Suncor Gets Approval For Oil Sands Tailings Management Plan

June 17 2010 - 8:48PM

Dow Jones News

Suncor Energy Inc. (SU) said it will spend more than C$1 billion

on an oil sands tailings pond-management plan approved by the

Alberta government Thursday.

It's the third plan to deal with the oil sands industry's

growing tailings ponds, which already cover more than 50 square

miles of land in Alberta. Tailings ponds pose one of the most

significant challenges to oil sands mining operations, as a portion

of the hot water they use to separate oil from sand is afterwards

contaminated with heavy metals and other toxins that make it an

environmental hazard. The tailings ponds can take decades or even

hundreds of years to dry on their own.

Companies in Alberta have been storing the tailings in large

containment ponds, but the problem keeps growing along with the oil

sands industry's production, which is expected to double over the

course of this decade.

In an effort to deal with the problem, the Alberta government

issued a directive requiring oil sands companies to submit plans to

begin to cut their annual generation of tailings by 20% starting in

July, ramping up to a 50% annual reduction by 2012.

Suncor's plan involves a drying process in which the tailings

are mixed with a wastewater treatment chemical and layered over a

sloping sand beach, where the water dries over a period of weeks,

and the silt left over after evaporation can be reclaimed. Kirk

Bailey, executive vice president of Suncor's oil sands division,

said the plan will cut tailings reclamation time by decades, and

that Suncor planned to complete the transformation of its first

tailings pond into a solid surface later this year.

The Alberta government said it believes Suncor's plan will cut

the size of its existing tailings ponds by 33 million cubic meters,

or about 30%, and allow it to avoid building more ponds. The

government approved Suncor's plan after adding conditions related

to coke conservation and sand disposal.

Alberta has so far approved plans by Suncor, the Syncrude

project and the Fort Hills oil sands project, which is also partly

owned by Suncor. Plans submitted by Canadian Natural Resources Ltd.

(CNQ), Imperial Oil Ltd. (IMO) and Royal Dutch Shell Plc (RDSA) are

still being reviewed, but don't meet the timeline set out by the

government.

However, Syncrude's tailings management plan also didn't meet

the timeline, but it was approved after the government said

additional conditions would allow it to meet the reduction schedule

by 2014.

Syncrude is a joint venture owned by Canadian Oil Sands Trust

(COS.UN.T), ConocoPhillips (COP), Imperial Oil, Suncor, Nexen Inc.

(NXY), Murphy Oil Corp. (MUR) and Mocal Energy Ltd. ConocoPhillips

has agreed to sell its stake to Chinese state-owned oil company

Sinopec (SNP).

-By Edward Welsch, Dow Jones Newswires; 613-237-0669;

edward.welsch@dowjones.com

Order free Annual Report for ConocoPhillips

Visit http://djnewswires.ar.wilink.com/?link=COP or call

1-888-301-0513

Order free Annual Report for Suncor Energy Inc.

Visit http://djnewswires.ar.wilink.com/?link=SU or call

1-888-301-0513

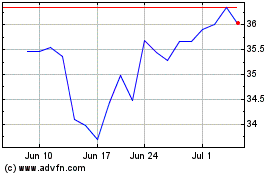

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

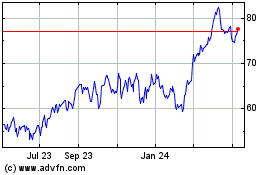

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024