CBS Corporation Completes Its Tender Offer for CNET Networks, Inc.

June 26 2008 - 10:06AM

PR Newswire (US)

NEW YORK, June 26 /PRNewswire-FirstCall/ -- CBS Corporation

(NYSE:CBS.A andNYSE:CBS) announced today that it has completed its

tender offer for all outstanding shares of common stock of CNET

Networks, Inc. (NASDAQ:CNET). CBS intends to complete the

acquisition in the next few business days. The initial offering

period expired at 12:00 Midnight, ET, on Friday, June 20, 2008. A

subsequent offering period commenced on Monday, June 23, 2008, and

expired at 12:00 Midnight, ET, on Wednesday, June 25, 2008. As of

that time, approximately 117.9 million shares were validly tendered

and accepted for purchase pursuant to the offer. CBS Corporation

will promptly pay for such shares, at the offer price of $11.50 per

share, net to the seller in cash, without interest and less any

required withholding taxes. After payment for the shares, CBS will

own, in total, approximately 78% of the outstanding shares of CNET

common stock. CBS Corporation intends to effect a "short-form"

merger under Delaware law, after exercising its top-up option under

the merger agreement, and CNET will become a direct, wholly-owned

subsidiary of CBS Corporation. As a result of the merger, any

shares of CNET common stock not tendered will be cancelled and

(except for shares held by CBS Corporation or its subsidiaries, or

shares for which appraisal rights are properly demanded) will be

converted into the right to receive the same $11.50 in cash per

share, without interest and less any required withholding taxes,

that was paid in the tender offer. Following the merger, CNET

common stock will cease to be traded on the NASDAQ Global Market.

About CBS Corporation CBS Corporation is a mass media company with

constituent parts that reach back to the beginnings of the

broadcast industry, as well as newer businesses that operate on the

leading edge of the media industry. CBS Corporation, through its

many and varied operations, combines broad reach with

well-positioned local businesses, all of which provide it with an

extensive distribution network by which it serves audiences and

advertisers in all 50 states and key international markets. It has

operations in virtually every field of media and entertainment,

including broadcast television (CBS and The CW - a joint venture

between CBS Corporation and Warner Bros. Entertainment), cable

television (Showtime and CBS College Sports Network), local

television (CBS Television Stations), television production and

syndication (CBS Paramount Network Television and CBS Television

Distribution), radio (CBS Radio), advertising on out-of-home media

(CBS Outdoor), publishing (Simon & Schuster), interactive media

(CBS Interactive), music (CBS Records), licensing and merchandising

(CBS Consumer Products), video/DVD (CBS Home Entertainment),

in-store media (CBS Outernet) and motion pictures (CBS Films). For

more information, log on to http://www.cbscorporation.com/.

Additional Information This press release is neither an offer to

purchase nor a solicitation of an offer to sell securities. The

tender offer has been made pursuant to a tender offer statement and

related materials. CNET stockholders are advised to read the tender

offer statement and related materials, which have been filed by CBS

with the U.S. Securities and Exchange Commission (the "SEC"). The

tender offer statement (including the offer to purchase, letter of

transmittal and related tender offer documents) filed by CBS with

the SEC and the solicitation/recommendation statement filed by CNET

with the SEC contain important information which should be read

carefully before any decision is made with respect to the tender

offer. The tender offer statement and the

solicitation/recommendation statement have been mailed to all CNET

stockholders of record. The tender offer statement and related

materials may be obtained at no charge by directing a request by

mail to MacKenzie Partners, Inc., 105 Madison Avenue, New York, New

York 10016, or by calling toll-free at (800) 322-2885, and may also

be obtained at no charge at http://www.cbscorporation.com/ and

http://www.cnetnetworks.com/ and the website maintained by the SEC

at http://www.sec.gov/. DISCLOSURE NOTICE: The information

contained in this release is as of June 26, 2008. Except as

required by law, CBS does not assume any obligation to update any

forward-looking statements contained in this release as a result of

new information or future events or developments. Some statements

in this release may constitute forward-looking statements. CBS

cautions that these forward-looking statements are subject to risks

and uncertainties that may cause actual results to differ

materially from those indicated in the forward-looking statements,

including the risk that the tender offer may not be completed or

the merger may not be consummated for various reasons, including

the failure to satisfy the conditions precedent to the completion

of the acquisition. A further list and description of risks and

uncertainties can be found in CBS' Annual Report on Form 10-K for

the fiscal year ended December 31, 2007 and in its periodic reports

on Forms 10-Q and 8-K. DATASOURCE: CBS Corporation CONTACT: Press,

Dana McClintock, +1-212-975-1077, , Andrea Prochniak,

+1-212-975-0053, , or Investor Relations, Marty Shea,

+1-212-975-8571, , Debra Wichser, +1-212-975-3718, Web site:

http://www.cbscorporation.com/ http://www.cnetnetworks.com/ Company

News On-Call: http://www.prnewswire.com/comp/965075.html

Copyright

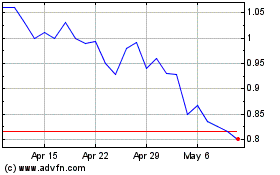

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Aug 2024 to Sep 2024

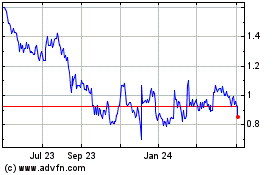

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Sep 2023 to Sep 2024