Camden Property Trust (NYSE:CPT) announced that its funds from

operations (“FFO”) for the first quarter of 2010 totaled $0.68 per

diluted share or $47.0 million, as compared to $0.88 per diluted

share or $51.6 million for the same period in 2009. The Company

reported net income attributable to common shareholders (“EPS”) of

$2.3 million or $0.03 per diluted share for the first quarter of

2010, as compared to $6.2 million or $0.11 per diluted share for

the same period in 2009. EPS for the three months ended March 31,

2009 included a $0.01 per diluted share impact from the results of

discontinued operations. A reconciliation of net income

attributable to common shareholders to FFO is included in the

financial tables accompanying this press release.

“We are pleased to report that our first quarter operating

results reflected better than anticipated performance from our

apartment communities,” said Richard J. Campo, Camden’s Chairman

and Chief Executive Officer. “With market conditions continuing to

improve across our portfolio, we expect our full-year 2010 FFO per

share to be in the upper half of our guidance range.”

Same Property

Results

For the 47,359 apartment homes included in consolidated same

property results, first quarter 2010 same property net operating

income (“NOI”) declined 9.1% compared to the first quarter of 2009,

with revenues declining 4.8% and expenses increasing 2.0%. On a

sequential basis, first quarter 2010 same property NOI declined

6.1% compared to the fourth quarter of 2009, with revenues

declining 0.9% and expenses increasing 7.6% compared to the prior

quarter. Same property physical occupancy levels for the portfolio

averaged 93.1% during the first quarter of 2010, compared to 93.0%

in the fourth quarter of 2009 and 93.6% in the first quarter of

2009.

The Company defines same property communities as communities

owned and stabilized as of January 1, 2009, excluding properties

held for sale and communities under redevelopment. A reconciliation

of net income attributable to common shareholders to net operating

income and same property net operating income is included in the

financial tables accompanying this press release.

Development

Activity

Camden had one wholly-owned development community in lease-up

during the first quarter: Camden Dulles Station in Oak Hill, VA, a

$72.3 million project that is currently 95% leased.

During the quarter, construction was completed on two joint

venture communities: Camden Travis Street, a $30.5 million project

that is currently 47% leased; and Belle Meade, a $37.0 million

project that is currently 54% leased. Lease-ups continued during

the quarter at two additional joint venture communities which

completed construction during 2009: Camden Amber Oaks in Austin,

TX, a $35.3 million project that is currently 89% leased; and

Braeswood Place in Houston, TX, a $50.3 million project that is

currently 70% leased.

Equity Issuance

During the first quarter, Camden issued 403,500 common shares

through its at-the-market (“ATM”) share offering program at an

average price of $43.64 per share, for total net consideration of

approximately $17.2 million. Subsequent to quarter-end, the Company

issued an additional 825,124 common shares through its ATM program

at an average price of $45.27 per share, for total net

consideration of approximately $36.8 million.

Earnings

Guidance

Camden maintained its earnings guidance for 2010 based on its

current and expected views of the apartment market and general

economic conditions. Full-year 2010 FFO is expected to be $2.35 to

$2.65 per diluted share, and full-year 2010 EPS is expected to be

$(0.24) to $0.06 per diluted share. Second quarter 2010 earnings

guidance is $0.61 to $0.65 per diluted share for FFO and $(0.03) to

$0.01 per diluted share for EPS. Guidance for EPS excludes

potential future gains on the sale of properties. Camden intends to

update its earnings guidance to the market on a quarterly

basis.

The Company’s 2010 earnings guidance is based on projections of

same property revenue declines between 2.25% and 4.25%, expense

growth between 2.0% and 3.5%, and NOI declines between 5.5% and

8.5%. Additional information on the Company’s 2010 financial

outlook and a reconciliation of expected net income attributable to

common shareholders to expected FFO are included in the financial

tables accompanying this press release.

Conference Call

The Company will hold a conference call on Friday, May 7, 2010

at 11:00 a.m. Central Time to review its first quarter 2010 results

and discuss its outlook for future performance. To participate in

the call, please dial 866-843-0890 (Domestic) or 412-317-9250

(International) by 10:50 a.m. Central Time and enter passcode:

4447563, or join the live webcast of the conference call by

accessing the Investor Relations section of the Company’s website

at camdenliving.com. Supplemental financial information is

available in the Investor Relations section of the Company’s

website under Earnings Releases or by calling Camden’s Investor

Relations Department at 800-922-6336.

Forward-Looking

Statements

In addition to historical information, this press release

contains forward-looking statements under the federal securities

law. These statements are based on current expectations, estimates

and projections about the industry and markets in which Camden

operates, management's beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance

and involve certain risks and uncertainties which are difficult to

predict.

About Camden

Camden Property Trust, an S&P 400 Company, is a real estate

company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 185 properties containing

63,658 apartment homes across the United States. Camden was

recently named by FORTUNE® Magazine for the third consecutive year

as one of the “100 Best Companies to Work For” in America, placing

10th on the list.

For additional information, please contact Camden’s Investor

Relations Department at 800-922-6336 or 713-354-2787 or access our

website at camdenliving.com.

CAMDEN OPERATING RESULTS (In thousands, except per

share and property data amounts)

(Unaudited)

Three Months Ended March 31,

OPERATING DATA

2010 2009 Property revenues Rental

revenues $ 131,161 $ 136,500 Other property revenues 21,045

20,532 Total property revenues

152,206 157,032

Property

expenses Property operating and maintenance 44,613 42,304 Real

estate taxes 18,445 18,601 Total

property expenses 63,058 60,905

Non-property income Fee and asset management income

1,838 2,031 Interest and other income 3,045 735 Income (loss) on

deferred compensation plans 3,482

(4,152 ) Total non-property income (loss) 8,365

(1,386 )

Other expenses Property

management 5,183 4,929 Fee and asset management 1,194 1,135 General

and administrative 7,404 8,232 Interest 31,555 32,245 Depreciation

and amortization 43,813 43,980 Amortization of deferred financing

costs 726 817 Expense (benefit) on deferred compensation plans

3,482 (4,152 ) Total other expenses

93,357 87,186

Income from operations 4,156 7,555 Gain on

early retirement of debt - 166 Equity in income (loss) of joint

ventures (105 ) 408

Income from

continuing operations before income taxes 4,051

8,129 Income tax expense - current (270 )

(299 )

Income from continuing operations 3,781

7,830 Income from discontinued operations -

675

Net income 3,781

8,505 Less (income) loss allocated to noncontrolling

interests from continuing operations 254 (521 ) Less income

allocated to perpetual preferred units (1,750 )

(1,750 )

Net income attributable to common

shareholders $ 2,285 $

6,234

CONDENSED CONSOLIDATED STATEMENTS OF OTHER

COMPREHENSIVE INCOME

Net income $ 3,781 $ 8,505

Other comprehensive income (loss) Unrealized loss on cash

flow hedging activities (6,817 ) (2,936 ) Reclassification of net

losses on cash flow hedging activities 5,879

5,276

Comprehensive income 2,843

10,845 Less (income) loss allocated to noncontrolling

interests from continuing operations 254 (521 ) Less income

allocated to perpetual preferred units (1,750 )

(1,750 )

Comprehensive income attributable to common

shareholders $ 1,347

8,574

PER SHARE DATA

Net income attributable to common shareholders - basic $ 0.03 $

0.11 Net income attributable to common shareholders - diluted 0.03

0.11 Income from continuing operations attributable to common

shareholders - basic 0.03 0.10 Income from continuing operations

attributable to common shareholders - diluted 0.03 0.10

Weighted average number of

common and common equivalent shares outstanding:

Basic 66,475 55,552 Diluted 68,169 56,047

Note: Please refer to the following pages for definitions and

reconciliations of all non-GAAP financial measures presented in

this document.

CAMDEN FUNDS FROM

OPERATIONS (In thousands, except per share and property

data amounts)

(Unaudited)

Three

Months Ended March 31,

FUNDS FROM OPERATIONS

2010 2009 Net income attributable to

common shareholders $ 2,285 $ 6,234

Real estate depreciation from continuing operations 42,639 43,010

Adjustments for unconsolidated joint ventures 2,163 1,916 Income

(loss) allocated to noncontrolling interests (105 )

421

Funds from operations - diluted $

46,982 $ 51,581

PER SHARE DATA

Funds from operations - diluted $ 0.68 $ 0.88 Cash distributions

0.45 0.70

Weighted average number of

common and common equivalent shares outstanding:

FFO - diluted 69,295 58,471

PROPERTY DATA

Total operating properties (end of period) (a) 185 182 Total

operating apartment homes in operating properties (end of period)

(a) 63,658 63,269 Total operating apartment homes (weighted

average) 50,578 50,688 Total operating apartment homes - excluding

discontinued operations (weighted average) 50,578 50,017

(a) Includes joint ventures and properties held for sale.

CAMDEN BALANCE SHEETS (In

thousands)

(Unaudited)

Mar 31, Dec

31, Sep 30, Jun 30, Mar 31, 2010

2009 2009 2009

2009 ASSETS Real estate assets, at cost Land $

748,604 $ 747,921 $ 746,825 $ 746,936 $ 746,935 Buildings and

improvements 4,527,523 4,512,124

4,484,335 4,473,906

4,466,296 5,276,127 5,260,045 5,231,160

5,220,842 5,213,231 Accumulated depreciation (1,191,604 )

(1,149,056 ) (1,107,227 )

(1,065,861 ) (1,023,466 ) Net operating real estate

assets 4,084,523 4,110,989 4,123,933 4,154,981 4,189,765 Properties

under development and land 196,371 201,581 279,620 268,655 258,239

Investments in joint ventures 42,994 43,542 43,236 22,334 15,158

Properties held for sale, including land -

- 6,622 6,732

20,696 Total real estate assets

4,323,888 4,356,112 4,453,411 4,452,702 4,483,858 Accounts

receivable - affiliates 32,657 36,112 35,971 35,909 36,105 Notes

receivable - affiliates 46,118 45,847 54,462 54,033 58,481 Other

assets, net (a) 92,983 102,114 104,669 92,421 84,905 Cash and cash

equivalents 28,553 64,156 81,683 157,665 7,256 Restricted cash

3,680 3,658 3,901

5,190 4,437 Total

assets $ 4,527,879 $ 4,607,999 $

4,734,097 $ 4,797,920 $ 4,675,042

LIABILITIES AND SHAREHOLDERS'

EQUITY Liabilities Notes payable Unsecured $ 1,590,473 $

1,645,926 $ 1,646,106 $ 1,728,150 $ 2,151,492 Secured 980,188

979,273 976,051 969,668 680,631 Accounts payable and accrued

expenses 69,858 74,420 78,466 65,012 73,250 Accrued real estate

taxes 17,005 23,241 42,386 30,154 19,113 Other liabilities (b)

138,136 145,176 145,464 132,763 137,397 Distributions payable

33,403 33,025

33,028 33,050 43,136

Total liabilities 2,829,063 2,901,061 2,921,501 2,958,797

3,105,019 Commitments and contingencies Perpetual

preferred units 97,925 97,925 97,925 97,925 97,925

Shareholders' equity Common shares of beneficial interest 778 770

770 769 666 Additional paid-in capital 2,548,722 2,525,656

2,522,525 2,517,788 2,242,940 Distributions in excess of net income

attributable to common shareholders (520,798 ) (492,571 ) (383,265

) (357,168 ) (345,481 ) Notes receivable secured by common shares

(101 ) (101 ) (101 ) (287 ) (291 ) Treasury shares, at cost

(461,517 ) (462,188 ) (462,188 ) (462,751 ) (462,751 ) Accumulated

other comprehensive loss (c) (42,093 ) (41,155

) (44,921 ) (41,886 )

(48,716 ) Total common shareholders' equity 1,524,991 1,530,411

1,632,820 1,656,465 1,386,367 Noncontrolling interest 75,900

78,602 81,851

84,733 85,731 Total

shareholders' equity 1,600,891

1,609,013 1,714,671

1,741,198 1,472,098 Total liabilities

and shareholders' equity $ 4,527,879 $ 4,607,999

$ 4,734,097 $ 4,797,920 $

4,675,042 (a) includes: net deferred

charges of: $ 10,704 $ 11,113 $ 11,617 $ 12,108 $ 10,061 (b)

includes: deferred revenues of: $ 2,467 $ 2,664 $ 2,938 $ 3,183 $

2,402 distributions in excess of investments in joint ventures of:

$ 32,195 $ 31,410 $ 30,507 $ 30,287 $ 31,318 fair value adjustment

of derivative instruments: $ 42,119 $ 41,083 $ 44,730 $ 41,797 $

48,693 (c) Represents the fair value adjustment of

derivative instruments and gain on post retirement obligations.

CAMDEN NON-GAAP FINANCIAL MEASURES

DEFINITIONS & RECONCILIATIONS (In

thousands, except per share amounts)

(Unaudited)

This document contains certain

non-GAAP financial measures management believes are useful in

evaluating an equity REIT's performance. Camden's definitions and

calculations of non-GAAP financial measures may differ from those

used by other REITs, and thus may not be comparable. The non-GAAP

financial measures should not be considered as an alternative to

net income as an indication of our operating performance, or to net

cash provided by operating activities as a measure of our

liquidity.

FFO

The National Association of Real

Estate Investment Trusts (“NAREIT”) currently defines FFO as net

income attributable to common shares computed in accordance with

generally accepted accounting principles (“GAAP”), excluding gains

or losses from depreciable operating property sales, plus real

estate depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. Camden’s definition

of diluted FFO also assumes conversion of all dilutive convertible

securities, including minority interests, which are convertible

into common equity. The Company considers FFO to be an appropriate

supplemental measure of operating performance because, by excluding

gains or losses on dispositions of operating properties and

excluding depreciation, FFO can help one compare the operating

performance of a company's real estate between periods or as

compared to different companies. A reconciliation of net income

attributable to common shareholders to FFO is provided below:

Three Months Ended March 31, 2010

2009 Net income attributable to common shareholders $

2,285 $ 6,234 Real estate depreciation from continuing operations

42,639 43,010 Adjustments for unconsolidated joint ventures 2,163

1,916 Income (loss) allocated to noncontrolling interests

(105 ) 421 Funds from operations - diluted $ 46,982

$ 51,581

Weighted average number of common

and common equivalent shares outstanding:

EPS diluted 68,169 56,047 FFO diluted 69,295 58,471 Net

income attributable to common shareholders - diluted $ 0.03 $ 0.11

FFO per common share - diluted $ 0.68 $ 0.88

Expected FFO

Expected FFO is calculated in a

method consistent with historical FFO, and is considered an

appropriate supplemental measure of expected operating performance

when compared to expected net income attributable to common

shareholders (EPS). A reconciliation of the ranges provided for

expected net income attributable to common shareholders per diluted

share to expected FFO per diluted share is provided below:

2Q10 Range 2010 Range Low High

Low High Expected net income

attributable to common shareholders per share - diluted ($0.03 ) $

0.01 ($0.24 ) $ 0.06 Expected real estate depreciation 0.60 0.60

2.43 2.43 Expected adjustments for unconsolidated joint ventures

0.03 0.03 0.13 0.13 Expected income allocated to noncontrolling

interests 0.01 0.01 0.03

0.03 Expected FFO per share - diluted 0.61 0.65 $ 2.35 $ 2.65

Note: This table

contains forward-looking statements. Please see the

paragraph regarding forward-looking statements earlier in this

document.

CAMDEN

NON-GAAP FINANCIAL

MEASURES

DEFINITIONS &

RECONCILIATIONS

Net Operating Income (NOI)

(In thousands, except per share

amounts)

NOI is defined by the Company as

total property income less property operating and maintenance

expenses less real estate taxes. The Company considers NOI to be an

appropriate supplemental measure of operating performance to net

income attributable to common shareholders because it reflects the

operating performance of our communities without allocation of

corporate level property management overhead or general and

administrative costs. A reconciliation of net income attributable

to common shareholders to net operating income is provided

below:

Three Months Ended March 31,

2010 2009 Net income attributable to common

shareholders $ 2,285 $ 6,234 Less: Fee and asset management income

(1,838 ) (2,031 ) Less: Interest and other income (3,045 ) (735 )

Less: (Income) loss on deferred compensation plans (3,482 ) 4,152

Plus: Property management expense 5,183 4,929 Plus: Fee and asset

management expense 1,194 1,135 Plus: General and administrative

expense 7,404 8,232 Plus: Interest expense 31,555 32,245 Plus:

Depreciation and amortization 43,813 43,980 Plus: Amortization of

deferred financing costs 726 817 Plus: Expense (benefit) on

deferred compensation plans 3,482 (4,152 ) Less: (Gain) on early

retirement of debt - (166 ) Less: Equity in (income) loss of joint

ventures 105 (408 ) Plus: Income allocated to perpetual preferred

units 1,750 1,750 Plus: Income (loss) allocated to noncontrolling

interests (254 ) 521 Plus: Income tax expense - current 270 299

Less: Income from discontinued operations -

(675 ) Net Operating Income (NOI) $ 89,148 $ 96,127

"Same Property" Communities $ 82,585 $ 90,813 Non-"Same Property"

Communities 5,201 4,116 Development and Lease-Up Communities 799

424 Redevelopment Communities 570 500 Dispositions / Other

(7 ) 274 Net Operating Income (NOI) $ 89,148 $

96,127

EBITDA

EBITDA is defined by the Company

as earnings before interest, taxes, depreciation and amortization,

including net operating income from discontinued operations,

excluding equity in (income) loss of joint ventures, (gain) loss on

early retirement of debt, and income (loss) allocated to

noncontrolling interests. The Company considers EBITDA to be an

appropriate supplemental measure of operating performance to net

income attributable to common shareholders because it represents

income before non-cash depreciation and the cost of debt, and

excludes gains or losses from property dispositions. A

reconciliation of net income attributable to common shareholders to

EBITDA is provided below:

Three Months Ended March 31, 2010

2009 Net income attributable to common shareholders $

2,285 $ 6,234 Plus: Interest expense 31,555 32,245 Plus:

Amortization of deferred financing costs 726 817 Plus: Depreciation

and amortization 43,813 43,980 Plus: Income allocated to perpetual

preferred units 1,750 1,750 Plus: Income (loss) allocated to

noncontrolling interests (254 ) 521 Plus: Income tax expense -

current 270 299 Less: (Gain) on early retirement of debt - (166 )

Less: Equity in (income) loss of joint ventures 105

(408 ) EBITDA $ 80,250 $ 85,272

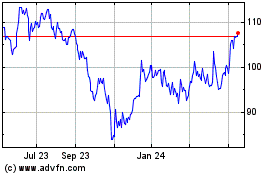

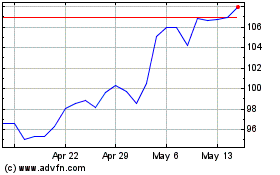

Camden Property (NYSE:CPT)

Historical Stock Chart

From May 2024 to Jun 2024

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jun 2023 to Jun 2024