Two-Thirds of Canadians Looking to 'Lock-In' to a Fixed Rate for Certainty of Mortgage Payments: BMO

March 15 2012 - 1:58PM

Marketwired

With interest rate hikes potentially coming as early as next year,

a BMO Bank of Montreal study shows Canadian homebuyers are looking

for payment certainty for as long as possible and are considering a

shorter amortization to build equity in their home.

The report, conducted by Leger Marketing, revealed:

-- The vast majority of Canadians (82 per cent) are looking for both rate

and cost certainty

-- Two-thirds (65 per cent) are looking to lock-in at a fixed rate to take

advantage of low interest rates

-- Half of Canadians (50 per cent) would consider shortening the

amortization period of their mortgage as a way to save money

-- Married individuals and those with children are more likely to consider

a shorter amortization (57 per cent and 63 per cent respectively);

paying off their mortgage faster is a bigger priority than those who are

single or those without children

"Up until recently, interest rate hikes may not have been top of

mind for Canadians, but there are now signals that rates may change

sooner than expected," said Katie Archdekin, Head of Mortgage

Products, BMO Bank of Montreal. "BMO has been encouraging Canadian

homebuyers to stress-test their mortgages and ensure that an

increase in interest rates is manageable. Having rate certainty can

help protect Canadian households from interest rate spikes."

According to BMO Economics, interest rates may begin to climb as

soon as next year.

Ms. Archdekin added, "We believe that for many Canadians a

mortgage that carries a maximum 25 year amortization is the right

choice for today's environment, as it helps households build equity

in their home faster."

Furthermore, Ms. Archdekin noted that on a $400,000 mortgage at

a 5 per cent interest rate, choosing a 25 year amortization can

save upwards of $70,000 in interest, which Canadians can put

directly towards their retirement.

BMO offers a new 10-year fixed mortgage at 3.99 per cent is

modelled after its popular 5-year fixed mortgage, which offers a

rate of 2.99 per cent. Both are available to new and existing

customers and come with a maximum 25-year amortization. Both rate

offers are available until March 28th.

The survey was completed on-line from February 21 to 23, 2012,

using Leger Marketing's online panel, LegerWeb. A sample of 1500

Canadians, 18+, were surveyed. A probability sample of the same

size would yield a margin of error of +/-2.5%, 19 times out of

20.

About BMO Financial Group

Established in 1817 as Bank of Montreal, BMO Financial Group is

a highly-diversified North American financial services

organization. With total assets of $538 billion as at January 31,

2012, and more than 47,000 employees, BMO Financial Group provides

a broad range of retail banking, wealth management and investment

banking products and solutions.

Contacts: Media Contacts: Jessica Park, Toronto (416)

867-3996jessica1.park@bmo.com Sarah Bensadoun, Montreal (514)

877-8224sarah.bensadoun@bmo.com Laurie Grant, Vancouver (604)

665-7596laurie.grant@bmo.com Web: www.bmo.com Twitter:

@BMOmedia

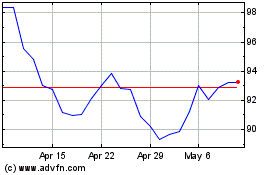

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Jul 2024 to Aug 2024

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Aug 2023 to Aug 2024