Assisted Living Concepts, Inc. (NYSE: ALC)

Highlights:

-- Adjusted EBITDAR as a percent of revenues increased to 33.8%, up from

32.3% in the first quarter of 2010

-- Increased average private pay occupancy by 2 and 29 units over the

fourth quarter of 2010 and the first quarter of 2010, respectively

-- Increased private pay rates by 2.4% over the fourth quarter of 2010

-- Board of Directors declared 2 for 1 stock split and post split dividend

of 10 cents per share

Assisted Living Concepts, Inc. ("ALC") (NYSE: ALC) reported net

income of $5.0 million in the first quarter of 2011, compared to a

net income of $3.6 million in the first quarter of 2010. During the

first quarter of 2011, ALC recorded "One-Time Items" described

below that resulted in an additional $0.4 million of net income.

Excluding the One-Time Items, net income in the first quarter of

2011 would have been $4.6 million.

"We continue to strengthen our portfolio of properties by making

positive strides in both private pay occupancy and earnings,"

commented Laurie Bebo, President and Chief Executive Officer. "The

first quarter of the year has historically been our most

challenging quarter from both an occupancy and expense perspective.

We are encouraged that the market has recognized our consistent

positive results and driven up our share price. We feel that a two

for one stock split will benefit our shareholders by adding

liquidity to our stock. We are pleased to report that confidence in

our balance sheet and our ability to continue to generate

significant amounts of cash has resulted in rewarding our

shareholders with an initial quarterly dividend of 10 cents per

post split share."

One Time Items recorded in the first quarter of 2011 included a

reduction in tax expense associated with the settlement of all

issues associated with a tax allocation agreement with a subsidiary

of our former parent Extendicare Inc. (now Extendicare Real Estate

Investment Trust) ($0.8 million), partially offset by charges

associated with a mark to market adjustment for interest rate swap

agreements ($0.2 million net of tax) and the write-off of deferred

financing fees associated with our refinanced debt ($0.2 million

net of tax).

Diluted earnings per common share for the quarters ended March

31, 2011 and 2010 were $0.43 and $0.31, respectively. Excluding One

Time Items, diluted earnings per common share for the quarter ended

March 31, 2011 was $0.39.

In addition, to these One Time Items, ALC's Company Conference

was held in our first quarter of 2011 as compared the second

quarter in 2010. This timing difference resulted in an increase in

General and Administrative expense in the first quarter of 2011 of

$0.3 million ($0.2 million net of tax) over the first quarter of

2010 or approximately $.02 per share.

Certain non-GAAP financial measures are used in the discussions

in this release in assessing the performance of the business. See

attached tables for definitions of Adjusted EBITDA and Adjusted

EBITDAR, reconciliations of net income (loss) to Adjusted EBITDA

and Adjusted EBITDAR, calculations of Adjusted EBITDA and Adjusted

EBITDAR as a percentage of total revenues (Adjusted EBITDAR and

Adjusted EBITDA margins), and non-GAAP financial measure

reconciliation information.

As of March 31, 2011, ALC operated 211 senior living residences

comprising 9,325 units.

The following discussions exclude the impact of discontinued

operations unless otherwise specified.

Quarters ended March 31, 2011, March 31, 2010, December 31,

2010

Revenues of $58.4 million in the first quarter ended March 31,

2011 increased $0.5 million or 1.0% from $57.9 million in the first

quarter of 2010 and were unchanged from the fourth quarter of

2010.

Adjusted EBITDAR for the first quarter of 2011 was $19.7

million, or 33.8% of revenues and

-- increased $1.0 million or 5.6% from $18.7 million and 32.3% of revenues

in the first quarter of 2010; and

-- decreased $1.2 million or 5.5% from $20.9 million and 35.7% of revenues

in the fourth quarter of 2010.

Adjusted EBITDA for the first quarter of 2011 was $15.4 million,

or 26.3% of revenues and

-- increased $1.8 million or 13.0% from $13.6 million and 23.5% of

revenues in the first quarter of 2010; and

-- decreased $1.0 million or 6.3% from $16.4 million and 28.0% of revenues

in the fourth quarter of 2010.

First quarter 2011 compared to first quarter 2010

Revenues in the first quarter of 2011 increased from the first

quarter of 2010 primarily due to higher average daily revenue as a

result of rate increases ($1.1 million) and an increase in private

pay occupancy ($0.3 million), partially offset by the planned

reduction in the number of units occupied by Medicaid residents

($0.9 million). Private pay rates increased in the first quarter of

2011 by an average of 2.0% over the first quarter of 2010. Overall

rates, including the impact of improved payer mix, increased in the

first quarter of 2011 by an average of 2.6% over the first quarter

of 2010.

Both Adjusted EBITDAR and Adjusted EBITDA increased in the first

quarter of 2011 primarily due to a decrease in residence operations

expenses ($0.5 million) (this excludes gains and losses on the

disposals of fixed assets) and an increase in revenues discussed

above ($0.5 million). Additionally, for Adjusted EBITDA only, a

decrease in residence lease expense ($0.7 million). Residence

operation expenses decreased primarily due to reduced salary

expense and property taxes. Staffing needs in the first quarter of

2011 as compared to the first quarter of 2010 decreased primarily

because of a decline in the number of units occupied by Medicaid

residents who tend to have higher care needs than private pay

residents. In addition, general economic conditions enabled us to

hire new employees at lower wage rates. Property tax expenses were

lower due to successful appeals of assessments in a variety of

states. General and administrative expenses were unchanged as

savings associated with upfront costs associated with transitioning

payroll and benefits from a third party vendor to in-house in the

first quarter of 2010 were offset by expenses associated with our

2011 Company Conference. In 2010, the Conference took place in the

second quarter.

First quarter 2011 compared to the fourth quarter 2010

Revenues in the first quarter of 2011 were consistent with

revenues in the fourth quarter of 2010. Higher average daily

revenue as a result of rate increases ($1.3 million) was offset by

two less days in the 2011 quarter ($1.2 million) and the reduction

in the number of units occupied by Medicaid residents ($0.1

million). Private pay and overall rates increased in the first

quarter of 2011 by an average of 2.4% over the fourth quarter of

2010.

Decreased Adjusted EBITDA and Adjusted EBITDAR in the first

quarter of 2011 as compared to the fourth quarter of 2010 resulted

primarily from an increase in residence operations expenses ($0.7

million) (this excludes gains and losses on the disposals of fixed

assets) and an increase in general and administrative expenses

($0.3 million) (this excludes non-cash equity-based compensation).

Additionally, for Adjusted EBITDA only, a decrease in residence

lease expense ($0.2 million). Residence operations expenses

increased primarily from increases in utility expenses resulting

from normal seasonal fluctuations partially offset by other

administrative expenses. General and administrative expenses

increased primarily as a result of expenses associated with our

Company Conference held in the first quarter of 2011. In 2010 the

Conference was held in the second quarter.

Stock Split

On May 2, 2011, the Board of Directors approved a stock split of

its Class A and Class B Common Stock at a ratio of 2 to 1, with a

planned effective date of May 20, 2011. Accordingly, as of the

effective date, each share of issued and outstanding Class A and

Class B Common Stock will be converted into two shares of Class A

and Class B Common Stock, respectively. The stock split will be

effected by filing a Certificate of Change to ALC s Amended and

Restated Articles of Incorporation with the Secretary of State of

Nevada.

Dividend

On May 2, 2011, the Board of Directors declared a post-stock

split cash dividend of 10 cents per share payable to shareholders

of record at the close of business on May 20, 2011 and will be paid

on June 15, 2011.

Liquidity

At March 31, 2011 ALC maintained a strong liquidity position

with availability under its credit agreement of $87.1 million.

Share Repurchase Program

In the first quarter of 2011, ALC repurchased 24,600 shares of

its Class A Common Stock at a cost of $0.8 million and an average

price of $32.42 per share (excluding fees). At May 2, 2011, $13.3

million remained under a previously authorized plan to purchase ALC

Class A common stock. On May 2, 2011, the Board of Directors

extended the stock repurchase plan by resetting the authorized

amount of repurchases to $15 million and removing the expiration

date. The plan will no longer be subject to an annual expiration

date and will only expire upon completion of stock repurchases

totaling $15 million or by action of the Board. Since becoming a

separately traded public company on November 11, 2006, ALC has

repurchased 2,465,936 shares of its Class A Common Stock at a cost

of $76.6 million and an average price of $31.04 per share

(excluding fees).

Investor Call

ALC has scheduled a conference call for tomorrow, May 3, 2011 at

10:00 a.m. (ET) to discuss its financial results for the first

quarter. The release will be posted on ALC's website at

www.alcco.com. The toll-free number for the live call is

877-209-9920 or international 612-332-0634. A taped rebroadcast of

the conference call will be available approximately three hours

following the live call until midnight on June 3, 2011, by dialing

toll free 800-475-6701, or international 320-365-3844, and using

access code 196057.

About Us

Assisted Living Concepts, Inc. and its subsidiaries operate 211

senior living residences comprising 9,325 units in 20 states. ALC's

senior living residences typically consist of 40 to 60 units and

offer a supportive, home-like setting. Residents may receive

assistance with the activities of daily living either directly from

ALC employees or through our wholly owned home health subsidiaries.

ALC employs approximately 4,100 people.

Forward-looking Statements

Statements contained in this release other than statements of

historical fact, including statements regarding anticipated

financial performance, business strategy and management's plans and

objectives for future operations, including management's

expectations about improving occupancy and private pay mix, are

forward-looking statements. Forward-looking statements generally

include words such as "expect," "project," "point toward,"

"intend," "will," "indicate," "anticipate," "believe," "estimate,"

"plan," "strategy" or "objective." Forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially from those expressed or implied. In addition

to the risks and uncertainties referred to in the release, other

risks and uncertainties are contained in ALC's filings with United

States Securities and Exchange Commission and include, but are not

limited to, the following: changes in the health care industry in

general and the senior housing industry in particular because of

governmental and economic influences; changes in general economic

conditions, including changes in housing markets, unemployment

rates and the availability of credit at reasonable rates; changes

in regulations governing the industry and ALC's compliance with

such regulations; changes in government funding levels for health

care services; resident care litigation, including exposure for

punitive damage claims and increased insurance costs, and other

claims asserted against ALC; ALC's ability to maintain and increase

census levels; ALC's ability to attract and retain qualified

personnel; the availability and terms of capital to fund

acquisitions, dividends, debt obligations and ALC's capital

expenditures; changes in competition; and demographic changes.

Given these risks and uncertainties, readers are cautioned not to

place undue reliance on ALC's forward-looking statements. All

forward-looking statements contained in this report are necessarily

estimates reflecting the best judgment of the party making such

statements based upon current information. ALC assumes no

obligation to update any forward-looking statement.

ASSISTED LIVING CONCEPTS, INC.

Consolidated Statements of Income

(In thousands, except earnings per share)

(unaudited)

Three Months Ended

March 31,

------------------

2011 2010

-------- --------

Revenues $ 58,409 $ 57,859

-------- --------

Expenses:

Residence operations (exclusive of depreciation and

amortization and residence lease expense shown

below) 35,069 35,712

General and administrative (including non-cash

stock-based compensation expense of $280 and $137,

respectively) 3,889 3,774

Residence lease expense 4,368 5,083

Depreciation and amortization 5,741 5,670

-------- --------

Total operating expenses 49,067 50,239

-------- --------

Income from operations 9,342 7,620

Other (expense) income

Interest expense:

Debt (2,082) (1,888)

Change in value of derivative and amortization (287) --

Write off of deferred financing costs (279) --

Interest income 2 4

Other 56 --

-------- --------

Income before income taxes 6,752 5,736

Income tax expense (1,741) (2,123)

-------- --------

Net income $ 5,011 $ 3,613

======== ========

Weighted average common shares:

Basic 11,472 11,578

Diluted 11,640 11,744

Per share data:

Basic earnings per common share $ 0.44 $ 0.31

Diluted earnings per common share $ 0.43 $ 0.31

Adjusted EBITDA (1) $ 15,363 $ 13,597

Adjusted EBITDAR (1) $ 19,731 $ 18,680

(1) See attached tables for definitions of Adjusted EBITDA and Adjusted

EBITDAR and reconciliations of net income to Adjusted EBITDA and

Adjusted EBITDAR.

ASSISTED LIVING CONCEPTS, INC

Consolidated Balance Sheets

(In thousands, except share and per share data)

March 31, December 31,

2011 2010

----------- -----------

ASSETS (unaudited)

Current Assets:

Cash and cash equivalents $ 2,908 $ 13,364

Investments 4,583 4,599

Accounts receivable, less allowances of $1,819

and $1,414, respectively 3,550 3,201

Prepaid expenses, supplies and other

receivables 5,465 3,020

Deposits in escrow 3,055 3,472

Income tax receivable -- 356

Deferred income taxes 4,784 5,108

Current assets of discontinued operations 168 168

----------- -----------

Total current assets 24,513 33,288

Property and equipment, net 435,584 437,303

Intangible assets, net 9,883 10,193

Restricted cash 3,448 3,448

Other assets 2,367 872

----------- -----------

Total Assets $ 475,795 $ 485,104

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 6,233 $ 6,154

Accrued liabilities 19,368 20,173

Deferred revenue 8,386 4,784

Income tax payable 1,519 --

Current maturities of long-term debt 2,460 2,449

Current portion of self-insured liabilities 500 500

----------- -----------

Total current liabilities 38,466 34,060

Accrual for self-insured liabilities 1,768 1,597

Long-term debt 110,501 129,661

Deferred income taxes 20,961 20,503

Other long-term liabilities 9,900 10,024

Commitments and contingencies ----------- -----------

Total Liabilities 181,596 195,845

Preferred Stock, par value $0.01 per share,

25,000,000 shares authorized; no shares issued

and outstanding -- --

Class A Common Stock, $0.01 par value, 80,000,000

shares authorized at March 31, 2011 and December

31, 2010; 12,464,070 and 12,408,369 shares issued

and 9,998,134 and 9,967,033 shares outstanding,

respectively 125 124

Class B Common Stock, $0.01 par value, 15,000,000

shares authorized at March 31, 2011 and December

31, 2010; 1,468,493 and 1,520,310 shares issued

and outstanding, respectively 15 15

Additional paid-in capital 315,571 315,292

Accumulated other comprehensive income / (loss) 352 (95)

Retained earnings 54,981 49,970

Treasury stock at cost, 2,465,936 and 2,441,336

shares, respectively (76,845) (76,047)

----------- -----------

Total Stockholders' Equity 294,199 289,259

----------- -----------

Total Liabilities and Stockholders' Equity $ 475,795 $ 485,104

=========== ===========

ASSISTED LIVING CONCEPTS, INC.

Consolidated Statements of Cash Flows

(In thousands)

(unaudited)

Three Months Ended

March 31,

------------------

2011 2010

-------- --------

OPERATING ACTIVITIES:

Net income $ 5,011 $ 3,613

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 5,741 5,670

Amortization of purchase accounting adjustments for

leases (167) (99)

Provision for bad debts 405 104

Provision for self-insured liabilities 255 170

Loss on disposal of fixed assets -- 170

Unrealized gain on investments (56) (27)

Equity-based compensation expense 280 137

Change in fair value of derivatives 287 --

Deferred income taxes 503 1,045

Changes in assets and liabilities:

Accounts receivable (754) (30)

Supplies, prepaid expenses and other receivables (2,445) (1,349)

Deposits in escrow 417 302

Current assets - discontinued operations -- (132)

Accounts payable 267 (904)

Accrued liabilities (559) (2,891)

Deferred revenue 3,602 1,505

Current liabilities - discontinued operations -- (34)

Payments of self-insured liabilities (83) (77)

Income taxes payable / receivable 1,875 927

Changes in other non-current assets 407 1,385

Other non-current assets - discontinued operations -- 399

Other long-term liabilities (9) 225

-------- --------

Cash provided by operating activities 14,977 10,109

INVESTING ACTIVITIES:

Payment for securities (46) (56)

Proceeds on sales of securities 311 --

Payments for new construction projects (463.3) (1,371)

Payments for purchases of property and equipment (3,437) (2,432)

-------- --------

Cash used in investing activities (3,635) (3,859)

FINANCING ACTIVITIES:

Payments of financing costs (1,902) --

Purchase of treasury stock (798) (20)

Repayment of borrowings on revolving credit facility (68,000) --

Proceeds on borrowings from revolving credit facility 50,000 --

Repayment of mortgage debt (1,098) (459)

-------- --------

Cash used by financing activities (21,798) (479)

-------- --------

(Decrease)/Increase in cash and cash equivalents (10,456) 5,771

Cash and cash equivalents, beginning of year 13,364 4,360

-------- --------

Cash and cash equivalents, end of period $ 2,908 $ 10,131

======== ========

Supplemental schedule of cash flow information:

Cash paid during the period for:

Interest $ 2,047 $ 1,782

Income tax payments, net of refunds 114 86

ASSISTED LIVING CONCEPTS, INC.

Financial and Operating Statistics

Continuing residences* Three months ended

----------------------------

March 31, December March 31,

2011 31, 2010 2010

-------- -------- --------

Average Occupied Units by Payer Source

Private 5,497 5,495 5,468

Medicaid 93 106 214

-------- -------- --------

Total 5,590 5,601 5,682

======== ======== ========

Occupancy Mix by Payer Source

Private 98.3% 98.1% 96.2%

Medicaid 1.7% 1.9% 3.8%

Percent of Revenue by Payer Source

Private 99.0% 98.8% 97.5%

Medicaid 1.0% 1.2% 2.5%

Average Revenue per Occupied Unit Day $ 116.09 $ 113.40 $ 113.13

Occupancy Percentage* 62.4% 62.1% 63.0%

* Depending on the timing of new additions and temporary closures of our

residences, we may increase or reduce the number of units we actively

operate. For the three months ended March 31, 2011, December 31, 2010 and

March 31, 2010 we actively operated 8,959, 9,026 and 9,016 units,

respectively.

Same residence basis** Three months ended

----------------------------

March 31, December March 31,

2011 31, 2010 2010

-------- -------- --------

Average Occupied Units by Payer Source

Private 5,470 5,475 5,432

Medicaid 93 104 197

-------- -------- --------

Total 5,563 5,579 5,629

======== ======== ========

Occupancy Mix by Payer Source

Private 98.3% 98.1% 96.5%

Medicaid 1.7% 1.9% 3.5%

Percent of Revenue by Payer Source

Private 99.0% 98.7% 97.6%

Medicaid 1.0% 1.3% 2.4%

Average Revenue per Occupied Unit Day $ 115.76 $ 111.71 $ 113.29

Occupancy Percentage 62.4% 62.6% 63.1%

** Excludes quarterly impact of 45 completed expansion units and 113 units

temporarily closed for renovation.

Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDAR

Adjusted EBITDA is defined as net income from continuing

operations before income taxes, interest expense net of interest

income, depreciation and amortization, equity based compensation

expense, transaction costs and non-cash, non-recurring gains and

losses, including disposal of assets and impairment of long-lived

assets (including goodwill) and loss on refinancing and retirement

of debt. Adjusted EBITDAR is defined as Adjusted EBITDA before rent

expenses incurred for leased assisted living properties. Adjusted

EBITDA and Adjusted EBITDAR are not measures of performance under

accounting principles generally accepted in the United States of

America, or GAAP. We use Adjusted EBITDA and Adjusted EBITDAR as

key performance indicators and Adjusted EBITDA and Adjusted EBITDAR

expressed as a percentage of total revenues as a measurement of

margin.

We understand that EBITDA and EBITDAR, or derivatives thereof,

are customarily used by lenders, financial and credit analysts, and

many investors as a performance measure in evaluating a company's

ability to service debt and meet other payment obligations or as a

common valuation measurement in the long-term care industry.

Moreover, ALC's revolving credit facility contains covenants in

which a form of EBITDA is used as a measure of compliance, and we

anticipate EBITDA will be used in covenants in any new financing

arrangements that we may establish. We believe Adjusted EBITDA and

Adjusted EBITDAR provide meaningful supplemental information

regarding our core results because these measures exclude the

effects of non-operating factors related to our capital assets,

such as the historical cost of the assets.

We report specific line items separately, and exclude them from

Adjusted EBITDA and Adjusted EBITDAR because such items are

transitional in nature and would otherwise distort historical

trends. In addition, we use Adjusted EBITDA and Adjusted EBITDAR to

assess our operating performance and in making financing decisions.

In particular, we use Adjusted EBITDA and Adjusted EBITDAR in

analyzing potential acquisitions and internal expansion

possibilities. Adjusted EBITDAR performance is also used in

determining compensation levels for our senior executives. Adjusted

EBITDA and Adjusted EBITDAR should not be considered in isolation

or as a substitute for net income, cash flows from operating

activities, and other income or cash flow statement data prepared

in accordance with GAAP, or as a measure of profitability or

liquidity. We present Adjusted EBITDA and Adjusted EBITDAR on a

consistent basis from period to period, thereby allowing for

comparability of operating performance.

Adjusted EBITDA and Adjusted EBITDAR Reconciliation

Information

The following table sets forth a reconciliation of net income to

Adjusted EBITDA and Adjusted EBITDAR:

The following table sets forth a reconciliation of net income to Adjusted

EBITDA and Adjusted EBITDAR:

Three Months Ended

----------------------------

March 31, March 31, December

2011 2010 31, 2010

-------- --------- --------

(In thousands, unaudited)

Net income $ 5,011 $ 3,613 $ 5,408

Add: Provision for income taxes 1,741 2,123 3,109

-------- --------- --------

Income before income taxes 6,752 5,736 8,517

Add:

Depreciation and amortization 5,741 5,670 5,693

Interest expense, net 2,080 1,884 2,101

Non-cash equity based compensation 280 137 45

Loss (gain) on disposal of fixed assets -- 170 (55)

Transaction expenses associated with property

acquisition -- -- 110

Gain on sale of equity investments (56) -- (23)

Change in value of derivative and amortization 287 -- --

Write-off of deferred financing costs 279 -- --

-------- --------- --------

Adjusted EBITDA $ 15,363 $ 13,597 $ 16,388

Add: Lease expense 4,368 5,083 4,491

-------- --------- --------

Adjusted EBITDAR $ 19,731 $ 18,680 $ 20,879

======== ========= ========

The following table sets forth the calculations of Adjusted EBITDA and

Adjusted EBITDAR as percentages of total revenue:

Three Months Ended

----------------------------

March 31, March 31, December

2011 2010 31, 2010

-------- --------- --------

(Dollar amounts in

thousands, unaudited)

Revenues $ 58,409 $ 57,859 $ 58,435

======== ======== ========

Adjusted EBITDA $ 15,363 $ 13,597 $ 16,388

======== ======== ========

Adjusted EBITDAR $ 19,731 $ 18,680 $ 20,879

======== ======== ========

Adjusted EBITDA as percent of total revenues 26.3% 23.5% 28.0%

======== ======== ========

Adjusted EBITDAR as percent of total revenues 33.8% 32.3% 35.7%

======== ======== ========

ASSISTED LIVING CONCEPTS, INC.

Reconciliation of Non-GAAP Measures

Three Months

Ended

March 31,

2010

(unaudited)

Net income $ 5,011

Add one time charges:

Change in value of derivative and amortization 287

Write-off of deferred financing costs 279

Less one time credits:

Settlement relating to tax allocation agreement 750

Gain on sale of equity investment 56

Net tax benefit from charges and credits (1) 186

------------

Pro forma net income excluding one time charges and credits $ 4,585

============

Weighted average common shares:

Basic 11,472

============

Diluted 11,640

============

Pro forma basic earnings per common share excluding one-time

charges and credits $ 0.40

============

Pro forma diluted earnings per common share excluding one-time

charges and credits $ 0.39

============

(1) Net tax benefit represents 36.5% of taxable addbacks excluding the

settlement relating to the tax allocation agreement. The settlement

relating to the tax allocation agreement is an adjustment to tax expense

and therefore non taxable.

For further information, contact: Assisted Living Concepts, Inc.

John Buono Sr. Vice President, Chief Financial Officer and

Treasurer Phone: (262) 257-8999 Fax: (262) 251-7562 Email: Email

Contact Visit ALC's Website @ www.alcco.com

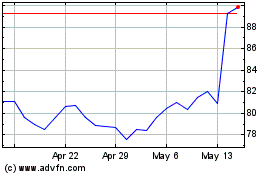

Alcon (NYSE:ALC)

Historical Stock Chart

From May 2024 to Jun 2024

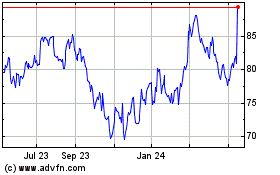

Alcon (NYSE:ALC)

Historical Stock Chart

From Jun 2023 to Jun 2024