Brookfield Infrastructure Signs Definitive Agreement with Intel

August 23 2022 - 7:41AM

Brookfield Infrastructure Partners L.P. (NYSE: BIP; TSX:

BIP.UN), together with its institutional partners (collectively,

“Brookfield Infrastructure”), has signed a definitive agreement

with Intel Corporation (“Intel”) to jointly fund Intel’s

under-construction semiconductor fabrication facility located in

Chandler, Arizona.

Intel’s announcement can be accessed here:

https://www.intc.com/news-events/press-releases/detail/1568/intel-advances-smart-capital-introduces-first-of-its-kind.

The arrangement supports Intel’s continued

build-out of U.S. semiconductor manufacturing capabilities. It also

highlights the important role Brookfield Infrastructure expects to

play in assisting leading companies like Intel onshore part of the

digital backbone of the global economy with the support of our

flexible and large-scale capital. Brookfield Infrastructure is

investing up to $15 billion for a 49% stake in Intel’s

manufacturing expansion at its Ocotillo campus in Chandler,

Arizona, with Intel having a 51% stake in this arrangement.This

multi-year capital expansion project will replenish BIP’s existing

backlog of capital projects that near completion this year,

including the Heartland Petrochemical Complex and the second phase

of our build-out of electricity transmission lines in Brazil. This

investment forms part of another successful round of asset rotation

as we monetize mature assets and reinvest proceeds over time in

capital projects that have return and risk expectations in-line

with our objectives.

Concurrent with transaction signing, Brookfield

Infrastructure secured binding non-recourse financing to fund a

significant portion of its capital investment in this arrangement

with Intel. BIP’s equity portion for this investment will be phased

over the duration of the construction period and is anticipated to

be $500 to $750 million in aggregate. Funding is expected to be

sourced primarily from retained operating cash flow and proceeds

from our capital recycling program, with the majority funded closer

to facility commissioning.

Closing of the transaction is targeted for the

end of 2022, subject to customary closing conditions.

About Brookfield Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across North and South America, Asia

Pacific and Europe. We are focused on assets that

generate stable cash flows and require minimal maintenance capital

expenditures. Investors can access its portfolio either

through Brookfield Infrastructure Partners L.P. (NYSE:

BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX:

BIPC), a Canadian corporation. Further information is available

at www.brookfield.com/infrastructure.

Brookfield Infrastructure is the flagship listed infrastructure

company of Brookfield Asset Management, a global alternative asset

manager with over $750 billion of assets under

management. For more information, go

to www.brookfield.com.

Contact Information

| MediaKerrie

McHugh HayesSenior Vice President, Communications Tel: +1 (212)

618-3469Email: kerrie.mchugh@brookfield.com |

Investor

RelationsStephen FukudaVice President, Corporate

Development & Investor RelationsTel: +1 (416) 956-5129Email:

stephen.fukuda@brookfield.com |

Cautionary Statement Regarding Forward-looking

Statements

This news release may contain forward-looking

information within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of Section

27A of the U.S. Securities Act of 1933, as amended,

Section 21E of the U.S. Securities Exchange Act of 1934,

as amended, and in any applicable Canadian securities regulations.

The words “will”, “target”, “future”, “growth”, “expect”,

“believe”, “may”, derivatives thereof and other expressions which

are predictions of or indicate future events, trends or prospects

and which do not relate to historical matters, identify the above

mentioned and other forward-looking statements. Forward-looking

statements in this news release include statements regarding the

terms of the definitive agreement with Intel and the timing and

financing thereof.

Although Brookfield Infrastructure believes that

these forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject

to a number of known and unknown risks and uncertainties. Factors

that could cause actual results of Brookfield Infrastructure to

differ materially from those contemplated or implied by the

statements in this news release include the ability to obtain

regulatory approvals and meet other closing conditions relating to

the definitive agreement with Intel, the ability to realize

financial, operational and other benefits from the proposed

transaction, general economic conditions in the jurisdictions in

which we operate and elsewhere which may impact the markets for our

products and services, the impact of market conditions on our

businesses, the fact that success of Brookfield Infrastructure is

dependent on market demand for an infrastructure company, which is

unknown, the availability of equity and debt financing for

Brookfield Infrastructure, the ability to effectively complete

transactions in the competitive infrastructure space and to

integrate acquisitions into existing operations, changes in

technology which have the potential to disrupt the business and

industries in which we invest, the market conditions of key

commodities, the price, supply or demand for which can have a

significant impact upon the financial and operating performance of

our business and other risks and factors described in the documents

filed by Brookfield Infrastructure with the securities regulators

in Canada and the United States including under “Risk Factors” in

Brookfield Infrastructure’s most recent Annual Report on Form 20-F

and other risks and factors that are described therein. Except as

required by law, Brookfield Infrastructure undertakes no obligation

to publicly update or revise any forward-looking statements or

information, whether as a result of new information, future events

or otherwise.

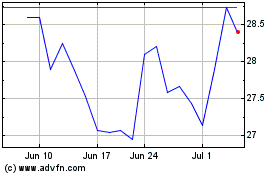

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Oct 2024 to Nov 2024

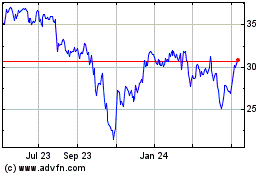

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Nov 2023 to Nov 2024