Barnes Group Inc. (NYSE: B), a diversified global manufacturer

and logistical services company, today reported financial results

for the fourth quarter and full year 2009. The Company reported

income from continuing operations of $6.2 million, or $0.11 per

diluted share, compared to a loss of $5.5 million, or negative

$0.10 per diluted share in the fourth quarter of 2008. Included in

the fourth quarter 2009 results are $1.3 million after-tax of

severance and plant consolidation charges as compared to $14.3

million for severance and plant consolidation charges and a

provision for deferred tax assets taken in the fourth quarter of

2008. Barnes Group’s fourth quarter 2009 sales totaled $256.5

million, down 3 percent from $265.4 million in the fourth quarter

of 2008.

For the full year 2009, Barnes Group achieved sales of $1.0

billion, down 24 percent from 2008. Income from continuing

operations for the full year 2009 was $39.0 million and earnings

per diluted share were $0.72, compared to income from continuing

operations in 2008 of $92.7 million or $1.66 per diluted share.

Barnes Group generated $143.5 million in cash from operations

for the 12 months of 2009, reflecting an improvement of 28 percent

over the prior year period level of $111.8 million. Cash flow

generation, driven by significant working capital reductions,

helped reduce debt to $351.5 million, a decline of 25 percent from

year-end 2008. As a result, the Company’s debt-to-capital ratio at

December 31, 2009 improved to 34 percent. The Company’s December

31, 2009 total debt covenant ratio of 3.10 times was below 3.75

times, the level required under the Company’s revolving credit

agreement.

“Reflecting on our year-long focus on cost control and cash

management, I am extremely proud of our accomplishments. We were

able to strengthen our balance sheet through effective working

capital management and debt reduction. Rigorous cost control,

working capital reductions, and alignment of capital spending with

anticipated demand helped us generate cash well beyond our goals

during this difficult year,” said Gregory F. Milzcik, President and

Chief Executive Officer, Barnes Group Inc.

“Our 2009 results were affected most by the decline in our

revenues due to the global economic downturn’s impact on our end

markets. We believe the steps we took to deal with the recession

have effectively adjusted our cost structure to enhance our

profitability at lower volumes and provide incremental profits on

revenue gains. Throughout 2010, we will continue to focus on

maintaining our financial discipline, as we shift the Company’s

attention toward profitable sales growth. Our efforts will enable

us to successfully transition from the depressed market conditions

of 2009 to more favorable conditions this year and further growth

in 2011,” Milzcik added.

($ millions; except

Three months ended December

31, Twelve months ended December 31, per share

data)

2009 2008

Change 2009 2008

Change Net Sales $256.5 $265.4 ($8.9) (3.4) %

$1,034.2 $1,362.1 ($327.9) (24.1) % Operating Income $11.4

$2.7 $8.6 316.7 % $60.5 $147.9 ($87.4) (59.1) % % of Sales 4.4 %

1.0 % - 3.4 pts. 5.9 % 10.9 % - (5.0) pts.

Income (Loss) fromContinuing

Operations

$6.2 ($5.5) $11.7 NM $39.0 $92.7 ($53.7) (57.9) % % of Sales 2.4 %

(2.1) % - 4.5 pts. 3.8 % 6.8 % - (3.0) pts. Net Income (Loss) $6.2

($11.1) ($17.3) NM $39.0 $82.6 ($43.6) (52.8) % % of Sales 2.4 %

(4.2) % - 6.6 pts. 3.8 % 6.1 % - (2.3) pts.

Income (Loss) fromContinuing

OperationsPer Diluted Share

$0.11 ($0.10) $0.21 NM $0.72 $1.66 ($0.94) (56.6) %

Net Income (Loss) PerDiluted

Share

$0.11 ($0.21) $0.32 NM

$0.72 $1.48 ($0.76)

(51.4) % NM = Not meaningful

Logistics and Manufacturing Services

- Fourth quarter 2009 sales at

Logistics and Manufacturing Services were $128.6 million, down 12

percent from $146.0 million in the same period last year. The

decline in sales was driven primarily by softness in the markets

served throughout North America. Additionally, sales declines in

the aftermarket aerospace market were primarily driven by lower

aircraft utilization and deferred maintenance. Foreign exchange

positively impacted sales by $4.5 million in the fourth

quarter.

- Operating profit of $5.2 million

for the fourth quarter of 2009 was down 5 percent compared to the

prior year period. Operating profit for the fourth quarter and full

year 2008 includes the impact of discrete actions of $5.3 million

(pre-tax) related primarily to workforce reductions. Operating

profit was driven lower primarily by the reduced sales volumes in

our businesses due to the decline in macroeconomic conditions in

our end-markets. Operational and productivity initiatives

implemented in 2008 and throughout 2009 to align the cost structure

with sales volumes provided beneficial results, tempering the

adverse profit impact of declining sales.

- Full year 2009 sales at

Logistics and Manufacturing Services were $539.1 million, down 22.1

percent from $691.8 million in 2008. Foreign exchange adversely

affected sales by $12.0 million for the full year. Full year

operating profit was $44.0 million, down 44 percent from $79.1

million in 2008. The decline in operating profit was driven by the

profit impact of the lower sales volume in each of the segment’s

businesses due to the impact of the economic conditions on the

end-markets served. Partially offsetting these declines was the

positive impact of operational and productivity actions taken in

the prior year.

Precision Components

- Fourth quarter 2009 sales at

Precision Components were $129.9 million, up 7 percent from $121.8

million in the same period last year. The end markets within our

businesses, particularly transportation, showed improvement from a

year ago and overall orders for the fourth quarter of 2009 outpaced

sales as production began to stabilize throughout the quarter.

Foreign exchange positively affected sales by $4.5 million in the

fourth quarter.

- Operating profit for the fourth

quarter of 2009 was $6.2 million, compared with an operating loss

of $3.0 million in the fourth quarter of 2008. Included in the

fourth quarter 2009 results are $3.6 million (pre-tax) of severance

and plant consolidation charges compared to $7.5 million (pre-tax)

of costs related to similar actions taken during the fourth quarter

of 2008. The improvement in operating profit was driven by cost

savings and cost containment initiatives taken in 2008 and

throughout 2009 to address deteriorating market conditions as well

as a higher level of sales activity.

- Full year 2009 sales at

Precision Components were $501.5 million, down 27 percent from

$683.0 million in 2008. Foreign exchange adversely affected sales

by $5.6 million for the full year. Full year operating profit in

2009 was down 76 percent to $16.6 million, from the 2008 operating

profit of $68.5 million. The decline in operating profit for the

full year was attributable to the sharp declines in demand within

the transportation and industrial end-markets and the impact of

employee reductions and facility consolidations taken throughout

2009 to address the market deterioration. Partially offsetting the

operating profit reduction were the favorable impacts of prior year

initiatives focused on cost savings and cost containment.

Additional Information

- For the full year 2009, other

income, net of other expenses increased $4.4 million, compared to

the prior year, as a result of a $3.8 million gain on the

repurchase of certain convertible subordinated notes.

- The Company’s effective tax rate

from continuing operations for 2009 was 2.4 percent compared with

22.1 percent in 2008. The decrease in the 2009 effective tax rate

from 2008 was due primarily to the higher concentration of profits

in lower taxing jurisdictions and the absence of profitability in

higher tax jurisdictions.

2010 Outlook

“With our actions to drive improved profitability and cash flow

performance implemented, and what we believe to be the early signs

of a recovery emerging, the Company’s targeted earnings for the

full year 2010, based on current market conditions, are $0.85 to

$1.05 per diluted share,” said Christopher J. Stephens, Jr., Senior

Vice President, Finance and Chief Financial Officer, Barnes Group

Inc.

“We believe that our actions to reduce costs and drive improved

cash flow performance, together with some recovery in the economy,

will benefit us in 2010. Earnings per share are expected to

increase in the range of 20 percent to 45 percent with sales growth

expected to be in the range of approximately 5 percent. Our efforts

remain focused on the underlying fundamentals of our business with

an emphasis on profitable sales growth and improved operational

efficiencies. The Company is stable, our balance sheet has

improved, and we are well positioned for the long term,” added

Stephens.

Conference Call

The Company will conduct a conference call with investors to

discuss fourth quarter and full year 2009 results at 8:30 a.m. EST

today, February 18, 2010. A webcast of the live call and an

archived replay will be available on the Barnes Group investor

relations link at www.BGInc.com.

Barnes Group Inc. (NYSE:B) is a diversified global manufacturer

and logistical services company focused on providing precision

component manufacturing and operating service support. Founded in

1857, over 4,800 dedicated employees at more than 60 locations

worldwide are committed to achieving consistent and sustainable

profitable growth. For more information, visit www.BGInc.com.

Barnes Group, the Critical Components People.

This release may contain certain forward-looking statements as

defined in the Private Securities Litigation and Reform Act of

1995. Forward-looking statements are made based upon management’s

good faith expectations and beliefs concerning future developments

and their potential effect upon the Company and can be identified

by the use of words such as “anticipated,” “believe,” “expect,”

“plans,” “strategy,” “estimate,” “project,” and other words of

similar meaning in connection with a discussion of future operating

or financial performance. These forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. The risks and uncertainties, which are described in our

periodic filings with the Securities and Exchange Commission,

include, among others, uncertainties arising from the behavior of

financial markets; future financial performance of the industries

or customers that we serve; changes in market demand for our

products and services; integration of acquired businesses; changes

in raw material prices and availability; our dependence upon

revenues and earnings from a small number of significant customers;

uninsured claims; and numerous other matters of global, regional or

national scale, including those of a political, economic, business,

competitive, regulatory and public health nature. The Company

assumes no obligation to update our forward-looking statements.

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF

INCOME (Dollars in thousands, except per share data)

Unaudited Three

months ended December 31, Twelve months ended December

31, 2009 2008

%Change

2009 2008

%Change

Net sales $ 256,469 $ 265,371 (3.4 ) $ 1,034,159 $

1,362,091 (24.1 ) Cost of sales 167,742 170,023 (1.3 )

671,110 847,641 (20.8 ) Selling and administrative expenses

77,372 92,623 (16.5 ) 302,534

366,510 (17.5 ) 245,114

262,646 (6.7 ) 973,644 1,214,151

(19.8 ) Operating income 11,355 2,725 NM 60,515 147,940

(59.1 ) Operating margin 4.4 % 1.0 % 5.9 % 10.9 %

Other income 190 162 17.3 4,394 602 NM Interest expense 5,362 6,275

(14.5 ) 22,596 26,606 (15.1 ) Other expenses 810

788 2.8 2,367 2,929 (19.2

) Income (loss) from continuing operations before income

taxes 5,373 (4,176 ) NM 39,946 119,007 (66.4 ) Income taxes

(benefit) (832 ) 1,364 NM 945

26,326 (96.4 ) Income (loss) from continuing

operations 6,205 (5,540 ) NM 39,001 92,681 (57.9 ) Loss from

discontinued operations, net of taxes - (5,590

) NM - (10,103 ) NM Net income (loss) $

6,205 $ (11,130 ) NM $ 39,001 $ 82,578 (52.8 )

Common Dividends $ 4,380 $ 8,347 (47.5 ) $

25,600 $ 33,345 (23.2 ) Per common share:

Basic: Income (loss) from continuing operations $ 0.11 $ (0.10 ) NM

$ 0.72 $ 1.72 (58.1 ) Loss from discontinued operations, net of

taxes - (0.11 ) NM -

(0.19 ) NM Net income (loss) $ 0.11 $ (0.21 ) NM $ 0.72

$ 1.53 (52.9 ) Diluted: Income (loss) from

continuing operations $ 0.11 $ (0.10 ) NM $ 0.72 $ 1.66 (56.6 )

Loss from discontinued operations, net of taxes -

(0.11 ) NM - (0.18 ) NM Net income

(loss) $ 0.11 $ (0.21 ) NM $ 0.72 $ 1.48 (51.4

) Dividends $ 0.08 $ 0.16 (50.0 ) $ 0.48

$ 0.62 (22.6 ) Average common shares outstanding:

Basic 55,118,278 53,047,555 3.9 53,879,976 53,989,034 (0.2 )

Diluted 55,680,735 53,047,555 5.0 54,206,426 55,812,666 (2.9 )

NM - Not meaningful

Notes:

1) Results for 2008 have been adjusted to reflect the change in the

accounting for convertible debt. 2) 2009 year-to-date Other income

included a pretax $3,773 gain on the purchase of certain

convertible notes and income taxes included the related tax expense

of $1,431. 3) 2008 year-to-date Other expenses included a pretax

$1,238 transaction loss on the sale of Spectrum Plastics and income

taxes included the related tax benefit of $394.

BARNES GROUP INC. OPERATIONS BY REPORTABLE BUSINESS

SEGMENT (Dollars in thousands) Unaudited

Three months ended December

31, Twelve months ended December 31, 2009

2008

%Change

2009 2008

%Change

Net Sales Logistics and Manufacturing Services $

128,592 $ 145,990 (11.9 ) $ 539,139 $ 691,769 (22.1 )

Precision Components 129,907 121,795 6.7 501,467 682,991 (26.6 )

Intrasegment sales (2,030 ) (2,414 ) 15.9

(6,447 ) (12,669 ) 49.1 Total net sales $

256,469 $ 265,371 (3.4 ) $ 1,034,159 $

1,362,091 (24.1 ) Operating profit Logistics

and Manufacturing Services $ 5,175 $ 5,434 (4.8 ) $ 43,952 $ 79,137

(44.5 ) Precision Components 6,180

(3,026 ) NM 16,563 68,456 (75.8 )

Total operating profit 11,355 2,408 NM 60,515 147,593 (59.0

) Interest income 58 151 (61.9 ) 428 565 (24.2 )

Interest expense (5,362 ) (6,275 ) (14.6 ) (22,596 ) (26,606 )

(15.1 ) Other income (expense), net (678 )

(460 ) 47.4 1,599 (2,545 ) NM Income

(loss) from continuing operations before income taxes $ 5,373

$ (4,176 ) NM $ 39,946 $ 119,007 (66.4 )

NM - Not meaningful

Notes:

1) Results for 2008 have been adjusted to reflect the change in the

accounting for convertible debt. 2) 2009 year-to-date Other income

(expense), net included a $3,773 gain on the purchase of certain

convertible debt. 3) 2008 year-to-date Other income (expense), net

included a $1,238 transaction loss on the sale of Spectrum Plastics

BARNES GROUP INC. CONSOLIDATED BALANCE

SHEETS (Dollars in thousands) Unaudited

December 31,2009

December 31,2008

Assets Current assets Cash and cash equivalents $ 17,427 $

20,958 Accounts receivable 160,269 173,215 Inventories 190,792

240,805 Deferred income taxes 23,630 27,650 Prepaid expenses and

other current assets 10,562 14,881 Total

current assets 402,680 477,509 Deferred income taxes

30,650 31,133 Property, plant and equipment, net 224,963 235,035

Goodwill 373,564 361,930 Other intangible assets, net 303,689

316,817 Other assets 16,444 12,931 Total

assets $ 1,351,990 $ 1,435,355

Liabilities and

Stockholders' Equity Current liabilities Notes and overdrafts

payable $ 4,595 $ 8,905 Accounts payable 85,588 80,495 Accrued

liabilities 73,538 84,372 Long-term debt - current 25,567

15,386 Total current liabilities 189,288 189,158

Long-term debt 321,306 441,670 Accrued retirement benefits

118,693 164,796 Other liabilities 37,990 41,157

Stockholders' equity 684,713 598,574

Total liabilities and

stockholders' equity

$ 1,351,990 $ 1,435,355

Notes:

1) Amounts for 2008 have been adjusted to reflect the change in the

accounting for convertible debt.

BARNES GROUP

INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars

in thousands) Unaudited

Twelve months ended

December 31, 2009

2008 Operating activities: Net income $ 39,001

$ 82,578 Adjustments to reconcile net income to net cash from

operating activities: Depreciation and amortization 51,487 52,403

Amortization of convertible debt discount 5,920 6,465 Loss on

disposition of property, plant and equipment 1,177 1,069 Gain on

repurchase of convertible notes (3,773 ) - Non-cash stock

compensation expense 4,208 5,841 Withholding taxes paid on stock

issuances (622 ) (2,580 ) Loss on the sale of Spectrum Plastics -

2,197 Changes in assets and liabilities, net of the effects of

acquisitions: Accounts receivable 18,650 26,329 Inventories 53,523

(2,725 ) Prepaid expenses and other current assets 7,056 (3,235 )

Accounts payable 4,149 (44,475 ) Accrued liabilities (10,151 )

(16,054 ) Deferred income taxes (10 ) 13,009 Long-term retirement

benefits (27,447 ) (7,581 ) Other 315 (1,433 )

Net cash provided by operating activities 143,483 111,808

Investing activities: Proceeds from disposition of

property, plant and equipment 6,808 784 Proceeds from the sale of

Spectrum Plastics, net - 5,400 Capital expenditures (30,502 )

(51,869 ) Business acquisitions, net of cash acquired - 47 Revenue

Sharing Program payments - (57,500 ) Other (2,386 )

(3,535 ) Net cash used by investing activities (26,080 )

(106,673 )

Financing activities: Net change in other

borrowings (4,504 ) 1,756 Payments on long-term debt (226,906 )

(260,335 ) Proceeds from the issuance of long-term debt 129,600

318,100 Proceeds from the issuance of common stock 6,687 5,171

Common stock repurchases (314 ) (34,209 ) Dividends paid (25,600 )

(33,345 ) Excess tax benefit on stock awards - 1,531 Other

(832 ) (430 ) Net cash used by financing activities

(121,869 ) (1,761 ) Effect of exchange rate changes on cash

flows 935 (3,016 ) Increase (decrease)

in cash and cash equivalents (3,531 ) 358 Cash and cash

equivalents at beginning of period 20,958

20,600 Cash and cash equivalents at end of period $

17,427 $ 20,958

Notes:

1) Results for 2008 have been adjusted to reflect the change in the

accounting for convertible debt.

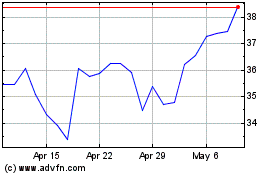

Barnes (NYSE:B)

Historical Stock Chart

From May 2024 to Jun 2024

Barnes (NYSE:B)

Historical Stock Chart

From Jun 2023 to Jun 2024