 5,120.0 4,946.5 4,956.4 4,608.2 Total shareholders' equity 468.6 476.3 470.9 452.9 558.3 546.7 528.5 491.7 500.0 504.7 Income Statement Net interest income 51.9 52.7 54.2 215.6 211.0 197.7 184.1 173.0 167.7 158.0 Provision (credit) for credit losses 4.9 4.3 1.9 (1.3) (14.6) 42.1 6.3 (1.5) (2.6) (5.4) Other operating income 10.0 10.4 11.0 47.9 43.1 45.2 41.8 38.8 36.5 42.3 Other operating expense 39.6 40.0 42.1 166.0 163.0 151.7 141.6 135.1 131.0 132.4 Income taxes (benefit) 4.3 4.5 5.1 24.8 25.8 11.8 19.6 18.8 34.6 26.3 Net income 13.1 14.5 16.2 73.9 79.9 37.3 58.3 59.5 41.2 47.0 Prof itability Return on average assets 0.70% 0.78% 0.87% 1.01% 1.13% 0.58% 0.99% 1.05% 0.75% 0.90% Return on average shareholders' equity 10.95% 12.12% 13.97% 15.47% 14.38% 6.85% 11.36% 12.22% 8.03% 9.16% Efficiency ratio (*) 63.91% 63.17% 64.58% 63.00% 64.16% 62.47% 62.69% 63.79% 64.14% 66.10% Net interest margin 2.88% 2.96% 3.08% 3.09% 3.18% 3.30% 3.35% 3.22% 3.28% 3.27% Capital Adequacy (period end data) Leverage capital ratio 8.74% 8.71% 8.60% 8.53% 8.48% 8.81% 9.53% 9.88% 10.35% 10.64% Total risk-based capital ratio 14.11% 13.93% 13.61% 13.48% 14.48% 15.19% 13.64% 14.69% 15.92% 15.49% Asset Quality Net loan chargeoffs/average loans 0.28% 0.24% 0.16% 0.09% 0.02% 0.15% 0.15% 0.02% 0.11% 0.03% Nonaccrual loans/total loans (period end) 0.12% 0.20% 0.10% 0.09% 0.12% 0.12% 0.03% 0.06% 0.07% 0.24% Year Ended December 31,2023

21Central Pacific Financial Corp. Commercial Real Estate Portfolio OFFICE RETAIL TOTAL BALANCE $193.8MM $246.4MM % OF TOTAL CRE 14% 18% % OF TOTAL LOANS 4% 5% WA LTV 55% 65% WA MONTHS TO MATURITY 73 64 INVESTOR / OWNER-OCCUPIED $144.8MM / $49.0MM $193.2MM / $53.2MM Diverse CRE portfolio, primarily Hawaii and Investor • Hawaii 77% / Mainland 23% • Investor 75% / Owner-Occupied 25% Industrial/Warehouse 28% Apartment 22% Retail 18% Restaurant 1% Office 14% Hotel 7% Shopping Center 3% Storage 3% Other 4% CRE Portfolio Composition as of September 30, 2023 Data as of September 30, 2023

22Central Pacific Financial Corp. • Total Hawaii Consumer $338MM / Total Mainland Consumer $345MM • Weighted average origination FICO: • 742 for Hawaii Consumer • 739 for Mainland Consumer • YTD Annualized NCO %: • HI Auto 0.2% • HI Other 0.7% • Mainland Auto 0.9% • Mainland Home Improvement 2.5% • Mainland Unsecured 4.0% • Home Improvement: Borrowers are homeowners who are shown to have better credit risk • Unsecured: Highly granular with average loan amounts of ~$13,000 Consumer Loan Portfolio HI- Auto $203 , 30% HI- Other $135 , 20% Mainland- Auto $107 , 15% Mainland- Home Improvement $117 , 17% Mainland- Unsecured $121 , 18% Consumer Portfolio Composition as of September 30, 2023 ($ Millions) Data as of September 30, 2023

23Central Pacific Financial Corp. • $4.5MM provision for credit loss on loans in 3Q23 driven by net charge-offs, plus a $0.4MM reserve for unfunded commitments, for a total provision for credit loss of $4.9MM • ACL coverage ratio increased to 1.17% for 3Q23 Note: Totals may not sum due to rounding. Allowance for Credit Losses $ Millions 3Q22 4Q22 1Q23 2Q23 3Q23 Beginning Balance 65.2 64.4 63.7 63.1 63.8 Less: Net Charge-offs (Recoveries) 1.6 1.7 2.3 3.4 3.9 Plus: Provision (Credit) for Credit Losses 0.7 1.0 1.6 4.1 4.5 Ending Balance 64.4 63.7 63.1 63.8 64.5 Coverage Ratio (ACL to Total Loans) 1.19% 1.15% 1.14% 1.16% 1.17%

24Central Pacific Financial Corp. High Quality Securities Portfolio • $1.3B or 17% of total assets • 81% government agency bonds • 92% AAA rated • Portfolio mix: HTM 51% / AFS 49% • Portfolio unrealized loss: HTM $108.2MM / AFS $147.1MM • Total portfolio unrealized loss $255.3MM vs $468.6MM book equity Gov't Agency 81% Municipals 13% Corporate 2% Non-Agency CMBS/RMBS 2% Other 2% Investment Portfolio Composition as of September 30, 2023 Data as of September 30, 2023

25Central Pacific Financial Corp. • Ample alternative sources of liquidity available • Available sources of liquidity total 122% of uninsured/uncollateralized deposits Available Sources of Liquidity * BTFP eligible securities at par, other unpledged securities at market value. $ Millions September 30, 2023 Cash on balance sheet 439 Other Funding Sources: Unpledged securities* 288 FHLB available borrowing capacity 1,820 FRB available borrowing capacity 290 Other funding lines 75 Total 2,473 Total Sources of Liquidity 2,912 Uninsured/uncollateralized Deposits 2,384 % of Uninsured/uncollateralized Deposits 122%

26Central Pacific Financial Corp. Central Pacific Bank recognized by Newsweek and Forbes – Best Bank in Hawaii* * Newsweek ranked CPB best small bank in Hawaii for 2023. Forbes named CPB best bank in Hawaii for 2022.

27Central Pacific Financial Corp. Environmental, Social & Governance (ESG) Focus * Amounts for 2022Y. Source: 2022 ESG Report can be found here: https://www.cpb.bank/esg. *

28Central Pacific Financial Corp. Mahalo