Wal-Mart Stores Inc. (WMT) is among several retailers expected

to report their latest quarterly results next week, which is

shortened by the Presidents Day holiday.

Technology heavyweights Dell Inc. (DELL) and Hewlett-Packard Co.

(HPQ) also are scheduled to report earnings next week.

Markets will examine reports on January's existing home sales

and new home sales, due Wednesday and Friday, respectively, for

more insight into the sector's sluggish recovery.

Bazaarvoice Inc. and Proto Labs Inc. are expected to debut next

week.

Quarterly Earnings Due From Retailers

A deluge of major retailers, including Wal-Mart, Saks Inc.

(SKS), Macy's Inc. (M), Gap Inc. (GPS), Kohl's Corp. (KSS) and J.C.

Penney Co. (JCP), are scheduled to release their latest earnings

results.

U.S. retailers delivered generally solid January sales results

amid an appetite for marked-down merchandise and some confidence

among consumers to spend a little extra. Earlier this month, Gap

projected fourth-quarter earnings ahead of estimates as Banana

Republic outperformed the other segments and January same-store

sales declined less than expected, while Kohl's raised its view as

it saw better-than-expected same-store sales last month. Meanwhile,

J.C. Penney has slashed its fiscal fourth-quarter guidance as sales

and traffic were softer than anticipated for the latest period.

Wal-Mart, Saks and Macy's are also expected to report

bottom-line growth.

Dell, Hewlett-Packard Expected To Post Weaker 4Q Profits

Computer maker Dell is expected to see its fourth-quarter

earnings drop slightly from a year earlier, according to analysts

polled by Thomson Reuters. The company has been broadening its

business scope in recent years to become more of a one-stop shop

for customers also seeking servers, storage, networking and

services. However, Dell has frequently reiterated it remains

committed to the personal computer market, a contrast to its

biggest rival Hewlett-Packard.

Last year, H-P flirted with the idea of shedding its PC

business, the world's largest, before deciding in October to hold

onto it, though the segment offers lower margins. The company saw a

turbulent year in 2011, which included an $11.7 billion deal for

British software provider Autonomy Corp. and the September firing

of Chief Executive Meg Whitman's predecessor, Leo Apotheker. In

November, H-P issued a first-quarter outlook that fell short of

analyst estimates. Analysts expect the company's revenue to decline

from the year-ago period.

Other major companies reporting next week include Kraft Foods

Inc. (KFT), Home Depot Inc. (HD) and Barnes & Noble Inc.

(BKS).

NYSE, Nasdaq Markets Closed Monday

U.S. equity trading on NYSE Euronext's (NYX) New York Stock

Exchange and Nasdaq OMX Group Inc. (NDAQ) will be closed Monday in

observance of Presidents Day.

Trading floors operated by CME Group Inc. (CME), which includes

the Nymex and Chicago floors, also will be closed Monday. CME

Globex will halt equity trading at 10:30 a.m. CST and is scheduled

to resume trading at 5 p.m. CST. CME Globex halts trading for

interest rate and foreign exchange products at noon CST and resumes

at 5 p.m. CST.

January Existing, New Home Sales Due

Reports on home sales and prices will offer more information on

the state of the ailing housing sector next week.

On Wednesday, the National Association of Realtors will report

on existing home sales for January. Economists surveyed by Dow

Jones Newswires think resales of 4.65 million homes were sold last

month, up slightly from the annual rate of 4.61 million in

December.

Data on new U.S. home sales are scheduled to be released Friday.

The Commerce Department's report is expected to show new home sales

increased 2.6% to an annual rate of 315,000 in January.

Consumers have been reluctant to buy homes. The obstacles

include worries about income prospects, inability to get financing

and the lack of a sufficient down payment.

Bazaarvoice, Proto Labs Expected To Price Next Week

Yet another initial public offering tied to the social media

space is readying to go public this coming week, but it isn't a

name that is going to spark the kind of brand recognition of Yelp

Inc. or Facebook Inc.

Bazaarvoice Inc., which bills itself as a maker of "social

commerce" marketing software, aims to raise as much as $95 million

on the Nasdaq under the symbol "BV." The company's product helps

businesses collect and display consumer reviews on their websites,

provides tools to analyze feedback and online postings, and helps

distribute content such as ratings and reviews among retail and

other brand sites.

The only other deal set to price this coming week is Proto Labs

Inc., which is looking to raise as much as $65 million through a

listing on the NYSE as "PRLB." The company manufactures custom

parts for product prototypes or pilot runs of products in

development. It uses proprietary software and automated

manufacturing technology to cut down on expenses and turn around

orders in as little as a day.

U.S. To Sell $99 Billion Treasury Notes Next Week

As expected, the U.S. Treasury plans to sell $35 billion of

two-year notes on Tuesday, $35 billion of five-year notes Wednesday

and $29 billion of seven-year notes on Thursday. Analysts expect

the shorter-dated sales to go smoothly because of the Federal

Reserve's stated intentions to keep rates low through at least late

2014.

Conferences

Among the scheduled conferences next week are the Consumer

Analyst Group of New York Conference on Monday through Friday in

Boca Raton, Fla.; EnerCom Inc.'s The Oil & Services Conference

Tuesday through Thursday in San Francisco; the Barclays Industrial

Select Conference on Wednesday and Thursday in Miami; and the

Credit Suisse Global Paper & Packaging Conference on Wednesday

and Thursday in New York.

Also scheduled are the Green Power Offshore Wind Power USA

conference Wednesday through Friday in Boston; the National

Investment Banking Association Investment Conference Wednesday

through Friday in New Orleans; and the Jefferies Global Clean

Technology Conference on Wednesday and Thursday in New York.

-By Nathalie Tadena, Dow Jones Newswires; 212-416-3287;

nathalie.tadena@dowjones.com

--Kathleen Madigan, Lynn Cowan, Cynthia Lin and other Dow Jones

Newswires staff members contributed to this article.

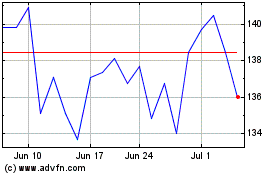

Capital One Financial (NYSE:COF)

Historical Stock Chart

From May 2024 to Jun 2024

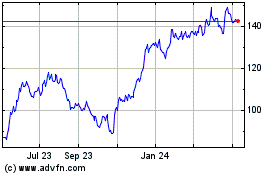

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2023 to Jun 2024