SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2020

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 1

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

São Paulo, February 27, 2020 – Ambev S.A. [B3: ABEV3; NYSE: ABEV] announces its results for the fourth quarter and full year of 2019. The following operating and financial information, unless otherwise indicated, is presented in nominal Reais and prepared according to the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and to the accounting practices issued by the Brazilian Accounting Standards Committee ("CPC”) and approved by the Brazilian Securities and Exchange Commission (“CVM”). The information herein should be read together with our financial information for the twelve-month period ended December 31, 2019 filed with the CVM and submitted to the U.S. Securities and Exchange Commission (“SEC”).

OPERATING AND FINANCIAL HIGHLIGHTS

Net revenue: Net revenue was up 5.7% in 4Q19, with volume increasing by 3.4% and growth in net revenue per hectoliter (NR/hl) of 2.2%. Net revenue was up in Brazil (+2.8%), Central America and the Caribbean (CAC) (+9.8%) and Latin America South (LAS)1 (+13.8%), and was down in Canada (-0.5%). In Brazil, volume was up 4.7% and NR/hl was down 1.8%. In CAC, volume and NR/hl grew by 4.3% and 5.3%, respectively. In LAS, volume was up 0.1% and NR/hl rose by 13.7%. In Canada, while volume declined by 1.5%, NR/hl increased by 1.0%. In the full year, net revenue was up 7.9%, with volume increasing by 2.7% and NR/hl growing by 5.0%.

Cost of goods sold (COGS): In 4Q19, COGS and cash COGS (excluding depreciation and amortization) were up 11.9% and 14.6%, respectively. On a per hectoliter basis, COGS grew by 8.3% while cash COGS was up 10.9%, mainly due to inflationary pressures in Argentina, FX and higher commodities prices. In the full year, COGS and cash COGS increased by 15.3% and 16.8%, respectively. On a per hectoliter basis, COGS rose by 12.2% while cash COGS was up 13.7%.

Selling, general & administrative (SG&A) expenses: In 4Q19, SG&A and cash SG&A (excluding depreciation and amortization) were up 15.2% and 12.3%, respectively, above our weighted average inflation (approximately 8.9%). The increase was mainly driven by inflationary pressure in Argentina, phasing between Q3 and Q4 in Brazil and higher NAB SG&A triggered by the volume growth and investment in our brands. In the full year, SG&A and cash SG&A grew by 7.5% and 6.1%, respectively.

EBITDA, gross margin and EBITDA margin: In 4Q19, EBITDA reached R$ 6,924.7 million, with an organic reduction of 2.7%, with a gross margin of 59.8% (-230bps) and EBITDA margin of 43.7% (-370bps). In the full year, EBITDA was R$ 21,147.1 million (+1.5%), with gross margin and EBITDA margin reaching 58.8% (-260bps) and 40.2% (-260bps), respectively.

Normalized profit and EPS: Normalized profit was R$ 4,633.5 million in 4Q19, 24.4% higher than in 4Q18, due to lower income taxes. Normalized EPS in the quarter was R$ 0.29 (+24.6%). In the full year, normalized profit increased by 8.5%, reaching R$ 12,549.9 million, with normalized EPS of R$ 0.77 (+8.1%).

Cash generation and CAPEX: Cash flow from operating activities in 4Q19 was R$ 9,634.9 million (+9.6%) and CAPEX reached R$ 2,003.9 million (+48.1%). In the full year, cash flow from operating activities totaled R$ 18,381.3 million (+0.2%) and CAPEX increased by 42.0% to R$ 5,069.4 million.

Payout and financial discipline: in 2019, we distributed R$ 7.7 billion in interest on shareholders’ equity, related to the profit generated in 2019. As of December 31, 2019, our net cash position was R$ 8,852.4 million.

1 The impacts on reported figures and organic growth resulting from applying Hyperinflation Accounting for our Argentinean subsidiaries, in accordance to IAS 29, are detailed on the section Financial Reporting in Hyperinflationary Economies - Argentina (page 20).

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 2

|

|

Financial highlights - Ambev consolidated

|

4Q18

|

4Q19

|

% As Reported

|

% Organic

|

FY18

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

45,755.8

|

47,295.7

|

3.4%

|

3.4%

|

158,716.9

|

163,243.0

|

2.9%

|

2.7%

|

|

Net revenue

|

16,017.8

|

15,856.8

|

-1.0%

|

5.7%

|

50,231.3

|

52,599.7

|

4.7%

|

7.9%

|

|

Gross profit

|

9,972.5

|

9,477.4

|

-5.0%

|

1.9%

|

30,981.9

|

30,921.6

|

-0.2%

|

3.4%

|

|

% Gross margin

|

62.3%

|

59.8%

|

-250 bps

|

-230 bps

|

61.7%

|

58.8%

|

-290 bps

|

-260 bps

|

|

Normalized EBITDA

|

7,631.6

|

6,924.7

|

-9.3%

|

-2.7%

|

21,685.7

|

21,147.1

|

-2.5%

|

1.5%

|

|

% Normalized EBITDA margin

|

47.6%

|

43.7%

|

-390 bps

|

-370 bps

|

43.2%

|

40.2%

|

-300 bps

|

-260 bps

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

3,463.7

|

4,219.0

|

21.8%

|

|

11,347.7

|

12,188.3

|

7.4%

|

|

|

Normalized profit

|

3,724.7

|

4,633.5

|

24.4%

|

|

11,561.6

|

12,549.9

|

8.5%

|

|

|

EPS (R$/shares)

|

0.21

|

0.26

|

21.9%

|

|

0.70

|

0.75

|

7.1%

|

|

|

Normalized EPS (R$/shares)

|

0.23

|

0.29

|

24.6%

|

|

0.71

|

0.77

|

8.1%

|

|

Note: Earnings per share calculation is based on outstanding shares (total existing shares excluding shares held in treasury).

IFRS 16/CPC 06 (R2) ADOPTION AND 2018 RESTATEMENT

Effective as of January 1, 2019, IFRS 16/CPC 06 (R2) replaced the previous lease accounting requirements and introduced significant changes to the accounting and disclosure of leases which were previously considered as operational. The Company opted for a complete retroactive adoption of IFRS 16/CPC 06 (R2) and, therefore, published its Financial Statements filed with the CVM and submitted to SEC restating 2018 results. For more details, refer to our financial information for the twelve-month period ended December 31, 2019 filed with the CVM and submitted to the U.S. Securities and Exchange Commission (“SEC”).

Reported 4Q18 and FY18 results in this press release correspond to the restated financial statements.

MANAGEMENT COMMENTS

In 4Q19, on a consolidated basis, we delivered top line growth of 5.7% to R$ 15,856.8 million with volume and net revenue per hectoliter growing by 3.4% and 2.2%, respectively, as we have been leveraging revenue management initiatives to ensure a more balanced mix between volume and price. Growth from ongoing premiumization was partially offset by advances in our smart affordability strategy and geographic mix. In the full year, top line rose by 7.9% to R$ 52,599.7 million, with volume and net revenue per hectoliter growth of 2.7% and 5.0%, respectively.

EBITDA in the quarter was R$ 6,924.7 million, which represents a decline of 2.7% versus 4Q18, with margin contraction of 370bps to 43.7%. The EBITDA margin was impacted mostly by a higher cost of sales resulting from significant commodity and transactional currency headwinds. In the full year, EBITDA was R$ 21,147.1 million (+1.5%), with EBITDA margin contraction of 260bps to 40.2%.

During 2019 Beer Brazil net revenue grew by 5.6%, and was more balanced, with volume increasing by 3.2% and net revenue per hectoliter going up 2.4%. The topline performance on the second half of the year, combined with meaningful cost pressures arising from commodities and transactional FX, led to an EBITDA decline, which we are not satisfied with.

We continue to execute on our strategic platforms:

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 3

|

Premiumize at Scale

· We continue to see premiumization as a trend with significant opportunity for premiumization across our geographies and we have the best portfolio, which will fuel our results over the next several years.

· In Brazil, the premium segment posted exciting results delivering double-digit growth in 4Q19 and FY19, led by our global brands portfolio.

o Budweiser, our largest global brand, plays a key role as a bridge for consumers who are trading up towards the premium segment. The brand’s quarter was marked by the 360-campaign, highlighting its functional attributes and inviting consumers to interact in social media.

o Stella Artois kept its solid growth pace, supported by a new functional campaign highlighting its brewing credentials - a Belgian pure malt beer with noble hops. The brand embraces the food platform and this quarter hosted another proprietary event: Christmas Market in Rio de Janeiro. We also launched Stella Artois Low Gluten, which is the first premium beer to address the health and wellness consumer trend in Brazil.

o Corona continued with its strong growth momentum. The brand was present in the trendiest New Year’s Eve parties in the country with the Corona Sunset circuit. The brand also produced a 7-episode web-series called “Follow the Sun” on the main summer New Year Eve’s destinations. The show has reached 42 million views to date.

o Beck’s is starting its roll-out focused on the southeast region of the country. This quarter we launched the 350ml can that addresses different consumption occasions. Beck’s is a legitimate pure malt beer that has followed the German Purity Law since 1873. It has a unique bitter flavor and is the highest selling German lager in the world.

o The domestic premium and craft portfolio also recorded important results, growing double digits in the quarter as well.

· Our premium portfolio in CAC delivered another strong quarter, with the premium brands growing by double-digits, led by Corona that grew by double-digits over a meaningful base and Stella Artois that grew by triple-digits. Our premium portfolio in CAC accounts for less than 5% of the total volume of our most important markets, and we believe this provides a large opportunity for future growth of the segment.

· In LAS, the premium portfolio posted double-digit growth in the quarter, led by global brands and the local premium champions, such as Huari and Patagonia, which is now being sold in Argentina, Chile, Paraguay and Uruguay. Cusqueña posted triple-digit growth in Chile once again, embracing the food platform.

· Canada’s strategy of premiumization delivered solid growth in 4Q19, driven by Corona, Stella Artois, Hoegaarden and our local craft portfolio.

Differentiate the Core

· In Brazil, we continue to invest in transformational changes to differentiate our core portfolio:

o This quarter we did a successful pilot of a new variety of Brahma: Brahma Duplo Malte, a Core Plus pure malt beer brewed with two types of malts. Brahma Duplo Malte reinforces beer expertise and has a positive impact on the brand equity of Brahma. In 2020, we will roll-out Brahma Duplo Malte nationally.

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 4

|

o Brahma, our classic lager, continued to experience a strong momentum, focusing this quarter on the soccer platform with campaigns targeted for the final game of Copa Conmenbol Libertadores, with strong engagement and positive health.

o Skol’s quarter was marked by the campaign of Skol Puro Malte for the summer, highlighting that Skol is the perfect beer for the season given its lightness and easy drinking profile. The Skol family volume grew in the fourth quarter, and was stable in the year, due to the successful roll-out of Skol Puro Malte.

o Bohemia, a Core Plus pure malt lager, posted triple-digit growth for the fourth consecutive quarter and over a meaningful base

· This quarter’s highlights from CAC included the solid performance of Presidente in the Dominican Republic and of Atlas Golden Light and Balboa Ice brands in Panama. Our Presidente campaigns targeted the baseball platform, the Dominican Republic’s national sport, inviting consumers to enjoy watching the game in stadiums, POC’s and in home. The activations included our sharing size bottle for stadiums and the launch of small packs for single serve, such as the 7oz returnable glass bottle and the 8oz can.

· In LAS, we continued to invest behind the differentiation of our brands: In Argentina, we launched Quilmes Red Lager, a new variety of our classic lager, while supporting Brahma, our easy drinking lager. In Bolivia, we launched a new Visual Brand Identity for our main brand Paceña. On the core plus segment, Andes Origen continues to grow by double-digits in Argentina.

· In Canada, within our core portfolio, Bud Light continues to perform well and gained share for the 24th straight year. The mainstream segment in Canada remains under pressure as consumers trade up to higher price tiers and trade out to the ready-to-drink category. Our above core portfolio outperformed the industry once again with Michelob Ultra leading the way, being the #1 share gainer in Canada in 2019.

Drive Smart Affordability

· Our Brazilian regional beers, Nossa, Magnífica and Legítima, continue to post exciting results, with share gains in the states where they were launched. Magnífica is already the leading brand of the value segment in the state of Maranhão.

· In Argentina, we are expanding the presence of 340ml returnable bottles across our portfolio.

Drive Operational Excellence

· We are continuously pursuing operational excellence that delivers both efficiencies and quality through an ecosystem that addresses our clients’ and consumers’ needs.

· Over the past 12 months we have made significant changes to our structure to focus even more on our clients, more than doubling our NPS in Brazil in this period.

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 5

|

Business Transformation Enabled by Technology

· Technology has been a key enabler for building an ecosystem at Ambev.

· Parceiro Ambev, our B2B tool and one of the largest e-commerce platforms in the country, continues to increase its stake in our sales to the on-premise channel, reaching more than 10% of our sales to this channel in 2019.

· Draftline, our in-house agency, has been instrumental in connecting Ambev and our clients directly to consumers, through a more efficient, strategic and personalized communication, based on real time marketing intelligence and business insights. In 2019, it operated with 8 Brazilian brands and in 2020 it will increase its activities to 22 Brazilian brands and regional offices, with hubs inside our distribution centers. Draftline recently opened offices in Argentina and Canada and will be one of the main drivers of our digital transformation.

Non-Alcoholic Beverages (NAB)

· In Brazil, we continue to invest in premiumization while also offering affordable options to consumers. We are premiumizing our portfolio with brands such as H2OH!, Tônica, Do Bem and Gatorade. On the affordability side, we are focused on adapting our packaging to specific sales channels. We also continue to make important investments in our main brand, Guaraná Antarctica, having launched its new Visual Brand Identity (VBI) in 4Q19.

Sustainability

· Brewing quality beer starts with the best ingredients. This requires a healthy and natural environment, as well as thriving communities. We are building a company to last, bringing people together for a Better World, now and for the next 100+ years. That’s why sustainability isn’t just part of our business, it is our business.

· We have ambitious Sustainability Goals for 2025, which were broken down into five pillars: Water, Climate & Energy, Circular Packaging, Sustainable Agriculture and Smart Drinking.

· Water is our main input and, therefore, it is at the top of our commitments. In the past 15 years, we reduced the volume of water needed to produce beverages by 46%. Currently, we use 2.92 liters of water to produce 1 liter of beer, which is a global benchmark. We also have a bottled water called AMA, which donates 100% of its profits to give water access to Brazilians in need.

· Another goal for 2025 is to have 100% of our energy purchased from renewable sources and to reduce carbon footprint throughout our value chain by 25%. We also launched a pioneering partnership with Volkswagen to buy 1,600 electric trucks powered by clean sources until 2023, which will prevent the annual emission of over 30,400 tons of carbon. Additionally, we recently committed to end plastic pollution from our packaging by 2025 through recycling, returnable bottles and R&D.

· We also have a strong focus on social impact, which includes our volunteering program and our efforts to promote smart drinking. We are not interested in making profit from the improper use of our products and have a solid platform to promote a lasting and healthy relationship with our consumers. Among our initiatives, we have a public-private partnership with the Federal Government for road safety and with the Federal District to reduce the harmful use of alcohol through various initiatives with the Health and Education departments.

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 6

|

OUTLOOK

Looking into 2020, for Beer Brazil we will continue to face cost pressures (our average FX hedging rate for 2020 is of 3.96 BRL/USD versus 3.61 BRL/USD in 2019), albeit to a lesser extent than last year given commodities tailwinds, and we will continue to strive for a balanced top line growth by building on the learnings from 2019.

We expect to resume Beer Brazil EBITDA growth for the full year. However, in 1Q20 we will face the highest cost of goods sold pressure of the year. Coupled with front-loaded sales and marketing investments, this should yield a high teens EBITDA decline in 1Q20. As the year goes by, we foresee our performance to gradually improve, as cost of goods sold pressure subsides, as well as the phasing of sales and marketing expenses normalizes.

As for our other businesses, in NAB Brazil, we will keep investing behind premiumization and health & wellness innovation to continue driving healthy topline growth.

We expect CAC to keep the strong momentum and we remain enthusiastic about the opportunities for the region.

In LAS, we have seen improved topline trends so far in 2020, although the Argentinean macroeconomic environment continues to be volatile and cost pressures remain given FX and inflationary pressures.

And in Canada, despite a soft beer industry, we are excited with our premiumization initiatives, supported by our portfolio, innovation pipeline and our efforts around growing in the “ready-to-drink” category.

We will continue to focus on: (i) becoming more customer and consumer centric; (ii) continuing to strengthen and further develop our portfolio; (iii) leveraging our unmatched distribution capability; (iv) bringing exciting innovations to consumers; (v) bolstering our digital transformation initiatives; and (vi) investing in our people. By successfully executing on our plans, we should deliver a better 2020, as well as create the conditions to drive sustainable growth over the long run.

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 7

|

AMBEV CONSOLIDATED INCOME STATEMENT

|

Consolidated income statement

|

4Q18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Net revenue

|

16,017.8

|

(6.7)

|

(1,225.8)

|

192.9

|

878.4

|

15,856.8

|

-1.0%

|

5.7%

|

|

Cost of goods sold (COGS)

|

(6,045.4)

|

1.9

|

404.3

|

(43.1)

|

(697.0)

|

(6,379.4)

|

5.5%

|

11.9%

|

|

Gross profit

|

9,972.5

|

(4.8)

|

(821.5)

|

149.8

|

181.4

|

9,477.4

|

-5.0%

|

1.9%

|

|

Selling, general and administrative (SG&A)

|

(3,860.4)

|

2.0

|

343.7

|

(58.0)

|

(562.1)

|

(4,134.8)

|

7.1%

|

15.2%

|

|

Other operating income/(expenses)

|

250.0

|

|

3.2

|

0.6

|

64.6

|

318.3

|

27.3%

|

24.9%

|

|

Normalized operating income (normalized EBIT)

|

6,362.1

|

(2.8)

|

(474.6)

|

92.3

|

(316.1)

|

5,660.9

|

-11.0%

|

-5.1%

|

|

Exceptional items above EBIT

|

(103.3)

|

|

9.3

|

0.7

|

(237.1)

|

(330.4)

|

nm

|

nm

|

|

Net finance results

|

(1,668.4)

|

|

|

|

|

(1,564.3)

|

-6.2%

|

|

|

Share of results of joint ventures

|

1.1

|

|

|

|

|

(11.2)

|

nm

|

|

|

Income tax expense

|

(1,127.8)

|

|

|

|

|

463.9

|

-141.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

3,463.7

|

|

|

|

|

4,219.0

|

21.8%

|

|

|

Attributable to Ambev holders

|

3,360.6

|

|

|

|

|

4,099.7

|

22.0%

|

|

|

Attributable to non-controlling interests

|

103.1

|

|

|

|

|

119.3

|

15.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized profit

|

3,724.7

|

|

|

|

|

4,633.5

|

24.4%

|

|

|

Attributable to Ambev holders

|

3,620.4

|

|

|

|

|

4,512.7

|

24.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

7,631.6

|

(2.8)

|

(615.0)

|

109.0

|

(198.2)

|

6,924.7

|

-9.3%

|

-2.7%

|

|

Consolidated income statement

|

FY18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Net revenue

|

50,231.3

|

44.0

|

(1,648.9)

|

|

3,973.3

|

52,599.7

|

4.7%

|

7.9%

|

|

Cost of goods sold (COGS)

|

(19,249.4)

|

(16.7)

|

523.1

|

|

(2,935.1)

|

(21,678.2)

|

12.6%

|

15.3%

|

|

Gross profit

|

30,981.9

|

27.3

|

(1,125.9)

|

|

1,038.3

|

30,921.6

|

-0.2%

|

3.4%

|

|

Selling, general and administrative (SG&A)

|

(14,692.0)

|

(22.8)

|

485.5

|

|

(1,098.2)

|

(15,327.5)

|

4.3%

|

7.5%

|

|

Other operating income

|

947.3

|

|

18.3

|

|

(87.6)

|

878.1

|

-7.3%

|

-9.2%

|

|

Normalized operating income (normalized EBIT)

|

17,237.3

|

4.5

|

(622.1)

|

|

(147.6)

|

16,472.1

|

-4.4%

|

-0.9%

|

|

Exceptional items above EBIT

|

(86.4)

|

|

16.1

|

|

(326.9)

|

(397.2)

|

nm

|

nm

|

|

Net finance results

|

(4,030.3)

|

|

|

|

|

(3,109.6)

|

-22.8%

|

|

|

Share of results of joint ventures

|

1.0

|

|

|

|

|

(22.3)

|

nm

|

|

|

Income tax expense

|

(1,773.9)

|

|

|

|

|

(754.7)

|

-57.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

11,347.7

|

|

|

|

|

12,188.3

|

7.4%

|

|

|

Attributable to Ambev holders

|

10,995.0

|

|

|

|

|

11,780.0

|

7.1%

|

|

|

Attributable to non-controlling interests

|

352.7

|

|

|

|

|

408.4

|

15.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized profit

|

11,561.6

|

|

|

|

|

12,549.9

|

8.5%

|

|

|

Attributable to Ambev holders

|

11,219.4

|

|

|

|

|

12,139.0

|

8.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

21,685.7

|

4.5

|

(858.4)

|

|

315.3

|

21,147.1

|

-2.5%

|

1.5%

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 8

|

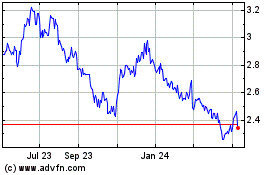

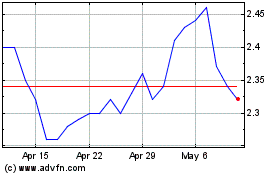

AMBEV CONSOLIDATED RESULTS

The combination of Ambev’s operations in Brazil, Central America and the Caribbean (CAC), Latin America South (LAS) and Canada’s business units, eliminating intercompany transactions, comprises our consolidated financial statements. The figures shown below are on an as-reported basis.

|

Volume (million hectoliters)

|

|

|

|

Net revenue per hectoliter (R$)

|

COGS per hectoliter (R$)

|

|

|

|

|

Normalized EBITDA (R$ million)

|

Normalized EBITDA Margin (%)

|

|

|

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 9

|

AMBEV CONSOLIDATED

We delivered R$ 15,856.8 million of net revenue (+5.7%) and R$ 6,924.7 million of EBITDA (-2.7%) during the quarter.

In FY19, net revenue totaled R$ 52,599.7 million (+7.9%) and EBITDA, R$ 21,147.1 million (+1.5%).

|

Ambev

|

4Q18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

45,755.8

|

|

|

|

1,540.0

|

47,295.7

|

3.4%

|

3.4%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

16,017.8

|

(6.7)

|

(1,225.8)

|

192.9

|

878.4

|

15,856.8

|

-1.0%

|

5.7%

|

|

Net revenue/hl (R$)

|

350.1

|

(0.1)

|

(25.9)

|

3.4

|

7.8

|

335.3

|

-4.2%

|

2.2%

|

|

COGS

|

(6,045.4)

|

1.9

|

404.3

|

(43.1)

|

(697.0)

|

(6,379.4)

|

5.5%

|

11.9%

|

|

COGS/hl (R$)

|

(132.1)

|

0.0

|

8.5

|

(0.4)

|

(11.0)

|

(134.9)

|

2.1%

|

8.3%

|

|

COGS excl. deprec. & amort.

|

(5,220.2)

|

1.9

|

308.4

|

(26.2)

|

(739.0)

|

(5,675.1)

|

8.7%

|

14.6%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(114.1)

|

0.0

|

6.5

|

(0.1)

|

(12.4)

|

(120.0)

|

5.2%

|

10.9%

|

|

Gross profit

|

9,972.5

|

(4.8)

|

(821.5)

|

149.8

|

181.4

|

9,477.4

|

-5.0%

|

1.9%

|

|

% Gross margin

|

62.3%

|

|

|

|

|

59.8%

|

-250 bps

|

-230 bps

|

|

SG&A excl. deprec. & amort.

|

(3,416.0)

|

2.0

|

299.2

|

(58.2)

|

(402.2)

|

(3,575.3)

|

4.7%

|

12.3%

|

|

SG&A deprec. & amort.

|

(444.4)

|

|

44.6

|

0.2

|

(159.9)

|

(559.5)

|

25.9%

|

38.6%

|

|

SG&A total

|

(3,860.4)

|

2.0

|

343.7

|

(58.0)

|

(562.1)

|

(4,134.8)

|

7.1%

|

15.2%

|

|

Other operating income/(expenses)

|

250.0

|

|

3.2

|

0.6

|

64.6

|

318.3

|

27.3%

|

24.9%

|

|

Normalized EBIT

|

6,362.1

|

(2.8)

|

(474.6)

|

92.3

|

(316.1)

|

5,660.9

|

-11.0%

|

-5.1%

|

|

% Normalized EBIT margin

|

39.7%

|

|

|

|

|

35.7%

|

-400 bps

|

-400 bps

|

|

Normalized EBITDA

|

7,631.6

|

(2.8)

|

(615.0)

|

109.0

|

(198.2)

|

6,924.7

|

-9.3%

|

-2.7%

|

|

% Normalized EBITDA margin

|

47.6%

|

|

|

|

|

43.7%

|

-390 bps

|

-370 bps

|

|

Ambev

|

FY18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

158,716.9

|

188.1

|

|

|

4,338.0

|

163,243.0

|

2.9%

|

2.7%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

50,231.3

|

44.0

|

(1,648.9)

|

|

3,973.3

|

52,599.7

|

4.7%

|

7.9%

|

|

Net revenue/hl (R$)

|

316.5

|

(0.1)

|

(10.1)

|

|

15.9

|

322.2

|

1.8%

|

5.0%

|

|

COGS

|

(19,249.4)

|

(16.7)

|

523.1

|

|

(2,935.1)

|

(21,678.2)

|

12.6%

|

15.3%

|

|

COGS/hl (R$)

|

(121.3)

|

0.0

|

3.2

|

|

(14.8)

|

(132.8)

|

9.5%

|

12.2%

|

|

COGS excl. deprec. & amort.

|

(16,564.1)

|

(16.7)

|

360.5

|

|

(2,785.4)

|

(19,005.8)

|

14.7%

|

16.8%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(104.4)

|

0.0

|

2.2

|

|

(14.3)

|

(116.4)

|

11.6%

|

13.7%

|

|

Gross profit

|

30,981.9

|

27.3

|

(1,125.9)

|

|

1,038.3

|

30,921.6

|

-0.2%

|

3.4%

|

|

% Gross margin

|

61.7%

|

|

|

|

|

58.8%

|

-290 bps

|

-260 bps

|

|

SG&A excl. deprec. & amort.

|

(12,928.8)

|

(22.8)

|

411.7

|

|

(785.0)

|

(13,324.9)

|

3.1%

|

6.1%

|

|

SG&A deprec. & amort.

|

(1,763.1)

|

|

73.8

|

|

(313.2)

|

(2,002.6)

|

13.6%

|

17.8%

|

|

SG&A total

|

(14,692.0)

|

(22.8)

|

485.5

|

|

(1,098.2)

|

(15,327.5)

|

4.3%

|

7.5%

|

|

Other operating income/(expenses)

|

947.3

|

|

18.3

|

|

(87.6)

|

878.1

|

-7.3%

|

-9.2%

|

|

Normalized EBIT

|

17,237.3

|

4.5

|

(622.1)

|

|

(147.6)

|

16,472.1

|

-4.4%

|

-0.9%

|

|

% Normalized EBIT margin

|

34.3%

|

|

|

|

|

31.3%

|

-300 bps

|

-280 bps

|

|

Normalized EBITDA

|

21,685.7

|

4.5

|

(858.4)

|

|

315.3

|

21,147.1

|

-2.5%

|

1.5%

|

|

% Normalized EBITDA margin

|

43.2%

|

|

|

|

|

40.2%

|

-300 bps

|

-260 bps

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 10

|

BRAZIL

In 4Q19, we delivered R$ 3,998.3 million of EBITDA in Brazil (-6.6%), with EBITDA margin of 45.0% (-450bps). Net revenue was up 2.8%, with volume increase of 4.7% and NR/hl decline of 1.8%. Cash COGS and cash COGS/hl were up 14.1% and 9.0%, respectively, while cash SG&A increased by 8.7%.

In FY19, net revenue in Brazil was up 7.1%, with volume increasing by 5.1%. EBITDA declined by 4.5%, with EBITDA margin contraction of 500bps to 40.9%. Cash COGS/hl increased by 18.4%, above our guidance of mid-teens growth, mainly due to package mix, driven by Beer Brazil.

|

Brazil

|

4Q18

|

Scope

|

Currency Translation

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

29,985.2

|

|

|

1,406.6

|

31,391.8

|

4.7%

|

4.7%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

8,650.3

|

|

|

243.1

|

8,893.4

|

2.8%

|

2.8%

|

|

Net revenue/hl (R$)

|

288.5

|

|

|

(5.2)

|

283.3

|

-1.8%

|

-1.8%

|

|

COGS

|

(3,214.8)

|

|

|

(390.5)

|

(3,605.3)

|

12.1%

|

12.1%

|

|

COGS/hl (R$)

|

(107.2)

|

|

|

(7.6)

|

(114.8)

|

7.1%

|

7.1%

|

|

COGS excl. deprec. & amort.

|

(2,816.7)

|

|

|

(397.2)

|

(3,213.9)

|

14.1%

|

14.1%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(93.9)

|

|

|

(8.4)

|

(102.4)

|

9.0%

|

9.0%

|

|

Gross profit

|

5,435.5

|

|

|

(147.5)

|

5,288.0

|

-2.7%

|

-2.7%

|

|

% Gross margin

|

62.8%

|

|

|

|

59.5%

|

-330 bps

|

-330 bps

|

|

SG&A excl. deprec. & amort.

|

(1,786.3)

|

|

|

(155.8)

|

(1,942.0)

|

8.7%

|

8.7%

|

|

SG&A deprec. & amort.

|

(309.8)

|

|

|

(52.2)

|

(362.0)

|

16.9%

|

16.9%

|

|

SG&A total

|

(2,096.1)

|

|

|

(208.0)

|

(2,304.0)

|

9.9%

|

9.9%

|

|

Other operating income/(expenses)

|

231.2

|

|

|

29.6

|

260.8

|

12.8%

|

12.8%

|

|

Normalized EBIT

|

3,570.7

|

|

|

(325.8)

|

3,244.9

|

-9.1%

|

-9.1%

|

|

% Normalized EBIT margin

|

41.3%

|

|

|

|

36.5%

|

-480 bps

|

-480 bps

|

|

Normalized EBITDA

|

4,278.6

|

|

|

(280.3)

|

3,998.3

|

-6.6%

|

-6.6%

|

|

% Normalized EBITDA margin

|

49.5%

|

|

|

|

45.0%

|

-450 bps

|

-450 bps

|

|

Brazil

|

FY18

|

Scope

|

Currency Translation

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

101,642.9

|

|

|

5,163.8

|

106,806.7

|

5.1%

|

5.1%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

26,814.2

|

|

|

1,910.3

|

28,724.5

|

7.1%

|

7.1%

|

|

Net revenue/hl (R$)

|

263.8

|

|

|

5.1

|

268.9

|

1.9%

|

1.9%

|

|

COGS

|

(10,014.8)

|

|

|

(2,081.5)

|

(12,096.3)

|

20.8%

|

20.8%

|

|

COGS/hl (R$)

|

(98.5)

|

|

|

(14.7)

|

(113.3)

|

14.9%

|

14.9%

|

|

COGS excl. deprec. & amort.

|

(8,513.8)

|

|

|

(2,078.2)

|

(10,592.0)

|

24.4%

|

24.4%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(83.8)

|

|

|

(15.4)

|

(99.2)

|

18.4%

|

18.4%

|

|

Gross profit

|

16,799.4

|

|

|

(171.2)

|

16,628.2

|

-1.0%

|

-1.0%

|

|

% Gross margin

|

62.7%

|

|

|

|

57.9%

|

-480 bps

|

-480 bps

|

|

SG&A excl. deprec. & amort.

|

(6,970.1)

|

|

|

(250.8)

|

(7,220.9)

|

3.6%

|

3.6%

|

|

SG&A deprec. & amort.

|

(1,157.3)

|

|

|

(207.5)

|

(1,364.8)

|

17.9%

|

17.9%

|

|

SG&A total

|

(8,127.4)

|

|

|

(458.3)

|

(8,585.7)

|

5.6%

|

5.6%

|

|

Other operating income/(expenses)

|

965.0

|

|

|

(138.6)

|

826.4

|

-14.4%

|

-14.4%

|

|

Normalized EBIT

|

9,637.0

|

|

|

(768.1)

|

8,868.9

|

-8.0%

|

-8.0%

|

|

% Normalized EBIT margin

|

35.9%

|

|

|

|

30.9%

|

-500 bps

|

-500 bps

|

|

Normalized EBITDA

|

12,295.3

|

|

|

(557.3)

|

11,737.9

|

-4.5%

|

-4.5%

|

|

% Normalized EBITDA margin

|

45.9%

|

|

|

|

40.9%

|

-500 bps

|

-500 bps

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 11

|

BEER BRAZIL

During the 4Q19, as anticipated in 3Q, some of the market dynamics were carried into this quarter, with the impact been reflected into a combination of a 0.2% lower net revenue per hectoliter and a 1.4% volume growth. Despite positive topline, EBITDA for Beer Brazil was R$ 3,395.3 million (-12.5%), with EBITDA margin contraction of 710bps to 44.9%, pressured by a strong increase in commodities and FX costs. Cash COGS and cash COGS/hl were up 19.2% and 17.5%, respectively. Cash SG&A increased by 6.4%, impacted driven by phasing between Q3 and Q4.

In FY19, we had a balanced topline, with volume growing by 3.2%, while net revenue per hectoliter increased by 2.4%. Nielsen reported industry growth of 2.4%. Our EBITDA declined by 6.5%, and margin contracted 530bps, mostly explained by commodities and FX impacts.

|

Beer Brazil

|

4Q18

|

Scope

|

Currency Translation

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

23,263.7

|

|

|

334.1

|

23,597.8

|

1.4%

|

1.4%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

7,471.5

|

|

|

89.5

|

7,561.0

|

1.2%

|

1.2%

|

|

Net revenue/hl (R$)

|

321.2

|

|

|

(0.8)

|

320.4

|

-0.2%

|

-0.2%

|

|

COGS

|

(2,616.2)

|

|

|

(431.5)

|

(3,047.7)

|

16.5%

|

16.5%

|

|

COGS/hl (R$)

|

(112.5)

|

|

|

(16.7)

|

(129.2)

|

14.8%

|

14.8%

|

|

COGS excl. deprec. & amort.

|

(2,272.9)

|

|

|

(435.7)

|

(2,708.6)

|

19.2%

|

19.2%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(97.7)

|

|

|

(17.1)

|

(114.8)

|

17.5%

|

17.5%

|

|

Gross profit

|

4,855.3

|

|

|

(342.0)

|

4,513.3

|

-7.0%

|

-7.0%

|

|

% Gross margin

|

65.0%

|

|

|

|

59.7%

|

-530 bps

|

-530 bps

|

|

SG&A excl. deprec. & amort.

|

(1,533.0)

|

|

|

(97.6)

|

(1,630.6)

|

6.4%

|

6.4%

|

|

SG&A deprec. & amort.

|

(275.0)

|

|

|

(35.8)

|

(310.8)

|

13.0%

|

13.0%

|

|

SG&A total

|

(1,808.0)

|

|

|

(133.4)

|

(1,941.4)

|

7.4%

|

7.4%

|

|

Other operating income/(expenses)

|

215.9

|

|

|

(42.3)

|

173.6

|

-19.6%

|

-19.6%

|

|

Normalized EBIT

|

3,263.2

|

|

|

(517.7)

|

2,745.5

|

-15.9%

|

-15.9%

|

|

% Normalized EBIT margin

|

43.7%

|

|

|

|

36.3%

|

-740 bps

|

-740 bps

|

|

Normalized EBITDA

|

3,881.5

|

|

|

(486.1)

|

3,395.3

|

-12.5%

|

-12.5%

|

|

% Normalized EBITDA margin

|

52.0%

|

|

|

|

44.9%

|

-710 bps

|

-710 bps

|

|

Beer Brazil

|

FY18

|

Scope

|

Currency Translation

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

77,784.2

|

|

|

2,479.6

|

80,263.7

|

3.2%

|

3.2%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

23,008.5

|

|

|

1,295.8

|

24,304.2

|

5.6%

|

5.6%

|

|

Net revenue/hl (R$)

|

295.8

|

|

|

7.0

|

302.8

|

2.4%

|

2.4%

|

|

COGS

|

(8,214.2)

|

|

|

(1,823.7)

|

(10,037.9)

|

22.2%

|

22.2%

|

|

COGS/hl (R$)

|

(105.6)

|

|

|

(19.5)

|

(125.1)

|

18.4%

|

18.4%

|

|

COGS excl. deprec. & amort.

|

(6,918.5)

|

|

|

(1,818.0)

|

(8,736.5)

|

26.3%

|

26.3%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(88.9)

|

|

|

(19.9)

|

(108.8)

|

22.4%

|

22.4%

|

|

Gross profit

|

14,794.3

|

|

|

(528.0)

|

14,266.3

|

-3.6%

|

-3.6%

|

|

% Gross margin

|

64.3%

|

|

|

|

58.7%

|

-560 bps

|

-560 bps

|

|

SG&A excl. deprec. & amort.

|

(6,029.4)

|

|

|

(9.1)

|

(6,038.5)

|

0.2%

|

0.2%

|

|

SG&A deprec. & amort.

|

(1,021.0)

|

|

|

(193.0)

|

(1,214.0)

|

18.9%

|

18.9%

|

|

SG&A total

|

(7,050.3)

|

|

|

(202.2)

|

(7,252.5)

|

2.9%

|

2.9%

|

|

Other operating income/(expenses)

|

740.1

|

|

|

(168.5)

|

571.6

|

-22.8%

|

-22.8%

|

|

Normalized EBIT

|

8,484.0

|

|

|

(898.6)

|

7,585.4

|

-10.6%

|

-10.6%

|

|

% Normalized EBIT margin

|

36.9%

|

|

|

|

31.2%

|

-570 bps

|

-570 bps

|

|

Normalized EBITDA

|

10,800.7

|

|

|

(699.9)

|

10,100.8

|

-6.5%

|

-6.5%

|

|

% Normalized EBITDA margin

|

46.9%

|

|

|

|

41.6%

|

-530 bps

|

-530 bps

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 12

|

NAB BRAZIL

In 4Q19, EBITDA for NAB Brazil was R$ 603.0 million (+51.8%), with EBITDA margin expansion of 1,160bps to 45.3%.

Net revenue was up 13.0%, as NR/hl was down 2.5% and volume increased by 16.0%. Cash COGS and cash COGS/hl declined by 7.1% and 19.9%, respectively, due to the easy comparable in the previous year, given the phasing of NAB COGS between 3Q18 and 4Q18. Cash SG&A was up 23.0%, impacted by higher distribution expenses related to volume growth and investments in our brands.

In FY19, NAB Brazil top line was up 16.1%, with volume increase of 11.3%. Nielsen reported industry growth of 2.7%. EBITDA was up 9.5%, with EBITDA margin contraction of 230bps to 37.0%.

|

NAB Brazil

|

4Q18

|

Scope

|

Currency Translation

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

6,721.5

|

|

|

1,072.5

|

7,794.0

|

16.0%

|

16.0%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,178.8

|

|

|

153.5

|

1,332.3

|

13.0%

|

13.0%

|

|

Net revenue/hl (R$)

|

175.4

|

|

|

(4.4)

|

170.9

|

-2.5%

|

-2.5%

|

|

COGS

|

(598.6)

|

|

|

41.0

|

(557.6)

|

-6.9%

|

-6.9%

|

|

COGS/hl (R$)

|

(89.1)

|

|

|

17.5

|

(71.5)

|

-19.7%

|

-19.7%

|

|

COGS excl. deprec. & amort.

|

(543.8)

|

|

|

38.5

|

(505.2)

|

-7.1%

|

-7.1%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(80.9)

|

|

|

16.1

|

(64.8)

|

-19.9%

|

-19.9%

|

|

Gross profit

|

580.2

|

|

|

194.6

|

774.7

|

33.5%

|

33.5%

|

|

% Gross margin

|

49.2%

|

|

|

|

58.1%

|

890 bps

|

890 bps

|

|

SG&A excl. deprec. & amort.

|

(253.2)

|

|

|

(58.2)

|

(311.4)

|

23.0%

|

23.0%

|

|

SG&A deprec. & amort.

|

(34.8)

|

|

|

(16.5)

|

(51.3)

|

47.3%

|

47.3%

|

|

SG&A total

|

(288.0)

|

|

|

(74.6)

|

(362.7)

|

25.9%

|

25.9%

|

|

Other operating income/(expenses)

|

15.3

|

|

|

71.9

|

87.3

|

nm

|

nm

|

|

Normalized EBIT

|

307.5

|

|

|

191.9

|

499.4

|

62.4%

|

62.4%

|

|

% Normalized EBIT margin

|

26.1%

|

|

|

|

37.5%

|

1140 bps

|

1140 bps

|

|

Normalized EBITDA

|

397.1

|

|

|

205.9

|

603.0

|

51.8%

|

51.8%

|

|

% Normalized EBITDA margin

|

33.7%

|

|

|

|

45.3%

|

1160 bps

|

1160 bps

|

|

NAB Brazil

|

FY18

|

Scope

|

Currency Translation

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

23,858.8

|

|

|

2,684.2

|

26,542.9

|

11.3%

|

11.3%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

3,805.7

|

|

|

614.5

|

4,420.2

|

16.1%

|

16.1%

|

|

Net revenue/hl (R$)

|

159.5

|

|

|

7.0

|

166.5

|

4.4%

|

4.4%

|

|

COGS

|

(1,800.6)

|

|

|

(257.8)

|

(2,058.4)

|

14.3%

|

14.3%

|

|

COGS/hl (R$)

|

(75.5)

|

|

|

(2.1)

|

(77.5)

|

2.8%

|

2.8%

|

|

COGS excl. deprec. & amort.

|

(1,595.3)

|

|

|

(260.2)

|

(1,855.5)

|

16.3%

|

16.3%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(66.9)

|

|

|

(3.0)

|

(69.9)

|

4.5%

|

4.5%

|

|

Gross profit

|

2,005.2

|

|

|

356.7

|

2,361.9

|

17.8%

|

17.8%

|

|

% Gross margin

|

52.7%

|

|

|

|

53.4%

|

70 bps

|

70 bps

|

|

SG&A excl. deprec. & amort.

|

(940.8)

|

|

|

(241.6)

|

(1,182.4)

|

25.7%

|

25.7%

|

|

SG&A deprec. & amort.

|

(136.3)

|

|

|

(14.5)

|

(150.8)

|

10.6%

|

10.6%

|

|

SG&A total

|

(1,077.1)

|

|

|

(256.1)

|

(1,333.2)

|

23.8%

|

23.8%

|

|

Other operating income/(expenses)

|

224.9

|

|

|

29.9

|

254.8

|

13.3%

|

13.3%

|

|

Normalized EBIT

|

1,153.0

|

|

|

130.5

|

1,283.5

|

11.3%

|

11.3%

|

|

% Normalized EBIT margin

|

30.3%

|

|

|

|

29.0%

|

-130 bps

|

-130 bps

|

|

Normalized EBITDA

|

1,494.6

|

|

|

142.6

|

1,637.1

|

9.5%

|

9.5%

|

|

% Normalized EBITDA margin

|

39.3%

|

|

|

|

37.0%

|

-230 bps

|

-230 bps

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 13

|

CENTRAL AMERICA AND THE CARIBBEAN (CAC)

CAC delivered EBITDA of R$ 884.6 million (+19.1%) in 4Q19, with EBITDA margin of 45.3% (+350bps).

Net revenue increased by 9.8%, led by volume growth of 4.3% coupled with NR/hl increase of 5.3%. Cash COGS grew by 8.9%, while cash COGS/hl grew by 4.4%. Costs in Panama continue to drive pressure on margins, but are now comparable to 4Q18, when the strong volume growth since 2017 has led to additional costs in order to supply the market with no disruption. Cash SG&A increased by 0.8%, driven by savings in non-working money and lower variable compensation accruals, due to different phasing from 2018. The other operating income increase in the quarter is mainly explained by a second installment of the insurance compensation received for the damages caused by the 3Q17 hurricane season. Without such compensation, normalized EBITDA organic growth in the quarter would have been 16.5%.

In FY19, top line in CAC was up 10.0%, with volume growth of 5.3%. EBITDA grew by 22.0%, with EBITDA margin expansion of 440bps to 43.8%. Without the insurance compensation received in 2Q and 4Q, normalized EBITDA organic growth in the year would have been 19.0%.

|

CAC

|

4Q18

|

Scope

|

Currency Translation

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

3,634.0

|

|

|

155.7

|

3,789.7

|

4.3%

|

4.3%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,714.6

|

|

69.8

|

168.8

|

1,953.2

|

13.9%

|

9.8%

|

|

Net revenue/hl (R$)

|

471.8

|

|

18.4

|

25.2

|

515.4

|

9.2%

|

5.3%

|

|

COGS

|

(780.0)

|

|

(32.2)

|

(31.5)

|

(843.7)

|

8.2%

|

4.0%

|

|

COGS/hl (R$)

|

(214.6)

|

|

(8.5)

|

0.5

|

(222.6)

|

3.7%

|

-0.2%

|

|

COGS excl. deprec. & amort.

|

(663.8)

|

|

(29.7)

|

(58.8)

|

(752.2)

|

13.3%

|

8.9%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(182.7)

|

|

(7.8)

|

(8.0)

|

(198.5)

|

8.7%

|

4.4%

|

|

Gross profit

|

934.6

|

|

37.6

|

137.3

|

1,109.5

|

18.7%

|

14.7%

|

|

% Gross margin

|

54.5%

|

|

|

|

56.8%

|

230 bps

|

240 bps

|

|

SG&A excl. deprec. & amort.

|

(334.2)

|

|

(12.4)

|

(2.6)

|

(349.2)

|

4.5%

|

0.8%

|

|

SG&A deprec. & amort.

|

(54.0)

|

|

(2.3)

|

(9.6)

|

(65.9)

|

22.0%

|

17.8%

|

|

SG&A total

|

(388.2)

|

|

(14.7)

|

(12.3)

|

(415.2)

|

6.9%

|

3.2%

|

|

Other operating income/(expenses)

|

1.4

|

|

1.3

|

30.2

|

32.9

|

nm

|

nm

|

|

Normalized EBIT

|

547.8

|

|

24.3

|

155.2

|

727.2

|

32.8%

|

28.3%

|

|

% Normalized EBIT margin

|

31.9%

|

|

|

|

37.2%

|

530 bps

|

540 bps

|

|

Normalized EBITDA

|

718.1

|

|

29.1

|

137.5

|

884.6

|

23.2%

|

19.1%

|

|

% Normalized EBITDA margin

|

41.9%

|

|

|

|

45.3%

|

340 bps

|

350 bps

|

|

CAC

|

FY18

|

Scope

|

Currency Translation

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

13,159.8

|

|

|

699.7

|

13,859.5

|

5.3%

|

5.3%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

5,813.9

|

|

363.5

|

580.5

|

6,757.9

|

16.2%

|

10.0%

|

|

Net revenue/hl (R$)

|

441.8

|

|

26.2

|

19.6

|

487.6

|

10.4%

|

4.4%

|

|

COGS

|

(2,559.1)

|

|

(155.5)

|

(219.5)

|

(2,934.1)

|

14.7%

|

8.6%

|

|

COGS/hl (R$)

|

(194.5)

|

|

(11.2)

|

(6.0)

|

(211.7)

|

8.9%

|

3.1%

|

|

COGS excl. deprec. & amort.

|

(2,233.8)

|

|

(137.5)

|

(221.4)

|

(2,592.7)

|

16.1%

|

9.9%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(169.7)

|

|

(9.9)

|

(7.4)

|

(187.1)

|

10.2%

|

4.4%

|

|

Gross profit

|

3,254.8

|

|

208.0

|

361.0

|

3,823.9

|

17.5%

|

11.1%

|

|

% Gross margin

|

56.0%

|

|

|

|

56.6%

|

60 bps

|

50 bps

|

|

SG&A excl. deprec. & amort.

|

(1,301.1)

|

|

(73.4)

|

85.4

|

(1,289.0)

|

-0.9%

|

-6.6%

|

|

SG&A deprec. & amort.

|

(169.9)

|

|

(11.1)

|

(24.0)

|

(205.0)

|

20.7%

|

14.1%

|

|

SG&A total

|

(1,470.9)

|

|

(84.5)

|

61.5

|

(1,494.0)

|

1.6%

|

-4.2%

|

|

Other operating income/(expenses)

|

20.1

|

|

4.4

|

61.3

|

85.8

|

nm

|

nm

|

|

Normalized EBIT

|

1,803.9

|

|

127.9

|

483.8

|

2,415.6

|

33.9%

|

26.8%

|

|

% Normalized EBIT margin

|

31.0%

|

|

|

|

35.7%

|

470 bps

|

480 bps

|

|

Normalized EBITDA

|

2,299.1

|

|

157.1

|

505.8

|

2,962.0

|

28.8%

|

22.0%

|

|

% Normalized EBITDA margin

|

39.5%

|

|

|

|

43.8%

|

430 bps

|

440 bps

|

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 14

|

LATIN AMERICA SOUTH (LAS)

In 4Q19, LAS delivered reported EBITDA of R$ 1,524.3 million2, which represents an organic growth of 2.2%3, with EBITDA margin of 46.9% (-540bps).

Top line rose by 13.8%, with volume growth of 0.1%, coupled with NR/hl increase of 13.7%, driven by our continued revenue management initiatives. Cash COGS and cash COGS/hl increased by 18.8% and 18.7%, respectively, negatively affected by FX, while cash SG&A grew by 37.5%. The performance in the quarter was also affected by social unrests in Bolivia and Chile.

In FY19, top line in LAS was up 15.1%, with volume decline of 3.5%. EBITDA increased by 12.3%, with EBITDA margin contraction of 110bps to 43.8%.

|

LAS

|

4Q18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

9,865.9

|

|

|

|

11.2

|

9,877.1

|

0.1%

|

0.1%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

3,983.7

|

(6.7)

|

(1,397.4)

|

192.9

|

474.5

|

3,247.2

|

-18.5%

|

13.8%

|

|

Net revenue/hl (R$)

|

403.8

|

(0.7)

|

(141.5)

|

11.8

|

55.3

|

328.8

|

-18.6%

|

13.7%

|

|

COGS

|

(1,466.0)

|

1.9

|

475.0

|

(43.1)

|

(228.3)

|

(1,260.6)

|

-14.0%

|

18.2%

|

|

COGS/hl (R$)

|

(148.6)

|

0.2

|

48.1

|

(0.5)

|

(26.8)

|

(127.6)

|

-14.1%

|

18.0%

|

|

COGS excl. deprec. & amort.

|

(1,233.2)

|

1.9

|

374.0

|

(26.2)

|

(201.6)

|

(1,085.1)

|

-12.0%

|

18.8%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(125.0)

|

0.2

|

37.9

|

0.4

|

(23.3)

|

(109.9)

|

-12.1%

|

18.7%

|

|

Gross profit

|

2,517.7

|

(4.8)

|

(922.4)

|

149.8

|

246.2

|

1,986.6

|

-21.1%

|

11.3%

|

|

% Gross margin

|

63.2%

|

|

|

|

|

61.2%

|

-200 bps

|

-140 bps

|

|

SG&A excl. deprec. & amort.

|

(723.4)

|

2.0

|

348.1

|

(58.2)

|

(220.8)

|

(652.3)

|

-9.8%

|

37.5%

|

|

SG&A deprec. & amort.

|

(81.9)

|

|

49.8

|

0.2

|

(47.2)

|

(79.1)

|

-3.4%

|

91.4%

|

|

SG&A total

|

(805.3)

|

2.0

|

397.8

|

(58.0)

|

(267.9)

|

(731.4)

|

-9.2%

|

41.8%

|

|

Other operating income/(expenses)

|

24.6

|

|

1.4

|

0.6

|

(12.0)

|

14.6

|

-40.7%

|

-35.3%

|

|

Normalized EBIT

|

1,737.1

|

(2.8)

|

(523.1)

|

92.3

|

(33.7)

|

1,269.8

|

-26.9%

|

-2.1%

|

|

% Normalized EBIT margin

|

43.6%

|

|

|

|

|

39.1%

|

-450 bps

|

-640 bps

|

|

Normalized EBITDA

|

2,051.8

|

(2.8)

|

(673.9)

|

109.0

|

40.1

|

1,524.3

|

-25.7%

|

2.2%

|

|

% Normalized EBITDA margin

|

51.5%

|

|

|

|

|

46.9%

|

-460 bps

|

-540 bps

|

|

LAS

|

FY18

|

Scope

|

Currency Translation

|

IAS 29

9M Impact

|

Organic Growth

|

FY19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

33,971.2

|

188.1

|

|

|

(1,168.2)

|

32,991.1

|

-2.9%

|

-3.5%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

10,753.9

|

44.0

|

(2,385.1)

|

|

1,615.9

|

10,028.7

|

-6.7%

|

15.1%

|

|

Net revenue/hl (R$)

|

316.6

|

(0.4)

|

(72.3)

|

|

60.2

|

304.0

|

-4.0%

|

19.0%

|

|

COGS

|

(4,261.7)

|

(16.7)

|

817.9

|

|

(537.4)

|

(3,998.0)

|

-6.2%

|

12.6%

|

|

COGS/hl (R$)

|

(125.5)

|

0.2

|

24.8

|

|

(20.7)

|

(121.2)

|

-3.4%

|

16.5%

|

|

COGS excl. deprec. & amort.

|

(3,569.1)

|

(16.7)

|

627.5

|

|

(398.1)

|

(3,356.4)

|

-6.0%

|

11.2%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(105.1)

|

0.1

|

19.0

|

|

(15.8)

|

(101.7)

|

-3.2%

|

15.0%

|

|

Gross profit

|

6,492.2

|

27.3

|

(1,567.2)

|

|

1,078.5

|

6,030.7

|

-7.1%

|

16.7%

|

|

% Gross margin

|

60.4%

|

|

|

|

|

60.1%

|

-30 bps

|

90 bps

|

|

SG&A excl. deprec. & amort.

|

(2,251.0)

|

(22.8)

|

619.2

|

|

(609.9)

|

(2,264.5)

|

0.6%

|

27.1%

|

|

SG&A deprec. & amort.

|

(329.3)

|

|

93.1

|

|

(39.8)

|

(276.0)

|

-16.2%

|

12.1%

|

|

SG&A total

|

(2,580.4)

|

(22.8)

|

712.3

|

|

(649.7)

|

(2,540.5)

|

-1.5%

|

25.2%

|

|

Other operating income/(expenses)

|

(24.6)

|

|

14.7

|

|

(8.1)

|

(18.0)

|

-27.0%

|

32.7%

|

|

Normalized EBIT

|

3,887.2

|

4.5

|

(840.2)

|

|

420.7

|

3,472.2

|

-10.7%

|

10.9%

|

|

% Normalized EBIT margin

|

36.1%

|

|

|

|

|

34.6%

|

-150 bps

|

-140 bps

|

|

Normalized EBITDA

|

4,909.1

|

4.5

|

(1,123.7)

|

|

599.9

|

4,389.8

|

-10.6%

|

12.3%

|

|

% Normalized EBITDA margin

|

45.6%

|

|

|

|

|

43.8%

|

-180 bps

|

-110 bps

|

2 Reported numbers are presented applying Hyperinflation Accounting for our Argentinean operations, as detailed on page 20. Organic growth between 4Q19 and 4Q18 excludes the effects of hyperinflation accounting inherent to 9M, which are isolated in the column “IAS 29 9M Impact”.

3 The scope in LAS refers to the transaction on May 2, 2018, under which we received from Anheuser-Busch InBev SA/NV (AB InBev) the perpetual licensing of Budweiser, among other brands, in Argentina, upon the recovery of the distribution rights by AB InBev from Compañia Cervecerías Unidas S.A. (CCU). The transaction also included the transfer to CCU of some Argentinean brands (Norte, Iguana and Baltica). The value of scopes in the fourth quarter are a result of currency variations of the YTD Scope.

AMBEV REPORTS 2019 FOURTH QUARTER AND FULL YEAR RESULTS UNDER IFRS

|

|

Fourth Quarter and Full Year 2019 Results

February 27, 2020

Page | 15

|

CANADA

Canada delivered EBITDA of R$ 517.4 million (-16.4%) in 4Q19, with EBITDA margin of 29.3% (-560bps).

Top line was down 0.5%, due to the volume decline of 1.5%, mostly driven by a soft beer industry. This was partially offset by a NR/hl growth of 1.0%. Cash COGS and cash COGS/hl increased by 16.1% and 17.8%, respectively, impacted by increased commodities prices, higher mix of imported beers and lower dilution of fixed costs. Cash SG&A increased by 4.0%, driven by higher logistics expenses, partially offset by savings in non-working money.

In FY19, net revenue in Canada was down 1.9%, with volume decline of 3.6%. EBITDA decreased by 10.7%, with EBITDA margin compression of 290bps to 29.0%.

|

Canada

|

4Q18

|

Scope

|

Currency Translation

|

Organic Growth

|

4Q19

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

2,270.6

|

|

|

(33.5)

|

2,237.1

|

-1.5%

|