Darwin Buys UK Organic Food Company Plum Baby For GBP10 Million

June 01 2010 - 9:10AM

Dow Jones News

Darwin Private Equity said Tuesday it has bought Plum Baby Foods

for GBP10 million, marking the London-based buyout firm's third

acquisition since launching in 2007.

Plum Foods sells organic products through retailers and

supermarket chains including Boots Alliance, Tesco PLC (TSCO.LN)

and J Sainsbury PLC (SBRY.LN). It expects annual revenue of GBP15

million in 2010.

"Plum is a very strong brand--we believe Plum has significant

growth potential and plan to invest heavily in the business to

build upon its market position," said Darwin partner Jonathan

Kaye.

Founder Susie Willis will remain in the business as creative

director, while Chief Executive Patrick Cairns is stepping down and

will be replaced by former Dairy Crest Group PLC (DCG.LN) and HJ

Heinz UK (HNZ) manager Paul Kaye.

Existing investors in the business including Beringea, Octopus

and Foresight are selling their interests.

Darwin was founded by former executives from Permira and CVC

Capital Partners and is currently investing out of its initial

fund, which has commitments of GBP217 million from investors such

as Goldman Sachs Group Inc. (GS) and private equity fund of funds

Pantheon Ventures. It invests in U.K. businesses with enterprise

values of between GBP10 million and GBP100 million.

It has already bought sports nutrition business Maximuscle and

Bromford Industries, which makes components for the aerospace

industry.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

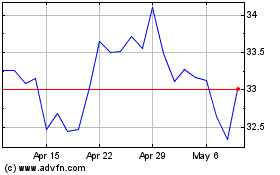

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

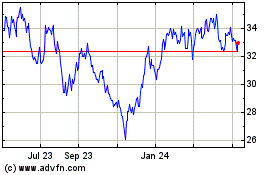

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024