Current Report Filing (8-k)

April 24 2020 - 3:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: April 24, 2020

VILLAGE SUPER MARKET, INC.

(Exact Name of Registrant as specified in its charter)

|

|

|

|

|

|

|

New Jersey

|

0-2633

|

22-1576170

|

|

(State or Other jurisdiction of incorporation)

|

(Commission File No.)

|

(I.R.S. Employer Identification No.)

|

733 Mountain Avenue

Springfield, New Jersey 07081

(Address of principal executive offices)

Registrant’s telephone number, including area code

(973) 467-2200

Check the appropriate box below if the Form 8-k filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communication pursuant to Rule 425 under the Securities Act ( 17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act ( 17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On April 20, 2020, the United States Bankruptcy Court for the Southern District of New York entered into a Sale Order approving the Asset Purchase Agreement (“APA”) entered on March 25, 2020, between Village Super Market, Inc. (“Village”) and Fairway Group Holdings Corp. and certain of its subsidiaries (“Fairway”). Under the APA, Village is to acquire certain assets, including five supermarkets, a production distribution center (the “PDC”) and the intellectual property of Fairway, including the names “Fairway” and “Fairway Markets.” Four of the supermarkets are in Manhattan, specifically the Upper West Side, Upper East Side, Kips Bay and Chelsea locations, and a fifth store is located in Pelham, NY. Village has agreed to pay $76.0 million for the Fairway assets, subject to closing adjustments set forth in the APA, and to assume certain liabilities, consisting primarily of those arising from acquired leases. Village’s cash purchase price will be reduced by a $2.1 million credit arising from the breakup of Village’s initial “stalking horse” bid. In accordance with the APA, the closing of the transaction is expected to occur in May 2020, subject to satisfaction of various closing conditions.

Signature

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Village Super Market, Inc.

|

|

|

|

|

Dated: April 24, 2020

|

/s/ John L. Van Orden

|

|

|

John L. Van Orden

|

|

|

(Chief Financial Officer)

|

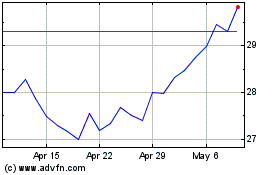

Village Super Market (NASDAQ:VLGEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

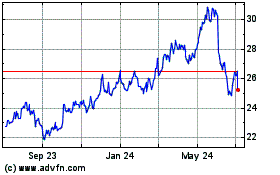

Village Super Market (NASDAQ:VLGEA)

Historical Stock Chart

From Apr 2023 to Apr 2024