VSE Welcomes New CEO

VSE Corporation (Nasdaq: VSEC) reported the following

unaudited consolidated financial results for the first quarter of

2019.

CEO Commentary

“As VSE’s newly appointed CEO, I look forward to building and

executing on a plan of revenue and profit growth for our three

operating groups, expanding our current customer, product, and

service initiatives, and pursuing new strategic opportunities,”

said John Cuomo, VSE’s CEO and President. “We remain focused on

operational excellence and returning value to our

stockholders.”

Mr. Cuomo continued, “While revenues declined compared to the

first quarter of 2018, our operating income slightly improved. We

are pleased with the contributions of our 1st Choice Aerospace

acquisition, which is meeting expectations. Our international

programs are growing, thus providing further uplift to our Aviation

Group revenues in the first quarter. Our Supply Chain Management

Group revenue decreases were partially offset by continuing

increases in parts sales and distribution to new commercial

customers. Despite revenue challenges in our Federal Services

Group, we have increased this group’s operating income through

margin and performance improvement.”

First Quarter Results (unaudited)

(in thousands, except per share data)

Three

months ended March 31, 2019 2018

% Change Revenues $ 169,919 $

176,897 (3.9 )% Operating income $ 11,813

$ 11,593 1.9 % Net income $ 6,603

$ 7,052 (6.4 )% EPS (Diluted) $ 0.60

$ 0.65 (7.7 )%

Financial Information

Revenues were $169.9 million in the first quarter of 2019

compared to $176.9 million in the first quarter of 2018. The

decrease in revenues is primarily attributable to our Federal

Services and Supply Chain Management groups. The decrease was

partially offset by an increase in revenue from our Aviation Group,

which was primarily attributable to revenues from our 1st Choice

Aerospace acquisition and increased parts distribution sales in our

international markets.

Operating income was $11.8 million for the first quarter of 2019

compared to $11.6 million in the first quarter of 2018. The

operating income increase was primarily attributable to our

Aviation Group, and margin improvements in our Federal Services

Group. Operating income for the first quarter of 2019 was reduced

by non-recurring costs associated with our CEO transition and the

acquisition of 1st Choice Aerospace.

Net income was $6.6 million for the first quarter of 2019, or

$0.60 per diluted share, compared to $7.1 million, or $0.65 per

diluted share for the first quarter of 2018. The decrease in net

income is primarily attributable to increased interest expense.

Bookings in our Federal Services Group were $51 million for

the first three months of 2019 compared to revenue for this group

of $69 million. Funded contract backlog at March 31, 2019 was $278

million, compared to $290 million at December 31, 2018 and

$261 million at March 31, 2018.

Non-GAAP Financial Information

The non-GAAP Financial Information (unaudited) listed below is

not calculated in accordance with U.S. generally accepted

accounting principles ("GAAP") under SEC Regulation G. We consider

EBITDA a non-GAAP financial measure and an important indicator of

performance and useful metric for management and investors to

evaluate our business' ongoing operating performance on a

consistent basis across reporting periods. EBITDA should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with GAAP.

EBITDA represents net income before interest expense, income

taxes, amortization of intangible assets and depreciation and other

amortization. Adjusted EBITDA represents EBITDA (as defined above)

adjusted for 1st Choice Aerospace acquisition related and CEO

transition costs.

Non-GAAP Financial Information (unaudited)

(in thousands)

Three

Month Results ended March 31, 2019

2018 % Change Net Income $ 6,603 $

7,052 (6 )% Interest Expense 3,158 2,175 45 % Income Taxes 2,052

2,366 (13 )% Amortization of Intangible Assets 4,991 4,004 25 %

Depreciation and Other Amortization 2,439

2,480 (2 )% EBITDA $ 19,243 $ 18,077 6 %

Acquisition Related and CEO Transition Costs 1,121

— — Adjusted EBITDA $ 20,364

$ 18,077 13 %

Capital Expenditures

Purchases of property and equipment were $601 thousand for the

first quarter of 2019 compared to $1.1 million for the first

quarter of 2018.

About VSE

Established in 1959, VSE is a diversified products and services

company providing logistics solutions with integrity, agility, and

value. VSE is dedicated to making our federal and commercial

clients successful by delivering innovative solutions for vehicle,

ship, and aircraft sustainment, supply chain management, platform

modernization, mission enhancement, and program management, and

providing energy, IT, and consulting services. For additional

information regarding VSE services and products, please see the

Company's web site at www.vsecorp.com or contact Christine Kaineg,

VSE Investor Relations, at (703) 329-3263.

Please refer to the Form 10-Q that will be filed with the

Securities and Exchange Commission (SEC) on or about May 3, 2019

for more details on our 2019 first quarter results. Also, refer to

VSE’s Annual Report on Form 10-K for the year ended December 31,

2018 for further information and analysis of VSE’s financial

condition and results of operations. VSE encourages investors and

others to review the detailed reporting and disclosures contained

in VSE’s public filings for additional discussion about the status

of customer programs and contract awards, risks, revenue sources

and funding, dependence on material customers, and management’s

discussion of short and long term business challenges and

opportunities.

Safe Harbor

This news release contains statements that to the extent they

are not recitations of historical fact, constitute “forward looking

statements” under federal securities laws. All such statements are

intended to be subject to the safe harbor protection provided by

applicable securities laws. For discussions identifying some

important factors that could cause actual VSE results to differ

materially from those anticipated in the forward looking statements

in this news release, see VSE’s public filings with the SEC.

VSE Corporation and Subsidiaries Unaudited

Consolidated Balance Sheets

(in thousands except share and per share

amounts)

March 31,2019

December 31,2018

Assets Current assets: Cash and cash equivalents $ 829 $ 162

Receivables, net 64,746 60,004 Unbilled receivables, net 44,450

41,255 Inventories, net 181,069 166,392 Other current assets

18,456 13,407 Total current assets 309,550 281,220

Property and equipment, net 40,167 49,606 Intangible assets,

net 152,901 94,892 Goodwill 259,212 198,622 Operating lease

right-of-use assets 26,371 — Other assets 15,844

14,488 Total assets $ 804,045 $ 638,828

Liabilities and Stockholders' equity Current liabilities: Current

portion of long-term debt $ 9,466 $ 9,466 Accounts payable 59,106

57,408 Current portion of earn-out obligation 10,700 — Accrued

expenses and other current liabilities 39,919 37,133 Dividends

payable 876 871 Total current liabilities

120,067 104,878 Long-term debt, less current portion 265,681

151,133 Deferred compensation 20,909 17,027 Long-term lease

obligations, less current portion — 18,913 Long-term operating

lease liabilities 26,845 — Earn-out obligation 14,300 — Deferred

tax liabilities 18,712 18,482 Total

liabilities 466,514 310,433 Commitments

and contingencies Stockholders' equity: Common stock, par value

$0.05 per share, authorized 15,000,000 shares; issued and

outstanding 10,949,775 and 10,881,106, respectively 547 544

Additional paid-in capital 28,788 26,632 Retained earnings 308,742

301,073 Accumulated other comprehensive (loss) income (546 )

146 Total stockholders' equity 337,531

328,395 Total liabilities and stockholders' equity $ 804,045

$ 638,828

VSE Corporation and Subsidiaries

Unaudited Consolidated Statements of Income

(in thousands except share and per share

amounts)

For the three months endedMarch 31,

2019 2018 Revenues: Products $ 88,901 $ 88,673

Services 81,018 88,224 Total revenues 169,919 176,897

Costs and operating expenses: Products 76,293 74,726

Services 75,440 85,755 Selling, general and administrative expenses

1,382 819 Amortization of intangible assets 4,991

4,004 Total costs and operating expenses 158,106

165,304 Operating income 11,813 11,593 Interest

expense, net 3,158 2,175 Income before income

taxes 8,655 9,418 Provision for income taxes 2,052

2,366 Net income $ 6,603 $ 7,052 Basic

earnings per share $ 0.60 $ 0.65 Basic weighted average

shares outstanding 10,920,171 10,860,555

Diluted earnings per share $ 0.60 $ 0.65 Diluted weighted

average shares outstanding 10,974,081 10,896,504

Dividends declared per share $ 0.08 $ 0.07

VSE Corporation and Subsidiaries Unaudited

Consolidated Statements of Cash Flows

(in thousands)

For the three months endedMarch 31,

2019 2018 Cash flows from operating activities: Net

income $ 6,603 $ 7,052 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 7,430 6,484 Deferred taxes (564 ) 283 Stock-based

compensation 1,640 1,263 Changes in operating assets and

liabilities, net of impact of acquisitions: Receivables, net 2,667

(978 ) Unbilled receivables, net (3,195 ) 13,589 Inventories, net

(7,798 ) (18,895 ) Other current assets and noncurrent assets

(4,990 ) 3,169 Accounts payable and deferred compensation 2,653

11,681 Accrued expenses and other current and noncurrent

liabilities (1,675 ) (9,949 ) Long-term lease obligations —

(406 ) Net cash provided by operating

activities 2,771 13,293 Cash

flows from investing activities: Purchases of property and

equipment (601 ) (1,053 ) Proceeds from the sale of property and

equipment 3 — Cash paid for acquisitions, net of cash acquired

(112,660 ) — Net cash used in investing

activities (113,258 ) (1,053 ) Cash flows from

financing activities: Borrowings on loan agreement 194,598 247,669

Repayments on loan agreement (80,183 ) (256,368 ) Payment of debt

financing costs (1,702 ) (1,798 ) Payments on capital lease

obligations — (346 ) Payments of taxes for equity transactions (687

) (641 ) Dividends paid (872 ) (759 ) Net cash

provided by (used in) financing activities 111,154

(12,243 ) Net increase (decrease) in cash and cash

equivalents 667 (3 ) Cash and cash equivalents at beginning of

period 162 624 Cash and cash

equivalents at end of period $ 829 $ 621

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190502005943/en/

VSE Financial News Contact:Christine Kaineg -- (703)

329-3263

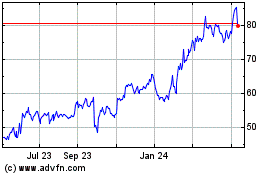

VSE (NASDAQ:VSEC)

Historical Stock Chart

From Aug 2024 to Sep 2024

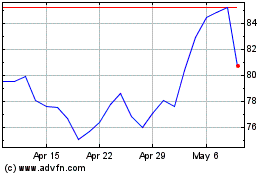

VSE (NASDAQ:VSEC)

Historical Stock Chart

From Sep 2023 to Sep 2024