2nd UPDATE: Burst Of Asset-Backed, Commercial Mortgage Bonds Offered

May 16 2011 - 4:10PM

Dow Jones News

More than $5.5 billion of asset-backed securities came to market

Monday, including three auto-loan-backed issues, a

student-loan-backed security and two commercial mortgage-backed

deals.

It was the busiest day of the month so far for the asset-backed

market, coming just before the summer slowdown traditionally

begins. "Everyone wants to issue before the lull starts to set in

next week," said Dan Nigro, chief executive of Warfield Consultants

in Montclair, N.J.

Other corporate bond markets also were unusually busy Monday.

Issuance of investment-grade and high-yield unsecured bonds also

jumped. High-grade issuers included Google Inc. (GOOG), with a $3

billion bond. High-yield issuers include R.R. Donnelley & Sons

Co. (RRD), with a $500 million bond; Centene Corp. (CNC), with a

$250 million deal; and E*Trade Financial Corp. (ETFC) with a $435

million bond.

"A push to get business done ahead of the Memorial Day weekend

has led to a jam packed calendar," Royal Bank of Scotland analysts

wrote in a note to clients. "Weekly volume has been rising steadily

[recently], with $10.0 billion pricing last week from 22 deals.

That marks the third-highest weekly volume this year."

Most of the consumer ABS bond sold so far this year--62.5%,

according to data from Citigroup--were backed by loans for vehicles

and auto-dealer inventory, followed by equipment-backed bonds

(12.6%) and student-loan-backed bonds (12%).

Companies have sold $29.41 billion of asset-backed securities so

far this year, down from $36.41 billion over the same period of

2010. This doesn't include CMBS.

J.P. Morgan Chase & Co.'s (JPM) self-led $1.447 billion

commercial mortgage-backed bond Monday was sold in the private Rule

144a market. The deal was backed by 42 fixed-rate mortgage loans on

84 properties, 41% of which were retail and 35.6% were offices.

Wells Fargo Securities and Royal Bank Of Scotland are tapping

the market with a $1.446 billion commercial mortgage-backed

security that is expected to price next week.

The three auto-sector bonds include Honda Auto Receivables Owner

Trust, with a $1.2 billion bond; Santander Drive Auto Receivables

Trust, with a $545 million bond; and Westlake Automobile

Receivables Trust, with a $250 million security.

SLM Corp. (SLM), better known as Sallie Mae, also has a $821

million student-loan-backed bond that is expected to price this

week, according to a person familiar with the matter. The security

is joint led by J.P. Morgan and Barclays Capital.

All the bonds are expected to price this week.

Industry participants say ABS issuance is strong because

investing in the asset-backed market provides an opportunity to

diversify a portfolio.

-By Anusha Shrivastava, Dow Jones Newswires; 212-416-2227;

anusha.shrivastava@dowjones.com

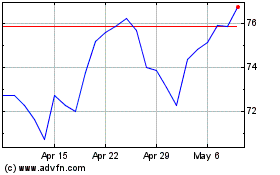

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024