U.S. commercial insurance rates show an aggregate increase near 6%

September 10 2024 - 8:00AM

According to WTW, a leading global advisory, broking, and solutions

company, U.S. commercial insurance rates grew at a rate of 5.9%

throughout the second quarter of 2024. Based on the company’s

Commercial Lines Insurance Pricing Survey (CLIPS) for Q2 2024, the

collective commercial price change reported by insurance carriers

in the quarterly survey showed an increase of 5.9%, down from 6.3%

in Q1 2024 (6.1% in Q2 2023). The survey compares commercial

insurance prices on policies underwritten during the second quarter

of 2024 to those for the same coverage in the same respective

quarter of 2023 for a year-over-year perspective.

The overall decline in commercial insurance price increase for

the quarter was largely attributable to a significant reduction in

price increase from the prior quarter in Commercial Property.

Growth in Commercial Property prices has markedly slowed compared

to Q1 2024, suggesting that the sector has reached its peak and is

beginning to stabilize. This decline in Commercial Property pricing

has significantly influenced the current market trend, leading to a

slower rate of increase across the broader commercial insurance

market, when compared to the first quarter of the year. Notable

adjustments in Commercial Property pricing are particularly evident

in the Large Account Commercial segment, while other market

segments have remained relatively stable overall.

Additionally, other commercial lines, including Workers'

Compensation (WC), Directors and Officers (D&O), and Cyber

insurance, continued to exhibit consistent pricing patterns as

observed in prior quarters. Conversely, Commercial Auto and Excess

Umbrella lines are facing sustained upward pressure due to high

loss cost trends.

Yi Jing, Senior Director, Insurance Consulting and Technology

(ICT) at WTW, commented, “The decline in Commercial Property prices

this quarter underscores a notable change in market conditions.

Although some sectors, such as Commercial Auto and Excess Umbrella,

continue to face upward pressure, many other lines are

demonstrating stability. These results highlight the shifting

dynamics within the commercial insurance market.”

CLIPS is a retrospective look at historical changes in

commercial property & casualty insurance (P&C) prices and

claims cost inflation. A forward-looking analysis of commercial

P&C trends, outlook, and rate predictions for the upcoming

quarter can be found in WTW’s Insurance Marketplace Realities

series (published twice yearly, every spring and fall).

About CLIPS

CLIPS data are based on both new and renewal business figures

obtained directly from carriers underwriting the business. CLIPS

participants represent a cross-section of U.S. P&C insurers

that includes many of the top 10 commercial lines companies and the

top 25 insurance groups in the U.S. This survey compared prices

charged on policies written during the second quarter of 2024 with

the prices charged for the same coverage during the same quarter of

2023. For this most recent survey, 43 participating insurers

representing approximately 20% of the U.S. commercial insurance

market (excluding state workers compensation funds) contributed

data.

About Insurance

Consulting and

Technology

WTW’s Insurance Consulting and Technology business serves the

insurance industry with a powerful combination of advisory services

and leading-edge technology. Our mission is to innovate and

transform insurance, and we deliver solutions that help clients

better select, finance, and manage risk and capital. We work

with clients of all sizes globally, including most of the world’s

leading insurance groups. Over 1,000 client companies use our

specialist insurance software on six continents. With over 1,700

colleagues in 35 markets, we continually strive to be a partner and

employer of choice to the insurance industry.

About WTW

At WTW (NASDAQ: WTW), we provide data-driven, insight-led

solutions in the areas of people, risk and capital. Leveraging the

global view and local expertise of our colleagues serving 140

countries and markets, we help organizations sharpen their

strategy, enhance organizational resilience, motivate their

workforce and maximize performance. Working shoulder to shoulder

with our clients, we uncover opportunities for sustainable

success—and provide perspective that moves you. Learn more at

wtwco.com.

Media Contacts

Douglas MenellyDouglas.Menelly@wtwco.com +1 (516) 972 0380

Arnelle SullivanArnelle.Sullivan@wtwco.com +1 (718) 208-0474

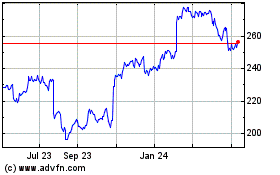

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

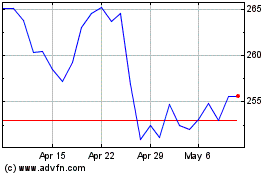

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Nov 2023 to Nov 2024