0000701347false00007013472023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

July 26, 2023

Central Pacific Financial Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Hawaii | | 001-31567 | | 99-0212597 |

(State or other

jurisdiction of

incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

220 South King Street, Honolulu, Hawaii

(Address of principal executive offices)

96813

(Zip Code)

(808) 544-0500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, No Par Value | | CPF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 26, 2023, Central Pacific Financial Corp. (the "Company") issued a press release regarding its results of operations and financial condition for the quarter ended June 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

ITEM 7.01. REGULATION FD DISCLOSURE

On July 26, 2023, Central Pacific Financial Corp. will hold an investor conference call and webcast to discuss financial results for the quarter ended June 30, 2023, including the attached press release and other matters relating to the Company.

The Company has also made available on its website a slide presentation containing certain additional information about the Company's financial results for the quarter ended June 30, 2023 (the "Earnings Supplement"). The Earnings Supplement is furnished herewith as Exhibit 99.2 and is incorporated herein by reference. All information in Exhibit 99.2 is presented as of the particular date or dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided except as required by law.

The Earnings Supplement contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the attached presentation as well as in the Company’s other documents filed with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements.

The information provided in Items 2.02 and 7.01 of this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall the information in Exhibits 99.1 and 99.2 be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

| | | | | | | | | | | | | | |

| (d) | | Exhibits |

| | 99.1 | | |

| | 99.2 | | |

| | | | |

| | 104 | | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | Central Pacific Financial Corp. |

| | | (Registrant) |

| | |

| | | |

| | | |

| Date: | July 26, 2023 | /s/ David S. Morimoto |

| | David S. Morimoto |

| | Senior Executive Vice President and Chief Financial Officer |

| | |

Exhibit 99.1

| | | | | | | | | | | |

| | | | FOR IMMEDIATE RELEASE |

| | | | |

| Investor Contact: | Ian Tanaka | Media Contact: | Tim Sakahara |

| | SVP, Treasury Manager | | AVP, Corporate Communications Manager |

| | (808) 544-3646 | | (808) 544-5125 |

| | ian.tanaka@cpb.bank | | tim.sakahara@cpb.bank |

CENTRAL PACIFIC FINANCIAL REPORTS SECOND QUARTER EARNINGS OF $14.5 MILLION

•Net income of $14.5 million, or $0.53 per diluted share for the quarter.

•ROA of 0.78% and ROE of 12.12% for the quarter.

•Total loans of $5.52 billion decreased by $36.7 million in the second quarter.

•Total deposits of $6.81 billion increased by $58.8 million in the second quarter. Core deposits of $5.98 billion increased by $10.1 million, or 0.2% in the second quarter. 65% of total deposits are FDIC-insured or fully collateralized as of June 30, 2023.

•Solid liquidity position with $311.0 million in cash on balance sheet and $2.71 billion in total other liquidity sources, including available borrowing capacity and unpledged investment securities as of June 30, 2023.

•Ratio of total available sources of liquidity to uninsured and uncollateralized deposits was 128% as of June 30, 2023.

•Leverage capital, tier 1 risk-based capital, total risk-based capital, and common equity tier 1 ratios improved to 8.7%, 11.8%, 13.9%, and 10.9%, respectively, in the second quarter, compared to 8.6%, 11.5%, 13.6%, and 10.6% in the first quarter.

•Board of Directors approved quarterly cash dividend of $0.26 per share.

HONOLULU, HI, July 26, 2023 – Central Pacific Financial Corp. (NYSE: CPF) (the "Company"), parent company of Central Pacific Bank (the "Bank" or "CPB"), today reported net income for the second quarter of 2023 of $14.5 million, or fully diluted earnings per share ("EPS") of $0.53, compared to net income of $16.2 million, or EPS of $0.60 in the previous quarter and net income of $17.6 million, or EPS of $0.64 in the year-ago quarter.

Pre-provision net revenue ("PPNR"), or net income excluding provision for credit losses and income taxes, totaled $23.3 million in the second quarter of 2023, compared to PPNR of $23.1 million in the previous quarter and $24.8 million in the year-ago quarter. Net income and PPNR in the year-ago quarter included an $8.5 million non-recurring gain on sale of Class B shares of Visa, partially offset by a $4.9 million non-recurring, non-cash settlement charge related to the termination and settlement of our defined benefit pension plan. Additional information on pre-provision net revenue is presented in Table 10.

"Central Pacific delivered solid results during the second quarter and further strengthened our balance sheet, liquidity and capital positions," said Arnold Martines, President and Chief Executive Officer. "We were successful in growing deposits by focusing on the needs of our long-time personal and business customers as well as attracting new relationships. We will continue our focus on building liquidity and ensuring strong credit quality while we navigate the current economic environment."

Central Pacific Financial Reports Second Quarter Earnings of $14.5 Million

Page 2

Earnings Highlights

Net interest income for the second quarter of 2023 was $52.7 million, which decreased by $1.5 million, or 2.7% from the previous quarter, and decreased by $0.2 million, or 0.5% from the year-ago quarter. The sequential quarter decrease in net interest income is primarily due to increases in average balances and rates paid on interest-bearing deposits, which outpaced the increases in average loan balances and loan yields.

Net interest margin ("NIM") for the second quarter of 2023 was 2.96%, which decreased by 12 basis points ("bps") from the previous quarter and decreased by 9 bps from the year-ago quarter. The sequential quarter decrease in NIM is primarily due to higher rates paid on deposits, which outpaced the increase in loan yields. Additional information on average balances, interest income and expenses and yields and rates is presented in Tables 4 and 5.

In the second quarter of 2023, the Company recorded a provision for credit losses of $4.3 million, compared to a provision of $1.9 million in the previous quarter and a provision of $1.0 million in the year-ago quarter. The provision in the second quarter consisted of a provision for credit losses on loans of $4.1 million and a provision for credit losses on off-balance sheet credit exposures of $0.2 million.

Other operating income for the second quarter of 2023 totaled $10.4 million, compared to $11.0 million in the previous quarter and $17.1 million in the year-ago quarter. The decrease from the previous quarter was primarily due to lower income from fiduciary activities of $0.3 million and lower income recovered on nonaccrual loans previously charged-off of $0.2 million (included in other). Other operating income in the year-ago quarter included the aforementioned $8.5 million gain on the sale of Class B common stock of Visa. Additional information on other operating income is presented in Table 3.

Other operating expense for the second quarter of 2023 totaled $39.9 million, compared to $42.1 million in the previous quarter and $45.3 million in the year-ago quarter. The decrease in other operating expense was primarily due to lower salaries and employee benefits of $1.2 million and lower legal and professional services of $0.4 million. Other operating expense in the year-ago quarter included the aforementioned non-cash settlement charge of $4.9 million related to the termination and settlement of our defined benefit pension plan. Additional information on other operating expense is presented in Table 3.

The efficiency ratio for the second quarter of 2023 was 63.17%, compared to 64.58% in the previous quarter and 64.68% in the year-ago quarter.

The effective tax rate for the second quarter of 2023 was 23.6%, compared to 23.8% in the previous quarter and 26.0% in the year-ago quarter.

Balance Sheet Highlights

Total assets at June 30, 2023 of $7.57 billion increased by $46.3 million, or 0.6% from $7.52 billion at March 31, 2023, and increased by $268.4 million, or 3.7% from $7.30 billion at June 30, 2022. At June 30, 2023, the Company had $311.0 million in cash on its balance sheet and $2.71 billion in total other liquidity sources, including available borrowing capacity and unpledged investment securities. Total available sources of liquidity as a percentage of uninsured and uncollateralized deposits was 128%.

Total loans, net of deferred fees and costs, at June 30, 2023 of $5.52 billion decreased by $36.7 million from $5.56 billion at March 31, 2023, and increased by $219.1 million, or 4.1% from $5.30 billion at June 30, 2022. Average yields earned on loans during the second quarter of 2023 was 4.37%, compared to 4.26% in the previous quarter and 3.60% in the year-ago quarter. Loans by type and geographic distribution are summarized in Table 6.

Total deposits at June 30, 2023 of $6.81 billion increased by $58.8 million or 0.9% from $6.75 billion at March 31, 2023, and increased by $183.7 million, or 2.8% from $6.62 billion at June 30, 2022. Core deposits, which include demand deposits, savings and money market deposits and time deposits up to $250,000, totaled $5.98 billion at June 30, 2023, and increased by $10.1 million, or 0.2% from $5.97 billion at March 31, 2023. Average rates paid on total deposits during the second quarter of 2023 was 0.84%, compared to 0.60% in the previous quarter and 0.06% in the year-ago quarter. At June 30, 2023, approximately 65% of the Company's total deposits were FDIC-insured or fully collateralized. Core deposit and total deposit balances are summarized in Table 7.

Asset Quality

Nonperforming assets at June 30, 2023 totaled $11.1 million, or 0.15% of total assets, compared to $5.3 million, or 0.07% of total assets at March 31, 2023 and $5.0 million, or 0.07% of total assets at June 30, 2022. The increase in nonperforming assets from the

Central Pacific Financial Reports Second Quarter Earnings of $14.5 Million

Page 3

previous quarter is primarily attributable to the addition of two Hawaii construction loans to a single borrower totaling $4.9 million. In mid-July 2023, the loans were paid-off in full.

Additional information on nonperforming assets, past due and restructured loans is presented in Table 8.

Net charge-offs in the second quarter of 2023 totaled $3.4 million, compared to net charge-offs of $2.3 million in the previous quarter, and net charge-offs of $1.0 million in the year-ago quarter. Annualized net charge-offs as a percentage of average loans was 0.24%, 0.16% and 0.08% during the three months ended June 30, 2023, March 31, 2023 and June 30, 2022, respectively.

The allowance for credit losses, as a percentage of total loans at June 30, 2023 was 1.16%, compared to 1.14% at March 31, 2023, and 1.23% at June 30, 2022. Additional information on net charge-offs and recoveries and the allowance for credit losses is presented in Table 9.

Capital

Total shareholders' equity was $476.3 million at June 30, 2023, compared to $470.9 million and $455.1 million at March 31, 2023 and June 30, 2022, respectively.

During the second quarter of 2023, the Company repurchased 23,750 shares of common stock, at a total cost of $0.4 million, or an average cost per share of $14.92. During the six months ended June 30, 2023, the Company repurchased 125,510 shares of common stock, at a total cost of $2.6 million, or an average cost per share of $20.39. As of June 30, 2023, $23.5 million remained available for repurchase under the Company's share repurchase program.

At June 30, 2023, the Company's leverage capital, tier 1 risk-based capital, total risk-based capital, and common equity tier 1 ratios were 8.7%, 11.8%, 13.9%, and 10.9%, respectively, compared to 8.6%, 11.5%, 13.6%, and 10.6%, respectively, at March 31, 2023.

On July 25, 2023, the Company's Board of Directors declared a quarterly cash dividend of $0.26 per share on its outstanding common shares. The dividend will be payable on September 15, 2023 to shareholders of record at the close of business on August 31, 2023.

Conference Call

The Company's management will host a conference call today at 1:00 p.m. Eastern Time (7:00 a.m. Hawaii Time) to discuss the quarterly results. Individuals are encouraged to listen to the live webcast of the presentation by visiting the investor relations page of the Company's website at http://ir.cpb.bank. Alternatively, investors may participate in the live call by dialing 1-888-510-2553 (access code: 9816541). A playback of the call will be available through August 26, 2023 by dialing 1-800-770-2030 (access code: 9816541) and on the Company's website. Information which may be discussed in the conference call is provided in an earnings supplement presentation on the Company's website at http://ir.cpb.bank.

About Central Pacific Financial Corp.

Central Pacific Financial Corp. is a Hawaii-based bank holding company with approximately $7.57 billion in assets as of June 30, 2023. Central Pacific Bank, its primary subsidiary, operates 27 branches and 57 ATMs in the state of Hawaii. For additional information, please visit the Company's website at http://www.cpb.bank.

**********

Central Pacific Financial Reports Second Quarter Earnings of $14.5 Million

Page 4

Forward-Looking Statements ("FLS")

This document may contain FLS concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements.

While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and rising interest rates; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and ongoing pandemic variants) on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to achieve the objectives of our RISE2020 initiative; our ability to successfully implement and achieve the objectives of our Banking-as-a-Service ("BaaS") initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic viruses and diseases) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); securities market and monetary fluctuations, including the replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index and uncertainties regarding potential alternative reference rates, including the Secured Overnight Financing Rate ("SOFR"); negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board ("PCAOB"), the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items.

For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Financial Highlights | |

| (Unaudited) | TABLE 1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| (Dollars in thousands, | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| except for per share amounts) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| CONDENSED INCOME STATEMENT | | | | | | | | | | | | | | |

| Net interest income | | $ | 52,734 | | | $ | 54,196 | | | $ | 56,285 | | | $ | 55,365 | | | $ | 52,978 | | | $ | 106,930 | | | $ | 103,913 | |

| Provision (credit) for credit losses | | 4,319 | | | 1,852 | | | 571 | | | 362 | | | 989 | | | 6,171 | | | (2,206) | |

| | | | | | | | | | | | | | |

| Total other operating income | | 10,435 | | | 11,009 | | | 11,601 | | | 9,629 | | | 17,138 | | | 21,444 | | | 26,689 | |

| Total other operating expense | | 39,903 | | | 42,107 | | | 40,434 | | | 41,998 | | | 45,349 | | | 82,010 | | | 83,554 | |

| | | | | | | | | | | | | | |

| Income tax expense | | 4,472 | | | 5,059 | | | 6,700 | | | 5,919 | | | 6,184 | | | 9,531 | | | 12,222 | |

| Net income | | 14,475 | | | 16,187 | | | 20,181 | | | 16,715 | | | 17,594 | | | 30,662 | | | 37,032 | |

| Basic earnings per share | | $ | 0.54 | | | $ | 0.60 | | | $ | 0.74 | | | $ | 0.61 | | | $ | 0.64 | | | $ | 1.14 | | | $ | 1.34 | |

| Diluted earnings per share | | 0.53 | | | 0.60 | | | 0.74 | | | 0.61 | | | 0.64 | | | 1.13 | | | 1.33 | |

| Dividends declared per share | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.52 | | | 0.52 | |

| | | | | | | | | | | | | | |

| PERFORMANCE RATIOS | | | | | | | | | | | | | | |

| Return on average assets (ROA) [1] | | 0.78 | % | | 0.87 | % | | 1.09 | % | | 0.91 | % | | 0.96 | % | | 0.82 | % | | 1.01 | % |

| Return on average shareholders’ equity (ROE) [1] | | 12.12 | | | 13.97 | | | 18.30 | | | 14.49 | | | 14.93 | | | 13.03 | | | 14.67 | |

| | | | | | | | | | | | | | |

| Average shareholders’ equity to average assets | | 6.40 | | | 6.23 | | | 5.97 | | | 6.30 | | | 6.45 | | | 6.31 | | | 6.89 | |

| Efficiency ratio [2] | | 63.17 | | | 64.58 | | | 59.56 | | | 64.62 | | | 64.68 | | | 63.88 | | | 63.98 | |

| Net interest margin (NIM) [1] | | 2.96 | | | 3.08 | | | 3.17 | | | 3.17 | | | 3.05 | | | 3.02 | | | 3.01 | |

| Dividend payout ratio [3] | | 49.06 | | | 43.33 | | | 35.14 | | | 42.62 | | | 40.63 | | | 46.02 | | | 39.10 | |

| | | | | | | | | | | | | | |

| SELECTED AVERAGE BALANCES | | | | | | | | | | | | | | |

| Average loans, including loans held for sale | | $ | 5,543,398 | | | $ | 5,525,988 | | | $ | 5,498,800 | | | $ | 5,355,088 | | | $ | 5,221,300 | | | $ | 5,534,741 | | | $ | 5,168,076 | |

| Average interest-earning assets | | 7,155,606 | | | 7,112,377 | | | 7,103,841 | | | 6,991,773 | | | 6,982,556 | | | 7,134,111 | | | 6,957,918 | |

| Average assets | | 7,463,629 | | | 7,443,767 | | | 7,389,712 | | | 7,320,751 | | | 7,309,939 | | | 7,453,753 | | | 7,325,042 | |

| Average deposits | | 6,674,650 | | | 6,655,660 | | | 6,673,922 | | | 6,535,321 | | | 6,626,462 | | | 6,665,208 | | | 6,603,467 | |

| Average interest-bearing liabilities | | 4,908,120 | | | 4,820,660 | | | 4,708,045 | | | 4,538,893 | | | 4,442,172 | | | 4,864,633 | | | 4,435,678 | |

| Average shareholders’ equity | | 477,711 | | | 463,556 | | | 441,084 | | | 461,328 | | | 471,420 | | | 470,673 | | | 504,825 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| [1] ROA and ROE are annualized based on a 30/360 day convention. Annualized net interest income and expense in the NIM calculation are based on the day count interest payment conventions at the interest-earning asset or interest-bearing liability level (i.e. 30/360, actual/actual). |

| [2] Efficiency ratio is defined as total operating expense divided by total revenue (net interest income and total other operating income). |

| [3] Dividend payout ratio is defined as dividends declared per share divided by diluted earnings per share. | | | | |

| | | | |

| | | | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Financial Highlights | |

| (Unaudited) | TABLE 1 (CONTINUED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| REGULATORY CAPITAL RATIOS | | | | | | | | | | |

| Central Pacific Financial Corp. | | | | | | | | | | |

| Leverage capital ratio | | 8.7 | % | | 8.6 | % | | 8.5 | % | | 8.7 | % | | 8.6 | % |

| Tier 1 risk-based capital ratio | | 11.8 | | | 11.5 | | | 11.3 | | | 11.5 | | | 11.6 | |

| Total risk-based capital ratio | | 13.9 | | | 13.6 | | | 13.5 | | | 13.7 | | | 13.9 | |

| Common equity tier 1 capital ratio | | 10.9 | | | 10.6 | | | 10.5 | | | 10.6 | | | 10.7 | |

| Central Pacific Bank | | | | | | | | | | |

| Leverage capital ratio | | 9.1 | | | 9.0 | | | 9.0 | | | 9.1 | | | 9.0 | |

| Tier 1 risk-based capital ratio | | 12.3 | | | 12.0 | | | 11.9 | | | 12.2 | | | 12.2 | |

| Total risk-based capital ratio | | 13.5 | | | 13.2 | | | 13.1 | | | 13.4 | | | 13.5 | |

| Common equity tier 1 capital ratio | | 12.3 | | | 12.0 | | | 11.9 | | | 12.2 | | | 12.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (dollars in thousands, except for per share amounts) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| BALANCE SHEET | | | | | | | | | | |

| Total loans, net of deferred fees and costs | | $ | 5,520,683 | | | $ | 5,557,397 | | | $ | 5,555,466 | | | $ | 5,422,212 | | | $ | 5,301,633 | |

| Total assets | | 7,567,592 | | | 7,521,247 | | | 7,432,763 | | | 7,337,631 | | | 7,299,178 | |

| Total deposits | | 6,805,737 | | | 6,746,968 | | | 6,736,223 | | | 6,556,434 | | | 6,622,061 | |

| Long-term debt | | 155,981 | | | 155,920 | | | 105,859 | | | 105,799 | | | 105,738 | |

| Total shareholders’ equity | | 476,279 | | | 470,926 | | | 452,871 | | | 438,468 | | | 455,100 | |

| Total shareholders’ equity to total assets | | 6.29 | % | | 6.26 | % | | 6.09 | % | | 5.98 | % | | 6.23 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| ASSET QUALITY | | | | | | | | | | |

| Allowance for credit losses (ACL) | | $ | 63,849 | | | $ | 63,099 | | | $ | 63,738 | | | $ | 64,382 | | | $ | 65,211 | |

| Nonaccrual loans | | 11,061 | | | 5,313 | | | 5,251 | | | 4,220 | | | 4,983 | |

| Non-performing assets (NPA) | | 11,061 | | | 5,313 | | | 5,251 | | | 4,220 | | | 4,983 | |

| ACL to total loans | | 1.16 | % | | 1.14 | % | | 1.15 | % | | 1.19 | % | | 1.23 | % |

| | | | | | | | | | |

| ACL to nonaccrual loans | | 577.24 | % | | 1,187.63 | % | | 1,213.83 | % | | 1,525.64 | % | | 1,308.67 | % |

| NPA to total assets | | 0.15 | % | | 0.07 | % | | 0.07 | % | | 0.06 | % | | 0.07 | % |

| | | | | | | | | | |

| PER SHARE OF COMMON STOCK OUTSTANDING | | | | | | | | | | |

| Book value per common share | | $ | 17.61 | | | $ | 17.44 | | | $ | 16.76 | | | $ | 16.08 | | | $ | 16.57 | |

| | | | | | | | | | |

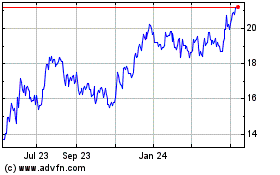

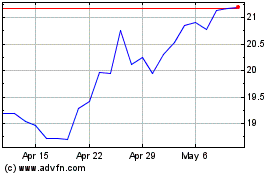

| Closing market price per common share | | 15.71 | | | 17.90 | | | 20.28 | | | 20.69 | | | 21.45 | |

| | | | | | | | | | |

|

|

|

|

|

|

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Consolidated Balance Sheets | |

| (Unaudited) | TABLE 2 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands, except share data) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| ASSETS | | | | | | | | | | |

| Cash and due from financial institutions | | $ | 129,071 | | | $ | 108,535 | | | $ | 97,150 | | | $ | 116,365 | | | $ | 108,389 | |

| Interest-bearing deposits in other financial institutions | | 181,913 | | | 90,247 | | | 14,894 | | | 22,332 | | | 22,741 | |

| Investment securities: | | | | | | | | | | |

| Available-for-sale debt securities, at fair value | | 664,071 | | | 687,188 | | | 671,794 | | | 686,681 | | | 787,373 | |

| Held-to-maturity debt securities, at amortized cost; fair value of: $581,222 at June 30, 2023, $599,300 at March 31, 2023, $596,780 at December 31, 2022, $590,880 at September 30, 2022, and $635,565 at June 30, 2022 | | 649,946 | | | 658,596 | | | 664,883 | | | 662,827 | | | 663,365 | |

| | | | | | | | | | |

| Total investment securities | | 1,314,017 | | | 1,345,784 | | | 1,336,677 | | | 1,349,508 | | | 1,450,738 | |

| Loans held for sale, at fair value | | 2,593 | | | — | | | 1,105 | | | 1,701 | | | 535 | |

| Loans, net of deferred fees and costs | | 5,520,683 | | | 5,557,397 | | | 5,555,466 | | | 5,422,212 | | | 5,301,633 | |

| Less: allowance for credit losses | | 63,849 | | | 63,099 | | | 63,738 | | | 64,382 | | | 65,211 | |

| Loans, net of allowance for credit losses | | 5,456,834 | | | 5,494,298 | | | 5,491,728 | | | 5,357,830 | | | 5,236,422 | |

| Premises and equipment, net | | 96,479 | | | 93,761 | | | 91,634 | | | 89,979 | | | 88,664 | |

| Accrued interest receivable | | 20,463 | | | 20,473 | | | 20,345 | | | 18,134 | | | 17,146 | |

| Investment in unconsolidated entities | | 45,218 | | | 45,953 | | | 46,641 | | | 36,769 | | | 37,341 | |

| | | | | | | | | | |

| Mortgage servicing rights | | 8,843 | | | 8,943 | | | 9,074 | | | 9,216 | | | 9,369 | |

| | | | | | | | | | |

| Bank-owned life insurance | | 168,136 | | | 168,244 | | | 167,967 | | | 167,761 | | | 167,202 | |

| Federal Home Loan Bank ("FHLB") stock | | 10,960 | | | 11,960 | | | 9,146 | | | 13,546 | | | 8,943 | |

| Right-of-use lease asset | | 33,247 | | | 34,237 | | | 34,985 | | | 35,978 | | | 36,978 | |

| Other assets | | 99,818 | | | 98,812 | | | 111,417 | | | 118,512 | | | 114,710 | |

| Total assets | | $ | 7,567,592 | | | $ | 7,521,247 | | | $ | 7,432,763 | | | $ | 7,337,631 | | | $ | 7,299,178 | |

| LIABILITIES | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Noninterest-bearing demand | | $ | 2,009,387 | | | $ | 2,028,087 | | | $ | 2,092,823 | | | $ | 2,138,083 | | | $ | 2,282,967 | |

| Interest-bearing demand | | 1,359,978 | | | 1,386,913 | | | 1,453,167 | | | 1,441,302 | | | 1,444,566 | |

| Savings and money market | | 2,184,652 | | | 2,184,675 | | | 2,199,028 | | | 2,194,991 | | | 2,214,146 | |

| Time | | 1,251,720 | | | 1,147,293 | | | 991,205 | | | 782,058 | | | 680,382 | |

| Total deposits | | 6,805,737 | | | 6,746,968 | | | 6,736,223 | | | 6,556,434 | | | 6,622,061 | |

| FHLB advances and other short-term borrowings | | — | | | 25,000 | | | 5,000 | | | 115,000 | | | — | |

| Long-term debt, net of unamortized debt issuance costs of: $566 at June 30, 2023, $627 at March 31, 2023, $688 at December 31, 2022, $748 at September 30, 2022 and $809 at June 30, 2022 | | 155,981 | | | 155,920 | | | 105,859 | | | 105,799 | | | 105,738 | |

| Lease liability | | 34,111 | | | 35,076 | | | 35,889 | | | 36,941 | | | 38,037 | |

| | | | | | | | | | |

| Other liabilities | | 95,484 | | | 87,357 | | | 96,921 | | | 84,989 | | | 78,242 | |

| Total liabilities | | 7,091,313 | | | 7,050,321 | | | 6,979,892 | | | 6,899,163 | | | 6,844,078 | |

| EQUITY | | | | | | | | | | |

| Shareholders' equity: | | | | | | | | | | |

| Preferred stock, no par value, authorized 1,000,000 shares; issued and outstanding: none at June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022, and June 30, 2022 | | — | | | — | | | — | | | — | | | — | |

| Common stock, no par value, authorized 185,000,000 shares; issued and outstanding: 27,045,792 at June 30, 2023, 27,005,545 at March 31, 2023, 27,025,070 at December 31, 2022, 27,262,879 at September 30, 2022, and 27,463,562 at June 30, 2022 | | 405,511 | | | 405,866 | | | 408,071 | | | 412,994 | | | 417,862 | |

| Additional paid-in capital | | 101,997 | | | 101,188 | | | 101,346 | | | 100,426 | | | 98,977 | |

| Retained earnings | | 104,046 | | | 96,600 | | | 87,438 | | | 74,301 | | | 64,693 | |

| Accumulated other comprehensive loss | | (135,275) | | | (132,728) | | | (143,984) | | | (149,253) | | | (126,432) | |

| Total shareholders' equity | | 476,279 | | | 470,926 | | | 452,871 | | | 438,468 | | | 455,100 | |

| Non-controlling interest | | — | | | — | | | — | | | — | | | — | |

| Total equity | | 476,279 | | | 470,926 | | | 452,871 | | | 438,468 | | | 455,100 | |

| Total liabilities and equity | | $ | 7,567,592 | | | $ | 7,521,247 | | | $ | 7,432,763 | | | $ | 7,337,631 | | | $ | 7,299,178 | |

| | | | | | | | | | |

|

| | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Consolidated Statements of Income | |

| (Unaudited) | TABLE 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands, except per share data) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| Interest income: | | | | | | | | | | | | | | |

| Interest and fees on loans | | $ | 60,455 | | | $ | 58,269 | | | $ | 56,682 | | | $ | 51,686 | | | $ | 46,963 | | | $ | 118,724 | | | $ | 91,912 | |

| Interest and dividends on investment securities: | | | | | | | | | | | | | | |

| Taxable investment securities | | 7,145 | | | 7,336 | | | 7,104 | | | 6,933 | | | 7,035 | | | 14,481 | | | 14,004 | |

| Tax-exempt investment securities | | 727 | | | 790 | | | 776 | | | 805 | | | 807 | | | 1,517 | | | 1,623 | |

| Dividends on investment securities | | — | | | — | | | — | | | — | | | — | | | — | | | 21 | |

| Interest on deposits in other financial institutions | | 877 | | | 277 | | | 370 | | | 107 | | | 191 | | | 1,154 | | | 263 | |

| Dividend income on FHLB stock | | 120 | | | 136 | | | 105 | | | 138 | | | 68 | | | 256 | | | 127 | |

| Total interest income | | 69,324 | | | 66,808 | | | 65,037 | | | 59,669 | | | 55,064 | | | 136,132 | | | 107,950 | |

| Interest expense: | | | | | | | | | | | | | | |

| Interest on deposits: | | | | | | | | | | | | | | |

| Demand | | 411 | | | 363 | | | 333 | | | 217 | | | 144 | | | 774 | | | 256 | |

| Savings and money market | | 4,670 | | | 3,386 | | | 2,488 | | | 1,054 | | | 317 | | | 8,056 | | | 646 | |

| Time | | 8,932 | | | 6,264 | | | 4,063 | | | 1,092 | | | 490 | | | 15,196 | | | 959 | |

| Interest on short-term borrowings | | 378 | | | 761 | | | 393 | | | 660 | | | 2 | | | 1,139 | | | 2 | |

| Interest on long-term debt | | 2,199 | | | 1,838 | | | 1,475 | | | 1,281 | | | 1,133 | | | 4,037 | | | 2,174 | |

| Total interest expense | | 16,590 | | | 12,612 | | | 8,752 | | | 4,304 | | | 2,086 | | | 29,202 | | | 4,037 | |

| Net interest income | | 52,734 | | | 54,196 | | | 56,285 | | | 55,365 | | | 52,978 | | | 106,930 | | | 103,913 | |

| Provision (credit) for credit losses | | 4,319 | | | 1,852 | | | 571 | | | 362 | | | 989 | | | 6,171 | | | (2,206) | |

| Net interest income after provision (credit) for credit losses | | 48,415 | | | 52,344 | | | 55,714 | | | 55,003 | | | 51,989 | | | 100,759 | | | 106,119 | |

| Other operating income: | | | | | | | | | | | | | | |

| Mortgage banking income | | 690 | | | 526 | | | 667 | | | 831 | | | 1,140 | | | 1,216 | | | 2,312 | |

| Service charges on deposit accounts | | 2,137 | | | 2,111 | | | 2,172 | | | 2,138 | | | 2,026 | | | 4,248 | | | 3,887 | |

| Other service charges and fees | | 4,994 | | | 4,985 | | | 4,972 | | | 4,955 | | | 4,610 | | | 9,979 | | | 9,098 | |

| Income from fiduciary activities | | 1,068 | | | 1,321 | | | 1,058 | | | 1,165 | | | 1,188 | | | 2,389 | | | 2,342 | |

| Net gain on sales of investment securities | | — | | | — | | | — | | | — | | | 8,506 | | | — | | | 8,506 | |

| Income from bank-owned life insurance | | 1,185 | | | 1,291 | | | 2,187 | | | 167 | | | (1,028) | | | 2,476 | | | (489) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other | | 361 | | | 775 | | | 545 | | | 373 | | | 696 | | | 1,136 | | | 1,033 | |

| Total other operating income | | 10,435 | | | 11,009 | | | 11,601 | | | 9,629 | | | 17,138 | | | 21,444 | | | 26,689 | |

| Other operating expense: | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 20,848 | | | 22,023 | | | 22,692 | | | 22,778 | | | 22,369 | | | 42,871 | | | 43,311 | |

| Net occupancy | | 4,310 | | | 4,474 | | | 3,998 | | | 4,743 | | | 4,448 | | | 8,784 | | | 8,222 | |

| Equipment | | 932 | | | 946 | | | 996 | | | 1,085 | | | 1,075 | | | 1,878 | | | 2,157 | |

| | | | | | | | | | | | | | |

| Communication | | 791 | | | 778 | | | 696 | | | 712 | | | 744 | | | 1,569 | | | 1,550 | |

| Legal and professional services | | 2,469 | | | 2,886 | | | 2,677 | | | 2,573 | | | 2,916 | | | 5,355 | | | 5,542 | |

| Computer software | | 4,621 | | | 4,606 | | | 3,996 | | | 4,138 | | | 3,624 | | | 9,227 | | | 6,706 | |

| Advertising | | 942 | | | 933 | | | 701 | | | 1,150 | | | 1,150 | | | 1,875 | | | 2,300 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other | | 4,990 | | | 5,461 | | | 4,678 | | | 4,819 | | | 9,023 | | | 10,451 | | | 13,766 | |

| Total other operating expense | | 39,903 | | | 42,107 | | | 40,434 | | | 41,998 | | | 45,349 | | | 82,010 | | | 83,554 | |

| Income before income taxes | | 18,947 | | | 21,246 | | | 26,881 | | | 22,634 | | | 23,778 | | | 40,193 | | | 49,254 | |

| Income tax expense | | 4,472 | | | 5,059 | | | 6,700 | | | 5,919 | | | 6,184 | | | 9,531 | | | 12,222 | |

| Net income | | $ | 14,475 | | | $ | 16,187 | | | $ | 20,181 | | | $ | 16,715 | | | $ | 17,594 | | | $ | 30,662 | | | $ | 37,032 | |

| Per common share data: | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.54 | | | $ | 0.60 | | | $ | 0.74 | | | $ | 0.61 | | | $ | 0.64 | | | $ | 1.14 | | | $ | 1.34 | |

| Diluted earnings per share | | 0.53 | | | 0.60 | | | 0.74 | | | 0.61 | | | 0.64 | | | 1.13 | | | 1.33 | |

| Cash dividends declared | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.26 | | | 0.52 | | | 0.52 | |

| Basic weighted average shares outstanding | | 27,024,043 | | | 26,999,138 | | | 27,134,970 | | | 27,356,614 | | | 27,516,284 | | | 27,011,659 | | | 27,553,629 | |

| Diluted weighted average shares outstanding | | 27,071,478 | | | 27,122,012 | | | 27,303,249 | | | 27,501,212 | | | 27,676,619 | | | 27,090,258 | | | 27,759,187 | |

| | | | | | | | | | | | | | |

| Note: Certain amounts in the prior period financial statements have been reclassified to conform to the presentation of the current period. |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) | |

| (Unaudited) | TABLE 4 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Three Months Ended | | Three Months Ended |

| | June 30, 2023 | | March 31, 2023 | | June 30, 2022 |

| | | Average | | Average | | | | Average | | Average | | | | Average | | Average | | |

| (Dollars in thousands) | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest |

| ASSETS |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits in other financial institutions | | $ | 69,189 | | | 5.08 | % | | $ | 877 | | | $ | 24,957 | | | 4.51 | % | | $ | 277 | | | $ | 106,083 | | | 0.72 | % | | $ | 191 | |

| Investment securities, excluding valuation allowance: | | | | | | | | | | | | | | | | | | |

| Taxable | | 1,379,319 | | | 2.07 | | | 7,145 | | | 1,395,985 | | | 2.10 | | | 7,336 | | | 1,487,129 | | | 1.89 | | | 7,034 | |

| Tax-exempt [1] | | 151,979 | | | 2.42 | | | 920 | | | 153,067 | | | 2.61 | | | 1,000 | | | 159,087 | | | 2.57 | | | 1,023 | |

| Total investment securities | | 1,531,298 | | | 2.11 | | | 8,065 | | | 1,549,052 | | | 2.15 | | | 8,336 | | | 1,646,216 | | | 1.96 | | | 8,057 | |

| Loans, including loans held for sale | | 5,543,398 | | | 4.37 | | | 60,455 | | | 5,525,988 | | | 4.26 | | | 58,269 | | | 5,221,300 | | | 3.60 | | | 46,963 | |

| Federal Home Loan Bank stock | | 11,721 | | | 4.10 | | | 120 | | | 12,380 | | | 4.40 | | | 136 | | | 8,957 | | | 3.02 | | | 68 | |

| Total interest-earning assets | | 7,155,606 | | | 3.89 | | | 69,517 | | | 7,112,377 | | | 3.80 | | | 67,018 | | | 6,982,556 | | | 3.17 | | | 55,279 | |

| Noninterest-earning assets | | 308,023 | | | | | | | 331,390 | | | | | | | 327,383 | | | | | |

| Total assets | | $ | 7,463,629 | | | | | | | $ | 7,443,767 | | | | | | | $ | 7,309,939 | | | | | |

| | | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | | $ | 1,367,878 | | | 0.12 | % | | $ | 411 | | | $ | 1,415,155 | | | 0.10 | % | | $ | 363 | | | $ | 1,435,088 | | | 0.04 | % | | $ | 144 | |

| Savings and money market deposits | | 2,172,680 | | | 0.86 | | | 4,670 | | | 2,182,942 | | | 0.63 | | | 3,386 | | | 2,204,934 | | | 0.06 | | | 317 | |

| Time deposits up to $250,000 | | 390,961 | | | 2.98 | | | 2,907 | | | 341,396 | | | 2.22 | | | 1,870 | | | 217,605 | | | 0.27 | | | 148 | |

| Time deposits over $250,000 | | 790,864 | | | 3.06 | | | 6,025 | | | 689,432 | | | 2.58 | | | 4,394 | | | 478,483 | | | 0.29 | | | 342 | |

| Total interest-bearing deposits | | 4,722,383 | | | 1.19 | | | 14,013 | | | 4,628,925 | | | 0.88 | | | 10,013 | | | 4,336,110 | | | 0.09 | | | 951 | |

| | | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank advances and other short-term borrowings | | 29,791 | | | 5.09 | | | 378 | | | 64,462 | | | 4.79 | | | 761 | | | 363 | | | 1.84 | | | 2 | |

| Long-term debt | | 155,946 | | | 5.65 | | | 2,199 | | | 127,273 | | | 5.86 | | | 1,838 | | | 105,699 | | | 4.30 | | | 1,133 | |

| Total interest-bearing liabilities | | 4,908,120 | | | 1.36 | | | 16,590 | | | 4,820,660 | | | 1.06 | | | 12,612 | | | 4,442,172 | | | 0.19 | | | 2,086 | |

| Noninterest-bearing deposits | | 1,952,267 | | | | | | | 2,026,735 | | | | | | | 2,290,352 | | | | | |

| Other liabilities | | 125,531 | | | | | | | 132,816 | | | | | | | 105,979 | | | | | |

| Total liabilities | | 6,985,918 | | | | | | | 6,980,211 | | | | | | | 6,838,503 | | | | | |

| Shareholders’ equity | | 477,711 | | | | | | | 463,556 | | | | | | | 471,420 | | | | | |

| Non-controlling interest | | — | | | | | | | — | | | | | | | 16 | | | | | |

| Total equity | | 477,711 | | | | | | | 463,556 | | | | | | | 471,436 | | | | | |

| Total liabilities and equity | | $ | 7,463,629 | | | | | | | $ | 7,443,767 | | | | | | | $ | 7,309,939 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net interest income | | | | | | $ | 52,927 | | | | | | | $ | 54,406 | | | | | | | $ | 53,193 | |

| | | | | | | | | | | | | | | | | | |

| Interest rate spread | | | | 2.53 | % | | | | | | 2.74 | % | | | | | | 2.98 | % | | |

| | | | | | | | | | | | | | | | | | |

| Net interest margin | | | | 2.96 | % | | | | | | 3.08 | % | | | | | | 3.05 | % | | |

| | | | | | | | | | | | | | | | | | |

|

| [1] Interest income and resultant yield information for tax-exempt investment securities is expressed on a taxable-equivalent basis using a federal statutory tax rate of 21%. |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) | |

| (Unaudited) | TABLE 5 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | Six Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| | | Average | | Average | | | | Average | | Average | | |

| (Dollars in thousands) | | Balance | | Yield/Rate | | Interest | | Balance | | Yield/Rate | | Interest |

| ASSETS |

| Interest-earning assets: | | | | | | | | | | | | |

| Interest-bearing deposits in other financial institutions | | $ | 47,195 | | | 4.93 | % | | $ | 1,154 | | | $ | 131,829 | | | 0.40 | % | | $ | 263 | |

| Investment securities, excluding valuation allowance: | | | | | | | | | | | | |

| Taxable | | 1,387,606 | | | 2.09 | | | 14,481 | | | 1,488,327 | | | 1.88 | | | 14,024 | |

| Tax-exempt [1] | | 152,520 | | | 2.52 | | | 1,920 | | | 161,208 | | | 2.55 | | | 2,056 | |

| Total investment securities | | 1,540,126 | | | 2.13 | | | 16,401 | | | 1,649,535 | | | 1.95 | | | 16,080 | |

| Loans, including loans held for sale | | 5,534,741 | | | 4.32 | | | 118,724 | | | 5,168,076 | | | 3.58 | | | 91,912 | |

| Federal Home Loan Bank stock | | 12,049 | | | 4.26 | | | 256 | | | 8,479 | | | 3.00 | | | 127 | |

| Total interest-earning assets | | 7,134,111 | | | 3.85 | | | 136,535 | | | 6,957,919 | | | 3.13 | | | 108,382 | |

| Noninterest-earning assets | | 319,642 | | | | | | | 367,124 | | | | | |

| Total assets | | $ | 7,453,753 | | | | | | | $ | 7,325,043 | | | | | |

| | | | | | | | | | | | |

| LIABILITIES AND EQUITY |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Interest-bearing demand deposits | | $ | 1,391,386 | | | 0.11 | % | | $ | 774 | | | $ | 1,430,222 | | | 0.04 | % | | $ | 256 | |

| Savings and money market deposits | | 2,177,783 | | | 0.75 | | | 8,056 | | | 2,208,659 | | | 0.06 | | | 646 | |

| Time deposits up to $250,000 | | 366,316 | | | 2.63 | | | 4,776 | | | 220,617 | | | 0.28 | | | 303 | |

| Time deposits over $250,000 | | 740,428 | | | 2.84 | | | 10,420 | | | 470,330 | | | 0.28 | | | 656 | |

| Total interest-bearing deposits | | 4,675,913 | | | 1.04 | | | 24,026 | | | 4,329,828 | | | 0.09 | | | 1,861 | |

| | | | | | | | | | | | |

| Federal Home Loan Bank advances and other short-term borrowings | | 47,031 | | | 4.88 | | | 1,139 | | | 182 | | | 1.84 | | | 2 | |

| Long-term debt | | 141,689 | | | 5.75 | | | 4,037 | | | 105,668 | | | 4.15 | | | 2,174 | |

| Total interest-bearing liabilities | | 4,864,633 | | | 1.21 | | | 29,202 | | | 4,435,678 | | | 0.18 | | | 4,037 | |

| Noninterest-bearing deposits | | 1,989,295 | | | | | | | 2,273,639 | | | | | |

| Other liabilities | | 129,152 | | | | | | | 110,868 | | | | | |

| Total liabilities | | 6,983,080 | | | | | | | 6,820,185 | | | | | |

| Shareholders’ equity | | 470,673 | | | | | | | 504,825 | | | | | |

| Non-controlling interest | | — | | | | | | | 32 | | | | | |

| Total equity | | 470,673 | | | | | | | 504,857 | | | | | |

| Total liabilities and equity | | $ | 7,453,753 | | | | | | | $ | 7,325,042 | | | | | |

| | | | | | | | | | | | |

| Net interest income | | | | | | $ | 107,333 | | | | | | | $ | 104,345 | |

| | | | | | | | | | | | |

| Interest rate spread | | | | 2.64 | % | | | | | | 2.95 | % | | |

| | | | | | | | | | | | |

| Net interest margin | | | | 3.02 | % | | | | | | 3.01 | % | | |

| | | | | | | | | | | | |

|

| [1] Interest income and resultant yield information for tax-exempt investment securities is expressed on a taxable-equivalent basis using a federal statutory tax rate of 21%. |

| | | | | | | | | | | | |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Loans by Geographic Distribution | |

| (Unaudited) | TABLE 6 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| HAWAII: | | | | | | | | | | |

| Commercial, financial and agricultural: | | | | | | | | | | |

| SBA Paycheck Protection Program | | $ | 1,565 | | | $ | 1,821 | | | $ | 2,555 | | | $ | 5,208 | | | $ | 19,469 | |

| Other | | 373,036 | | | 375,158 | | | 383,665 | | | 358,805 | | | 367,676 | |

| Real estate: | | | | | | | | | | |

| Construction | | 168,012 | | | 154,303 | | | 150,208 | | | 138,724 | | | 134,103 | |

| Residential mortgage | | 1,942,906 | | | 1,941,230 | | | 1,940,999 | | | 1,923,068 | | | 1,890,783 | |

| Home equity | | 750,760 | | | 743,908 | | | 739,380 | | | 719,399 | | | 698,209 | |

| Commercial mortgage | | 1,037,826 | | | 1,030,086 | | | 1,029,708 | | | 1,002,874 | | | 994,405 | |

| Consumer | | 327,790 | | | 342,922 | | | 346,789 | | | 347,388 | | | 341,213 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 4,601,895 | | | 4,589,428 | | | 4,593,304 | | | 4,495,466 | | | 4,445,858 | |

| Allowance for credit losses | | (44,828) | | | (44,062) | | | (45,169) | | | (47,814) | | | (51,374) | |

| Loans, net of allowance for credit losses | | $ | 4,557,067 | | | $ | 4,545,366 | | | $ | 4,548,135 | | | $ | 4,447,652 | | | $ | 4,394,484 | |

| | | | | | | | | | |

| U.S. MAINLAND: [1] | | | | | | | | | | |

| Commercial, financial and agricultural: | | | | | | | | | | |

| SBA Paycheck Protection Program | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 712 | |

| Other | | 170,557 | | | 179,906 | | | 160,282 | | | 158,474 | | | 156,567 | |

| Real estate: | | | | | | | | | | |

| Construction | | 32,807 | | | 27,171 | | | 16,515 | | | 12,872 | | | 10,935 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial mortgage | | 329,736 | | | 331,546 | | | 333,367 | | | 332,872 | | | 309,230 | |

| Consumer | | 385,688 | | | 429,346 | | | 451,998 | | | 422,528 | | | 378,331 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 918,788 | | | 967,969 | | | 962,162 | | | 926,746 | | | 855,775 | |

| Allowance for credit losses | | (19,021) | | | (19,037) | | | (18,569) | | | (16,568) | | | (13,837) | |

| Loans, net of allowance for credit losses | | $ | 899,767 | | | $ | 948,932 | | | $ | 943,593 | | | $ | 910,178 | | | $ | 841,938 | |

| | | | | | | | | | |

| TOTAL: | | | | | | | | | | |

| Commercial, financial and agricultural: | | | | | | | | | | |

| SBA Paycheck Protection Program | | $ | 1,565 | | | $ | 1,821 | | | $ | 2,555 | | | $ | 5,208 | | | $ | 20,181 | |

| Other | | 543,593 | | | 555,064 | | | 543,947 | | | 517,279 | | | 524,243 | |

| Real estate: | | | | | | | | | | |

| Construction | | 200,819 | | | 181,474 | | | 166,723 | | | 151,596 | | | 145,038 | |

| Residential mortgage | | 1,942,906 | | | 1,941,230 | | | 1,940,999 | | | 1,923,068 | | | 1,890,783 | |

| Home equity | | 750,760 | | | 743,908 | | | 739,380 | | | 719,399 | | | 698,209 | |

| Commercial mortgage | | 1,367,562 | | | 1,361,632 | | | 1,363,075 | | | 1,335,746 | | | 1,303,635 | |

| Consumer | | 713,478 | | | 772,268 | | | 798,787 | | | 769,916 | | | 719,544 | |

| | | | | | | | | | |

| Total loans, net of deferred fees and costs | | 5,520,683 | | | 5,557,397 | | | 5,555,466 | | | 5,422,212 | | | 5,301,633 | |

| Allowance for credit losses | | (63,849) | | | (63,099) | | | (63,738) | | | (64,382) | | | (65,211) | |

| Loans, net of allowance for credit losses | | $ | 5,456,834 | | | $ | 5,494,298 | | | $ | 5,491,728 | | | $ | 5,357,830 | | | $ | 5,236,422 | |

| | | | | | | | | | |

| [1] U.S. Mainland includes territories of the United States. |

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Deposits | |

| (Unaudited) | TABLE 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Noninterest-bearing demand deposits | | $ | 2,009,387 | | | $ | 2,028,087 | | | $ | 2,092,823 | | | $ | 2,138,083 | | | $ | 2,282,967 | |

| Interest-bearing demand deposits | | 1,359,978 | | | 1,386,913 | | | 1,453,167 | | | 1,441,302 | | | 1,444,566 | |

| Savings and money market deposits | | 2,184,652 | | | 2,184,675 | | | 2,199,028 | | | 2,194,991 | | | 2,214,146 | |

| Time deposits less than $100,000 | | 221,366 | | | 188,289 | | | 181,547 | | | 153,238 | | | 129,103 | |

| Other time deposits $100,000 to $250,000 | | 206,498 | | | 183,861 | | | 148,601 | | | 108,723 | | | 84,840 | |

| Core deposits | | 5,981,881 | | | 5,971,825 | | | 6,075,166 | | | 6,036,337 | | | 6,155,622 | |

| | | | | | | | | | |

| Government time deposits | | 383,426 | | | 360,501 | | | 290,057 | | | 195,057 | | | 165,000 | |

| | | | | | | | | | |

| Other time deposits greater than $250,000 | | 440,430 | | | 414,642 | | | 371,000 | | | 325,040 | | | 301,439 | |

| Total time deposits greater than $250,000 | | 823,856 | | | 775,143 | | | 661,057 | | | 520,097 | | | 466,439 | |

| Total deposits | | $ | 6,805,737 | | | $ | 6,746,968 | | | $ | 6,736,223 | | | $ | 6,556,434 | | | $ | 6,622,061 | |

| | | | | | | | | | |

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Nonperforming Assets, Past Due and Restructured Loans | |

| (Unaudited) | TABLE 8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 |

| Nonaccrual loans: | | | | | | | | | | |

| Commercial, financial and agricultural - Other | | $ | 319 | | | $ | 264 | | | $ | 297 | | | $ | 277 | | | $ | 333 | |

| Real estate: | | | | | | | | | | |

| Construction | | 4,851 | | | — | | | — | | | — | | | — | |

| Residential mortgage | | 4,385 | | | 3,445 | | | 3,808 | | | 2,771 | | | 3,490 | |

| Home equity | | 797 | | | 712 | | | 570 | | | 584 | | | 592 | |

| Commercial mortgage | | 77 | | | 77 | | | — | | | — | | | — | |

| Consumer | | 632 | | | 815 | | | 576 | | | 588 | | | 568 | |

| | | | | | | | | | |

| Total nonaccrual loans | | 11,061 | | | 5,313 | | | 5,251 | | | 4,220 | | | 4,983 | |

| Other real estate owned ("OREO"): | | | | | | | | | | |

| | | | | | | | | | |

| Real estate: | | | | | | | | | | |

| | | | | | | | | | |

| Residential mortgage | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total OREO | | — | | | — | | | — | | | — | | | — | |

| Total nonperforming assets ("NPAs") | | 11,061 | | | 5,313 | | | 5,251 | | | 4,220 | | | 4,983 | |

| Loans delinquent for 90 days or more still accruing interest: | | | | | | | | | | |

| Commercial, financial and agricultural: | | | | | | | | | | |

| SBA PPP | | — | | | — | | | 13 | | | — | | | — | |

| Other | | — | | | — | | | 26 | | | 669 | | | 309 | |

| Real estate: | | | | | | | | | | |

| | | | | | | | | | |

| Residential mortgage | | 959 | | | — | | | 559 | | | 503 | | | — | |

| Home equity | | 133 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Consumer | | 2,207 | | | 1,908 | | | 1,240 | | | 623 | | | 842 | |

| | | | | | | | | | |

| Total loans delinquent for 90 days or more still accruing interest | | 3,299 | | | 1,908 | | | 1,838 | | | 1,795 | | | 1,151 | |

| Restructured loans still accruing interest: | | | | | | | | | | |

| | | | | | | | | | |

| Real estate: | | | | | | | | | | |

| | | | | | | | | | |

| Residential mortgage | | 1,339 | | | 1,376 | | | 1,845 | | | 2,030 | | | 2,006 | |

| | | | | | | | | | |

| Commercial mortgage | | 805 | | | 846 | | | 886 | | | 925 | | | 965 | |

| Consumer | | 47 | | | 54 | | | 62 | | | 69 | | | 76 | |

| | | | | | | | | | |

| Total restructured loans still accruing interest | | 2,191 | | | 2,276 | | | 2,793 | | | 3,024 | | | 3,047 | |

| Total NPAs and loans delinquent for 90 days or more and restructured loans still accruing interest | | $ | 16,551 | | | $ | 9,497 | | | $ | 9,882 | | | $ | 9,039 | | | $ | 9,181 | |

| | | | | | | | | | |

| Total nonaccrual loans as a percentage of total loans | | 0.20 | % | | 0.10 | % | | 0.09 | % | | 0.08 | % | | 0.09 | % |

| Total NPAs as a percentage of total loans and OREO | | 0.20 | % | | 0.10 | % | | 0.09 | % | | 0.08 | % | | 0.09 | % |

| Total NPAs and loans delinquent for 90 days or more still accruing interest as a percentage of total loans and OREO | | 0.26 | % | | 0.13 | % | | 0.13 | % | | 0.11 | % | | 0.12 | % |

| Total NPAs, loans delinquent for 90 days or more and restructured loans still accruing interest as a percentage of total loans and OREO | | 0.30 | % | | 0.17 | % | | 0.18 | % | | 0.17 | % | | 0.17 | % |

| | | | | | | | | | |

| Quarter-to-quarter changes in NPAs: | | | | | | | | | | |

| Balance at beginning of quarter | | $ | 5,313 | | | $ | 5,251 | | | $ | 4,220 | | | $ | 4,983 | | | $ | 5,336 | |

| Additions | | 7,105 | | | 1,609 | | | 2,162 | | | 1,072 | | | 1,881 | |

| Reductions: | | | | | | | | | | |

| Payments | | (290) | | | (505) | | | (198) | | | (329) | | | (285) | |

| Return to accrual status | | (212) | | | (14) | | | (44) | | | (616) | | | (979) | |

| | | | | | | | | | |

| Net charge-offs, valuation and other adjustments | | (855) | | | (1,028) | | | (889) | | | (890) | | | (970) | |

| Total reductions | | (1,357) | | | (1,547) | | | (1,131) | | | (1,835) | | | (2,234) | |

| Balance at end of quarter | | $ | 11,061 | | | $ | 5,313 | | | $ | 5,251 | | | $ | 4,220 | | | $ | 4,983 | |

| | | | | | | | | | |

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Allowance for Credit Losses on Loans | |

| (Unaudited) | TABLE 9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| Allowance for credit losses: | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 63,099 | | | $ | 63,738 | | | $ | 64,382 | | | $ | 65,211 | | | $ | 64,754 | | | $ | 63,738 | | | $ | 68,097 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Provision (credit) for credit losses on loans | | 4,135 | | | 1,615 | | | 1,032 | | | 731 | | | 1,456 | | | 5,750 | | | (1,475) | |

| | | | | | | | | | | | | | |

| Charge-offs: | | | | | | | | | | | | | | |

| Commercial, financial and agricultural - Other | | 362 | | | 779 | | | 678 | | | 550 | | | 487 | | | 1,141 | | | 741 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Consumer | | 3,873 | | | 2,686 | | | 1,881 | | | 1,912 | | | 1,390 | | | 6,559 | | | 2,606 | |

| | | | | | | | | | | | | | |

| Total charge-offs | | 4,235 | | | 3,465 | | | 2,559 | | | 2,462 | | | 1,877 | | | 7,700 | | | 3,347 | |

| | | | | | | | | | | | | | |

| Recoveries: | | | | | | | | | | | | | | |

| Commercial, financial and agricultural - Other | | 125 | | | 250 | | | 210 | | | 220 | | | 215 | | | 375 | | | 565 | |

| Real estate: | | | | | | | | | | | | | | |

| Construction | | — | | | — | | | — | | | 14 | | | 62 | | | — | | | 62 | |

| Residential mortgage | | 7 | | | 53 | | | 133 | | | 14 | | | 36 | | | 60 | | | 148 | |

| Home equity | | 15 | | | — | | | — | | | 36 | | | — | | | 15 | | | — | |

| | | | | | | | | | | | | | |

| Consumer | | 703 | | | 908 | | | 540 | | | 618 | | | 565 | | | 1,611 | | | 1,161 | |

| | | | | | | | | | | | | | |

| Total recoveries | | 850 | | | 1,211 | | | 883 | | | 902 | | | 878 | | | 2,061 | | | 1,936 | |

Net charge-offs | | 3,385 | | | 2,254 | | | 1,676 | | | 1,560 | | | 999 | | | 5,639 | | | 1,411 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Balance at end of period | | $ | 63,849 | | | $ | 63,099 | | | $ | 63,738 | | | $ | 64,382 | | | $ | 65,211 | | | $ | 63,849 | | | $ | 65,211 | |

| | | | | | | | | | | | | | |

| Average loans, net of deferred fees and costs | | $ | 5,543,398 | | | $ | 5,525,988 | | | $ | 5,498,800 | | | $ | 5,355,088 | | | $ | 5,221,300 | | | $ | 5,534,741 | | | $ | 5,168,076 | |

| Annualized ratio of net charge-offs to average loans | | 0.24 | % | | 0.16 | % | | 0.12 | % | | 0.12 | % | | 0.08 | % | | 0.20 | % | | 0.05 | % |

| | | | | | | | | | | | | | |

|

|

| | | | | |

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES | |

| Reconciliation of Non-GAAP Financial Measures | |

| (Unaudited) | TABLE 10 |

To supplement our consolidated financial statements presented in accordance with GAAP, the Company also uses non-GAAP financial measures in addition to our GAAP results. The Company believes non-GAAP financial measures may provide useful information for evaluating our cash operating performance, ability to service debt, compliance with debt covenants and measurement against competitors. This information should be considered as supplemental in nature and should not be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be comparable to similarly entitled measures reported by other companies.

The Company believes that pre-provision net revenue ("PPNR"), a non-GAAP financial measure, is useful as a tool to help evaluate the ability to provide for credit costs through operations. The following tables set forth a reconciliation of our PPNR and our PPNR to average assets for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 14,475 | | | $ | 16,187 | | | $ | 20,181 | | | $ | 16,715 | | | $ | 17,594 | | | $ | 30,662 | | | $ | 37,032 | |

| Add: Income tax expense | | 4,472 | | | 5,059 | | | 6,700 | | | 5,919 | | | 6,184 | | | 9,531 | | | 12,222 | |

| Pre-tax income | | 18,947 | | | 21,246 | | | 26,881 | | | 22,634 | | | 23,778 | | | 40,193 | | | 49,254 | |

| Add: Provision (credit) for credit losses | | 4,319 | | | 1,852 | | | 571 | | | 362 | | | 989 | | | 6,171 | | | (2,206) | |

| PPNR | | $ | 23,266 | | | $ | 23,098 | | | $ | 27,452 | | | $ | 22,996 | | | $ | 24,767 | | | $ | 46,364 | | | $ | 47,048 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | Jun 30, | | Mar 31, | | Dec 31, | | Sep 30, | | Jun 30, | | Jun 30, |

| (Dollars in thousands) | | 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 14,475 | | | $ | 16,187 | | | $ | 20,181 | | | $ | 16,715 | | | $ | 17,594 | | | $ | 30,662 | | | $ | 37,032 | |

| Net income (annualized) | | 57,900 | | | 64,748 | | | 80,724 | | | 66,860 | | | 70,376 | | | 61,324 | | | 74,064 | |

| PPNR | | 23,266 | | | 23,098 | | | 27,452 | | | 22,996 | | | 24,767 | | | 46,364 | | | 47,048 | |

| PPNR (annualized) | | 93,064 | | | 92,392 | | | 109,808 | | | 91,984 | | | 99,068 | | | 92,728 | | | 94,096 | |

| Average assets | | 7,463,629 | | | 7,443,767 | | | 7,389,712 | | | 7,320,751 | | | 7,309,939 | | | 7,453,753 | | | 7,325,042 | |

| Return on average assets ("ROA") | | 0.78 | % | | 0.87 | % | | 1.09 | % | | 0.91 | % | | 0.96 | % | | 0.82 | % | | 1.01 | % |

| PPNR to average assets | | 1.25 | % | | 1.24 | % | | 1.49 | % | | 1.26 | % | | 1.36 | % | | 1.24 | % | | 1.28 | % |

2nd Quarter 2023 Earnings Supplement July 26, 2023

2Central Pacific Financial Corp. Forward-Looking Statements This document may contain forward-looking statements (“FLS”) concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the “Company”) or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; and any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons. Factors that could cause actual results to differ from those discussed in the forward-looking statements include but are not limited to: the effects of inflation and rising interest rates; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and ongoing pandemic variants) on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement and achieve the objectives of our BaaS initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic viruses and diseases) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd- Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); securities market and monetary fluctuations, including the replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index and uncertainties regarding potential alternative reference rates, including the Secured Overnight Financing Rate ("SOFR"); negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board ("PCAOB"), the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and in particular, the discussion of "Risk Factors" set forth therein and herein. We urge investors to consider all of these factors carefully in evaluating the forward- looking statements contained in this document. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. Tourism Visitor arrivals compared to pre-pandemic 94.6% 1 Employment Unemployment Rate June 2023 3.0% 1 FACTORS FOR A FAVORABLE HAWAII OUTLOOK ▪ Tourism back up to pre-pandemic levels ▪ Substantial Federal government contracts and military investments ▪ Increase in public and private investments to address housing shortage ▪ Strong real estate market with stable prices ▪ Low unemployment ▪ Cooling inflation 1 Source: Hawaii Department of Business, Economic Development & Tourism. Tourism represents total visitor arrivals in May 2023 compared to May 2019. 2 Source: Honolulu Board of Realtors. Strong Hawaii Economic Position Housing Oahu Median Single- Family Home Price June 2023 $1.1M 2

4Central Pacific Financial Corp. 2nd Quarter 2023 Financial Highlights • Improved liquidity position with greater cash position, deposit growth and modest loan decline • Pre-Provision Net Revenue (PPNR) stable • Strong capital and asset quality • Quarterly cash dividend maintained at $0.26 • Fitch affirmed CPF at BBB- with Stable outlook 2Q23 1Q23 NET INCOME / DILUTED EPS $14.5 Mil / $0.53 $16.2 Mil / $0.60 PPNR $23.3 Mil $23.1 Mil RETURN ON ASSETS (ROA) 0.78% 0.87% RETURN ON EQUITY (ROE) 12.12% 13.97% TOTAL LOAN GROWTH -$37 Mil (-0.7%) +$2 Mil (--%) TOTAL DEPOSIT GROWTH +$59 Mil (+0.9%) +$11 Mil (+0.2%) NET INTEREST MARGIN (NIM) 2.96% 3.08%

5Central Pacific Financial Corp. Continued focus on near-term moderating loan portfolio Strong and diverse loan portfolio, with over 75% secured by real estate Diversified Loan Portfolio C&I 10% Construction 4% Residential Mortgage 35% Home Equity 13% Coml Mortgage 25% Consumer 13% Loan Portfolio Composition as of June 30, 2023 3.53 3.77 4.08 4.45 4.55 5.01 5.55 5.56 5.52 3.00 3.50 4.00 4.50 5.00 5.50 6.00 2016 2017 2018 2019 2020 2021 2022 1Q23 2Q23 $ B il li o n s Loan Balances Outstanding-Excluding PPP

6Central Pacific Financial Corp. • Diversified CRE portfolio, primarily Hawaii and Investor • Office exposure: $194MM outstanding (14% of total CRE, 4% of total loans), WA LTV 55%, 73 WA months to maturity • Investor: $146MM / Owner-Occupied: $48MM • Retail exposure: $251MM outstanding (18% of total CRE, 5% of total loans), WA LTV 64%, 63 WA months to maturity • Investor: $203MM / Owner-Occupied: $48MM Commercial Real Estate Portfolio Industrial/Warehouse 28% Apartment 23% Retail 17% Restaurant 1% Office 14% Hotel 7% Shopping Center 3% Storage 2% Other 5% CRE Portfolio Composition as of June 30, 2023 Hawaii 76% Mainland 24% Investor 75% Owner-Occupied 25%