Brazil's Vale Makes Copper Play, But Still Trails Global Giants

July 29 2010 - 12:36PM

Dow Jones News

Brazilian mining giant Vale SA (VALE, VALE5.BR) tightened its

grip on the domestic metals market with the purchase of copper

refiner Paranapanema SA (PMAM4.BR), but the move still leaves Vale

far behind its larger global rivals in the copper industry.

Vale, which first stalked Paranapanema in early 2008, said

Thursday that it would launch a public tender for up to 100% of the

metals holding company in a deal that could be worth as much as

2.01 billion Brazilian reals ($1.13 billion).

While Vale's bid for Paranapanema will fit a strategic niche for

the company locally, it does little to advance the mining company's

stated goal of becoming one of the world's main copper

producers.

Vale has installed copper production capacity of about 300,000

metric tons per year from its Sossego mine in Brazil, as well as

nickel byproduct output from Sudbury and Voisey Bay in Canada.

That's less than one-fifth the output at the world's largest

producer, Chilean state-owned copper company Corporacion Nacional

del Cobre, or Codelco, which produced 1.7 million tons in 2009.

Copper production is estimated to climb to about 458,000 tons

per year by the end of 2011, when three more projects are expected

to come onstream, Vale said.

Paranapanema, however, will give Vale a 34% share of the

Brazilian market for refined copper products. It also is the sole

Brazilian producer of cathodes certified by the London Metal

Exchange. In addition, the copper concentrates Vale produces at

Sossego will benefit from refining and processing at Paranapanema's

facilities.

The holding company also controls Cibrafertil, a fertilizer

company that makes about 306,000 tons of single superphosphate a

year. The unit will offer increased synergies with Vale's recent

expansion in fertilizers.

Earlier this year, Vale acquired Fertilizantes Fosfatosos SA

(FFTL4.BR), or Fosfertil, and the upstream fertilizer assets of

Bunge Ltd. (BG). in a series of deals valued at more than $5

billion.

Brazil imports about 90% of the fertilizer or raw materials for

fertilizer to support the country's massive agriculture sector.

The Paranapanema, Fosfertil and Bunge deals also returned Vale

to its very successful strategy of small-scale acquisitions that

paid off handsomely for the company in the early 2000s, creating

the world's largest producer and exporter of iron ore. The return

to the miner's acquisition roots should please shareholders after

bigger plays failed to pay off.

Vale made a failed bid for Anglo-Swiss mining group Xstrata PLC

(XTA.LN) in 2008 and has had trouble with the integration of

Canadian nickel mining company Inco.

The Inco deal was Vale's first major acquisition, when it paid

$18.9 billion in 2006 as nickel prices neared their peak. Vale has

since struggled with labor issues and nettlesome start-ups at

projects acquired in the deal, such as the Goro nickel mine in New

Caledonia.

Vale shares were 0.6% higher at BRL42.75 as of 1530 GMT, while

Paranapanema shares jumped 7.1% to BRL6.22. Vale's offer valued

Paranapanema's shares at BRL6.30.

Paranapanema's capital is composed of 319.17 million shares, and

the company's current free float is at 39.42%. It is controlled by

Previ, the pension fund for workers of state-run Banco do Brasil

(BBAS3.BR); Petros, the pension fund for workers at the state-run

energy company Petrobras (PBR); and by BNDESPAr, the shareholding

and investment arm of the government-controlled National

Development Bank, or BNDES.

-By Jeff Fick and Rogerio Jelmayer, Dow Jones Newswires;

55-21-2586-6085; jeff.fick@dowjones.com

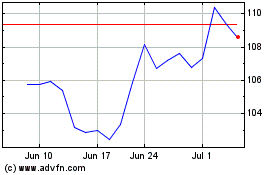

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2024 to Jul 2024

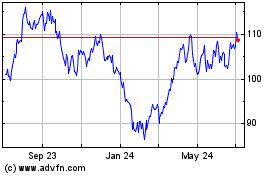

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jul 2023 to Jul 2024