CA Inc. Beats 4Q Earnings, Rev Down - Analyst Blog

May 08 2013 - 5:42AM

Zacks

CA Inc. (CA)

reported fourth-quarter 2013 adjusted earnings per share (“EPS”) of

65 cents, ahead of the Zacks Consensus Estimate of 53 cents.

Revenues

Total revenue in the reported

quarter was $1.15 billion, down 3.4% from $1.19 billion in the

year-ago quarter. When adjusted for currency, revenues declined

2.0% year over year. This was due to a decline in Mainframe

Solutions and the Enterprise solutions business.

Revenue

Segments

Mainframe Solutions generated

revenues of $620.0 million, down 1.4% year over year. Enterprise

Solutions’ revenues were $432.0 million, down 7.3% year over year.

Services’ revenues were down 6.5% year over year to $99.0

million.

Bookings

The company witnessed total bookings of $1.46 billion, down 5.0% on

a reported basis. North America bookings were $986.0 million, up

10.0% on a reported basis. The company won a large government

contract, which constituted a major part of this booking.

International Bookings were $477.0

million, down 26.0% from the year-ago quarter.

The company renewed 27 license

agreements during fiscal 2013, with contract value in excess of

$10.0 million each.

Operating

Results

GAAP income from continuing

operations before interest and income taxes was $274.0 million,

down 8.9% from $301.0 million reported in the year-ago quarter.

Therefore, the operating margin for the quarter was 24.0% down from

25.0% reported in the year-ago quarter.

On a GAAP basis, net income was

$242.0 million or 53 cents per share versus $211.0 million 45 cents

per share in the year-ago quarter. Excluding special items, such as

software amortization, intangible amortization, restructuring and

other and hedging gains/losses, but including stock-based

compensation expenses, non-GAAP net income in the fourth quarter

stood at 65 cents per share versus 52 cents in the prior-year

quarter.

Balance Sheet, Cash Flow

& Share Repurchase

CA generated cash flow from

continuing operations of $570 million, up 0.7% from $566.0 million

on a reported basis. Cash, cash equivalents and investments was

$2.78 billion, up from $2.55 billion reported in previous quarter.

Considering the company’s total outstanding debt of $1.29 billion,

net cash, cash equivalents and investments was $1.35 billion.

Moreover, during the reported

quarter, CA repurchased around 3 million shares of stock for $74.0

million.

Guidance

For fiscal 2014, the company expects total revenue is expected to

decline in the range of 4.0% to 2.0%. CA expects growth in non-GAAP

earnings per share from continuing operations to decline in the

range of 4.0%–7.0%, amounting to $2.35 to $2.43. Cash flow from

continuing operations is expected to decline in the range of 29.0%

to 35.0%. Moreover, the company has also declared that it would be

taking a charge of approximately $150 million in the fiscal year

2014, which will help them to take care of its business

priorities.

Outlook

CA Inc. reported mixed

fourth-quarter results, with bottom-line exceeding the Zacks

Consensus Estimate and revenues missing the same. Most of CA’s

revenue generating segments was adversely affected during the

reported quarter, yet cash position improved sequentially. The

company’s guidance for fiscal 2014 appears to be modest.

However, we are positive about the

CA Inc’s increased cloud exposure. Decent renewal rate, modest cash

position and share repurchase also appear encouraging. On the other

hand, increasing competition and exposure to Europe remain

concerns.

CA currently has a Zacks Rank #3

(Hold).

Investors can also consider other

stocks in the technology industry that are currently performing

well such as Aspen Tech Inc. (AZPN),

Progress Software (PRGS) with a

Zacks Rank #1 (Strong Buy) and Symantec Corp.

(SYMC) having a Zacks Rank#2.

ASPEN TECH INC (AZPN): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

PROGRESS SOFTWA (PRGS): Free Stock Analysis Report

SYMANTEC CORP (SYMC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

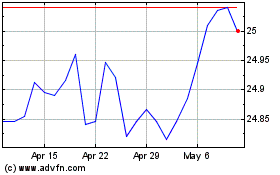

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jun 2024 to Jul 2024

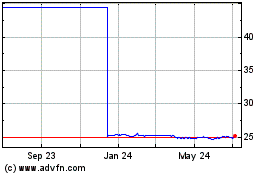

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jul 2023 to Jul 2024