Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 11 2021 - 5:30PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-238617

May 11, 2021

PRICING TERM

SHEET

(to Preliminary Prospectus Supplement, dated May 11, 2021)

|

|

|

|

|

|

|

|

|

Issuer:

|

|

CenterPoint Energy, Inc. (the “Issuer”)

|

|

|

|

|

Legal Format:

|

|

SEC Registered

|

|

|

|

|

Anticipated Ratings*:

|

|

Baa2 (stable) / BBB (stable) / BBB (stable) (Moody’s / S&P / Fitch)

|

|

|

|

|

|

|

Security:

|

|

1.45% Senior Notes due 2026

|

|

2.65% Senior Notes due 2031

|

|

Floating Rate Senior Notes due 2024

|

|

|

|

|

|

|

Principal Amount:

|

|

$500,000,000

|

|

$500,000,000

|

|

$700,000,000

|

|

|

|

|

|

|

Maturity Date:

|

|

June 1, 2026

|

|

June 1, 2031

|

|

May 13, 2024

|

|

|

|

|

|

|

Interest Payment Dates:

|

|

June 1 and December 1 of each year, commencing December 1, 2021

|

|

June 1 and December 1 of each year, commencing December 1, 2021

|

|

February 13, May 13, August 13 and November 13 of each year, commencing August 13, 2021

|

|

|

|

|

|

|

Coupon:

|

|

1.45%

|

|

2.65%

|

|

Floating rate based on Compounded SOFR plus 0.65%; calculated quarterly.

|

|

|

|

|

|

|

Benchmark Treasury:

|

|

0.750% due April 30, 2026

|

|

1.125% due February 15, 2031

|

|

N/A

|

|

|

|

|

|

|

Benchmark Treasury Yield:

|

|

0.798%

|

|

1.622%

|

|

N/A

|

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+70 basis points

|

|

+105 basis points

|

|

N/A

|

|

|

|

|

|

|

Re-offer Yield:

|

|

1.498%

|

|

2.672%

|

|

N/A

|

|

|

|

|

|

|

Price to Public:

|

|

99.767% of the principal amount

|

|

99.806% of the principal amount

|

|

100.000% of the principal amount

|

|

|

|

|

|

|

Optional Redemption:

|

|

Prior to May 1, 2026, greater of 100% or make-whole at a discount rate of Treasury plus 10 basis points (calculated to May 1, 2026); and on or after May 1, 2026, 100% plus, in either case, accrued and unpaid

interest.

|

|

Prior to March 1, 2031, greater of 100% or make-whole at a discount rate of Treasury plus 15 basis points (calculated to March 1, 2031); and on or after March 1, 2031, 100% plus, in either case, accrued and unpaid

interest.

|

|

Not redeemable prior to May 13, 2022. On or after May 13, 2022, in whole or in part, at 100% of the principal amount of the Floating Rate Senior Notes due 2024 being redeemed plus accrued and unpaid interest thereon to but

excluding the date of redemption.

|

|

|

|

|

|

|

CUSIP/ISIN:

|

|

15189T BA4 /

US15189TBA43

|

|

15189T BB2 / US15189TBB26

|

|

15189T AZ0 /

US15189TAZ03

|

|

|

|

|

Denominations:

|

|

$2,000 and integral multiples of $1,000 in excess thereof

|

|

|

|

|

Trade Date:

|

|

May 11, 2021

|

|

|

|

|

Expected Settlement Date:

|

|

May 13, 2021

|

|

|

|

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

Mizuho Securities USA

LLC

MUFG Securities Americas Inc.

PNC Capital Markets LLC

U.S. Bancorp Investments, Inc.

Scotia Capital (USA) Inc.

|

|

|

|

|

|

|

|

|

|

|

Co-Manager:

|

|

R. Seelaus & Co., LLC

|

|

|

|

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

|

Capitalized terms used and not defined herein have the meanings assigned in the Issuer’s

Preliminary Prospectus Supplement, dated May 11, 2021.

The Issuer has filed a registration statement (including a prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling

BofA Securities, Inc. toll-free at 1-800-294-1322 or emailing to dg.prospectus_requests@bofa.com, Mizuho Securities USA LLC

toll-free at 1-866-271-7403, MUFG Securities Americas Inc. toll-free at 1-877-649-6848, PNC Capital Markets LLC toll-free

at 1-855-881-0697 or U.S. Bancorp Investments, Inc. toll-free at 1-877-558-2607.

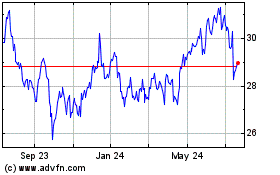

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Aug 2024 to Sep 2024

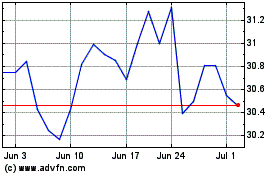

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Sep 2023 to Sep 2024